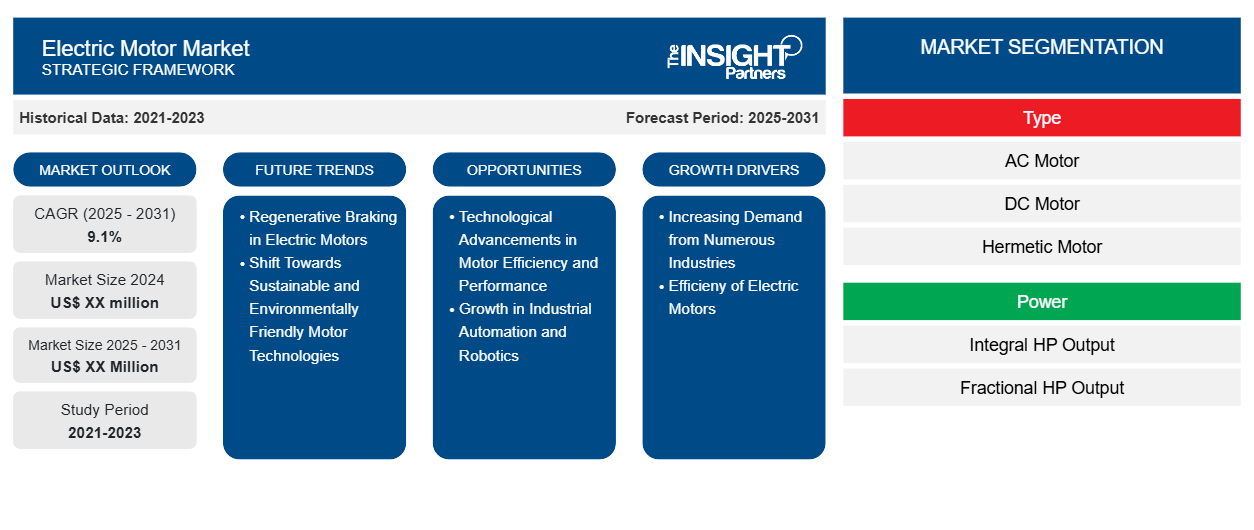

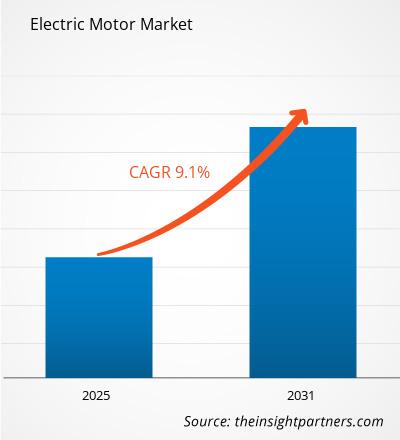

The Electric Motor Market is expected to register a CAGR of 9.1% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The Report is Segmented by Type (AC Motor, DC Motor,Hermetic Motor ); Power (Integral HP Output, Fractional HP Output); Voltage (Below 690 V, Between 690 V to 45 kV, Above 45 kV); Application (Industrial Machinery, Motor Vehicles, HVAC Equipment, Aerospace & Transportation, Household Appliances, Others). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments

Purpose of the Report

The report Electric Motor Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Electric Motor Market Segmentation

Type

- AC Motor

- DC Motor

- Hermetic Motor

Power

- Integral HP Output

- Fractional HP Output

Voltage

- Below 690 V

- Between 690 V to 45 kV

- Above 45 kV

Application

- Industrial Machinery

- Motor Vehicles

- HVAC Equipment

- Aerospace & Transportation

- Household Appliances

- Others

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Motor Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electric Motor Market Growth Drivers

- Increasing Demand from Numerous Industries:Electric motors are widely employed in a variety of sectors and applications because of their numerous benefits. Electric motors outperform combustion engines in terms of energy conversion rates, reaching up to 98%. This means that they convert nearly all of the energy they absorb into mechanical work.Electric motors emit no emissions, making them eco-friendly.Electric motors have fewer moving components than combustion engines, requiring less maintenance. Thus, the demand for electric motor from numerous industries is expected to grow during the forecast period.

- Efficieny of Electric Motors: Efficiency is one of the most significant advantages of electric motors. Electric motors usually convert more than twice as much electrical energy into mechanical energy, or motion, as traditional internal combustion engines. An electric motor generates torque using electric current and magnetic fields, whereas an ICE motor takes a longer time to combust gasoline and turn the crankshaft. Thus, the demand for electric motors is expected to grow during the forecast period owing to their high efficiency.

