Medical Contract Manufacturing Market 2031 | Size, Trends & Opportunities

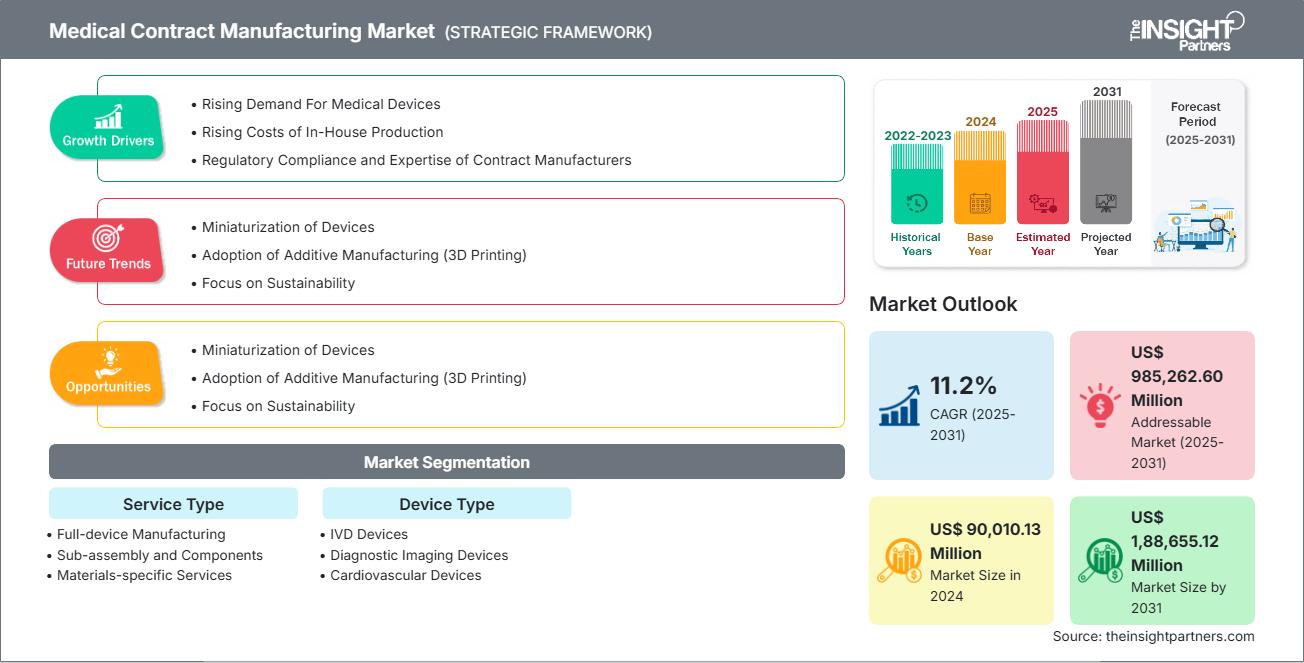

Medical Contract Manufacturing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Full-device Manufacturing, Sub-assembly and Components, and Materials-specific Services), Device Type (IVD Devices, Diagnostic Imaging Devices, Cardiovascular Devices, Drug Delivery Devices, Orthopedic Devices, Respiratory Care Devices, Ophthalmology Devices, Surgical Devices, Diabetes Care Devices, Dental Devices, Endoscopy and Laparoscopy Devices, Gynecology and Urology Devices, Neurology Devices, Patient Assistive Devices, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Nov 2025

