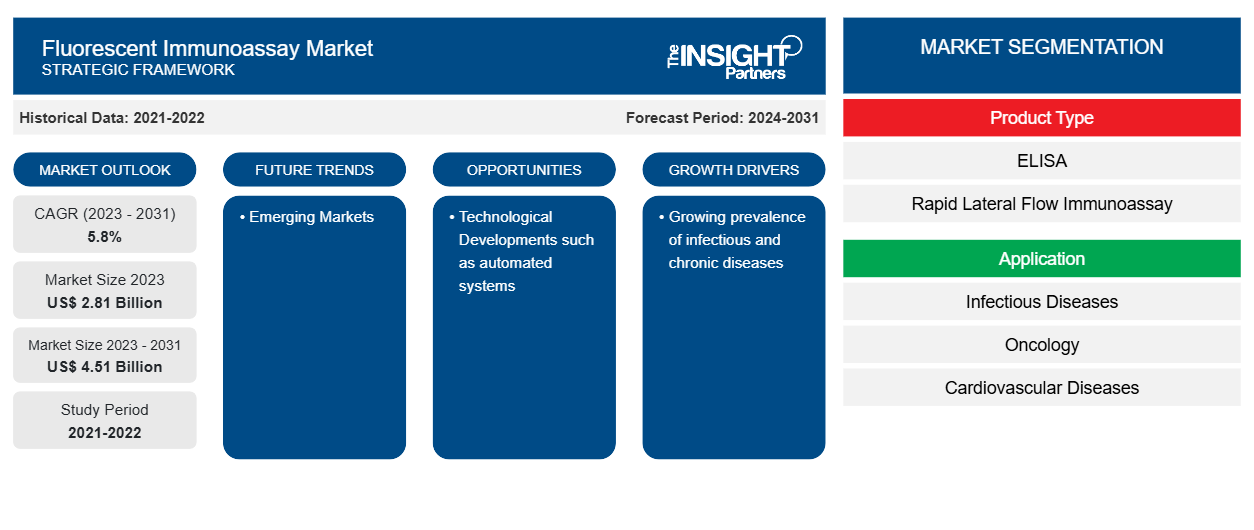

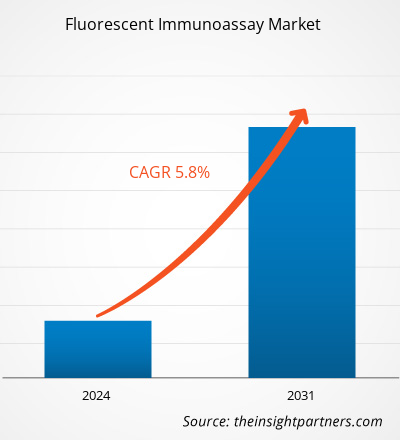

The fluorescent immunoassay market size is projected to reach US$ 4.51 billion by 2031 from US$ 2.81 billion in 2023. The market is expected to register a CAGR of 5.8% during 2023–2031. Portable fluorescent immunoassay devices for point of care testing are likely to remain key trends in the market.

Fluorescent Immunoassay Market Analysis

Growing prevalence of infectious diseases is the key factor driving the market's growth. Fluorescent immunoassays are widely used in diagnosis of infectious diseases such as COVID-19, HIV, Hepatitis among others. As per the World Health Organization (WHO), in December 2023, 39.9 million patients were living with HIV of which 1.4 million were children (0–14 years old) and 38.6 million were adults (15+ years old).

Fluorescent Immunoassay Market Overview

Increasing prevalence of infectious and chronic diseases, technological developments such as multiplexing capabilities, automate fluorescence immunoassay systems, development of portable devices, expanding applications of fluorescent immunoassays in areas such as oncology, neurological diseases, among others, integration with digital health, streamline regulatory pathways, favourable reimbursement scenario, and growing research and development activities to develop new assay and kits are factors driving the growth of the fluorescent immunoassay market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fluorescent Immunoassay Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fluorescent Immunoassay Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fluorescent Immunoassay Market Drivers and Opportunities

Rising Prevalence of Cancer is likely to Increase the Demand for Fluorescent Immunoassay.

Fluorescent immunoassays help detect cancer biomarkers, which help in early cancer screening, diagnosis, and prognosis. As per the American Cancer Society, there were around 20 million cancer cases across the globe in 2022, and the number of cancer cases is expected to reach 35 million by 2050. Such a huge burden of cancer cases around the world is likely to increase the demand for fluorescent immunoassay.

