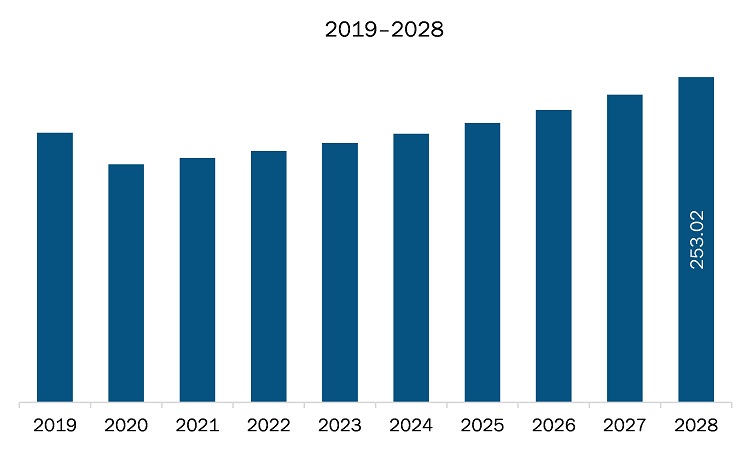

The backshell market in North America is expected to grow from US$ 190.09 million in 2021 to US$ 253.02 million by 2028; it is estimated to grow at a CAGR of 4.2% from 2021 to 2028.

In the manufacturing of military aircraft, vehicles, and naval vessels, manufacturers are giving significant importance to lightweight components. The lightweight of aircraft, vehicles, and naval vessels helps enhance maneuverability capabilities, which plays a vital role in the compact battlefield. Moreover, the use of lightweight components increases fuel efficiency. Currently, aluminum is getting widely used in various components to reduce the overall weight of military-grade aircraft, vehicles, and vessels. Steel is 2.5 times heavier than aluminum. Also, aluminum has a higher anticorrosion capability, and it does not require any specialized coating compared to that of steel. Further, aluminum is more malleable and elastic than steel; thus, it is considered more desirable. Further, aluminum’s performance in terms of reliability, strength, durability, mil-standards, EMI shielding, environmental protection, and strain relief that of metal and composite backshell. Thus, the increasing emphasis on the use of lightweight components along with the growing demand for military aircraft, vehicles, and vessels drives the growth of the backshell market. The aluminum backshells are gaining importance in the commercial aviation business, as the commercial (civil and general aviation) aircraft manufacturers are consistently striving hard to reduce fuel consumption and CO2 emission and increase endurance. The usage of heavier metallic components restricts the aircraft OEMs to attain the above-mentioned parameters. Owing to this, the usage of lightweight components or parts is surging among these manufacturers. As the commercial aircraft OEMs are emphasizing aluminum backshells for varied connectors, the demand for aluminum backshells is growing among the MRO service providers. Apart from the owners of the newly manufactured aircraft fleet, the owners of the existing aircraft fleet are also concentrating on retrofitting their aircraft models with lightweight and advanced aluminum backshells as these products increase the lifespan of connectors by 4% to 8%. Also, the retrofitting of aluminum backshell helps in reducing aircraft weight, thereby facilitating the aircraft fleet owners to accomplish their weight and CO2 reduction and longer endurance strategies. Due to this, the MRO service providers are increasingly procuring aluminum backshells, which is fueling the growth of the backshell market.

Due to favorable government policies to encourage innovation, the presence of a large industrial base, and high purchasing power, North America is one of the most important regions for adopting and developing new technologies, particularly in developed countries such as the United States and Canada. As a result, any influence on industry growth is projected to have a negative influence on the region's economic growth. Businesses in the region have been significantly impacted by COVID-19 in four key areas: supply chain/operations, personnel, 2020 investments, and product offering. Due to the extreme measures adopted during the pandemic, overhead expenditures, including expenditure for sales, research & development (R&D), and administration of various providers, declined unfavorably.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America backshell market. The North America backshell market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Backshell Market Segmentation

North America Backshell Market – By Type

- Circular

- Rectangular

North America Backshell Market – By Material

- Aluminum

- Nickel

- Stainless Steel

- Others

North America Backshell Market – By Military Standard

- AS85049 Series

- MIL-DTL-38999

- MIL-DTL-83723

- MIL-DTL-5015

- MIL-DTL-26482

- Others

North America Backshell Market – By Application

- Ground

- Naval

- Air

- Commercial Aircraft

- Military Aircraft

North America Backshell Market – By Country

- US

- Canada

- Mexico

North America Backshell Market – Companies Mentioned

- Amphenol Corporation

- Collins Aerospace

- TE Connectivity

- Souriau Sunbank (EATON)

- Arrow Electronics, Inc.

- Glenair, Inc.

- Curtiss-Wright Corporation

- Isodyne Inc.

- PEI-Genesis.com

North America Backshell Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 190.09 Million |

| Market Size by 2028 | US$ 253.02 Million |

| CAGR (2021 - 2028) | 4.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For