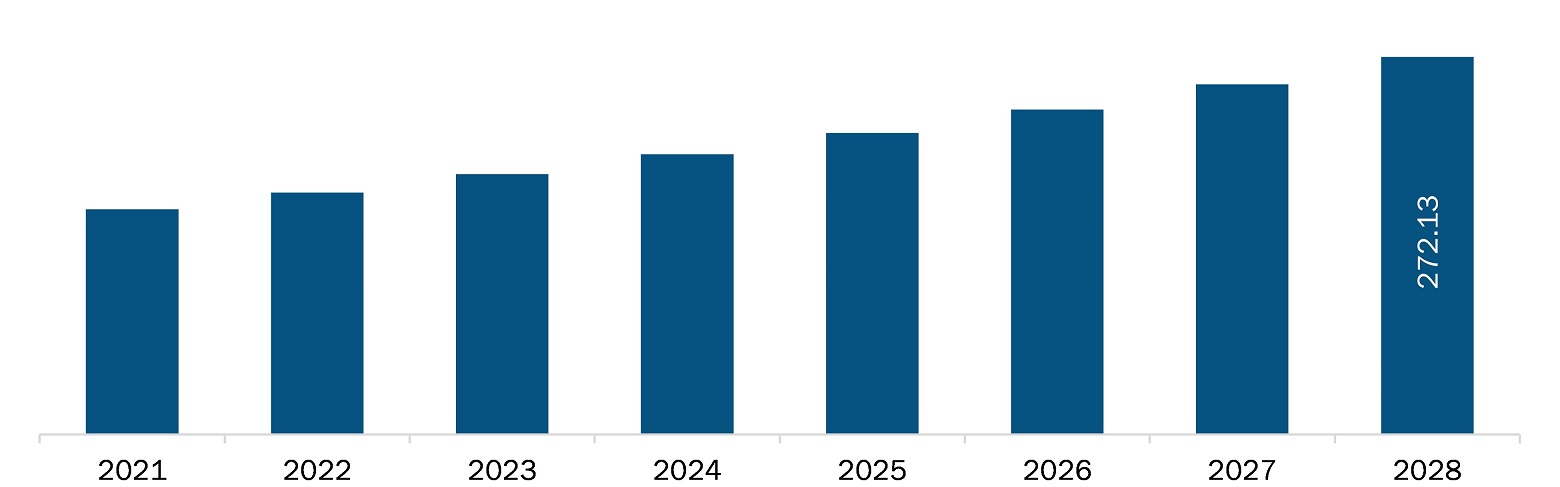

The North America artificial cornea and corneal implant market is expected to reach US$ 272.13 million by 2028 from US$ 162.29 million in 2021; it is estimated to grow at a CAGR of 7.7% from 2021–2028.

The growth of the Artificial Cornea and Corneal Implant market is attributed to key factors such as the growing prevalence of eye diseases that can cause corneal blindness and rising elderly population. However, the expensive ophthalmology surgeries and devices hamper the market growth.

Corneal diseases are the second-leading cause of blindness worldwide, after cataract. According to the World Health Organization (WHO), at least 2.2 billion people in the world will have near or far vision impairment by February 2020. These 1 billion people include people with moderate or severe distance vision impairment or blindness due to refractive errors (88.4 million), cataracts (94 million), glaucoma (7.7 million), corneal opacity (4.2 million), diabetes Retinopathy (3.9 million), trachoma (2 million), and near vision weakness due to unresolved presbyopia (826 million). Population growth and aging would further propel the risk of visual impairment among a larger number of people. According to the National Eye Institute, the number of persons suffering from cataract would rise from 24.4 million in 2010 to ~50 million by 2050. As populations age and average life expectancy continues to increase worldwide, the number of people with cataracts will continue to grow. Furthermore, people over 60 years of age; steroid users; and family members of those who have been diagnosed with glaucoma; people suffering from diabetes, high myopia, and hypertension, and eye injuries are at a greater risk of glaucoma. Thus, the rising prevalence of eye diseases that causes corneal blindness worldwide highly demands artificial cornea and corneal implant. Also, the rise in geriatric population is fuelling the artificial cornea and corneal implant market growth.

The COVID-19 outbreak in North America had a significant impact on the US. Various healthcare research centers across the country were solely focused on COVID-19 treatments. On the other hand, to prevent the spread of the novel coronavirus, the number of patient visits to clinics decreased significantly in the first and second quarters of 2020. As a result, the number of elective eye procedures performed per week in hospitals and clinics has decreased over time. According to an article in Ophthalmology Times, the number of elective procedures has decreased from 200 to only 10 each week in U.S. In addition, the number of patient visits to examination facilities has decreased by 15% in countries, such as the US. Also, it is predicated that the volume of ophthalmic practice has decreased by 81%, owing to a decline in patients seeking care for glaucoma (88%) and cataract surgery (81%) (97%). During this time, government assistance such as Paycheck Protection Program loans aided many practices, allowing the ophthalmic business to successfully resume operations. Ophthalmologists will benefit from such a scenario since it will allow them to resume their work safely.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

NORTH AMERICA ARTIFICIAL CORNEA AND CORNEAL IMPLANT MARKET SEGMENTATION

By Type

- Human Cornea

- Artificial Cornea

By Transplant Type

- Penetrating Keratoplasty

- Endothelial Keratoplasty

- Others

By Disease Indication

- Fuchs’ Dystrophy

- Keratoconus

- Fungal Keratitis

- Others

By End User

- Hospitals

- Specialty Clinics and ASCs

- Others

By Country

- US

- Canada

- Mexico

Company Profiles

- AJL OPHTHALMIC S.A

- ADVANCING SIGHT NETWORK

- CORNEA BIOSCIENCES, INC

- KERAMED, INC

- EyeYon Medical

- Florida Lions Eye Bank

- CorneaGen

North America Artificial Cornea and Corneal Implant Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 162.29 Million |

| Market Size by 2028 | US$ 272.13 Million |

| CAGR (2021 - 2028) | 7.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For