- Report Code : TIPRE00041692

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 295

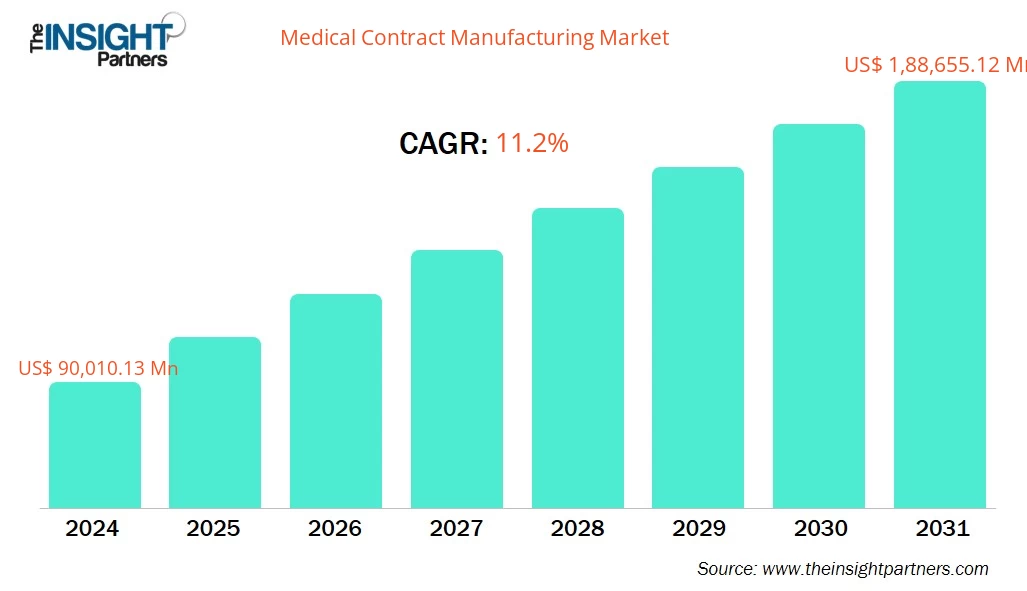

The medical contract manufacturing market is projected to reach US$188.65 billion by 2031 from US$ 90.01 billion in 2024 and to register a CAGR of 11.2% during 2025–2031.

Medical Contract Manufacturing Market Analysis

The primary market growth factors include the rising demand for medical devices, increasing costs of in-house production, growing regulatory compliance, and the expertise of contract manufacturers. Surging demand for personalized and home healthcare devices will create ample opportunities for the medical contract manufacturing market in the coming years.

Medical Contract Manufacturing Market Overview

The global medical contract manufacturing market is still growing gradually, a result of medical device and pharmaceutical companies outsourcing production to reduce costs, accelerate time-to-market, and leverage specialized manufacturing capabilities. The growth is mainly due to the increased use of advanced medical devices, which include minimally invasive instruments, wearables, and diagnostic technologies. Additionally, this growth is attributed to the expansion of biologics and the rise of personalized medicine, which require highly specialized production environments.

There are drivers, such as OEMs, who are shifting their focus toward innovation and regulatory strategy, resulting in them relying more deeply on CMOs that have expertise in precision engineering, clean-room assembly, and scalable production.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMedical Contract Manufacturing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Contract Manufacturing Market Drivers and Opportunities

Market Drivers:

- Rising Demand for Medical Devices: To meet the growing healthcare demands, and with the help of technology, advanced medical devices are in high demand. To meet this demand, manufacturers are turning to specialized outsourced production partners to scale their operations.

- Increasing Costs of In-House Production: The escalating costs of capital, labor, and quality control are making in-house manufacturing very expensive. As a result, companies are choosing to outsource to contract manufacturers that can provide efficient, scalable, and cost-effective production.

- Growing Regulatory Compliance and Expertise of Contract Manufacturers: Strictly complicated are the regulations that force OEMs to depend on contract manufacturers who are compliance experts, have well-established quality systems, and possess the necessary certifications for safe and compliant product development and manufacturing.

Market Opportunities:

- Surging Demand for Personalized and Home Healthcare Devices: The shift toward personalized and in-home healthcare solutions significantly escalates the need for specialized devices, opening up opportunities for manufacturers providing customized designs, quick prototyping, and patient-centric product innovation.

