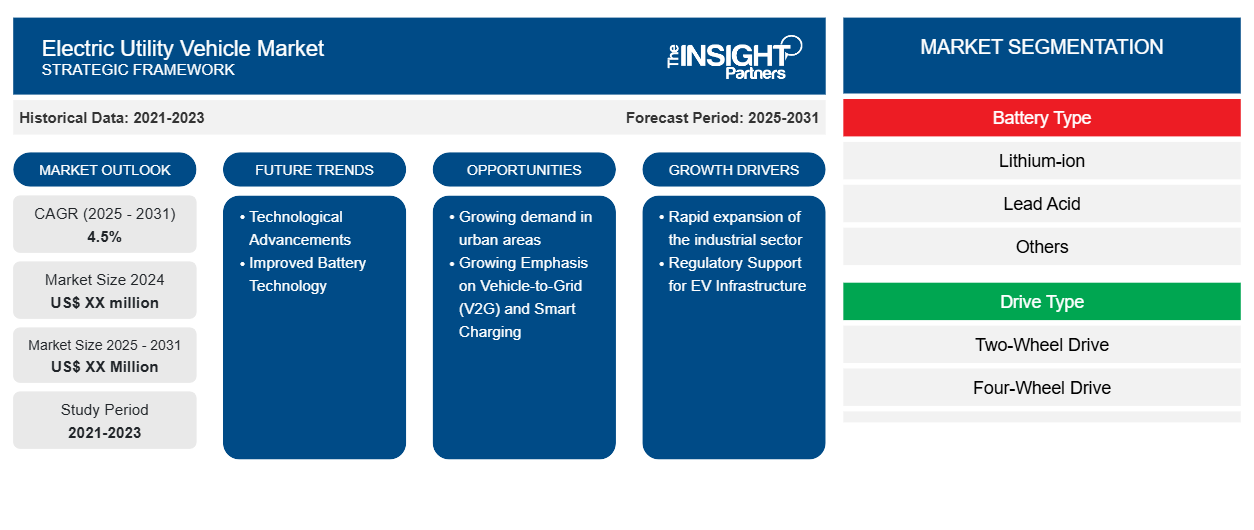

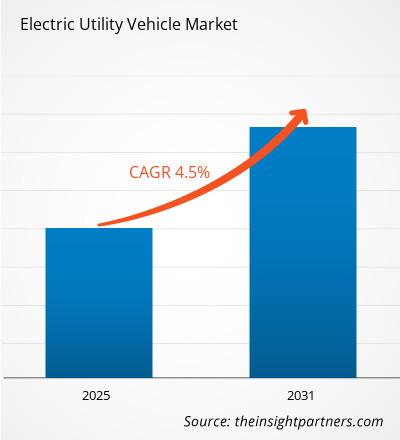

The Electric Utility Vehicles Market is expected to register a CAGR of 4.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

Electric Utility Vehicle Market covers analysis By Battery Type (Lithium-ion, Lead Acid, and Others); Drive Type (Two-Wheel Drive, and Four-Wheel Drive), By Speed (Up to 25 mph, 26-45 mph, and Above 45 mph), Application (Mining, Building & Construction, Sports, Agriculture, Golf Course, Commercial, and Others),

Purpose of the Report

The report Electric Utility Vehicles Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Electric Utility Vehicles Market Segmentation

Battery Type

- Lithium-ion

- Lead Acid

- Others

Drive Type

- Two-Wheel Drive

- Four-Wheel Drive

Speed

- Up to 25 mph

- 26-45 mph

- Above 45 mph

Application

- Mining

- Building & Construction

- Sports

- Agriculture

- Golf Course

- Commercial

- Others

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Utility Vehicle Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electric Utility Vehicles Market Growth Drivers

- Rapid expansion of the industrial sector: Accross the globe rapid expansion of industrial sector is major driving factor for the market growth. Rising focus of the automakers towards the carbon emission free vehicles drives the market growth. According to the India Brand Equity Foundation Organization, the India's industrial manufacturing sector is expected to reach US$ 1 trillion by 2026. With such growth in the industrial development, the demand for electric utility vehicles is growing at rapid pace.

- Regulatory Support for EV Infrastructure: Governments are also investing in the expansion of EV charging infrastructure to support the adoption of electric utility vehicles. These investments lower the barrier to entry for fleet operators and consumers by ensuring widespread access to fast and efficient charging solutions.

Electric Utility Vehicles Market Future Trends

- Technological Advancements: Rising development of the advanced technology based electric vehicle models by the key players is creating ample opportunity in the market. For instance, in March, 2023, Club Car, a world-leading manufacturer of small-wheel, zero-emissions electric vehicles, is rolling out its latest street-legal electric vehicle, the Club Car Urban LSV and XR that are now available through our commercial distributor network in North America. The new Urban platform expands Club Car’s leading electric vehicle portfolio, which has been prominent in commercial markets for decades. Featuring automotive styling, ergonomic design, a top speed of 25 mph for use on roads, and the ability to customize the vehicle for specific needs, the new Club Car Urban brings a unique utility vehicle solution addressing needs for large campuses, last mile delivery, municipalities, and hospitality spaces. (Company Website News)

- Improved Battery Technology: One of the key enablers of the electric utility vehicle market is the rapid advancement of lithium-ion battery technology. Innovations in battery chemistry have led to improvements in energy density, charging speed, and cost-effectiveness, which directly enhance the performance and affordability of electric vehicles. As battery prices continue to fall, electric utility vehicles are becoming more competitive with their internal combustion counterparts.

