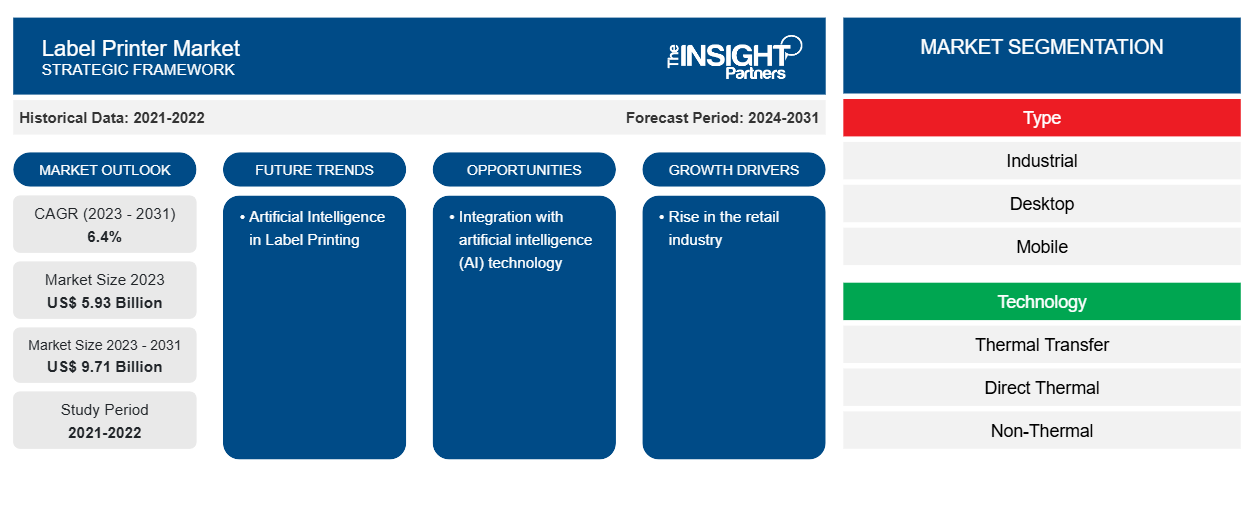

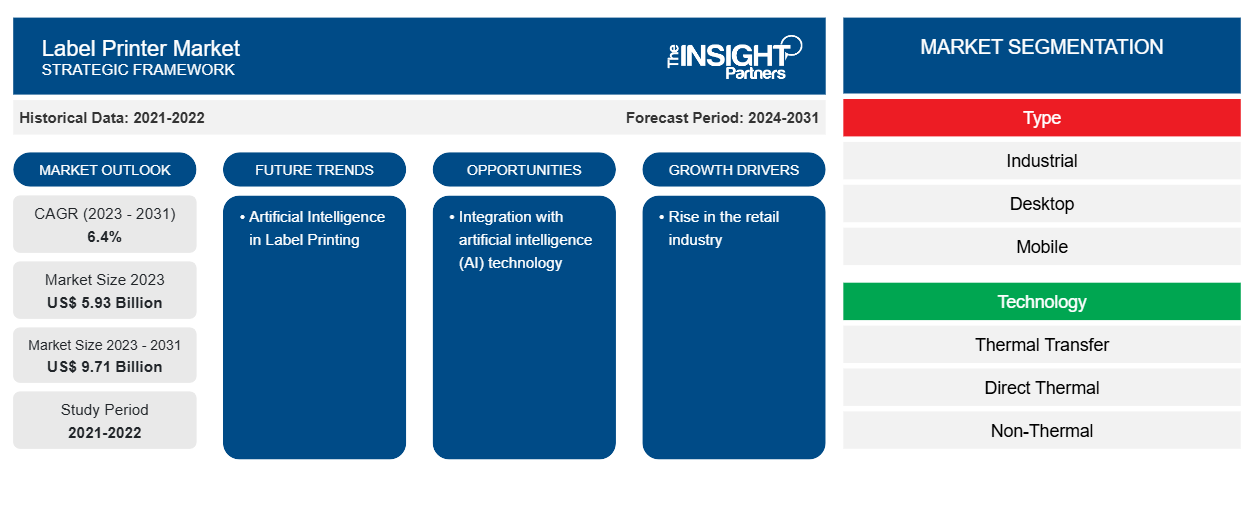

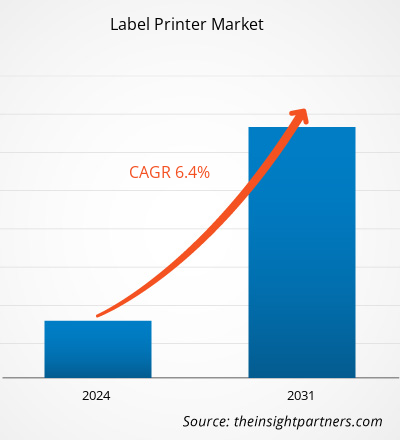

The label printer market size is projected to reach US$ 9.71 billion by 2031 from US$ 5.93 billion in 2023. The market is expected to register a CAGR of 6.4% in 2023–2031. Increasing demand for label printers from the pharmaceutical sector and growth in the packaging industry are likely to remain key label printer market trends.

