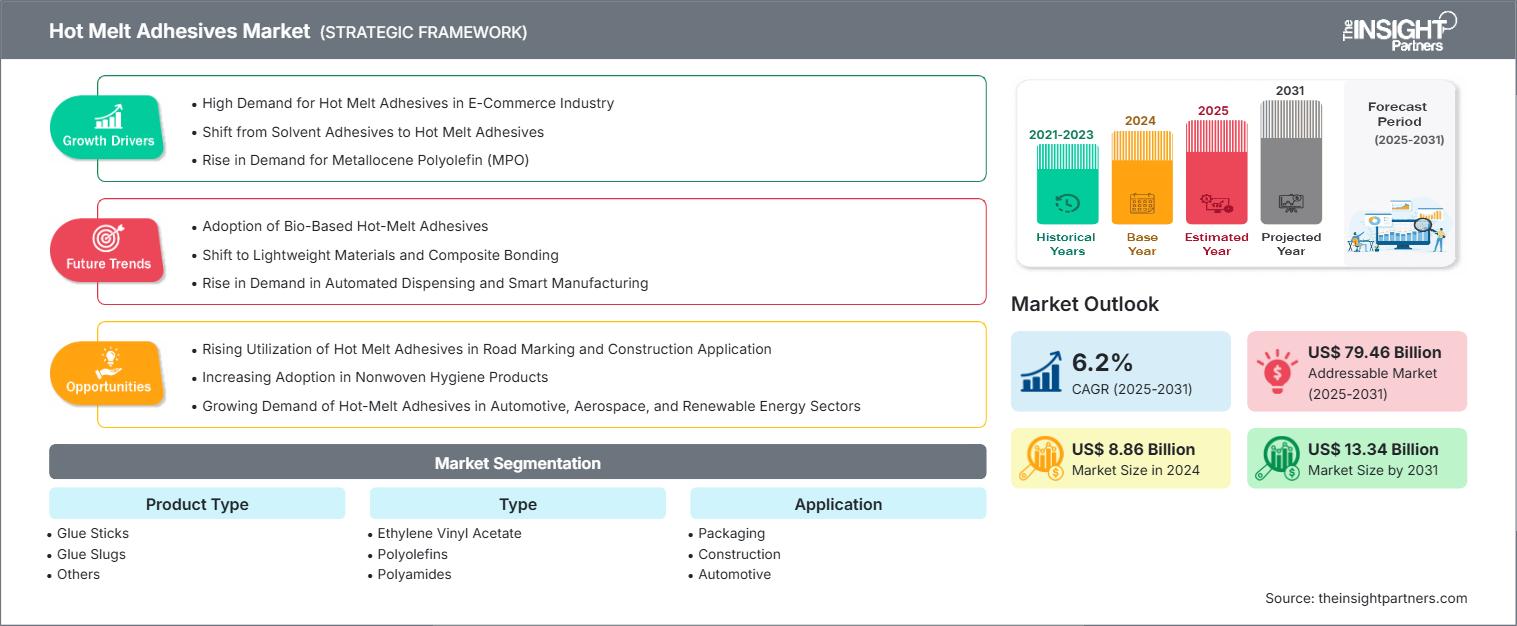

Global Hot Melt Adhesives Market Growth, Share, Trends & Forecast 2025-2031

Hot Melt Adhesives Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Glue Sticks, Glue Slugs, and Others), Type (Ethylene Vinyl Acetate, Polyolefins, Polyamides, Polyurethanes, Styrene Block Copolymers, and Others), and Application (Packaging, Construction, Automotive, Furniture, Footwear, Electronics, and Others)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00015496

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 254

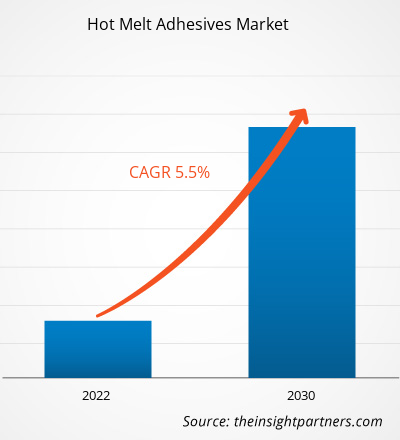

The hot melt adhesives market size is projected to reach US$ 13.34 billion by 2031 from US$ 8.86 billion in 2024. The market is expected to register a CAGR of 6.2% during 2025–2031.

