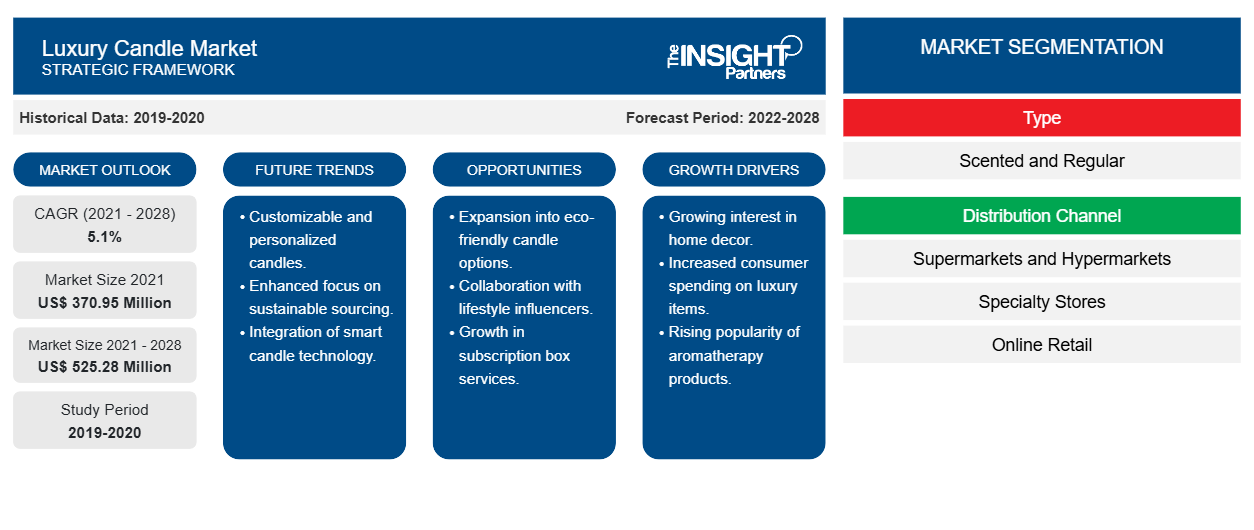

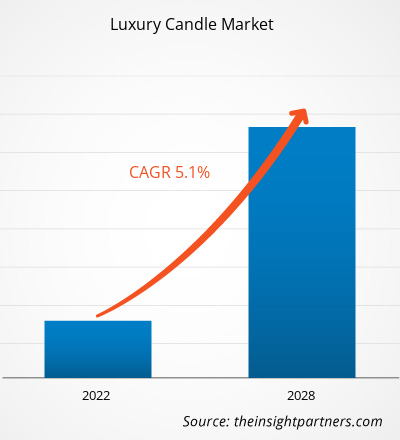

The luxury candle market was valued at US$ 370.95 million in 2021 and is projected to reach US$ 525.28 million by 2028; it is expected to grow at a CAGR of 5.1% from 2021 to 2028.

The global luxury candle market growth is being driven by the rising adoption of aromatherapy, increasing preference for home decor, and growing number of high net worth individuals (HNWIs). The attractive packaging and novel fragrance being incorporated in luxury candles pave the way for profitable growth opportunities for the active vendors in the market.

