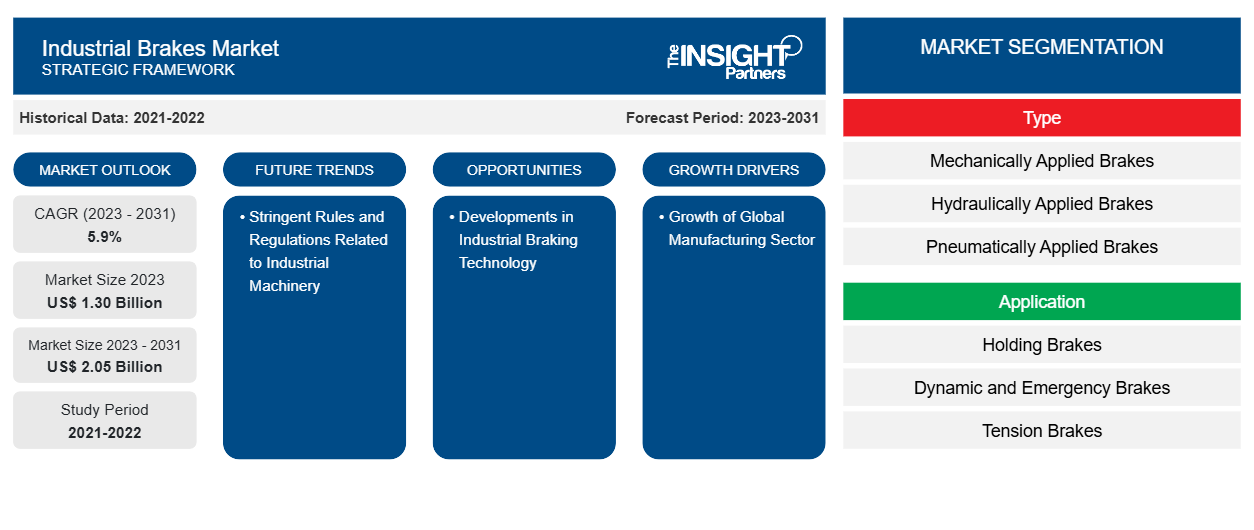

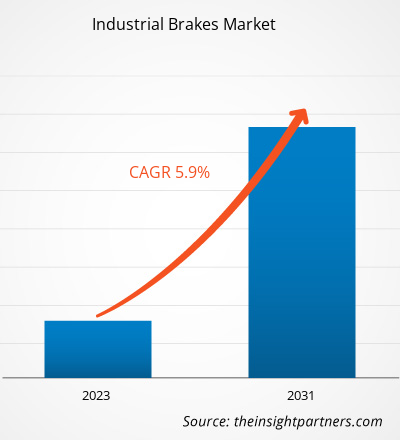

Industrial brakes market size is projected to reach US$ 2.05 billion by 2031 from US$ 1.30 billion in 2023. The market is expected to register a CAGR of 5.9% in 2023–2031.

An industrial brake is a frictional device used to halt a spinning inertia load or to retain a component in a fixed position. In most cases, the inertia load is caused by many spinning components that must be halted. To slow anything down, they transform the kinetic energy created by friction between two surfaces into heat. Industrial brakes differ from car brakes in that they are used in a variety of industrial machines. Industrial brakes work in all-weather situations, require less maintenance owing to fewer moving components, and are easy to modify for various applications. During the forecast period, all of these reasons are likely to boost the demand for industrial brakes across the world.

Industrial brakes provide numerous benefits, one of which is the low number of parts and spares needed. Other benefits include easy hygiene owing to the one-piece design, a high return on investment due to the extended life of industrial brakes, and the ability to work in harsh situations. Additionally, growing industrialization and increasing government investments in the industrial sectors to promote output are expected to have a substantial influence on the industrial brakes market during the projected period.

Industrial Brakes Market Analysis

The key stakeholders in the global industrial brakes market ecosystem include raw material suppliers, industrial brakes manufacturers, and end-users. The rising demand for advanced brakes in manufacturing units across different industries is one of the prominent factors driving the demand for industrial brakes. The raw material suppliers offer several different units for various types of industrial brakes, such as mechanically applied brakes, hydraulically applied brakes, pneumatically applied brakes, and electrically applied brakes. In addition to this, the use of industrial brakes by end users for facilitating by offering the necessary velocity, acceleration, and deceleration to the industrial equipment is further influencing the demand for industrial brakes.