Label Printer Market Analysis

Numerous industries, including supply chain management, retail price marking, packaging labels, and others, use label printers. The information or symbols about the product or item that are helpful to both the seller and the customer are printed using label printers. Demand for desktop and mobile/portable printers is expected to soar during the forecast period due to the manufacturing industry's ongoing need for simple, convenient label printing tools. In addition, the growth in the retail industry further fosters the demand for label printers.

Label Printer Market Overview

A label printer is a type of computer printer that can print on cardstock (tags) or self-adhesive label material. Label makers are label printers that come with an integrated keyboard and display for standalone operation (i.e., not connected to a separate computer). Because they require specialized feed mechanisms to handle rolled stock or tear sheet (fanfold) stock, label printers differ from regular printers. A variety of label materials, such as paper and synthetic polymer (plastic) materials, are used by label printers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Label Printer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Label Printer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Label Printer Market Drivers and Opportunities

Rise in the retail industry to Favor Market

Across the globe, the rise in disposable income and the purchasing power of consumers are increasing, leading to the buying of various retail products. In addition, the population growth also results in the demand for retail products. Thus, the growth in the retail sector and e-commerce industry generates the demand for equipment and machinery such as label printers, which fasten the operations in these industries to meet the customer's demand on time. Printers, such as price label printers and barcode printers, guarantee that goods are appropriately tracked, priced, and displayed to consumers. As the information on the label helps retailers manage their inventory and store products efficiently, the demand for label printers is gaining traction in the retail industry.

Artificial Intelligence in Label Printing– An Opportunity in the Label Printer Market

Nowadays, with the digital landscape always changing, companies in all sectors are always looking for new and creative ways to improve their operations and obtain a competitive advantage. Label printing is just one of the many areas of business operations that artificial intelligence (AI) has the potential to completely transform. Businesses can use AI to automate the design process and produce beautiful labels by utilizing sophisticated algorithms. Large volumes of data, such as design elements, industry trends, and consumer preferences, can be analyzed by AI algorithms to create customized label designs for particular brands or products. Businesses can guarantee that their labels fulfill the highest standards of accuracy and aesthetic appeal by implementing AI-powered quality control systems. This factor will ultimately improve customer satisfaction and brand reputation. Such benefits of AI in label printing will generate the demand for advanced printers and will create lucrative growth opportunities for the label printer market.

Label Printer Market Report Segmentation Analysis

Key segments that contributed to the derivation of label printer market analysis are type, technology, and end-user industry.

- Based on type, the market is segmented into industrial, desktop, and mobile. The desktop segment held a larger market share in 2023.

- By technology, the market is segmented into thermal transfer, direct thermal, and non-thermal. The direct thermal segment held the largest share of the market in 2023.

- Based on the end-use industry, the market is segmented into manufacturing, retail, transportation & logistics, healthcare, FMCG, entertainment, and others. The retail segment held a larger market share in 2023.

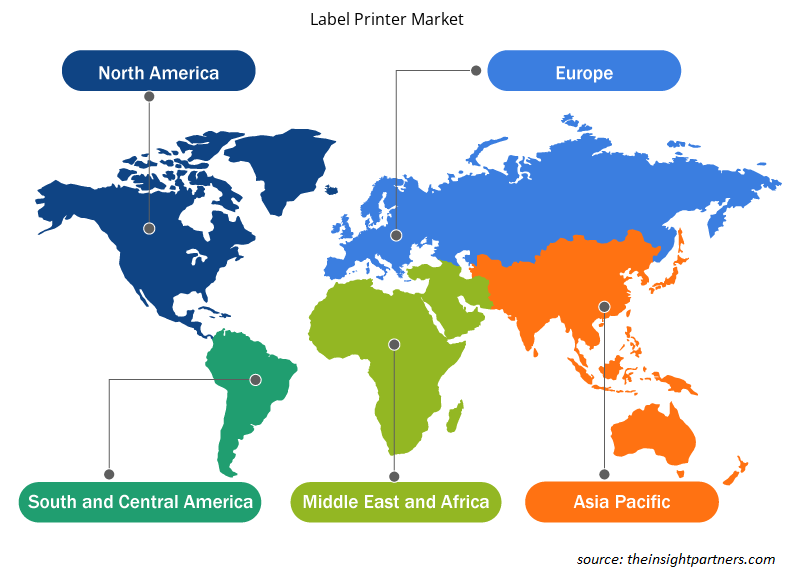

Label Printer Market Share Analysis by Geography

The geographic scope of the label printer market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In terms of revenue, North America accounted for the largest label printer market share. The US, Canada, and Mexico are among the key countries in North America. The rise in demand for label printers from the end-user industries, such as manufacturing, retail, logistics, and others, is fuelling the market growth in the region. The population growth in the region further generates the demand for various products and services that require labels carrying all the product-related information, which further fuels the demand for label printers.