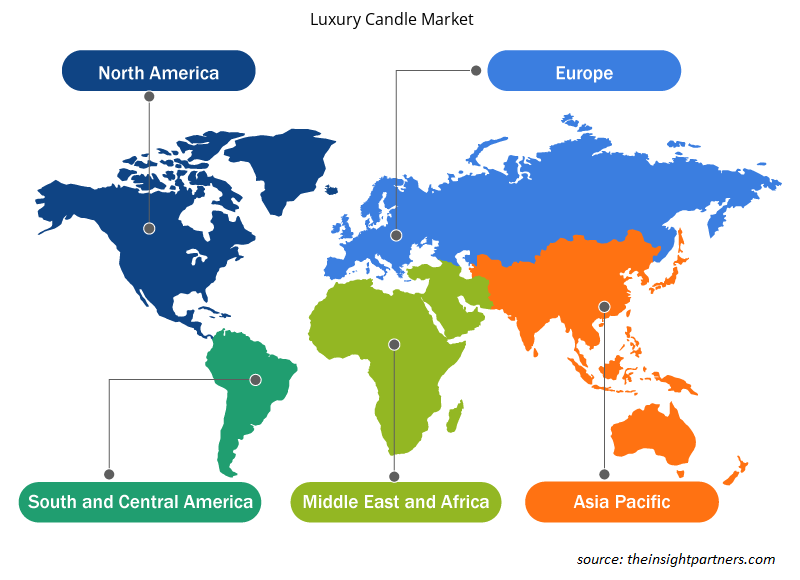

In 2020, North America held the largest share of the global luxury candle market, and Asia Pacific is estimated to register the fastest CAGR over the forecast period. The rising inclination of people in countries such as China, India, and Japan toward self-care and self-love is driving the demand for luxury candles. Moreover, the increasing influence of social media and celebrities on people's lifestyles is one of the significant factors driving the growth of the luxury candles market in Asia Pacific. People in the region readily follow social media trends and influencers and celebrities. Manufacturers of luxury candles collaborate with celebrities and social media influencers and are also launch paid promotion campaigns to boost the sales of their products. Moreover, rising per capita income and growing expenditure on home decor and home renovation activities across Asia Pacific are expected to propel the growth of the luxury candles market over the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Luxury Candle Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Luxury Candle Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Luxury Candle Market

The COVID-19 pandemic has negatively impacted many industries, including the consumer goods industry. The supply chains were disrupted severely due to nationwide lockdown and border restrictions, which affected the production and distribution of various products. The majority of the people were confined to their homes due to the COVID-19-induced lockdowns, owing to which there was a hike in the sale of home fragrance products, including luxury candles. Consumers began focusing their time on self-care routines to minimize stress, anxiety, and discomfort. All these factors opened positive growth opportunities for the luxury candle market. Industries are recovering from their losses and manufacturers are now permitted to operate with full capacity. Thus, luxury candle manufacturers are able to overcome the demand and supply gap due to the revival of their operations. Additionally, the luxury candle market is expected to witness significant growth in the coming years due to the cross-border movement of people and the growth of the tourism industry.

Market Insights

Rising Home Decor Industry

The home furnishing and home decor sector has seen significant expansion in recent years, owing to an increase in people's interest in making their living spaces more pleasant and homely. Moreover, people spent more time inside their houses due to the outbreak of COVID-19 and stay-at-home mandates. As a result, many people began to redecorate and modify their homes. This resulted in increased sales of home decor items such as curtains, pillows, lamps, vases, and candles. Consumers are looking for new ways to brighten up their living spaces; therefore, sales of home decor items are projected to increase significantly in the coming years. Candles are an important element of celebrations, festivities, and home decor. They enhance the ambiance and add a finishing touch to the overall decoration. Moreover, candles suit any home decor theme, which make them versatile home decor products. Thus, the rapidly expanding home decor industry is significantly boosting the growth of the luxury candle market.

Type Insights

Based on type, the luxury candle market is bifurcated into scented and regular. The scented segment accounted for a larger market share in 2020 is expected to register a higher CAGR during the forecast period. Scented candles come in a range of fragrances, including fruity, herbal, earthy, airy, woodsy, masculine, feminine, and floral. They are widely being used in home decor by therapists across massage centers and spas to create a calming and soothing effect. Due to these factors, the demand for scented candles is projected to proliferate in the coming years.

Distribution Channel Insights

Based on distribution channel, the luxury candle market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The supermarkets and hypermarkets segment accounted for the largest market share in 2020, and the online retail segment is expected to register the highest CAGR during the forecast period. Supermarkets and hypermarkets are large retail stores that offer a wide range are considered effective distribution channels for luxury candles. In comparison to other distribution channels, supermarkets and hypermarkets provide a variety of items from different brands at one convenient location and at reasonable costs. Many leading manufacturers of luxury candles target selling their products through prominent supermarkets and hypermarket chains such as Walmart, Lidl, and Kroger as there is high customer traffic. Such stores have a separate section of beauty and wellness products where customers can easily find the specific product. This factor is also driving the popularity of supermarkets and hypermarkets for purchasing luxury candles.

