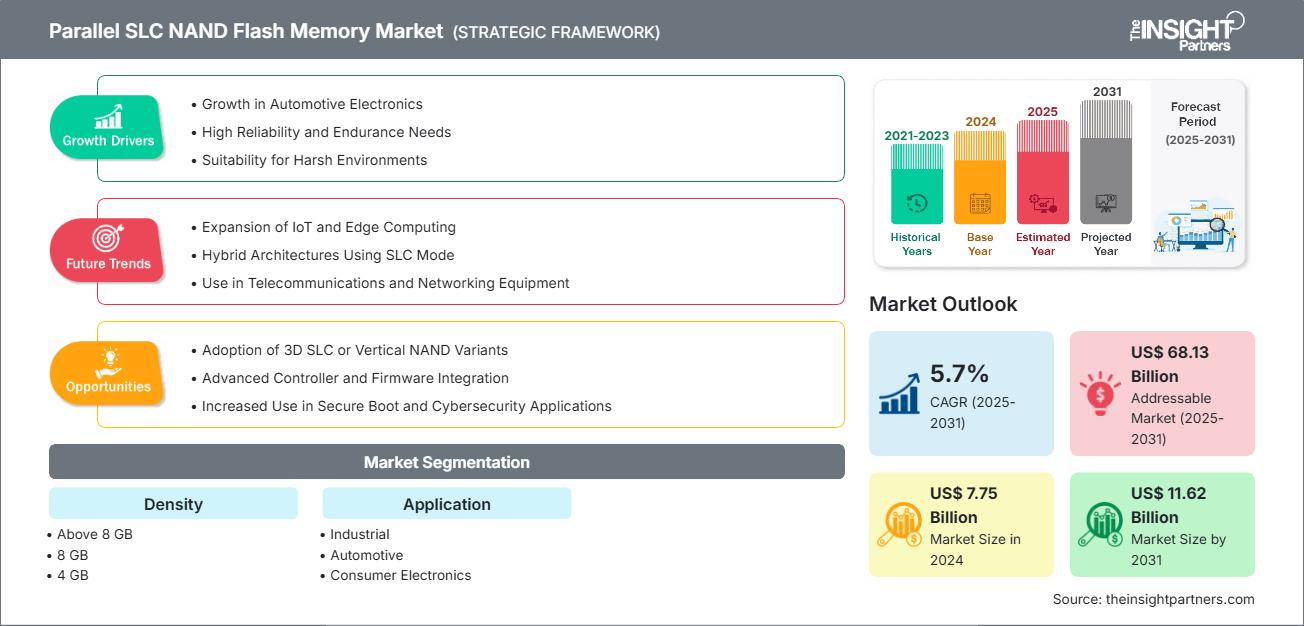

Parallel SLC NAND Flash Memory Market Growth, Trends & Opportunities by 2031

Parallel SLC NAND Flash Memory Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Density (Above 8 GB, 8 GB, 4 GB, 2 GB, and 1 GB), Application (Industrial, Automotive, Consumer Electronics, Computers and IT, Communication, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Nov 2025

- Report Code : TIPRE00041484

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 251

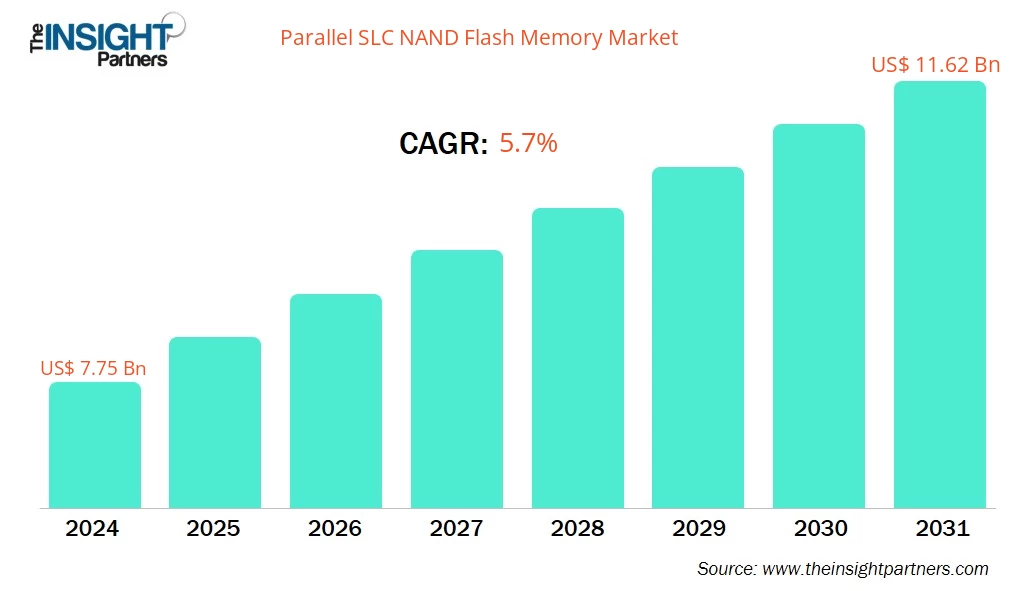

The parallel SLC NAND flash memory market size is projected to reach US$ 11.62 billion by 2031, up from US$ 7.75 billion in 2024. The market is expected to register a CAGR of 5.7% during 2025–2031.