Industrial Brakes Market Overview

Industrial brakes are widely used in heavy machinery and industrial vehicles manufacturing such as excavators, bulldozers, backhoes, skid steers, and among others. Industrial brakes are also used in various food processing equipment, medical devices, hydraulic machines in industrial plants, automotive manufacturing and other applications. The industrial brakes market has the largest share in the Asia Pacific region owing to several small and medium-scale manufacturers followed by the leading players. Some of the industrial brake manufacturers across the Asia Pacific region include Altra Industrial Motion Corp., ADVICS CO., LTD.; Akebono Brake Industry Co., Ltd., AMETEK Inc., Eaton Corporation plc; Emco Precima Engineering Pvt Ltd. and among others. These manufacturers supply industrial brakes to various industries across the globe.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Brakes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Brakes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industrial Brakes Market Drivers and Opportunities

Growth of the Global Manufacturing Sector

Since the beginning of the Industrial Revolution, technological advancements have led to tremendous surge in industrial production capacities; as a result, manufacturing is on the rise across the world. According to PricewaterhouseCoopers (PwC), growing economies, labor quality, tax policies, regulatory environments, and transportation and energy prices are the factors that have catalyzed the comeback of this sector. As a result of the expanding manufacturing sector, the dependent markets, including mechanical equipment providers, are also flourishing. With the emergence of new categories of consumers in developing countries, manufacturers across the world are likely to have significant new prospects; further, innovations generate new demands, thus propelling the use of modern equipment and systems in manufacturing units.

Stringent Rules and Regulations Related to Industrial Machinery

Machines are necessary for the production process, but mishaps during their operations can result in burns, blindness, and amputation. Safeguarding, standardizing operating procedures, and thorough training may assist in keeping the staff safe and secure. Governments and organizations across the world are transforming their operations by implementing emission and safety standards in production facilities. The Occupational Safety and Health Administration (OSHA) fines for the infraction of safety standards totaled more than US$ 50 million in the fiscal year 2018. As a result, the US government is developing a long-term regulatory road plan for the flourishment of the manufacturing sector, escalating its contribution to the GDP.

Developments in Industrial Braking Technology

When designing equipment systems, it's crucial to think about how the braking system will affect the operation of subsequent machines. Fail-safe brakes assist in shutting off the machine’s movement quickly in accidents, performance failures, or power failures, among others. Companies are also working on hydraulic release brakes that are spring-loaded braking systems using hydraulic energy to produce adjustable torque. The need for industrial brakes is high in mining winches, overhead cranes, steel rolling systems, and other similar devices. Furthermore, warehousing, medical, steel mills, and food processing industries hold significant potential for the industrial brakes market. Companies are actively working on spring-applied brakes with high permitted braking energies, high torques, and wear resistance. For instance, Kor-Pak, an OEM and distributor of industrial brakes and clutches, is developing end-to-end braking systems for the mining and manufacturing industries.

Industrial Brakes Market Report Segmentation Analysis

Key segments that contributed to the derivation of the industrial brakes market analysis are temperature type, warehouse type, and application.

- Based on type, the market is divided into mechanically applied brakes, hydraulically applied brakes, pneumatically applied brakes, electrically applied brakes, and others. Mechanically applied brakes apply force, most commonly friction, to slow or stop a machine or an object from moving. The force is applied to a body that is in rotational or linear motion, such as an axle, shaft, or wheel. Mechanical brakes are used in material handling, manufacturing, and other power transmission applications and are most commonly associated with automobiles. For engaging and disengaging shafts, mechanical brakes are frequently used in conjunction with a mechanical clutch. To decelerate, friction-based brakes use a coarse and tough substance (a brake lining) that is tightened or forced against a moving body. Friction-based braking creates a lot of heat and considerable noise, which degrades the involved surface areas.

- Based on application, the global industrial brakes market is divided into holding brakes, dynamic and emergency brakes, and tension brakes. Motor-holding brakes are responsible for maintaining the motor's position when the power stage is turned off. The holding brake is neither a safety feature nor a maintenance brake. This brake is used in factory automation, medical equipment, elevators and escalators, construction equipment, robotics, and machine tool equipment. Many companies offer holding brakes for various applications and industrial environments. For example, Vortex Engineering Works provides spring-holding brakes for operations in the textile industry.

- Depending upon the industry vertical, the market is divided into manufacturing, metal and mining, construction, power generation, marine and shipping, and others.