A few players operating in the luxury candle market include The Estée Lauder Companies Inc.; Diptyque; SISLEY; HERMES; Creed Boutique, LLC; Acqua di Parma S.r.l.; Newell Brands; Parfums de Marly; Louis Vuitton; and Maison Francis Kurkdjian. These players majorly focus on product innovation and research and development. They incorporate premium and unique fragrances in the product to acquire large consumer groups across the globe. Such strategies are projected to open lucrative growth opportunities for the luxury candle market in the coming years.

Luxury Candle Market Regional Insights

The regional trends and factors influencing the Luxury Candle Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Luxury Candle Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Luxury Candle Market

Luxury Candle Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 370.95 Million |

| Market Size by 2028 | US$ 525.28 Million |

| Global CAGR (2021 - 2028) | 5.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Luxury Candle Market Players Density: Understanding Its Impact on Business Dynamics

The Luxury Candle Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Luxury Candle Market are:

- The Estée Lauder Companies Inc.

- Diptyque

- SISLEY

- HERMES

- Creed Boutique, LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Luxury Candle Market top key players overview

Report Spotlights

- Progressive industry trends in the luxury candle market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the luxury candle market from 2019 to 2028

- Estimation of global demand for luxury candle

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the luxury candle market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the luxury candle market at various nodes

- Detailed overview and segmentation of the market, as well as the luxury candle industry dynamics

- Size of the luxury candle market in various regions with promising growth opportunities

Based on type, the luxury candle market is bifurcated into scented and regular. Based on distribution channel, the global luxury candle market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. Geographically, the luxury candle market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South and Central America (SAM).

The key players operating in the global luxury candle market include The Estée Lauder Companies Inc.; Diptyque; SISLEY; HERMES; Creed Boutique, LLC; Acqua di Parma S.r.l.; Newell Brands; Parfums de Marly; Louis Vuitton; and Maison Francis Kurkdjian.

Frequently Asked Questions

Based on end-use industry, which segment is the fastest growing segment in the global styrene monomer market?

The automobile segment is the fastest growing segment in the global styrene monomer market during the forecasted period. Acrylonitrile-butadiene styrene (as a thermoplastic resin) and styrene-acrylonitrile are used in automotive applications.

Based on application, which segment is the fastest growing segment in the global styrene monomer market?

The Acrylonitrile-Butadiene Styrene (ABS) segment is the fastest growing segment in the global styrene monomer market during the forecasted period. Various properties of acrylonitrile-butadiene styrene plastic make it a suitable material for applications such as automotive, sports equipment, electrical appliances, and toys.

Based on end-use industry, which segment is leading the global styrene monomer market during the forecast period?

The packaging segment held the largest share of the styrene monomer market in 2021. Styrene monomers are extensively utilized in food packaging. Polystyrene foam is used in lightweight protective packaging and foodservice containers.

Based on application, which segment is leading the global styrene monomer market during the forecast period?

The polystyrene segment held the largest share of the global styrene monomer market in 2021. Styrene is mainly used in the production of polystyrene, which is a major material used in applications such as packaging, consumer electronics, toys, recreational equipment, and refrigerator door liners.

Which region held the largest share of the global styrene monomer market?

In 2021, Asia Pacific held the largest share of the global styrene monomer market. The food industry is one of the major end-users of the styrene monomer as it is extensively utilized in food packaging. Moreover, in the Asia Pacific region, growing construction work is expected to accelerate the demand for styrene monomers.

Can you list some of the major players operating in the global styrene monomer market?

The major players operating in the global styrene monomer market are Americas Styrenics LLC (AmSty), Asahi Kasei Corporation, BASF SE, Idemitsu Kosan Co.,Ltd., INEOS Styrolution Group GmbH, LG Chem, LOTTE Chemical CORPORATION, LyondellBasell Industries Holdings B.V., Trinseo, Westlake Chemical Corporation, among others.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Luxury Candle Market

- The Estée Lauder Companies Inc.

- Diptyque

- SISLEY

- HERMES

- Creed Boutique, LLC

- Acqua di Parma S.r.l.

- Newell Brands

- Parfums de Marly

- Louis Vuitton

- Maison Francis Kurkdjianare

Get Free Sample For

Get Free Sample For