Emerging Markets

Growing healthcare expenditure, improving healthcare infrastructure, and rising prevalence of infectious and chronic diseases are likely to create growth opportunities for the fluorescent immunoassay market in emerging markets. For instance, the Ministry of Health and Family Welfare allocated Rs. 90,659 crore (US$ 10.93 billion), which is an increase of 1.69% compared to Rs. 89,155 crore (US$ 10.75 billion) in 2023-24.

Fluorescent Immunoassay Market Report Segmentation Analysis

Key segments that contributed to the derivation of the fluorescent immunoassay market analysis are product, and end user.

- The global fluorescent immunoassay market, based on product type is segmented into ELISA, rapid lateral flow immunoassay and others. In 2023, the ELISA segment held the largest share of the market. Moreover, the same segment is also expected to witness fastest growth during the forecast period, owing to the rise in the detection and diagnosis of various medical conditions across the globe.

- Based on application, the fluorescent immunoassay market is segmented into infectious diseases, oncology, cardiovascular diseases, others. In 2021, the infectious diseases segment held the largest share of the market and the same segment is also expected to witness fastest growth duringthe forecast period, owing to the rise in the prevalence of infectious diseases across the globe.

- Based on route of administration, the global fluorescent immunoassay market is divided into intravenous, subcutaneous, and other applications. The intravenous segment held the largest share of the market in 2023 and is expected to grow at the highest CAGR during the forecast period.

- By end-user, the global fluorescent immunoassay market is segmented into Hospitals & Clinics, diagnostic centers, Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and others. The hospitals segment held the largest share of the market in 2023 and the same segment is anticipated to register the highest CAGR in the market during the forecast period.

Fluorescent Immunoassay Market Share Analysis by Geography

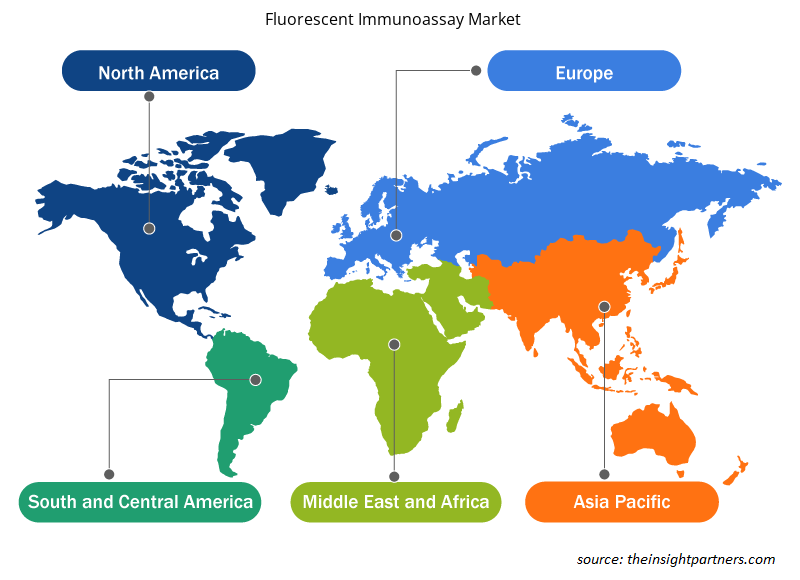

The geographic scope of the fluorescent immunoassay market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North American region holds the largest market share, whereas the Asia Pacific region is the fastest-growing region. The growth of the market in North America is mainly due to the rising demand for fluorescent immunoassays as the US and Canada are experiencing growing numbers of research and development activities and rising investments in clinical diagnostic businesses by key market players. Moreover, Asia Pacific is the fastest-growing global market for fluorescent immunoassays. China, India, and Japan are three major contributors to the growth of the market. The factors contributing to the growth of the fluorescent immunoassay market in these countries are the rise in cases of chronic diseases over the years. Countries such as Australia, India, and South Korea are estimated to serve various growth opportunities due to the rising development in the healthcare sector.

