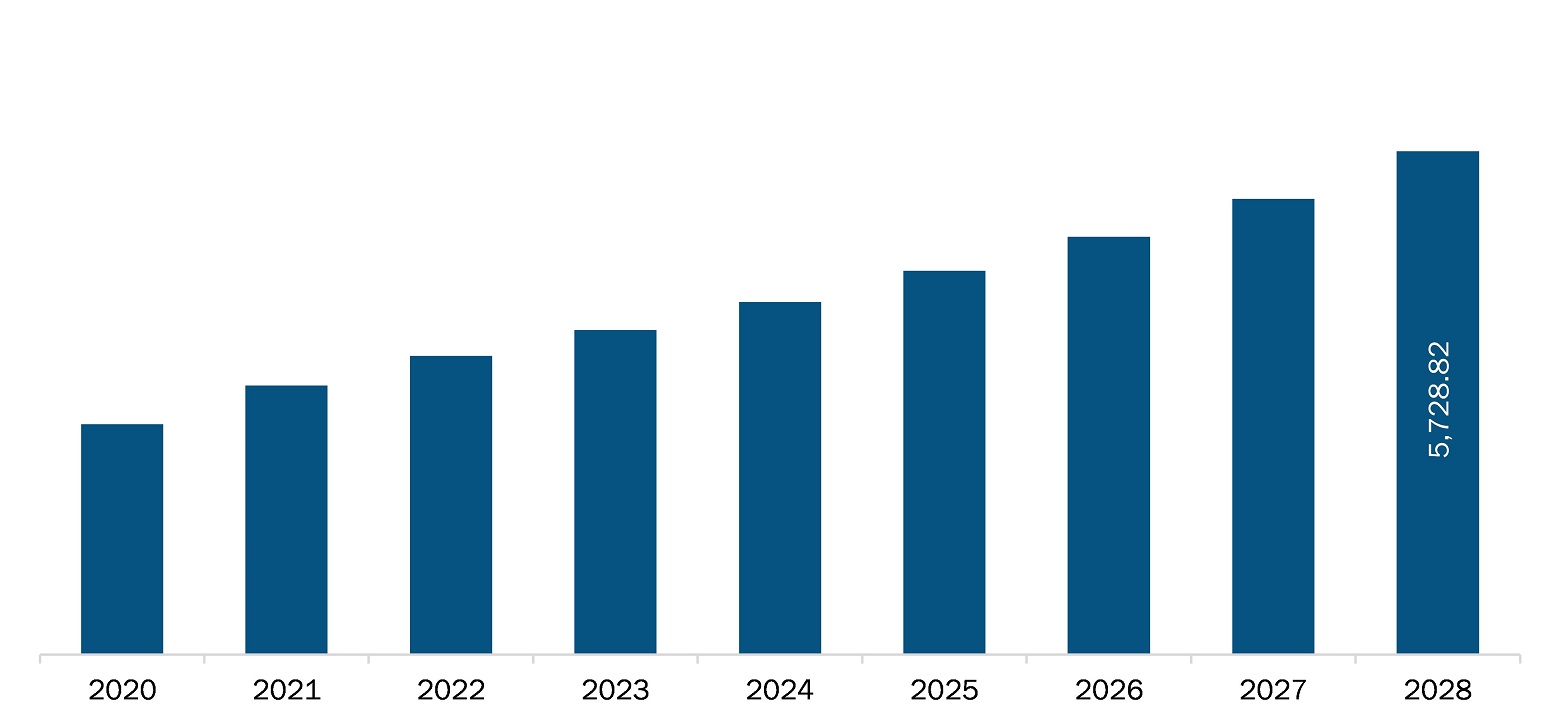

The Europe dual clutch transmission market is expected to reach US$ 5,728.82 million by 2028 from an estimated value of US$ 3,061.38 million in 2021; it is likely to grow at a CAGR of 9.4% from 2021 to 2028.

Growing sales of SUVs worldwide and increasing concerns about fuel economy and CO2 emission are driving the market. However, the increasing adoption of electric vehicles and their high costs may hamper the growth of the Europe dual clutch transmission market during the forecast period.

A dual clutch transmission (DCT) combines the convenience of an automatic transmission with the fuel efficiency of a manual transmission. The 21st century has observed refinement in vehicle design in terms of problems relating to aerodynamics. The global scenario is not much different. Therefore, there is enormous scope for improving the aerodynamics of cars to conserve depleting oil reserves. Dual clutch transmissions (DCTs) refer to the double friction clutches; they are designed and operated fully automated in vehicles. Also, the auto industry has seen a perpetual increase in the level of global competition. The increase in the complexity of vehicle design and content has led to time-consuming and expensive development processes. The high cost and long gestation period imply a notable risk for the automakers.

On the contrary, technology will play an ever-increasing role in this global competition, requiring high-quality products that are safe to use and economical to design and manufacture. Furthermore, advanced techniques such as dual clutch transmission systems are used by automotive OEMs to minimize fuel consumption and CO2 emissions while preserving performance. The Environmental Protection Agency (EPA) and the Nationwide Highway Traffic Safety Administration (NHTSA) worked together to create a national program for greenhouse gas emissions (GHG) and fuel efficiency requirements for light-duty automobiles (passenger cars and trucks). Phase 1 covered model years 2012 to 2016, while Phase 2 covered model years 2017 to 2025. Moreover, the growth of CO2 restrictions continues to be the fundamental driver of automobile technology advancements. The need for greenhouse gas-neutral powertrains drives the development of electrified systems and the search for feasible options for alternative, low-carbon fuels. Also, dual-clutch transmission effectively boosts the driving experience as it improves acceleration and offers smooth gear shifting. Furthermore, the rising adoption of hybrid vehicles across the globe, coupled with the increasing integration of DCT, is creating attractive sales opportunities.

In Europe, France is the hardest-hit country due to the COVID-19 outbreak. The COVID-19 pandemic has led to a sudden fall in customer demand in multiple industries, severely affecting the European Union (EU) industries. At the same time, crises in multiple supply chains across various sectors occurred, including the automotive sector. Further, in April 2020, the new car registrations of major European markets had reached the lowest level since World War II. The crisis is mainly due to the low demand from the customer side. This has led to a slowdown in vehicle manufacturing. With the slowdown in the production of vehicles, the market demand for dual clutch transmission reduced significantly in 2020. However, in 2021, with the relaxation of lockdowns and the start of vaccination drives, the automotive manufacturing activities have started again, and the raw materials are easily available. Further, industrial production in the EU increased by 0.5% in April 2021 compared to the previous year. Comparing April 2021 and April 2020, the production of motor vehicles increased by more than 400%, according to Eurostat Statistics data of June 2021. Thus, this will fuel the growth of the dual clutch transmission market in the region.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

EUROPE DUAL CLUTCH TRANSMISSION MARKET SEGMENTATION

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Propulsion Type

- Internal Combustion Engine (ICE)

- Hybrid

By Vehicle Segment

- A/B

- C

- D

- E and Above

- SUV

By Forward Gears

- 6 and Below

- 7

- 8 and Above

By Country

- France

- Italy

- Russia

- Germany

- U.K

- Rest of Europe

Company Profiles

- Magna International Inc.

- Schaeffler Technologies AG & Co. KG

- BorgWarner Inc.

- Daimler AG

- Volkswagen AG

- ZF Friedrichshafen AG

- OC Oerlikon Management AG

- Ricardo

- Renault Group

- Hyundai Transys

Europe Dual Clutch Transmission Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3,061.38 Million |

| Market Size by 2028 | US$ 5,728.82 Million |

| CAGR (2021 - 2028) | 9.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For