Defense and Aerospace NAND and NOR Flash Memory Market Size, Share & Opportunities 2031

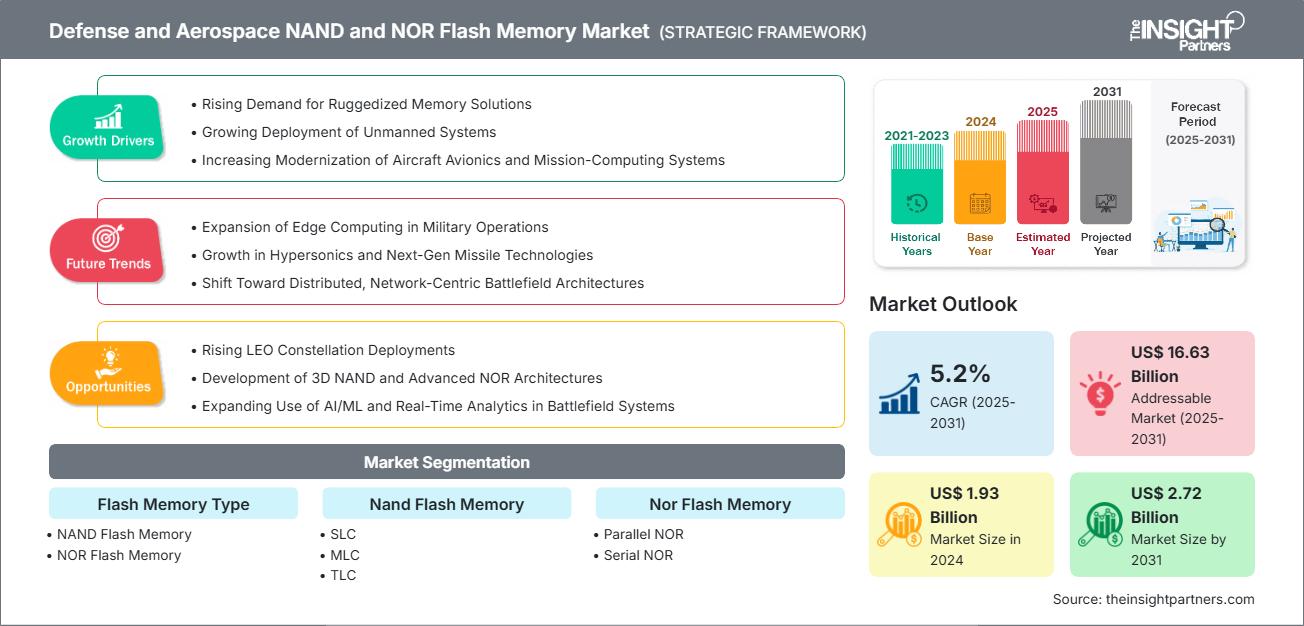

Defense and Aerospace NAND and NOR Flash Memory Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Flash Memory Type (NAND Flash Memory and NOR Flash Memory), NAND Flash Memory (SLC, MLC, TLC, and Others), NOR Flash Memory (Parallel NOR and Serial NOR), NAND Flash Memory Architecture (2D NAND and 3D NAND), NOR Flash Memory Density (Upto 2 MB, 4 MB to 64 MB, 128 MB to 512 MB, and Greater than 1 GB), NAND Flash Memory Density (Upto 2 GB, 4 GB to 64 GB, 128 GB to 512 GB, and Above 1 Tb), and Region (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Dec 2025