Parallel SLC NAND Flash Memory Market Analysis

Parallel SLC NAND flash memory is in high demand due to the need for high reliability, data integrity in harsh industrial environments, and long lifecycle support for legacy systems. The market is also driven by the growing demand for high-performance memory solutions in the aerospace, defense, and industrial automation sectors.

Parallel SLC NAND Flash Memory Market Overview

Parallel SLC NAND flash is a non-volatile memory specifically engineered for situations where data integrity and reliability over time are crucial. It employs a single-level cell (SLC) architecture that keeps only one bit per cell, and is also integrated with a parallel (ASYNC/ONFI) interface for direct memory access. Due to this, the device has a much better endurance, can write data much faster, has a much lower latency, and can operate very stably over a wide range of temperatures as compared to multi-level cell (MLC/TLC/QLC) NAND and the modern serial-based devices (such as eMMC, UFS, NVMe).

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONParallel SLC NAND Flash Memory Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Parallel SLC NAND Flash Memory Market Drivers and Opportunities

Market Drivers:

- Critical demand for high reliability and data integrity: In aerospace, medical, and industrial automation, performance cannot be compromised. The exceptional longevity and very low bit error rate of parallel SLC NAND are the primary reasons it is used in sectors where data corruption may cause severe consequences.

- Operation in extreme environmental conditions: Parallel SLC NAND can deliver consistent performance within a very broad temperature range (-40 °C to +85 °C and even beyond). Thus, it is the only memory technology that can be used in the automotive, defense, and outdoor industrial sectors, where a consumer-grade memory product would fail.

- Need for Deterministic Performance and Low Latency: Complex NAND architectures often exhibit variable latency due to processes such as garbage collection and wear-leveling. In contrast, parallel SLC NAND is simpler and offers consistent, predictable read/write times, which is an essential feature for real-time embedded systems and control applications.

Market Opportunities:

- Expansion of local industrial IoT & critical control: The Industrial Internet of Things (IIoT) and the new generation of critical control systems' radical expansion present a significant opportunity. These types of applications demand local storage that is strong and reliable, thus paving the way for a niche market of super high-reliability parallel SLC NAND.

- Customization and value-added services: Manufacturers and distributors can capitalize on this high-reliability demand niche by offering value-added services, such as custom screening, extended temperature testing, and long-term supply agreements that are specifically tailored to meet the needs of high-reliability customers.

- Modernization of aging essential infrastructure: Changes in the energy distribution systems, transit networks, and security mechanisms typically require a "like-for-like" or "better-than-like" component substitution. As a result, this generates a prolonged aftermarket and revitalization prospect for parallel SLC NAND with advanced features.

Parallel SLC NAND Flash Memory Market Report Segmentation Analysis

The parallel SLC NAND flash memory market is segmented into distinct categories to provide a clearer understanding of its operation, growth potential, and current trends. Below is the standard segmentation approach used in most industry reports:

By Density:

- Above 8 GB: This segment of the market is designed for extremely fast and high-performance applications that require a substantial amount of local storage for complex code or large-scale data logging.

- 8 GB: This density level is common in the market and balances sizable storage capacity with the strong endurance characteristic of SLC technology. Industrial computing, networking equipment, and control systems of a high technological level are typical areas of its application.

- 4 GB: It is the main density level for deeply embedded systems in automotive, medical, and industrial automation sectors. Additionally, it offers a reliable solution for storing firmware and operating systems.

- 2 GB: Primarily, it is utilized in the upgrading of existing systems and in applications that have moderate storage requirements but require the highest possible reliability. It is positioned as a cost-saving measure.

- 1 GB: This is a fundamental density level ideal for essential tasks such as boot code, firmware storage, and basic embedded systems, where reliability takes precedence over capacity.

By Application:

- Industrial

- Automotive

- Consumer Electronics

- Computers and IT

- Communication

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The parallel SLC NAND flash memory market in Asia Pacific is expected to witness the fastest growth.

Parallel SLC NAND Flash Memory Market Regional InsightsThe regional trends influencing the Parallel SLC NAND Flash Memory Market have been analyzed across key geographies.

Parallel SLC NAND Flash Memory Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 7.75 Billion |

| Market Size by 2031 | US$ 11.62 Billion |

| Global CAGR (2025 - 2031) | 5.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Density

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Parallel SLC NAND Flash Memory Market Players Density: Understanding Its Impact on Business Dynamics

The Parallel SLC NAND Flash Memory Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Parallel SLC NAND Flash Memory Market Share Analysis by Geography

Asia Pacific is witnessing the fastest growth. Emerging markets in Latin America, and Middle East & Africa offer numerous untapped opportunities for parallel SLC NAND flash memory providers.

