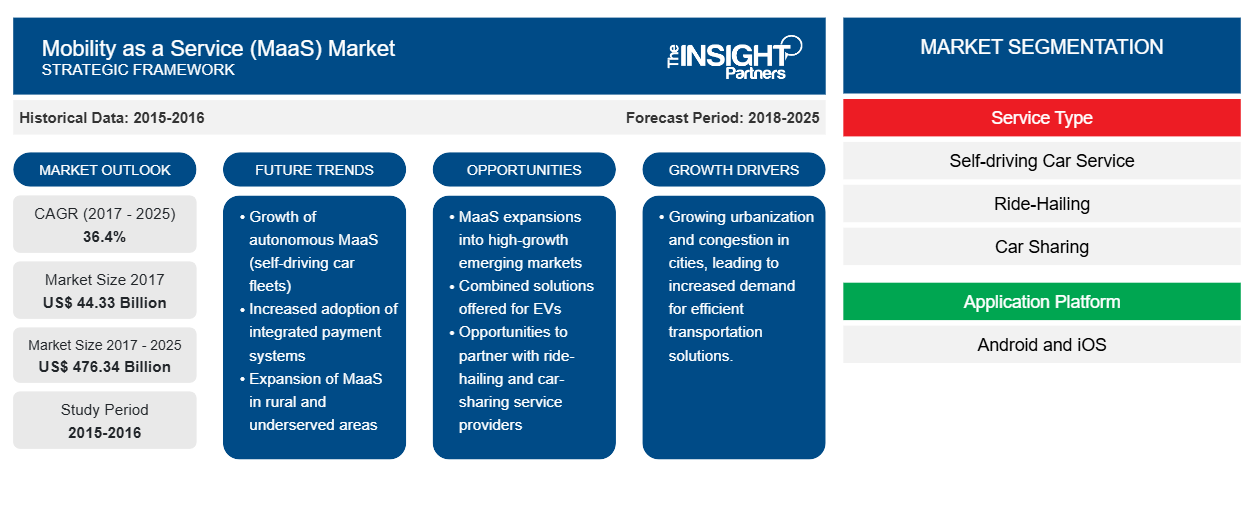

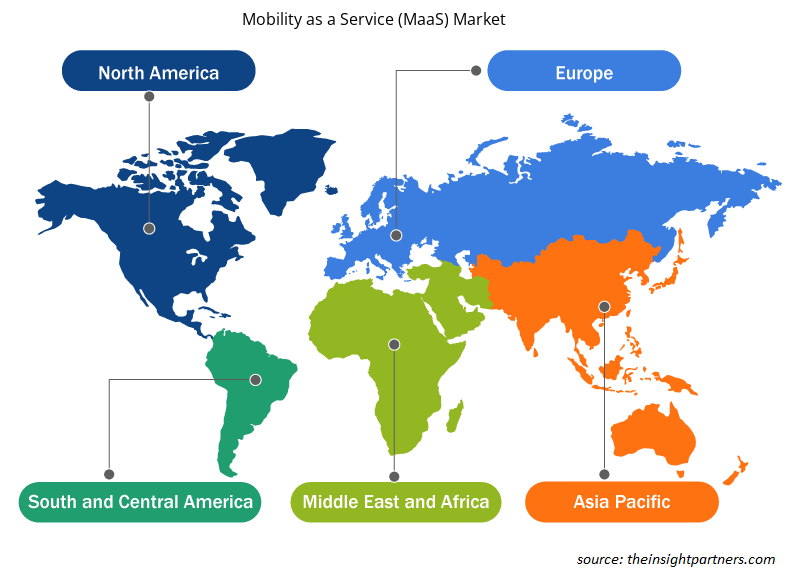

[Research Report] The mobility as a service (MaaS) market was valued at US$ 44.33 billion in 2017 and is projected to reach US$ 476.34 billion by 2025; it is expected to grow at a CAGR of 36.4% from 2018 to 2025.

