Inspection Drone Market Size, Share, Trends, and Growth Forecast 2031

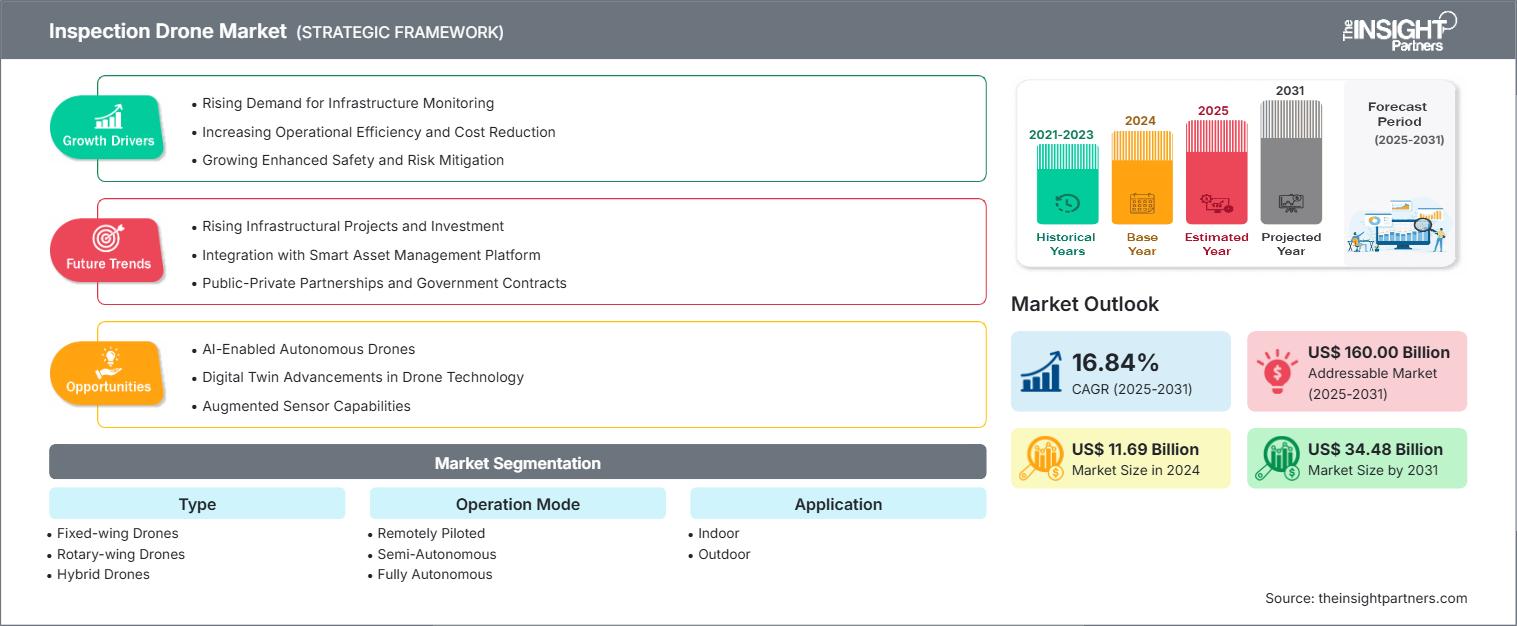

Inspection Drone Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Fixed-wing Drones, Rotary-wing Drones, and Hybrid Drones), Operation Mode (Remotely Piloted, Semi-Autonomous, and Fully Autonomous), Application (Indoor and Outdoor), End-Use Industry (Energy and Power, Manufacturing, Government and Public Utilities, Agriculture and Real Estate, Oil and Gas, Transportation, Military and Defense, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00014697

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 286

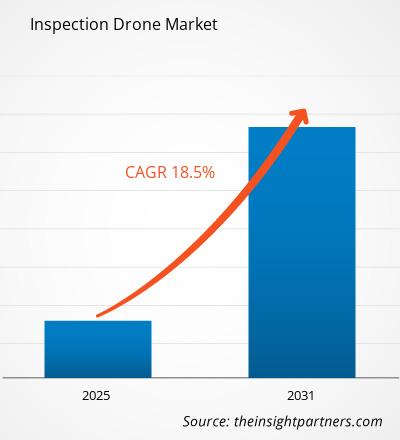

The inspection drone market size is expected to reach US$ 34.4 billion by 2031 from US$ 11.6 billion in 2024. The market is anticipated to register a CAGR of 16.8% during 2025–2031.