Hot Melt Adhesives Market Analysis

The hot melt adhesives market is growing steadily worldwide, driven by a range of industrial applications and technological innovations. These bonding agents, characterized by their quick bonding properties and versatility in various applications, are widely accepted in the packaging, automotive, electronics, construction, and hygiene industries.

Hot Melt Adhesives Market Overview

The growing e-commerce sector has significantly increased the demand in the packaging sector, where hot melt adhesives support faster production and automation. Additionally, these adhesives contribute to sustainability by emitting fewer volatile organic compounds compared to solvent-based products. Advancements in technology have increased the variety of hot melt adhesives, leading to innovations that achieve greater bond strength, low-temperature operation, and compatibility with various substrates.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHot Melt Adhesives Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Hot Melt Adhesives Market Drivers and Opportunities

Market Drivers:

- Varied Uses Spur Demand Globally: The hot melt adhesives market has broad usage in the packaging, automotive, building, and textile sectors, which has led to high demand worldwide.

- Growth of E-Commerce Increases Packaging Adhesive Requirement: The rapid growth in e-commerce is driving the increased use of efficient packaging adhesives, resulting in the expansion of the hot melt adhesives market in the logistics and retail industries.

- Eco-Friendliness in Adhesives fueled by Sustainability Trends: Increased consumer and regulatory interest in sustainability is driving the development of low-VOC, recyclable, and bio-based hot melt adhesives in various industries.

- Adoption of Automation Enhances Efficiency of Manufacturing Process: An increase in the application of automated production lines creates a greater need for hot melt adhesives because of their quick bonding and efficient properties.

Market Opportunities:

- Promising Growth Prospects in Asia Pacific Market: The rising investments in Asia in terms of industrial base and infrastructure present profitable business opportunities for hot melt adhesive manufacturers.

- Innovation of Biodegradable and Recyclable Adhesive Technologies: Innovative, environmentally friendly, and sustainable adhesives are expected to expand into new market segments as consumer and regulatory pressures increase.

- Low Temperature and Spray Adhesive Products Innovation: The end-use is further increased by introducing advanced formulations that can be used in low-temperature processes and spray applications.

- Increasing Adoption in Electronics Assembly and Consumer Goods: The use of hot melt adhesives in electronics bonding and consumer durable goods provides new sources of revenue.

Hot Melt Adhesives Market Report Segmentation Analysis

The hot melt adhesives market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Product Type:

- Glue Sticks: They are used well in crafts, schools, and offices, and are best suited because they are easy to melt, apply, and bond paper, fabric, and lightweight materials.

- Glue Slugs: High-strength compact pellets are ideal in automated assembly lines because they provide fast set times, consistent viscosity, and strong bonds on plastics, wood, and metal substrates.

- Others: This segment covers bulk blocks, two-component sticks, and micronized powders, tailored to specific industrial applications such as footwear, electronics, and heavy-duty construction bonding.

By Type:

- Ethylene Vinyl Acetate

- Polyolefins

- Polyamides

- Polyurethanes

- Styrene Block Copolymers

- Others

By Application:

- Packaging

- Construction

- Automotive

- Furniture

- Footwear

- Electronics

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South & Central America

As the end-use industries such as construction, automotive, and packaging expand, the Asia Pacific hot melt adhesives market remains vital.

Hot Melt Adhesives

Hot Melt Adhesives Market Regional InsightsThe regional trends and factors influencing the Hot Melt Adhesives Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Hot Melt Adhesives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Hot Melt Adhesives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 8.86 Billion |

| Market Size by 2031 | US$ 13.34 Billion |

| Global CAGR (2025 - 2031) | 6.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Hot Melt Adhesives Market Players Density: Understanding Its Impact on Business Dynamics

The Hot Melt Adhesives Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Hot Melt Adhesives Market Share Analysis by Geography

The Asia Pacific hot melt adhesives market is growing significantly. Emerging markets in South & Central America and the Middle East and Africa have untapped opportunities for hot melt adhesives providers to expand.