- Report Code : TIPRE00041704

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 381

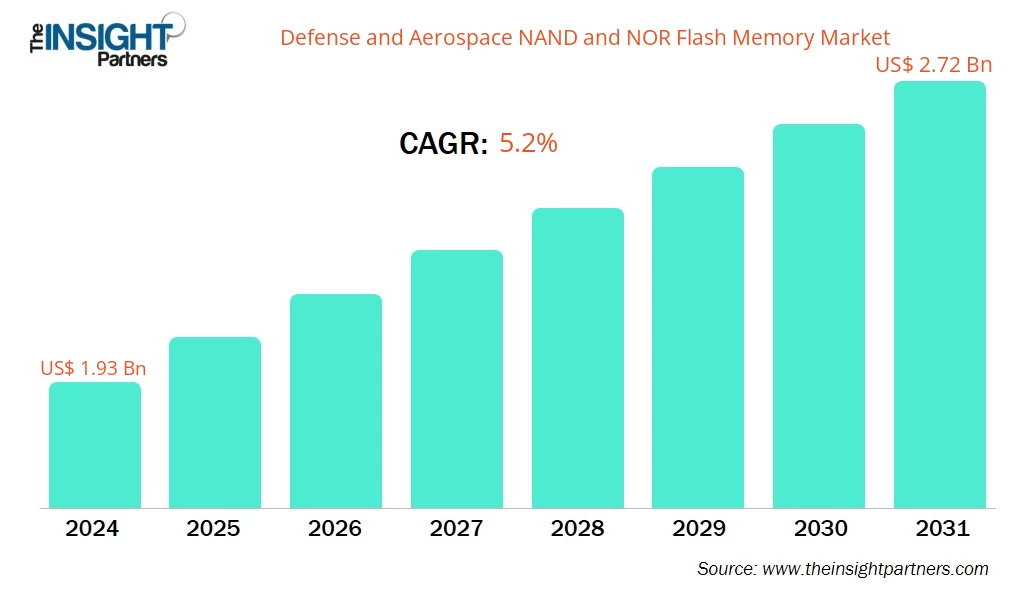

The defense and aerospace NAND and NOR flash memory market size is projected to reach US$2.72 billion by 2031 from US$1.93 billion in 2024. The market is expected to register a CAGR of 5.2% during 2025–2031.

Defense and Aerospace NAND and NOR Flash Memory Market Analysis

Rising demand for ruggedized memory solutions, growing deployment of unmanned systems, and increased modernization of aircraft avionics and mission-computing systems are driving the defense and aerospace NAND and NOR flash memory market. The market is expected to grow during the forecast period due to the rising deployment of LEO constellations, the development of 3D NAND and advanced NOR architectures, and the expanding use of AI/ML and real-time analytics in battlefield systems. Expansion of edge computing in military operations, growth in hypersonic and next-generation missile technologies, and the shift toward distributed, network-centric battlefield architectures are key trends shaping the market. However, high qualification and certification costs, a limited number of suppliers, and supply chain vulnerabilities may hinder market growth.

Defense and Aerospace NAND and NOR Flash Memory Market Overview

NAND and NOR flash memory are types of memory that keep data even when the power is off. They are used a lot in defense and aerospace because they work well and are reliable in tough conditions. NAND flash stores lots of data, writes and erases quickly, and is cost-effective, so it is good for storing large amounts of information. However, it is slower than NOR flash when reading random data. NOR flash reads data quickly, lets you access small pieces of data directly, and works in a predictable way, which is important for running programs straight from the memory.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDefense and Aerospace NAND and NOR Flash Memory Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Defense and Aerospace NAND and NOR Flash Memory Market Drivers and Opportunities

Market Drivers:

- Rising Demand for Ruggedized Memory Solutions: The demand for ruggedized NAND and NOR flash memory is accelerating in the defense and aerospace sectors due to the increasingly harsh and variable environments in which modern platforms operate.

- Growing Deployment of Unmanned Systems: The growing deployment of unmanned systems—including unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and unmanned surface/underwater vehicles (USVs/UUVs)—is becoming one of the most powerful demand catalysts for the defense and aerospace NAND AND NOR flash memory market.

- Increasing Modernization of Aircraft Avionics and Mission-Computing Systems: The increased modernization of aircraft avionics and mission-computing systems is accelerating demand for advanced NAND and NOR flash memory in the Defense and Aerospace market.

- Need for High-Reliability, Firmware/Boot Storage in Avionics and Military Systems: NOR flash (and sometimes specialized NAND) is ideal for storing boot code, firmware, and embedded software where read-reliability and stability over long durations matter.

- Rising Complexity of Aerospace and Defense Systems: As systems become more complex, with more sensors, edge processing, logging, firmware layers, etc., demand for non-volatile memory (both code storage and data logging) increases.