Electric Motor Market Future Trends

- Regenerative Braking in Electric Motors:The process of regenerative braking in an electric motor offers various benefits. Regenerative braking recovers kinetic energy wasted as heat while braking and turns it into electrical power to charge the battery. This, in turn, has the potential to increase driving range, resulting in less time spent charging and more time driving. Regenerative braking also slows the car down, which helps regular brakes perform their job. This means less wear and tear, which extends their life and requires fewer replacements.

- Shift Towards Sustainable and Environmentally Friendly Motor Technologies: A prominent trend in the electric motor market is the increasing focus on sustainability and environmentally friendly motor technologies. Manufacturers are developing motors that reduce energy consumption and utilize environmentally conscious materials. For example, there is a growing trend in the adoption of rare-earth-free motors and motors that use sustainable, recyclable materials. As environmental regulations tighten and companies strive to meet sustainability goals, this trend towards greener, more sustainable electric motor technologies will continue to drive innovation and market growth.

Electric Motor Market Opportunities

- Technological Advancements in Motor Efficiency and Performance: There is a significant opportunity for innovation in the electric motor market through advancements in motor efficiency and performance. Technologies like permanent magnet synchronous motors (PMSMs), brushless DC motors (BLDC), and induction motors are becoming more energy-efficient, offering reduced operational costs and improved reliability. Manufacturers have the opportunity to develop next-generation motors that enhance performance, reduce energy consumption, and extend the lifespan of motors, opening up new possibilities in industries such as automotive, industrial automation, and home appliances.

- Growth in Industrial Automation and Robotics: The increasing adoption of industrial automation and robotics presents a strong opportunity for electric motor manufacturers. Electric motors are at the heart of automation systems, driving robots, conveyors, and automated machinery. As industries seek to improve productivity, reduce labor costs, and enhance precision, the demand for electric motors in automation systems is expanding. Manufacturers can capitalize on this trend by designing specialized motors that offer better control, higher torque, and precise movement, making them ideal for use in robotics and other automation applications.

Electric Motor Market Regional Insights

The regional trends and factors influencing the Electric Motor Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electric Motor Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electric Motor Market

Electric Motor Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 9.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

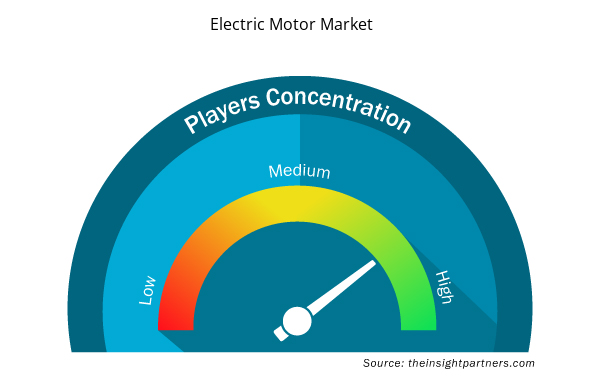

Electric Motor Market Players Density: Understanding Its Impact on Business Dynamics

The Electric Motor Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electric Motor Market are:

- ABB Ltd

- AMETEK Inc

- Emerson Electric Co

- General Electric

- Johnson Electric Holdings Limited

- Nidec Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electric Motor Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Electric Motor Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Electric Motor Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Transdermal Drug Delivery System Market

- Equipment Rental Software Market

- Biopharmaceutical Tubing Market

- Dried Blueberry Market

- Europe Industrial Chillers Market

- Fish Protein Hydrolysate Market

- Medical Second Opinion Market

- Military Rubber Tracks Market

- Molecular Diagnostics Market

- Third Party Logistics Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The Electric Motor Market is estimated to witness a CAGR of 9.1% from 2023 to 2031

Regenerative braking in electric motors to play a significant role in the global electric motor market in the coming years

Increasing demand from numerous industries and efficieny of electric motors are the major factors driving the electric motor market

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

1. ABB Ltd.

2. AMETEK, Inc.

3. Franklin Electric Co. Inc.

4. General Electric

5. Johnson Electric Holdings Limited

6. Nidec Corporation

7. Regal Beloit Corporation

8. Rockwell Automation, Inc.

9. Siemens AG

10. Toshiba Corp

Get Free Sample For

Get Free Sample For