Electric Utility Vehicles Market Opportunities

- Growing demand in urban areas: Rising demand from urban areas for delivery services, rising demand for utility vehicles for waste management, and growing demand for public transportation is expected to create ample opportunity for the market growth. Additionally, electric utility vehicles are widely used by municipal corporations, sports authorities and among others.

- Growing Emphasis on Vehicle-to-Grid (V2G) and Smart Charging: As electric utility vehicles become more integrated with smart grid technologies, opportunities for vehicle-to-grid (V2G) systems and smart charging solutions are growing. These technologies allow electric vehicles to not only draw power from the grid but also return energy during peak demand periods, offering potential savings for fleet operators and contributing to energy grid stability.

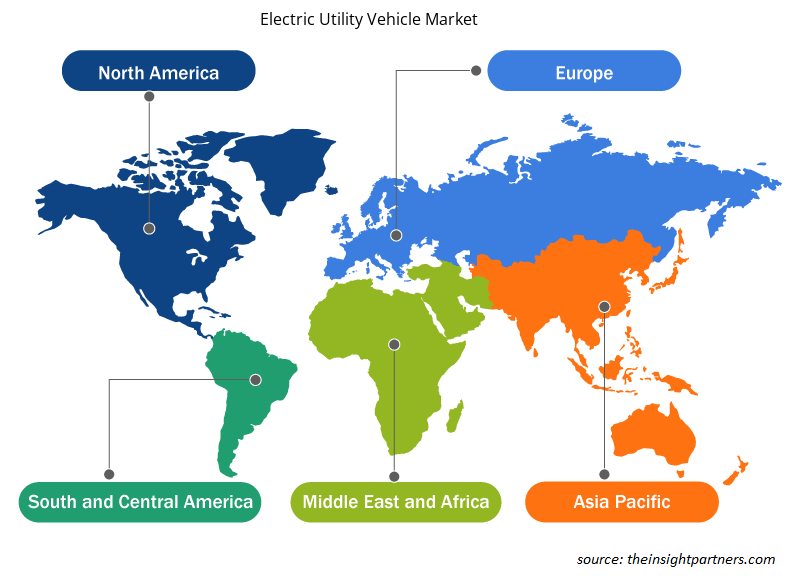

Electric Utility Vehicle Market Regional Insights

The regional trends and factors influencing the Electric Utility Vehicle Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electric Utility Vehicle Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electric Utility Vehicle Market

Electric Utility Vehicle Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 4.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Battery Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Electric Utility Vehicle Market Players Density: Understanding Its Impact on Business Dynamics

The Electric Utility Vehicle Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electric Utility Vehicle Market are:

- American LandMaster

- Bintelli Electric Vehicles

- Deere and Company

- Ingersoll-Rand plc

- Marshell Green Power Co. Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electric Utility Vehicle Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Electric Utility Vehicles Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Electric Utility Vehicles Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

What are the options available for the customization of this report?

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

What are the deliverable formats of the Electric Utility Vehicles Market report?

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Which are the leading players operating in the Electric Utility Vehicles Market?

The major players in the market includes Polaris, Club Car, Toyota Industries Corporation, Deere & Company, Textron, Alke, Renault Group, Briggs & Stratton, Rivian, Columbia Vehicle Group Inc.

What is the expected CAGR of the Electric Utility Vehicles Market?

The Electric Utility Vehicles Market is estimated to witness a CAGR of 4.5% from 2023 to 2031

What are the restraining factors impacting the global Electric Utility Vehicles Market?

The high manufacturing cost for electric utility vehicles hinders the market growth.

What are the driving factors impacting the Electric Utility Vehicles Market?

The major factors driving the Electric Utility Vehicles Market are: Increasing sale of electric vehicles with government support and initiatives drives the market growth.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Boat Sails Market

- Heavy Commercial Vehicle Air Brake Systems Market

- Heavy Commercial Vehicle Clutch Market

- Electric Vehicle Heat Pump Systems Market

- Event Logistics Market

- Industrial Vehicles Market

- Motorsport Transmission Market

- Automotive Telematics Market

- Third Party Logistics Market

- Low Speed Electric Vehicle Market

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies

1. American LandMaster

2. Bintelli Electric Vehicles

3. Deere and Company

4. Ingersoll-Rand plc

5. Marshell Green Power Co. Ltd

6. Polaris Inc.

7. Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd

8. Textron Inc.

9. The Toro Company

10. Yamaha Motor Co., Ltd.

Get Free Sample For

Get Free Sample For