Market Opportunities:

- Rising LEO Constellation Deployments: The accelerating deployment of Low Earth Orbit (LEO) satellite constellations is becoming a major catalyst for growth in the defense and aerospace NAND and NOR flash memory market.

- Development of 3D NAND and Advanced NOR Architectures: The development of 3D NAND and advanced NOR architectures purpose-built for rugged, long-life defense applications.

- Expanding Use of AI/ML and Real-Time Analytics in Battlefield Systems: Modern military platforms are increasingly equipped with AI/ML-enabled systems for real-time threat detection, predictive maintenance, autonomous navigation, target recognition, and situational awareness.

- Advancements in Flash Technology: Improved flash tech can enable larger data storage (for logging, black-box data, and recordings) in defense systems at lower cost/bit, widening its applicability.

- Favorable Regulations: Governments and defense agencies often mandate qualified, high-reliability components; this requirement can favor established flash memory suppliers, enabling them to secure contracts for specialized NOR/NAND chips.

Defense and Aerospace NAND and NOR Flash Memory Market Report Segmentation Analysis

The defense and aerospace NAND and NOR flash memory market is divided into different segments for a clearer understanding of market functioning, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Flash Memory Type:

- NAND Flash Memory: Providing high-density, ruggedized data storage for mission data, sensor payloads, ISR collection, battlefield analytics, and onboard recording in aircraft, UAVs, satellites, and naval platforms.

- NOR Flash Memory: Its unmatched reliability, fast random-access performance, and ability to execute code directly from Flash (XIP), a requirement for systems where startup speed, determinism, and firmware integrity are mission-critical.

By NAND Flash Memory:

- SLC

- MLC

- TLC

- Others

By NOR Flash Memory:

- Parallel NOR

- Serial NOR

By NAND Flash Memory Architecture:

- 2D NAND

- 3D NAND

By NOR Flash Memory Density:

- Upto 2 MB

- 4 MB to 64 MB

- 128 MB to 512 MB

- Greater than 1 GB

By NAND Flash Memory Density:

- Upto 2 GB

- 4 GB to 64 GB

- 128 GB to 512 GB

- Above 1 Tb

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Defense and Aerospace NAND and NOR Flash Memory Market Regional Insights

The regional trends and factors influencing the Defense and Aerospace NAND and NOR Flash Memory Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Defense and Aerospace NAND and NOR Flash Memory Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Defense and Aerospace NAND and NOR Flash Memory Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.93 Billion |

| Market Size by 2031 | US$ 2.72 Billion |

| Global CAGR (2025 - 2031) | 5.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Flash Memory Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Defense and Aerospace NAND and NOR Flash Memory Market Players Density: Understanding Its Impact on Business Dynamics

The Defense and Aerospace NAND and NOR Flash Memory Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Defense and Aerospace NAND and NOR Flash Memory Market top key players overview

Defense and Aerospace NAND and NOR Flash Memory Market Share Analysis by Geography

The defense and aerospace NAND and NOR flash memory market in Asia Pacific is witnessing the fastest growth driven by to rapid military modernization, rising geopolitical tensions, expanding aviation fleets, and increasing investments in indigenous space programs. Emerging markets in Latin America, and the Middle East and Africa also have many untapped opportunities for defense and aerospace NAND and NOR flash memory providers to expand.

The defense and aerospace NAND and NOR flash memory market grow differently in each region owing to emphasis on cybersecurity, secure supply chains, and industrial autonomy fuels the adoption of trusted-memory components. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers:

- Rising defense modernization program spending

- Strong aerospace manufacturing sector growth

- Increasing demand for ruggedized storage

- Trends: Surge in advanced avionics procurement

2. Europe

- Market Share: Substantial share due to early adoption of digital commerce

- Key Drivers:

- Growing cross-border defense collaboration initiatives

- Investments in next-generation combat aircraft

- Rising cybersecurity needs for militaries

- Trends: Demand for secure mission-critical memory

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

- Key Drivers:

- Rapid military modernization across nations

- Rising geopolitical tensions driving procurement

- Expansion in indigenous aerospace manufacturing

- Trends: Increased investment in space exploration

4. South and Central America

- Market Share: Growing market with steady progress

- Key Drivers:

- Gradual modernization of defense infrastructure

- Growing adoption of surveillance technologies

- Trends: Upgrade of military electronic systems

5. Middle East and Africa

- Market Share: Small market share, growing at a fast pace

- Key Drivers:

- Heightened defense spending amid instability

- Expanding demand for secure avionics

- Trends: Rising focus on cyber-defense resilience

Defense and Aerospace NAND and NOR Flash Memory Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Micron Technology Inc and Samsung Electronics Co Ltd and Infineon Technologies AG. Regional and niche providers such as Flexxon Pte Ltd (Singapore), Macronix International Co., Ltd (Taiwan), and 3D PLUS (US) also add to the competitive landscape across different regions.

