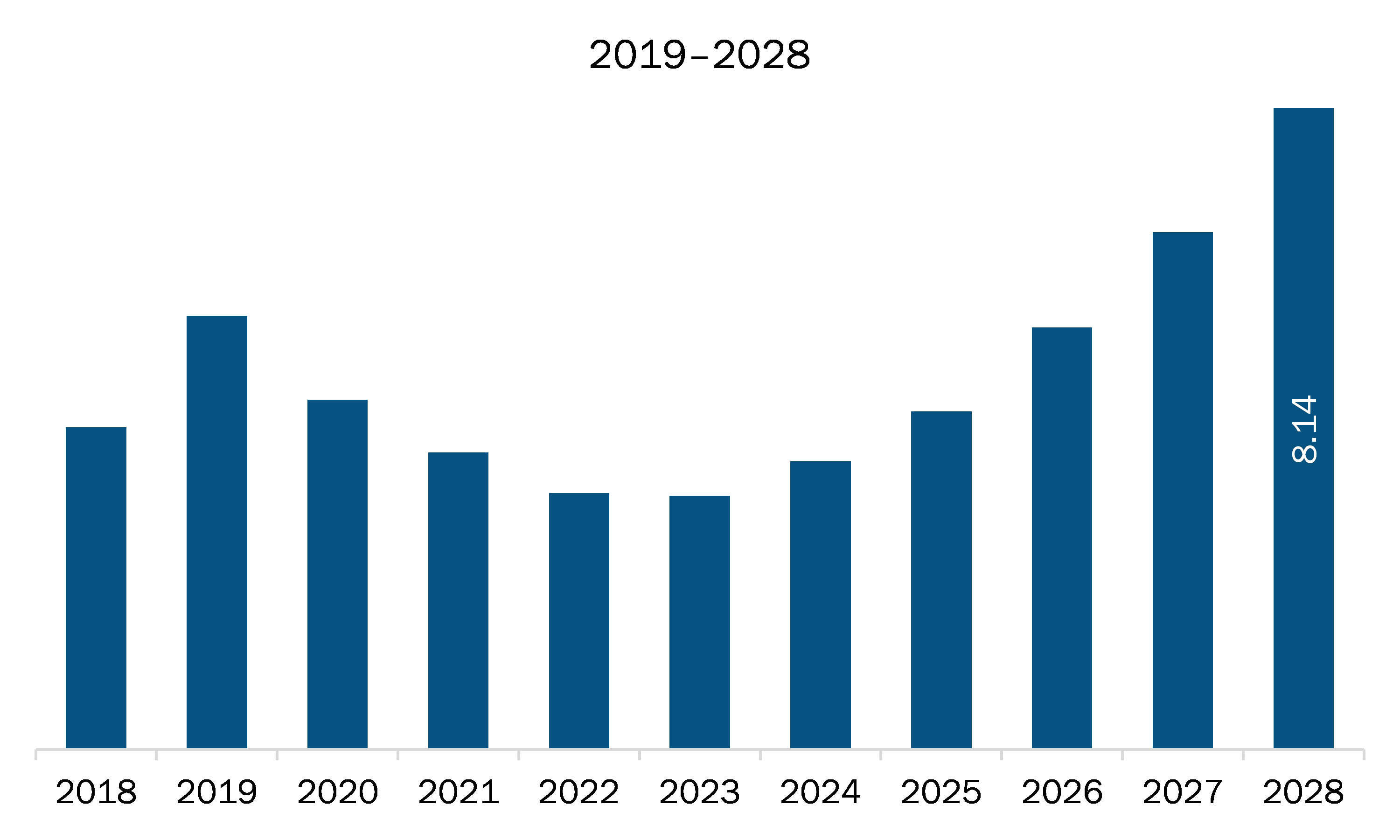

The tennis racquet market in MEA is expected to grow from US$ 7.85 million in 2021 to US$ 8.14 million by 2028; it is estimated to grow at a CAGR of 0.5% from 2021 to 2028.

South Africa, Saudi Arabia, and UAE are major economies in MEA. The demand for tennis racquet products is surging due to new product innovations by various market players such as Yonex Co., Ltd. The company has launched the new VCORE PRO tennis racquet, more focused on precision and control. With 36% more racquet flex, the 3rd-generation VCORE PRO is developed for players seeking control over all facets of ball movement such as the ball's trajectory, spin, speed, bounce, and ball placement. Similarly, the DUNLOP brand of Sumitomo Rubber Industries, Ltd. has introduced an innovative CX Series range of control racquets. This innovative range has been designed to give players complete control over their power, spin, and accuracy. Sensors in the handle of racquets record a considerable amount of information, from the number and range of shots hit to the power and amount of spin. The International Tennis Federation had previously outlawed the smart racquets in competition; however, players can now use the technology, such as Rafael Nadal's new racquet and devices like heart-rate monitors that record data about player performance in real time. Hence, the increased demand for tennis racquet products, along with new product developments, is strongly complementing the Middle East and Africa Tennis Racquet market growth.

Turkey, South Africa, Iraq, and Israel reported a high number of COVID-19 confirmed cases and deaths in the MEA. According to the International Finance Corporation, the COVID-19 pandemic has had a severe impact on the economy of the MEA, which led to decline in oil production and tourism, as well as remittances. Turkey has the highest number of COVID-19 cases in the MEA, followed by South Africa and the UAE, among others. Due to lockdown in the Middle Eastern and African countries, various consumer goods companies remained closed, which led to the reduction in the sale of various products, including tennis racquet.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the tennis racquet market. The MEA tennis racquet market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEA Tennis Racquet Market Segmentation

MEA Tennis Racquet Market – By End User

- Adults

- Kids

MEA Tennis Racquet Market – By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Others

MEA Tennis Racquet Market- By Country

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

MEA Tennis Racquet Market-Companies Mentioned

- Amer Sports

- Authentic Brands Group LLC

- Babolat

- GAMMA Sports

- Maus Frères SA

- PACIFIC Holding GmbH

- Sumitomo Rubber Industries, Ltd.

- Yonex Co., Ltd.

Middle East and Africa Tennis Racquet Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.85 Million |

| Market Size by 2028 | US$ 8.14 Million |

| CAGR (2021 - 2028) | 0.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By End User

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For