HVAC System Market Size, Share, Growth & Future by 2031

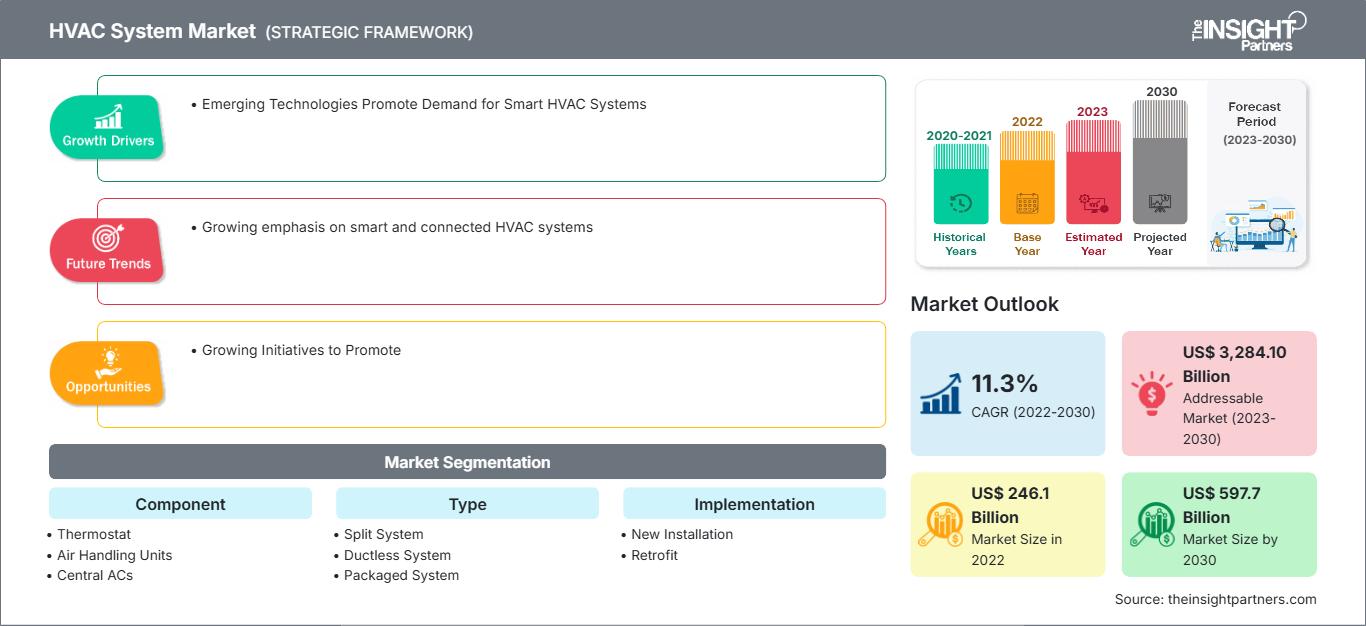

HVAC System Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Split System, Ductless System and Packaged System), Implementation (New Installation and Retrofit), Application (Residential, Commercial, and Industrial), Component (Thermostat, Air Handling Units, Central AC, Furnace, Heat Pump, Compressor, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Status : Published

- Report Code : TIPRE00005293

- Category : Electronics and Semiconductor

- No. of Pages : 166

- Available Report Formats :

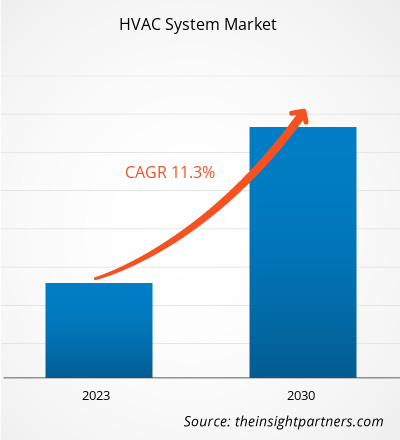

The HVAC system market size is projected to reach US$ 158.33 billion in 2024 and is expected to reach US$ 243.86 billion by 2031. The HVAC system market is estimated to register a CAGR of 6.46% from 2025–2031.

