Heat Shrink Tubing Market Drivers and Forecasts by 2031

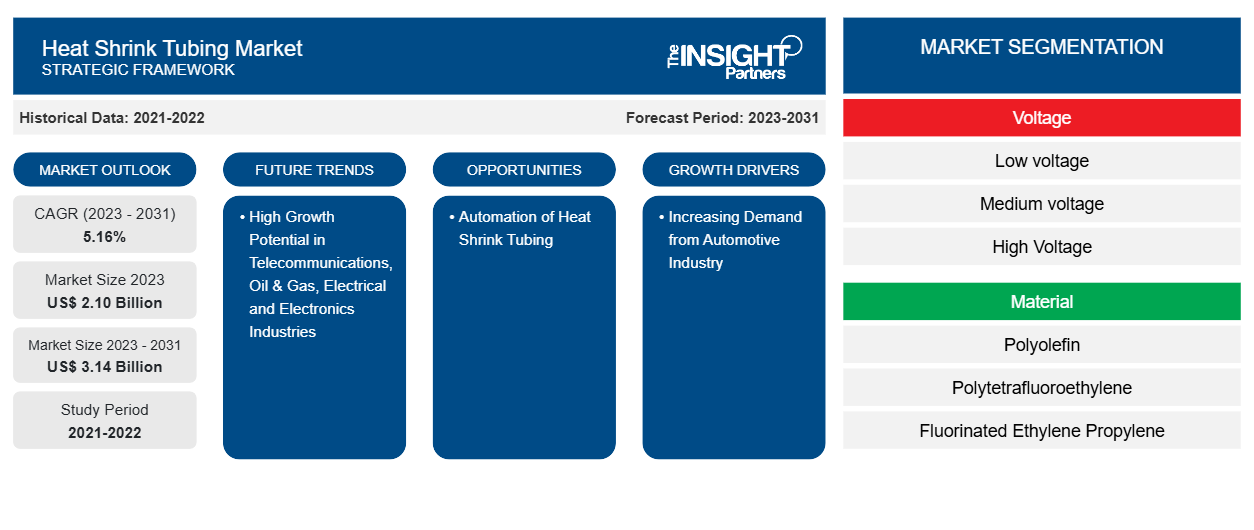

Heat Shrink Tubing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Voltage [ Low voltage (Less than 5kV), Medium voltage (5-35 kV), and High Voltage (Above 35kV) ], Material (Polyolefin, Polytetrafluoroethylene, Fluorinated Ethylene Propylene, Perfluoro alkoxy Alkane, Polyvinylidene fluoride, and Others ), End User ( Energy, Utilities, Electrical Power, Infrastructure/Building Construction, Industrial , Telecommunication, Automotive, Aerospace, Defense, Mass transit and Mobility, Medical, Petrochemical, and Mining ), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Mar 2026

- Report Code : TIPRE00008443

- Category : Manufacturing and Construction

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

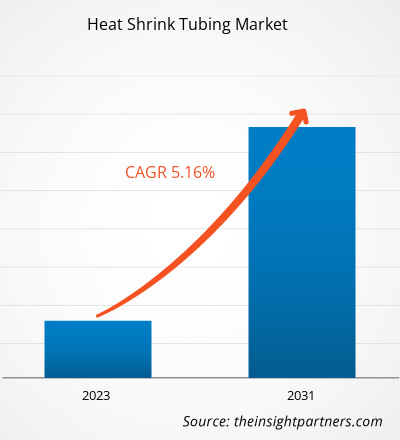

The heat shrink tubing market size is projected to reach US$ 3.14 billion by 2031 from US$ 2.10 billion in 2023, with a CAGR of 5.16% by 2031. Rising demand from the automobile industry and government initiatives to upgrade transmission and expand distribution systems are among the major factors driving the growth of the market. Furthermore, high growth potential from industries such as electrical & electronics telecommunications, and oil & gas provides lucrative growth opportunities for the market. Automation of the heat shrink tubing process is expected to emerge as a trend in the market during 2023-2031.

