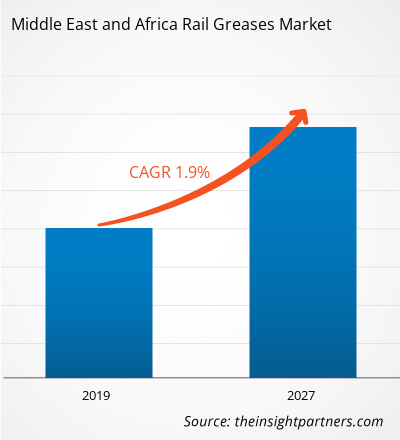

The rail greases market in MEA is expected to reach US$ 39.93 million by 2027 from US$ 34.11 million in 2018 and is expected to grow at a CAGR of 1.9% from 2019 to 2027.

Grease is a solid or semi-solid lubricating oil. It is usually comprised of mineral oil and thickeners such as calcium-based soap and lithium-based soaps. Grease possesses characteristic feature such as high initial viscosity, which make it frictional. Grease is being used for maintenance of various rail elements such as railway axles & wheels, bearings & chains, brake elements, interior components, pantographs and railway track components, as it prevents entry of contaminants or loss of lubricant. Soft grease used in gearboxes, for noise reduction, as leakage resistant, and for suspension of solid additives. Greased components consumes a small amount of power and is an even less vulnerable impact to any wear tear damage. Besides, it is popularly used across various industries such as automobile, railway, construction, pharmaceutical, food & beverage, mining and numerous others. For rails, greases can be used in mechanisms where lubrication is required frequently and where a lubricating oil does not stay for long. The demand of greases in railway industry is growing due to the development of new railway infrastructure across major countries such as South Africa, Saudi Arabia, UAE and Rest of MEA coupled with the maintenance activities of different parts used in railway transportation.

South Africa, Saudi Arabia, UAE and Rest of MEA are major economies in MEA. South Africa has dominated the Middle East and Africa Rail Greases market with highest market share and is estimated to be the fastest growing region during the forecast period. The growth of the rail greases market in this country is primarily due to booming economy, rapid urbanization and growing investment by the government of emerging countries in the development of railway infrastructure. The country is experimenting with state-of-the-art transport technologies to make urban rail systems more efficient, reliable and passenger friendly. The South Africa metro systems are progressively moving from semi-automatic to driverless/unmanned train operations. Most of the upcoming systems are introducing the deployment of cutting-edge technological solutions for the comfort and safety of commuters. Hence, the rail greases market is expected to experience rapid growth in the country. Furthermore, numerous government initiatives for digitization in the country’s conventional railway networks will also drive the rail greases market during the forecast period.

Railway vehicle elements such as axles & wheels, bearings & chains, brake elements, interior components, and pantographs need frequent maintenance and lubrication for smooth running and high performance. Applying greases on wheels offer various benefits such as it reduces labor costs, extends repair intervals, and reduces lubricant consumption. Using greases for railway vehicle elements offers various operation benefits such as increases equipment reliability, reduces unplanned downtime, reduces energy and fuel consumption, and improves equipment profitability. Moreover, greases can help in saving energy and reducing noise. The axle box bearing of a vehicle-track system is an important component of a railway and train bogie, which bears a variety of complicated stochastic loads between the track and bogie. The reliability and service life of axle box bearings can influence railway safety. Grease plays a major part in the lubrication of railway axle box bearings as lubrication failures of axle box bearings can lead to accidents, such as hot axle cutting and bearing burnout. Apart from this, greases are also used in other railway components such as track components, brakes and interior components. Greases used in the railway track components are designed to minimize friction, reduce temperature, and prevent wear between wheel flange and rails. Greases are also used in screws and bolts used in the installation of railway track elements to protect them from rusting. Thus, the rail greases are mostly required for the maintenance activities and for smooth running and high performance of different parts such as railway vehicle components and railway track components. This fact has driven the market for rail greases during the forecast.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the rail greases market. The MEA rail greases market is expected to grow at a good CAGR during the forecast period.

COVID-19 has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The chemical and material industry are one of the major industries suffering serious disruptions such as supply chain breaks, disruptions in manufacturing due to lockdown and office shutdowns as a result of this outbreak. All these factors have greatly affected the rail grease market. Saudi Arabia has the largest COVID-19 cases in the MEA region, and is followed by South Africa and UAE, among others. UAE was the first country in MEA to report a confirmed case of coronavirus.

MEA Rail Greases Market Revenue and Forecast to 2027 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEA Rail Greases Market Segmentation

MEA Rail Greases Market – By Product Type

- Lithium Grease

- Calcium Grease

- Other Grease

MEA Rail Greases Market – By Application

- Railway Vehicle Elements

- Railway Track Elements

- Switches and Fish Plates

- Curve Rails

- Screw and Bolts

MEA Rail Greases Market – By Distribution Channel

- Offline

- Online

MEA Rail Greases Market – By Country

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

MEA Rail Greases Market -Companies Mentioned

- Royal Dutch Shell Plc

- Exxon Mobil Corporation

- Total SA

- Petroliam Nasional Berhad (Petronas)

- FUCHS

- SKF Group

- Chevron Corporation

- Klüber Lubrication

- Sinopec Corp.

Middle East and Africa Rail Greases Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 34.11 Million |

| Market Size by 2027 | US$ 39.93 Million |

| Global CAGR (2019 - 2027) | 1.9% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Small Internal Combustion Engine Market

- Battery Testing Equipment Market

- Public Key Infrastructure Market

- High Speed Cable Market

- Point of Care Diagnostics Market

- Wheat Protein Market

- Personality Assessment Solution Market

- Space Situational Awareness (SSA) Market

- Airline Ancillary Services Market

- Aircraft Landing Gear Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, and Distribution Channel (Offline and Online

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Saudi Arabia

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Middle East and Africa Rail Greases Market

- Royal Dutch Shell Plc

- Exxon Mobil Corporation

- Total SA

- Petroliam Nasional Berhad (Petronas)

- FUCHS

- SKF Group

- Chevron Corporation

- Klüber Lubrication

- Sinopec Corp.

Get Free Sample For

Get Free Sample For