Analyst Perspective:

The mobility as a service (MaaS) market has been experiencing rapid growth and transformation in recent years. MaaS refers to a concept where various modes of transportation, such as public transit, ride-sharing, bike-sharing, and car-sharing, are integrated into a single platform or service, providing users with a seamless and convenient transportation experience. The MaaS market has gained significant traction due to the increasing demand for sustainable and efficient transportation solutions, advancements in technology, and the rise of the sharing economy. MaaS platforms typically offer users a range of options, including real-time travel information, booking and payment services, and personalized route planning, all accessible through mobile applications or online platforms. One of the key drivers of the MaaS market is the growing urbanization and congestion in cities worldwide. As more people move to cities, efficient transportation becomes crucial. MaaS aims to address these challenges by providing users with a comprehensive range of transportation options tailored to their specific needs. This can help reduce reliance on private vehicles, alleviate traffic congestion, and improve overall transportation efficiency. The advancements in digital technologies, such as mobile connectivity, GPS, and data analytics, have enabled the seamless integration of different transportation modes within MaaS platforms. This integration allows users to plan, book, and pay for their entire journey using a single application, eliminating the need for multiple tickets or separate payment systems. Data collected from users' travel patterns and preferences can be leveraged to optimize transportation networks, improve service quality, and enhance the overall user experience. The MaaS market is also witnessing increased collaboration among stakeholders, including transportation operators, technology providers, and governments. Public-private partnerships are forming to develop MaaS ecosystems that integrate public transit with private mobility services. Governments recognize the potential of MaaS to address transportation challenges and actively support its implementation through policy frameworks and funding initiatives.

Market Overview:

A customer-focused transport concept is called "mobility as a service." The service allows customers to plan, reserve, and pay for a variety of mobility services. It integrates transportation options like taxis, automobile rentals/lease, and bike and car sharing through digital channels. The major goal of MaaS development is to offer travelers mobility solutions tailored to their travel needs.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mobility as a Service (MaaS) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mobility as a Service (MaaS) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

The Increasing Urbanization and Smart City Initiatives to Drive Growth of Mobility as a Service Market

The increasing urbanization and smart city initiatives play a vital role in driving the development of the Mobility as a Service (MaaS) market. As cities worldwide grapple with rising population densities, traffic congestion, and environmental concerns, the concept of MaaS emerges as a promising solution to address these challenges. Urbanization leads to a higher concentration of people in cities, resulting in increased demand for efficient and sustainable transportation options. MaaS offers a holistic approach to Mobility by integrating various modes of transportation, such as public transit, ridesharing, bike-sharing, and even autonomous vehicles, into a single platform. This integrated approach allows urban dwellers to conveniently plan, book, and pay for their journeys, eliminating relying solely on private vehicles. By offering diverse transportation options through MaaS, cities can reduce congestion, alleviate parking issues, and enhance overall transportation efficiency. Smart city initiatives further propel the growth of MaaS by leveraging technology and data to optimize urban Mobility. Smart cities deploy intelligent transportation systems, sensors, and connectivity to gather real-time data on traffic patterns, parking availability, and public transit utilization. This data is then used to develop predictive algorithms and provide personalized recommendations to users through MaaS platforms. By harnessing technology and data-driven insights, MaaS enables cities to offer seamless and efficient transportation services, ultimately improving the quality of life for residents.

Moreover, smart city initiatives often prioritize sustainability and environmental considerations. MaaS aligns perfectly with these goals by promoting shared Mobility, reducing reliance on private vehicles, and integrating electric vehicles into the transportation ecosystem. Through MaaS, cities can encourage public transit, ridesharing, and other eco-friendly modes of transportation, thereby reducing carbon emissions and improving air quality. This alignment with sustainability objectives makes MaaS an attractive solution for smart cities seeking to create greener and more livable urban environments. In addition, smart city infrastructure, such as digital payment systems, connected mobility platforms, and smart transportation hubs, provides a solid foundation for MaaS deployment. These technological advancements facilitate the seamless integration of different transportation modes, enabling users to effortlessly access and pay for services. The convenience and ease of use offered by MaaS platforms encourage more individuals to adopt sustainable and multimodal transportation options, further driving the market's growth.

Segmental Analysis:

Based on application platform the market is categorized as android, iOS, and others. The android segment held the largest share of the mobility as a service market in 2020 and is anticipated to register the highest CAGR in the market during the forecast period. The Android segment has emerged as the leader in the Mobility as a Service (MaaS) market, holding the largest share. This can be attributed to widespread adoption, open-source nature, compatibility with diverse hardware and connectivity options, a robust app ecosystem, and integration with other Google services. Android's large user base, extensive developer community, and availability of a wide range of MaaS applications and solutions have contributed to its dominance in the market. Furthermore, Android's integration with Google Maps and its ability to support multiple transportation modes has strengthened its position as the preferred platform for MaaS providers.