Label Printer Market Regional Insights

The regional trends and factors influencing the Label Printer Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Label Printer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Label Printer Market

Label Printer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.93 Billion |

| Market Size by 2031 | US$ 9.71 Billion |

| Global CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

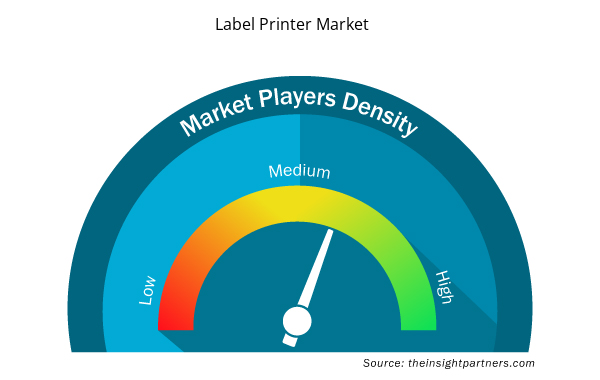

Label Printer Market Players Density: Understanding Its Impact on Business Dynamics

The Label Printer Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Label Printer Market are:

- Toshiba Tec Corporation

- Honeywell International Inc.

- Postek Electronics Co., Ltd.

- Wasp Barcode Technologies

- VIPColor Technologies Pte Ltd.

- GoDEX International Co., Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Label Printer Market top key players overview

Label Printer Market News and Recent Developments

Label Printer Marketis evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In February 2023, Epson announced its first label printers specifically for crafters and the home. The LabelWorks LW-C610 and LW-C410 are lightweight, portable, and easy to use from a mobile, making them ideal for de-cluttering, organizing, and crafting throughout the entire home & office. (Source: Epson, Press Release, 2023)

- In May 2023, Newland AIDC, a leading company in the automatic identification and data capture industry, announced the launch of its first label printer, the NLS-LP410. The new thermal transfer label printer is the latest addition to the company's superior comprehensive product line, which includes barcode scanners, mobile terminals, interactive kiosks, and OEM scan engines. (Source: Newland AIDC, Press Release, 2023)

- In April 2023, SATO, a global leader in barcode printing, labeling and auto-ID solutions, announced the launch of the CT4-LX-HC, a dedicated smart and intuitive 4” label printer for the healthcare sector. The CT4-LX-HC is an exceptionally versatile desktop printer designed to achieve next-level patient and consumer care. It also features an antimicrobial casing that can be wiped down with disinfectant wipes to minimize the risk of infections and recontamination in a clinical setting. (Source: SATO, Press Release, 2023)

Label Printer Market Report Coverage and Deliverables

The “Label Printer Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Constipation Treatment Market

- Health Economics and Outcome Research (HEOR) Services Market

- GMP Cytokines Market

- Nuclear Waste Management System Market

- Oxy-fuel Combustion Technology Market

- Dealer Management System Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Microcatheters Market

- Lyophilization Services for Biopharmaceuticals Market

- Passport Reader Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , Technology , End-User Industry , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the estimated market size for the global label printer market in 2023?

The global label printer market was estimated to be US$ 5.93 billion in 2023 and is expected to grow at a CAGR of 6.4% during the forecast period 2023 - 2031.

What are the driving factors impacting the global label printer market?

The rise in the retail industry and demand from the pharmaceutical sector are the major factors that propel the global label printer market.

What are the future trends of the global label printer market?

Integration with artificial intelligence (AI) technology is anticipated to play a significant role in the global label printer market in the coming years.

Which are the key players holding the major market share of the global label printer market?

The key players holding majority shares in the global label printer market are Toshiba Tec Corporation; Honeywell International Inc.; Postek Electronics Co., Ltd.; Wasp Barcode Technologies; and VIPColor Technologies Pte Ltd.

What will be the market size of the global label printer market by 2031?

The global label printer market is expected to reach US$ 9.71 billion by 2031.

What is the incremental growth of the global label printer market during the forecast period?

The incremental growth expected to be recorded for the global label printer market during the forecast period is US$ 3.78 billion.

Get Free Sample For

Get Free Sample For