- Growing Integration of Digital Health: The extensive use of networking devices, remote monitoring, and data-driven care presents numerous opportunities for manufacturers with expertise in integrating sensors, software, and connectivity into advanced medical technologies.

- Increasing Strategic Developments by the Market Players: The surge in partnerships, acquisitions, and technology investments among industry players presents numerous opportunities for expanded capabilities, accelerated innovation, and strengthened end-to-end manufacturing solutions in the medical contract manufacturing landscape.

Medical Contract Manufacturing Market Report Segmentation Analysis

The medical contract manufacturing market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Device Type:

- IVD Devices: Contract manufacturers support precision engineering and sterile production for IVD instruments and consumables, enabling them to be accurate, scalable, and compliant for high-volume diagnostics.

- Diagnostic Imaging Devices: CMOs enable the supply of complex imaging systems by providing modern electronic component integration, rigorous quality control measures, and reliable performance testing to ensure the diagnostic imaging systems function correctly.

- Cardiovascular Devices: Manufacturers introduce high-precision cardiovascular implants and instruments into the market, utilizing specialized materials, cleanroom assembly, and regulatory expertise to ensure the devices are safe and compliant.

- Drug Delivery Devices: Through rigorous validation and scalable production, CMOs can maintain reliable therapeutic delivery in the market by producing accurate dosing technologies, such as inhalers, injectors, and pumps.

- Orthopedic Devices: Manufacturers utilize advanced machining techniques, biocompatible materials, and rigorous testing to develop implants and fixation systems that meet the highest standards of orthopedic performance and regulatory compliance.

- Respiratory Care Devices: The manufacturing of ventilatory and respiratory devices is in the hands of contract manufacturers who are responsible for precise assembly, sensor integration, and quality assurance to ensure the devices are capable of supporting acute and chronic respiratory care.

- Ophthalmology Devices: By employing micro-precision manufacturing, CMOs can offer products such as delicate ophthalmic instruments and implants that meet the standards of accuracy, safety, and high optical performance.

- Surgical Devices: Through precision machining, sterilization services, and validated processes, manufacturers ensure the supply of high-quality surgical instruments and disposables, thereby supporting both minimally invasive and open procedures.

- Diabetes Care Devices: Through sensor integration, miniaturization, and reliable high-volume production capabilities, CMOs can offer products such as glucose monitoring systems and insulin delivery devices.

- Dental Devices: Manufacturers in the dental industry equip it with precision fabrication and process compliance, supporting restorative, surgical, and diagnostic dental applications through the provision of dental tools, implants, and consumables.

- Endoscopy and Laparoscopy Devices: CMOs bring to the market minimally invasive visualization systems that utilize optics integration, sterile assembly, and accurate component manufacturing for surgical and diagnostic use.

- Gynecology and Urology Devices: Through precision engineering, biocompatible materials, and validated processes, contract manufacturers have been able to provide support for specialized instruments and devices used in reproductive and urinary procedures.

- Neurology Devices: Manufacturers introduce neurodiagnostic and neurostimulation devices to the market that require expertise in microelectronics, safety validation, and high-precision assembly for use in neurology.

- Patient Assistive Devices: CMOs refine the development of mobility aids and assistive technologies by utilizing durable materials, providing ergonomic design support, and implementing scalable manufacturing processes to enhance patient independence.

- Others: This segment is dedicated to the medical devices of the niche market that require custom manufacturing, specially selected materials, and tailored compliance to meet the unique clinical and performance requirements.

By Service Type:

- Full-device Manufacturing:

- Sub-assembly and Components:

- Materials-specific Services:

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The medical contract manufacturing market in North America is expected to hold a significant market share. The rising demand for medical devices, increasing costs of in-house production, growing regulatory compliance, and expertise of contract manufacturers are likely to drive the market growth.