Regional Analysis:

The Asia Pacific mobility as a service market was valued at US$ 16.23 billion in 2017 and is projected to reach US$ 198.29 billion by 2025; it is expected to grow at a CAGR of 38.9% during the forecast period. The Asia Pacific region has emerged as a leader in the Mobility as a Service (MaaS) market, taking a prominent position due to several key factors. The region's rapid urbanization and population growth have created a strong demand for efficient and sustainable transportation solutions. The densely populated cities in countries like China, India, Japan, and South Korea face significant traffic congestion and pollution challenges. MaaS offers a promising solution by providing integrated and multimodal transportation options, allowing users to navigate these urban environments easily. The Asia Pacific region has witnessed remarkable digital infrastructure and mobile technology advancements. With a high penetration of smartphones and widespread access to mobile internet, the region is well-equipped to support MaaS platforms and services. The tech-savvy population in countries like South Korea and Japan, known for their early adoption of technology, further drives the growth of MaaS in the region.

Furthermore, supportive government policies and initiatives have played a vital role in fostering the development of MaaS in the Asia Pacific. Governments in countries like Singapore and China have actively promoted smart city initiatives and sustainable transportation systems, offering incentives and regulatory frameworks to encourage the adoption of MaaS. These efforts have created an enabling environment for MaaS providers to operate and expand their services. Grab, Gojek and Didi Chuxing have established a strong presence, offering a wide range of mobility services beyond traditional ride-hailing, including bike-sharing, car-sharing, and integrated transportation platforms. These companies have built extensive networks and user bases, driving the overall adoption of MaaS in the region. Also, the cultural and geographical diversity of the Asia Pacific region presents unique opportunities for MaaS providers. Different countries have distinct transportation needs and preferences, necessitating customized and localized solutions. MaaS providers that can adapt their services to cater to the specific demands of each market have gained a competitive edge in the region.

Mobility As A Service Mobility as a Service (MaaS) Market Regional Insights

The regional trends and factors influencing the Mobility as a Service (MaaS) Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Mobility as a Service (MaaS) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mobility as a Service (MaaS) Market

Mobility as a Service (MaaS) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 44.33 Billion |

| Market Size by 2025 | US$ 476.34 Billion |

| Global CAGR (2017 - 2025) | 36.4% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Mobility as a Service (MaaS) Market Players Density: Understanding Its Impact on Business Dynamics

The Mobility as a Service (MaaS) Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mobility as a Service (MaaS) Market are:

- Lyft, Inc.

- Uber Technologies, Inc.

- Beeline Singapore

- SkedGo Pty Ltd.

- UbiGo AB

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mobility as a Service (MaaS) Market top key players overview

Key Player Analysis:

The mobility as a service market analysis consists of the players such as Lyft, Inc., Uber Technologies, Inc., Moovel Group GmbH, Beeline Singapore, Whim App (MaaS Global Oy), Splyt Technologies Ltd., Qixxit, UbiGo AB, Tethys Technology, Inc., Smile Mobility, SkedGo Pty Ltd, Transit Systems Pty Ltd., and Citymapper. Among the players in the mobility as a service Moovel Group GmbH and Smile Mobility are the top two players owing to the diversified product portfolio offered.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the mobility as a service market. A few recent key market developments are listed below:

- In August 2022, Lime, an electric vehicle company, and Whim, a mobility app, expanded their collaboration to another country. In June 2022, Whim launched e-scooters in Antwerp and Brussels, Belgium, followed by Helsinki, Finland. Whim has access to all Lime e-scooters in Zurich, Winterthur, and Basel. Whim, in addition to two other e-scooter providers in more than ten cities, allows users to plan, book, and pay for trips using multiple modes of transportation.

- In May 2022, FOD Mobility Group introduces customized marketing support services for Mobilleo customers. FOD Mobility Group now offers a comprehensive range of tailored marketing support services for clients who may not have the necessary marketing experience or resources in-house, in addition to providing the Mobility as a Service (MaaS) technology itself via their market-leading Mobile platform.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Boat Sails Market

- Heavy Commercial Vehicle Air Brake Systems Market

- Heavy Commercial Vehicle Clutch Market

- Electric Vehicle Heat Pump Systems Market

- Event Logistics Market

- Industrial Vehicles Market

- Motorsport Transmission Market

- Automotive Telematics Market

- Third Party Logistics Market

- Low Speed Electric Vehicle Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Mobility as a Service (MaaS) Market

1. Lyft, Inc.2. Uber Technologies, Inc.3. Beeline Singapore4. SkedGo Pty Ltd.5. UbiGo AB6. MaaS Global Oy7. Moovel Group GmBH8. Qixxit9. Splyt Technologies Ltd.10. Transit Systems Pty Ltd.11. Smile Mobility12. Citymapper

Get Free Sample For

Get Free Sample For