The parallel SLC NAND flash memory market experiences different growth rates in each region. Below is a summary of market share and trends by region:

1. North America

- The demand for high-reliability parallel SLC NAND flash memory is mainly driven by the need to modernize the aging industrial and critical infrastructures, which is a result of the presence of leading aerospace, defense, and medical technology companies in the region.

2. Europe

- The European parallel SLC NAND flash memory market is supported by a solid industrial automation and automotive manufacturing base, strict regulations for product safety and data integrity, and the requirement to maintain legacy systems with long lifecycles.

3. Asia Pacific

- Major factors driving market expansion include rapid industrialization, the growth of the manufacturing sector for industrial IoT and telecommunications equipment, and the presence of a large electronics supply chain catering to global high-reliability sectors.

4. South and Central America

- The modernization of industrial automation, mining, and energy sectors—driven by growing investments and the need for robust components that can withstand harsh environmental conditions—has created a niche demand for parallel SLC NAND solutions in the region.

5. Middle East and Africa

- The need for electronic components that can function reliably under extreme temperatures—driven by expanding investments in telecommunications infrastructure, oil & gas exploration, and power grid systems—is likely to increase the demand for parallel SLC NAND flash memory in this region.

Parallel SLC NAND Flash Memory Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The market is highly competitive. Key players contributing to this competitive scenario include automation memory manufacturing giants such as Micron Technology, Winbond Electronics, KIOXIA (formerly Toshiba), and Infineon Technologies (formerly Cypress). Furthermore, several specialized semiconductor companies and distributors, such as ATP Electronics, Swissbit, and Apacer Technology, focus exclusively on the high-reliability and legacy support segments, creating a dynamic and segmented market that caters to diverse industrial needs.

This high level of competition urges companies to stand out by offering:

- Guaranteed longevity and product stability

- Superior endurance and extended temperature ratings

- Value-added services and customization

- Proven reliability and global technical support

Opportunities and Strategic Moves

- To deliver full subsystem solutions, prominent memory producers are collaborating through partnerships with industrial computing module manufacturers (such as Kontron, Advantech) and FPGA/SoC suppliers, thereby providing embedded system designers with the most compatible and reliable solutions.

- Top suppliers are shifting their business model away from purely transactional sales toward signing long-term supply agreements (LTSA) and "Component-as-a-Service" contracts, which assure supply and reduce the risk of obsolescence for clients in the essential sector.

- To support the performance and reliability limits of their SLC NAND for the most demanding applications, companies are investing heavily in state-of-the-art packaging, wafer-level screening, and enhanced data integrity features, such as a robust error correction code (ECC), allowing them to charge a premium.

Other companies analyzed during the course of research:

- ATP Electronics

- Swissbit AG

- Apacer Technology Inc.

- Viking Technology (A Sanmina Company)

- Integrity Technology (BIWIN)

- Transcend Information, Inc.

- Cactus Technology Ltd.

- Delkin Devices, Inc.

- Innodisk Corporation

- ADATA Technology Co., Ltd.

- KingSpec Electronics (A focus on industrial/embedded)

- Foremay, Inc.

- Virtium LLC

- STEC, Inc.

- Renesas Electronics Corporation

Parallel SLC NAND Flash Memory Market News and Recent Developments

- SK hynix Begins Mass Production of 321-Layer QLC NAND Flash: In August 2025, SK hynix Inc. announced that it had completed the development of its 321-layer 2 TB QLC1 NAND flash product and had begun its mass production. This development marks the world’s first implementation of more than 300 layers using QLC technology, setting a new benchmark in NAND density. The company plans to release the product in the first half of next year, following completion of global customer validation.

- Kioxia and Sandisk Unveil Next-Generation 3D Flash Memory Technology Achieving 4.8Gb/s NAND Interface Speed: In February 2025, Kioxia Corporation and SanDisk Corporation pioneered a state-of-the-art 3D flash memory technology, setting the industry benchmark with a 4.8Gb/s NAND interface speed, superior power efficiency, and increased density.

Parallel SLC NAND Flash Memory Market Report Coverage and Deliverables

The "Parallel SLC NAND Flash Memory Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Parallel SLC NAND Flash Memory Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Parallel SLC NAND Flash Memory Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Parallel SLC NAND Flash Memory Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the parallel SLC NAND flash memory market

- Detailed company profiles

Frequently Asked Questions

2. Supply chain volatility of newer memory technologies

3. Expansion of industrial IoT and rugged edge computing

1. Shift toward long-term supply agreements and customization

2. Development of enhanced endurance and extended temperature products

3. Growth in legacy system support and component lifecycle management

1. Industrial

2. Automotive

3. Consumer Electronics

4. Computers and IT

5. Others

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For