Medical Contract Manufacturing Market Regional InsightsThe regional trends and factors influencing the Medical Contract Manufacturing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Medical Contract Manufacturing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Medical Contract Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 90.01 Billion |

| Market Size by 2031 | US$ 188.65 Billion |

| Global CAGR (2025 - 2031) | 11.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Contract Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Contract Manufacturing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Medical Contract Manufacturing Market top key players overview

Medical Contract Manufacturing Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in South and Central America, the Middle East, and Africa also offer many untapped opportunities for medical contract manufacturers to expand.

The growth rates of the medical contract manufacturing market are different in each region, owing to the recommendations of regulatory agencies and medical guidelines for medical contract manufacturers. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers: North America is a leader with state-of-the-art manufacturing infrastructure, a strong regulatory skill set, high device consumption, and well-established CMOs facilitating complex, high-value medical technologies.

- Trends: Manufacturing advancements and sustainable practices

2. Europe

- Market Share: Substantial share due to increasing prevalence of pain conditions

- Key Drivers: Europe relies on strict quality norms, mature healthcare systems, and specialized production capabilities that sharply increase the demand for precision medical contract services.

- Trends: Regulatory influence on market structure

3. Asia Pacific

- Market Share: Fastest-growing region with rising market shares every year

- Key Drivers: Asia Pacific is a fast-growing region, primarily driven by cost benefits, skilled labor, government support, and rising domestic healthcare requirements, making it a global outsourcing hub.

- Trends: Innovations in contact manufacturing services

4. South and Central America

- Market Share: Growing market with steady progress

- Key Drivers: The area has considerable outsourcing potential, resulting from broadening access to healthcare, enhanced manufacturing capabilities, and the continuous influx of investments from global medical device companies.

- Trends: Technological developments in drug manufacturing

5. Middle East and Africa

- Market Share: Small market growing at a rapid pace

- Key Drivers: MEA offers future opportunities as the development of healthcare infrastructure attracts investment for manufacturing and facilitates the production of essential medical devices locally.

- Trends: Growth in the CDMO market

Medical Contract Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to established players such as Jabil Inc., TE Connectivity Ltd, and Cirtec Medical Corp. Regional and niche providers such as UFP Technologies, Inc., and MICRO add to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Advanced products

- Value-added services such as customization and sustainable solutions

- Competitive pricing models

- Compliance with regulatory guidelines

Opportunities and Strategic Moves

- Companies are investing in research and development, which drives innovation in detection technologies. These investments improve the sensitivity and specificity, addressing specific eye health issues in different regions.

- Manufacturers will likely focus on local production to cut costs and strengthen supply chains, especially in high-volume markets such as India.

Other companies analyzed during the course of research:

- Sanmina Corporation

- Plexus Corporation

- Gerresheimer AG

- Celestica Inc.

- Benchmark Electronics, Inc.

- Nordson Corporation

- Teleflex, Inc.

- Phillips-Medisize Corporation

- Tecomet, Inc.

- Nipro Corporation

Medical Contract Manufacturing Market News and Recent Developments

- David Schnur Associates (DSA) recently announced an exclusive, multi-year strategic agreement with Freudenberg Medical: David Schnur Associates (DSA) announced an exclusive, multi-year strategic agreement to add Freudenberg Medical to its network of partners. Through this partnership, DSA will provide customers with precision metals and coating solutions, expanding industry access to Freudenberg Medical's component and surface treatment solutions.

- Biomerics Expands Medical-Grade Polyurethane Offerings With Quadraflex AREX: Biomerics, the leading vertically integrated medical device contract manufacturer in the interventional device market, announced the addition of Quadraflex AREX to its medical-grade polyurethane material offerings.

Medical Contract Manufacturing Market Report Coverage and Deliverables

The "Medical Contract Manufacturing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Medical contract manufacturing market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Medical contract manufacturing market trends, and market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Medical contract manufacturing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the medical contract manufacturing market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For