Fluorescent Immunoassay Market Regional Insights

The regional trends and factors influencing the Fluorescent Immunoassay Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fluorescent Immunoassay Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fluorescent Immunoassay Market

Fluorescent Immunoassay Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.81 Billion |

| Market Size by 2031 | US$ 4.51 Billion |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

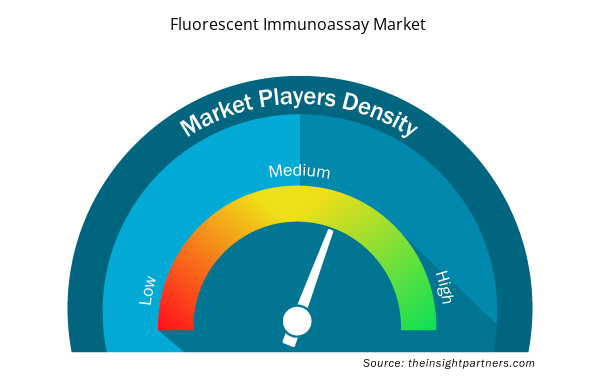

Fluorescent Immunoassay Market Players Density: Understanding Its Impact on Business Dynamics

The Fluorescent Immunoassay Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fluorescent Immunoassay Market are:

- Abbott

- BD

- bioMerieux SA

- F. Hoffman-La Roche Ltd.

- Siemens AG

- Sysmex Corp.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fluorescent Immunoassay Market top key players overview

Fluorescent Immunoassay Market News and Recent Developments

The fluorescent immunoassay market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the fluorescent immunoassay market are listed below:

- Roche announced that it has launched a high-throughput SARS-CoV-2 antigen test as an aid in the diagnosis of SARS-CoV-2 infections. The laboratory-based Elecsys SARS-CoV-2 Antigen test had earlier received CE mark and has recently obtained the import license from CDSCO (Source: F. Hoffmann-La Roche Ltd., Press Release, June 2021)

- Ortho Clinical Diagnostics announced its quantitative COVID-19 IgG antibody test achieved CE Mark. Ortho’s VITROS Anti-SARS-CoV-2 IgG Quantitative Antibody test is traceable to the WHO International Standard for anti-SARS-CoV-2 IgG antibodies, which is developed to facilitate the standardization SARS-CoV-2 serological methods. (Source: Ortho Clinical Diagnostics, Newsletter, May 2021)

- Ortho Clinical Diagnostics announced the US FDA granted Emergency Use Authorization to its second COVID-19 antibody test—the VITROS Immunodiagnostic Products Anti-SARS-CoV-2 IgG Test (COVID-19 IgG antibody test). (Source: Ortho Clinical Diagnostics, Newsletter, April 2021)

Fluorescent Immunoassay Market Report Coverage and Deliverables

The “Fluorescent Immunoassay Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Fluorescent immunoassay market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Fluorescent immunoassay market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Fluorescent immunoassay market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the fluorescent immunoassay market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sterilization Services Market

- Hydrogen Compressors Market

- Electronic Toll Collection System Market

- Portable Power Station Market

- Rare Neurological Disease Treatment Market

- Genetic Testing Services Market

- Saudi Arabia Drywall Panels Market

- Aesthetic Medical Devices Market

- Compounding Pharmacies Market

- Pipe Relining Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the expected CAGR of the fluorescent immunoassay market?

The fluorescent immunoassay market is estimated to grow with a CAGR of 5.8% from 2023 to 2031.

What would be the estimated value of the fluorescent immunoassay market by 2031?

The estimated value of the fluorescent immunoassay market by 2031 is US$ 4.51 billion

Which are the leading players operating in the fluorescent immunoassay market?

The fluorescent immunoassay market majorly consists of the players such as Abbott, BD, bioMerieux SA, F. Hoffman-La Roche Ltd., Siemens AG, Sysmex Corp., Thermo Fisher Scientific Inc., Quidel Corp., Ortho Clinical Diagnostics Holdings plc, and Danaher among others.

What are the future trends of the fluorescent immunoassay market?

Portable fluorescent immunoassay devices for point of care testing are likely to remain key trends in the market.

What are the driving factors impacting the fluorescent immunoassay market?

Growing prevalence of infectious and chronic diseases across the globe and technological developments such as automated systems are expected to boost the market growth over the years. However, disadvantages of fluorescent immunoassays are likely to have a negative impact on the growth of the market in the coming years.

Which region dominated the fluorescent immunoassay market in 2023?

North America dominated the fluorescent immunoassay market in 2023

Get Free Sample For

Get Free Sample For