HVAC System Market Analysis

Worldwide, the need for electric power is increasing as a result of the expansion of data centers, the rapid electrification of the transport sector, and the increasing need for comfort in commercial and residential buildings. The deteriorating condition of buildings and the tightening of energy efficiency and emission regulations are the main factors that are pushing up the demand for HVAC systems worldwide. To attract buyers, manufacturers are equipping their energy-efficient chillers, heat pumps, and VRF systems with lower GWP refrigerants, smart controls, and modular designs.

HVAC System Market Overview

Heating, ventilation, air conditioning, and refrigeration (HVAC) systems are the major source of comfort and air quality in residential, commercial, and industrial buildings all over the world. Currently, the demand for innovative HVAC systems is mainly driven by requirements for high energy efficiency, accurate climate control, and better indoor air quality, which is a must for new buildings in different climate zones.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHVAC System Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

HVAC System Market Drivers and Opportunities

Market Drivers:

- Rising Global Electricity Demand: The increasing per capita electricity consumption in the leading economies is caused by data centers, EV charging, and rapid urbanization, driving market growth.

- Aging HVAC System Upgradation: In North America, Europe, and Asia, retrofit and performance contracting projects aimed at lowering operating costs and enhancing resilience are becoming the main replacement motion.

- Tightening Environmental and Efficiency Regulations: Tightening environmental and efficiency regulations are driving the global transition to low, carbon, high, performance systems.

Market Opportunities:

- Smart, Connected HVAC with AI Optimization: The market is ready for BMS, integrated, cloud, connected HVAC that employs AI for predictive scheduling, fault detection, and real-time optimization.

- Electrification, Heat Pumps, and EV Ecosystem: The electrification of buildings and the growth of EV charging networks are changing the HVAC system market.

- Residential Electrification and Smart Homes: Households are transitioning from using fossil fuel furnaces to electric heat pumps. These heat pumps are usually connected with smart thermostats, sensors, and home energy management platforms.

HVAC System Market Report Segmentation Analysis

The HVAC system market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Split System: Split systems allow energy-efficient cooling/heating through indoor/outdoor units without the use of ducts, which are ideal for zoned control in homes with increasing SEER standards.

- Ductless System: Ductless mini-splits are the leader with a 40% share, a perfect solution for retrofitting in old houses where there are no ducts, thus allowing flexible zoning and energy savings of up to 30% according to DOE data.

- Packaged System: Packaged units have all components integrated in one cabinet for rooftops; thus, they are ideal for commercial spaces with limited space, and the primary factor for their use is the fast installation in new builds.

By Implementation:

- New Installation:

- Retrofit:

By Application:

- Residential

- Commercial

- Industrial

By Component:

- Thermostat

- Air Handling Units

- Central AC

- Furnace

- Heat Pump

- Compressor

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

HVAC System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 158.33 Billion |

| Market Size by 2031 | US$ 243.86 Billion |

| Global CAGR (2025 - 2031) | 6.46% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

HVAC System Market Players Density: Understanding Its Impact on Business Dynamics

The HVAC System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

HVAC System Market Share Analysis by Geography

The HVAC systems market in Asia Pacific is growing at a fast pace due to factors such as urbanization, a big commercial construction pipeline, increasing middle-class comfort level, and hot & humid climates.

Below is a summary of market share and trends by region:

1. North America

- Market Share: A mature HVAC market with high penetration in residential and commercial buildings, driven by replacement demand, energy code compliance, and retrofits of aging systems.

- Key Drivers:

- Homeowners are upgrading their old HVAC systems to high-efficiency heat pumps, VRF, and advanced controls to help lower their energy bills and operating costs.

- Trends: Rapid expansion of smart, connected HVAC systems is one of the latest trends in North America.

2. Europe

- Market Share: A large share supported by stringent climate targets, rigorous building codes, and widespread use of district heating and cooling networks.

- Key Drivers:

- Extensive heat pump deployment for space and water heating is the main driver toward decarbonization in the EU.

- Trends: The use of low-GWP refrigerants with priority given to them, hybrid heat pump/boiler systems, and HVAC integration with on-site renewables and thermal storage for nearly zero-energy buildings are some of the latest trends discussed by the experts in the field.

3. MEA

- Market Share: A rapidly expanding, climate-driven cooling market with high demand in the Gulf countries and the growing urban centers.