A highly competitive environment drives companies to offer unique products and services, including:

- Durable and compact designs optimized for limited space and harsh environments

- Customization options for specific platform configurations and OEM / integration requirements

- Competitive pricing models to meet cost-sensitive demands of large-scale procurement / defense budgets

Opportunities and Strategic Moves

- Growing demand from expanding space and defense programs (satellites, next-gen aircraft & systems).

- Shift toward modular, scalable, and space-qualified memory architectures enabling flexible integration.

- Emerging demand for intelligent, AI-ready, and high-performance memory solutions for space / defense applications.

- Strategic moves by memory vendors: investing in space-qualified portfolios, supply-chain control & lifecycle support

Major Companies operating in the Defense and Aerospace NAND and NOR Flash Memory Market are:

- Macronix International Co., Ltd (Taiwan)

- Flexxon Pte Ltd (Singapore)

- Micron Technology Inc. (US)

- Samsung Electronics Co Ltd (South Korea)

- Winbond Electronics Corp (Taiwan)

- Alliance Memory, Inc. (US)

- 3D PLUS (France)

- ATP Electronics, Inc (Taiwan)

- Infineon Technologies AG (Germany)

- KIOXIA Holdings Corporation (Japan)

- SK Hynix Inc (South Korea)

- Phison Electronics Corporation (US)

- Microchip Technology Inc (US)

- Renesas Electronics Corp (Japan)

- Power Device Corporation (US)

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Murata Machinery, Ltd

- BEUMER GROUP

- MHI

- TGW Logistics Group

- WITRON

- JR Automation

- WESTFALIA TECHNOLOGIES, INC.

- DIXON AUTOMATIC TOOL, INC.

- Eckhart

- IHI Corporation

- Armstrong

- Ward Ventures, Inc.

- Pallet Shuttle Automation, LLC

- Macrodyne Technologies Inc.

- CHL Systems Inc

Defense and Aerospace NAND and NOR Flash Memory Market News and Recent Developments

- Microchip Technology Expanded its India Footprint- Microchip Technology has expanded its India footprint with the acquisition of 1.72 lakh square feet (16,000 square meters) of premium office space at the Export Promotion Industrial Park (EPIP) Zone in Whitefield, Bengaluru. This move highlights the company’s continued focus on strengthening its engineering and design capabilities in the region.

- Renesas Electronics Corporation Launched MPUs- Renesas Electronics Corporation introduced a new high-performance microprocessor (MPU) in the RTOS-based RZ/A series that meets the growing demands of advanced human-machine interface (HMI) systems. The new RZ/A3M MPU comes with large SDRAM, SRAM and RTOS support to facilitate the seamless execution of complex tasks and real-time graphical displays.

Defense and Aerospace NAND and NOR Flash Memory Market Report Coverage and Deliverables

The "Defense and Aerospace NAND and NOR Flash Memory Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Defense and aerospace NAND and NOR flash memory market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Defense and aerospace NAND and NOR flash memory market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Defense and aerospace NAND and NOR flash memory market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Defense and aerospace NAND and NOR flash memory market

- Detailed company profiles

Frequently Asked Questions

1. Rising LEO Constellation Deployments

2. Development of 3D NAND and Advanced NOR Architectures

3. Expanding Use of AI/ML and Real-Time Analytics in Battlefield Systems

1. SLC

2. MLC

3. TLC

4. Others

1. 2D NAND

2. 3D NAND

1. Rising Demand for Ruggedized Memory Solutions

2. Growing Deployment of Unmanned Systems

3. Increasing Modernization of Aircraft Avionics and Mission-Computing Systems

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For