Heat Shrink Tubing Market Analysis

The major stakeholders in the market ecosystem include raw material providers, heat shrink tube manufacturers, and customer or end-user. The raw material provider is a crucial stakeholder in the ecosystem of the market. The major parts of the heat shrink tubing include materials such as Polyolefin, Polytetrafluoroethylene, Fluorinated Ethylene Propylene, Perfluoro alkoxy Alkane, Polyvinylidene Fluoride, and Others.

Heat Shrink Tubing Market Overview

Heat shrink tube manufacturers produces the product as per the industry's requirement compatible for a wide range of applications. Heat shrink tubing companies are growingly focusing on improving battery efficiencies and range by enhancing charging infrastructure. The presence of large number of heat shrink tubing manufacturers are competing at large scale primarily based on advanced material and availability of presence across the globe. It includes 3M, Shenzhen Woer Heat Shrinkable Material Co., Ltd; TE Connectivity, and Sumitomo Electric Industries, Ltd among other players.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHeat Shrink Tubing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Heat Shrink Tubing Market Drivers and Opportunities

Increasing Demand from Automotive Industry

With the growing trend of electric vehicles, the increasing need for wired appliances is boosting the market. Heat shrink tube in an electric vehicle is used in many applications for wire shielding from charging socket to electrical components throughout the vehicle dashboard, windscreen wiper system, lighting system, central locking system, acoustic system, air condition system, and so on.

High Growth Potential in Telecommunications, Oil & Gas, Electrical and Electronics Industries

Heat shrink tubing has various uses and is widely used within telecommunications networking cables. Heat shrink tubes are used to safeguard these connections, cables, conductors, joints, and terminals, against environmental damage. Furthermore, the oil & gas industry faces the most challenging environmental effects and conditions. Extreme heat, corrosion, pressure, and other factors affect the equipment utilized in the oil & gas industry. Heat shrink tubing makes sures the equipment delivers consistent and reliable performance. Thus, the demand for heat shrink tubing across telecommunications, oil & gas, and electrical & electronics industries provides ample opportunities for market growth.

Heat Shrink Tubing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the market analysis are voltage, material, and end-user.

- Based on the voltage, the market is divided into Low voltage (Less than 5kV), Medium voltage (5-35 kV), and High Voltage (Above 35kV). The low voltage (less than 5KV) segment held a larger market share in 2023.

- Based on material, the global heat shrink tubing market is divided into below Polyolefin, Polytetrafluoroethylene, Fluorinated Ethylene Propylene, Perfluoro alkoxy Alkane, Polyvinylidene fluoride, and Others. The Polyolefin segment held a larger market share in 2023.

- Depending on the end-user, the global market is divided into Energy, Utilities, Electrical Power, Infrastructure/Building Construction, Industrial, Telecommunication, Automotive, Aerospace, Defense, Mass transit and Mobility, Medical, Petrochemical, and Mining. The utilities segment held a larger market share in 2023.

Heat Shrink Tubing Market Share Analysis by Geography

The scope of the heat shrink tubing market report encompasses North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). In terms of revenue, APAC dominated the heat shrink tubing market share in 2023. North America is the second-largest contributor to the global heat shrink tubing market, followed by Europe.

Heat Shrink Tubing Market Regional InsightsThe regional trends and factors influencing the Heat Shrink Tubing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Heat Shrink Tubing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Heat Shrink Tubing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.10 Billion |

| Market Size by 2031 | US$ 3.14 Billion |

| Global CAGR (2023 - 2031) | 5.16% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Voltage

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Heat Shrink Tubing Market Players Density: Understanding Its Impact on Business Dynamics

The Heat Shrink Tubing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Heat Shrink Tubing Market top key players overview

Heat Shrink Tubing Market News and Recent Developments

The market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In March 2024, Materials specialist and pioneer of FEP Peelable Heat Shrink Tubing (PHST), Junkosha, unveiled its latest catheter-based innovation, the 1.8:1 shrink ratio Translucent PHST solution, at the MD&M West show from February 6th to 8th2024. (Source: Junkosha, Press Release)

Heat Shrink Tubing Market Report Coverage and Deliverables

The “Heat Shrink Tubing Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- HEAT SHRINK TUBING Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- HEAT SHRINK TUBING Market Trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- HEAT SHRINK TUBING Market Analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- HEAT SHRINK TUBINGIndustry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For