The hot melt adhesives market growth differs in each region due to the surging construction activities, technological advancements in manufacturing, and the growth of the automotive industry. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds significant share of global market

-

Key Drivers:

- Booming e-commerce industry

- Growing automotive industry

- Rising construction and infrastructure development

- Trends: Environmental regulations push sustainable adhesive product development

2. Europe

- Market Share: Substantial market share owing to automotive and aerospace expansion

-

Key Drivers:

- Lucrative automotive, aerospace, and electronic sectors

- Strict government regulations on the use of eco-friendly materials

- Innovation in the manufacturing processes

- Trends: Use of hot melt adhesives in packaging and aerospace industries

3. Asia Pacific

- Market Share: The fastest-growing region with an increasing market share annually

-

Key Drivers:

- Rapid industrialization and urbanization

- Automobile and electronics industries

- Infrastructure and manufacturing development supported by governments

- Trends: Growing demand in construction and manufacturing industries

4. Middle East and Africa

- Market Share: Growing market with steady progress

-

Key Drivers:

- Growing industrial investments and urbanization

- Development in the construction sector

- Trends: Expansion of manufacturing capabilities and market penetration efforts

5. South and Central America

- Market Share: Although small, it is growing quickly

-

Key Drivers:

- Rising demand in automotive and manufacturing sectors

- Growing urbanization and regional industrialization

- Trends: Emerging opportunities through new production and technology adoption

Hot Melt Adhesives Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of established players such as H.B. Fuller Company, Henkel AG & Company KGaA, Arkema, 3M, Sika AG, Jowat SE, Hexcel Corporation, The Dow Chemical Company, Gorilla Glue Company, and DIC CORPORATION.

This high level of competition urges companies to stand out by:

- Creating bio-based adhesive formulations for low temperatures that prioritize sustainability and differentiate from conventional products

- Developing products with smart performance additives, such as antimicrobial agents or conductivity enhancers of superior, purpose-specific bonding solutions

- Partnering with automation equipment OEMs to distribute entirely tunable, complete hot melt adhesive dispensing systems

Opportunities and Strategic Moves

- Launch bio-based adhesive lines

- Localize low-temperature adhesive production

- Collaborate with e-commerce giants

- Develop composite bonding solutions

- Invest in automated dispensing technologies

Major Companies operating in the hot melt adhesives market are:

- H.B. Fuller Company

- Henkel AG & Company KGaA

- Arkema

- 3M

- Sika AG

- Jowat SE

- Hexcel Corporation

- The Dow Chemical Company

- Gorilla Glue Company

- DIC CORPORATION

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- BASF SE

- Ashland Global Holdings Inc

- Avery Dennison Corporation

- Tesa SE

- Henkel Corporation

- RPM International Inc

- Wacker Chemie AG

- Soudal NV

- Resibras Química

- Krona Química

Hot Melt Adhesives Market News and Recent Developments

- H.B. Fuller Company – Merger and Acquisition News H.B. Fuller Company announced the acquisition of ND Industries Inc., a leading provider of specialty adhesives and fastener locking and sealing solutions serving customers in the automotive, electronics, aerospace, and other industries

- Jowat's Jowatherm PUR 630.30: Versatile Hot Melt Jowat SE developed Jowatherm PUR 630.30, an adhesive with low viscosity and a broad spectrum of adhesion, ideal for many different lamination applications, such as in the automotive industry. A key feature of Jowatherm PUR 630.30 is its excellent wash resistance, ensuring a permanent and reliable bond that withstands even high stress.

Hot Melt Adhesives Market Report Coverage and Deliverables

The "Hot Melt Adhesives Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- Hot melt adhesives market size and forecast at global, regional, and country levels for all market segments covered under the scope

- Hot melt adhesives market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces Analysis and SWOT analysis

- Hot melt adhesives market analysis covering market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the hot melt adhesives market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For