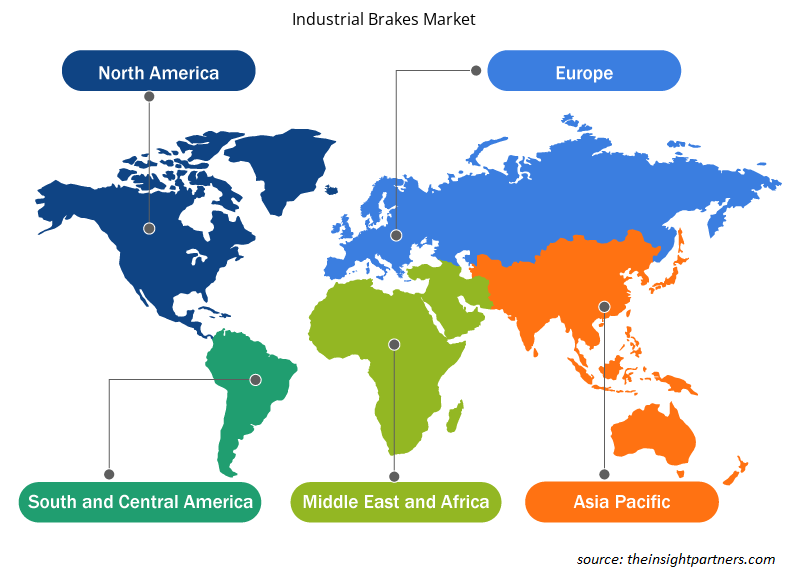

Industrial Brakes Market Share Analysis by Geography

The geographic scope of the Industrial Brakes market report is mainly divided into five regions: North America, APAC, Europe, Middle East & Africa, and SAM.

Persistent developments in the industrial sector in Asia Pacific countries add to their economic prosperity. This change has resulted in rising affluence, urbanization, and population expansion. Furthermore, Asia Pacific makes for a substantial portion of the global energy consumption, with the industrial sector accounting for the majority of the regional energy consumption. The region comprises 58 economies and is home to over 60% of the world's population. As per ADB Annual Report 2018, its share in the global purchasing power parity gross domestic product (GDP PPP) increased from 30.1% in 2000 to 42.6% in 2017, and three nations—China, Japan, and India—accounted for more than 70% of the region's total production in 2017. In 2014, the total energy consumption of Asia Pacific increased at double the pace of the world; it consumes more than 50% of the total energy supply of the world and accounts for ~55% of global fuel emissions.

The expansion of the industrial sector also results in higher energy consumption and greenhouse gas emissions. The use of energy-saving alternatives in enterprises that require optimal working conditions is increasing demand for various types of industrial brakes. Furthermore, increased energy security, improved workplace environmental quality, and new job creation with the introduction of business prospects related to energy efficiency have also led to the growth of industrialization in the region, thereby propelling the industrial brakes market growth.

Industrial Brakes Market Regional Insights

The regional trends and factors influencing the Industrial Brakes Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Industrial Brakes Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Industrial Brakes Market

Industrial Brakes Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.30 Billion |

| Market Size by 2031 | US$ 2.05 Billion |

| Global CAGR (2023 - 2031) | 5.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Industrial Brakes Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Brakes Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Industrial Brakes Market are:

- Akebono Brake Industry Co., Ltd.

- Altra Industrial Motion Corporation

- Ametek Inc.

- Aplicación Nuevas Tecnologías Antec SAU

- Dellner Bubenzer Germany GmbH

- Hilliard Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Industrial Brakes Market top key players overview

Industrial Brakes Market News and Recent Developments

The industrial brakes market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In March 2023, TVS Apache Brakes brand in India launched advanced technology-based ZAP brake pads for electric vehicles. ZAP is a braking fluid that was created and developed to meet the user’s requirement for electric vehicles. It improves corrosion resistance, provides protection, and offers silent braking for electric vehicles. (Source: Eurofins, Press Release)

Industrial Brakes Market Report Coverage and Deliverables

The “Industrial Brakes Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Industrial Brakes Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Industrial Brakes Market Trends

- Detailed PEST Analysis and SWOT analysis

- Industrial Brakes Market Analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments.

- Industrial Brakes Market Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed Company Profiles

Frequently Asked Questions

Which region dominated the industrial brakes market in 2023?

North America is expected to dominate the industrial brakes market in 2023.

What are the driving factors impacting the industrial brakes market?

The growth of the global manufacturing sector drives market growth.

What are the future trends of the industrial brakes market?

Stringent rules and regulations related to industrial machinery driving the market trend.

Which are the leading players operating in the industrial brakes market?

Akebono Brake Industry Co., Ltd., Altra Industrial Motion Corporation, Ametek Inc., Aplicación Nuevas Tecnologías Antec SAU, Dellner Bubenzer Germany GmbH, Hilliard Corporation, Kobelt Manufacturing Co. Ltd., KOR-PAK Corporation, Ringspann GmbH and Tolomatic, Inc

What would be the estimated value of the industrial brakes market by 2031?

Industrial brakes market size is projected to reach US$ 2.05 billion by 2031 from US$ 1.30 billion in 2023.

What is the expected CAGR of the industrial brakes market?

The market is expected to register a CAGR of 5.9% in 2023–2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For