- Key Drivers:

- One of the major factors that has led to large central cooling systems becoming a necessity is the extreme temperatures that characterize the area, besides the development of tourism and commercial sectors.

- Trends: Adoption of high-efficiency chillers, seawater and thermal storage cooling, and increasing interest in solar-powered and hybrid HVAC solutions for sustainable megaprojects.

4. Asia Pacific

- Market Share: The region with the largest and fastest-growing HVAC market, mainly China, India, Japan, and Southeast Asia, leads the way.

- Key Drivers:

- Urbanization, construction booms, and rising middle-class comfort expectations.

- Trends: A strong demand for inverter-based room air conditioners, VRF in commercial buildings, heat pump manufacturing localization, and the integration of HVAC with smart city and building management platforms.

5. South America

- Market Share: Noteworthy but progressively expanding, the market is mainly concentrated in Brazil, Mexico, Chile, and Colombia.

- Key Drivers:

- The expansion of the commercial real estate, retail, and hospitality sectors, which are the major consumers of modern HVAC systems.

- Trends: The local market is gradually moving from the use of basic split units to higher efficiency inverter systems, natural/low GWP refrigerants are being used more, and there are more ESCO-driven retrofit projects aimed at reducing cooling-related electricity costs.

HVAC System Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Carrier Global Corporation, Trane Technologies plc, and Daikin Industries, Ltd. Regional and niche providers, such as Systemair AB, Trane Technologies Plc, also add to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- High-efficiency heat pumps and VRF systems with SEER 25+ ratings.

- Customized IoT-enabled solutions for data centers, renewables, and smart buildings.

- Cost-competitive manufacturing with low-GWP refrigerants.

- Robust after-sales via predictive analytics and remote diagnostics.

Opportunities and Strategic Moves

- Utilities and building owners have coupled with IoT providers to keep a tab, on the side of improving efficiency and maintenance in commercial retrofits and data centers.

- Manufacturers propel smart HVAC further by embedding AI controls, low-GWP tech, and cloud platforms for real-time optimization.

- Small, modular VRF/ductless concepts are becoming more popular; thus, they are enabling the easy transition of the old buildings to new ones without the need for a complete overhaul.

Major Companies operating in the North America HVAC System Market are:

- Daikin Industries Ltd

- Johnson Controls International Plc

- Carrier Global Corp

- Honeywell International Inc

- Mitsubishi Electric Corp

- Robert Bosch GmbH

- Systemair AB

- LG Electronics Inc

- Emerson Electric Co

- Hitachi Ltd

- Trane Technologies Plc

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Ingersoll Rand Plc

- Nortek Air Solutions

- GE Appliances, a Haier company

- Electrolux AB

- Syntec Airflow Systems

- Others

HVAC System Market News and Recent Developments

- Carrier Global Corporation Announces Investment Plans of US$ 1 billion in the US In May 2025, Carrier Global Corporation, a global leader in intelligent climate and energy solutions, announced plans to invest an additional US$ 1 billion over five years in US manufacturing, innovation, and workforce expansion, incremental to its ongoing commitments to American operations.

- Daikin Applied broke ground for the construction of a new energy-efficient manufacturing facility in Mexico. In June 2024, Alliance Air, a subsidiary of Daikin Applied, a leading global commercial and industrial HVAC manufacturer, broke ground for the construction of a new energy-efficient manufacturing facility in Tijuana, Mexico, to support sustainable data center growth across North America.

HVAC System Market Report Coverage and Deliverables

The "HVAC System Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- HVAC system market size and forecast at global, regional, and country levels for all the segments covered under the scope

- HVAC system market trends, as well as dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- HVAC system market analysis covering key trends, global and regional framework, major players, regulations, and recent developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the HVAC system market

- Detailed company profiles

Frequently Asked Questions

2) Electrification and heat pump adoption are rising.

3) Commercial sector is in need of space, saving VRF retrofits

1) Thermostat

2) Air Handling Units

3) Central AC

4) Furnace

5) Heat Pump

6) Compressor

7) Others

1) Decarbonization Policies and Efficiency Upgrades

2) Industrial and CHP Expansion

3) Ongoing Market Shift towards Digitalization and Flexible Operation

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For