Inspection Drone Market Analysis

Inspection drones are UAV systems outfitted with cameras and sensors (thermal, LiDAR, multispectral, etc.) plus navigation/autonomy. They inspect assets in hard‑to‑reach or hazardous locations, offering faster, safer inspections, detailed high‑resolution data, access to remote sites, cost savings, and enabling predictive maintenance.

Inspection Drone Market Overview

An inspection drone is defined as an unmanned aerial vehicle (UAV) that can be outfitted with cameras, sensors, or other specialized apparatus to assess infrastructure, equipment, or environments. Compared to recreational drones, inspection drones are typically much more stable in-flight, can achieve longer flight times, and advantageously include more advanced navigation options.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONInspection Drone Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Inspection Drone Market Drivers and Opportunities

Market Drivers:

- Increase in Infrastructure Inspection Aging infrastructure and global construction require frequent and accurate inspections. Drones provide safer, faster, and more cost-effective inspections of bridges, towers, and pipelines while decreasing the amount of labor and downtime involved.

- Cost-Efficiency and Increased Efficiency Drones can significantly reduce inspection time and worker-associated costs, especially compared to conventional means. Using high-resolution imaging and automation, drones can provide complete inspection data while decreasing risks to workers and operating expenses, making it a desirable option for energy, mining and even agriculture.

- Technology Advancements in UAV Capabilities Drone technology has improved through advances in artificial intelligence, sensor technology, GPS, and autonomous drive capabilities to perform complex inspections with extreme precision. Drones can also carry larger payloads, provide better battery life, and offer real-time analytics when in the field, adding to their appeal as fundamental industrial inspection tools.

- Tighter Safety Regulations Industries are facing tougher safety regulations involving inspections of hazardous environments, such as the oil & gas and nuclear energy sectors. Drones provide opportunities to remotely inspect and monitor job sites, while reducing risk to workers and maintaining compliance through accurate inspection and documentation

Market Opportunities:

- Combining AI and ML Powered by AI and ML, drones can autonomously detect defects, analyze patterns, and predict when to inspect for maintenance. The ability to predict when to inspect assets is incredibly valuable for industries that want to maintain their assets proactively and minimize downtime.

- Expansion into Emerging Economies Emerging economies are majorly investing in infrastructure, energy, and smart cities. Implementing drone inspection services in these regions offers untapped growth opportunities for manufacturers and service providers.

- Adoption of Drones in Agriculture for Crop Surveillance Drones are dramatically changing precision agriculture, with farmers increasingly searching for the highest-quality solutions to monitor crop health, irrigation, and pest control. Agricultural drones equipped with multispectral cameras.

- Increased Use of Drones for Response and Recovery Drones are increasingly being adopted to inspect post-disaster infrastructure. Drones can survey large or inaccessible areas very quickly, allowing governments and organizations to quickly and accurately assess damages and help deploy resources promptly.

Inspection Drone Market Report Segmentation Analysis

The inspection drone market is is segmented into:

By Type:

- Fixed-wing Drones: Fixed-wing drones hold a significant position in the inspection drones market due to their extended flight times, larger coverage areas, and higher energy efficiency compared to multi-rotor drones.

- Rotary-wing Drones: The rotary-wing drone segment holds a significant share in the inspection drones market, driven by its ability to hover, maneuver in tight spaces, and take off/land vertically.

- Hybrid Drones: Hybrid drones represent a rapidly growing segment in the inspection drones market due to their ability to combine the advantages of fixed-wing and rotary-wing designs.

By Operation Mode:

- Remotely Piloted: The maximum share of the market under inspection drones is held by the remotely piloted, owing to its relative widespread use in industries requiring high precision and real-time human control.

- Semi-Autonomous: Semi-autonomous share a good chunk of the inspection drones market as they hold a compromise between human controls and some automated properties.

- Fully Autonomous: On account of the fast rate of enhancement in artificial intelligence, machine learning, and real-time data processing, the fully autonomous segment has seen an increased growth rate in inspection drones.

By Application:

- Indoor

- Outdoor

By End User Industry:

- Energy and Power

- Manufacturing

- Government and Public Utilities

- Agriculture and Real Estate

- Oil and Gas

- Transportation

- Military and Defense

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Inspection Drone

Inspection Drone Market Regional InsightsThe regional trends and factors influencing the Inspection Drone Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Inspection Drone Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Inspection Drone Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 11.69 Billion |

| Market Size by 2031 | US$ 34.48 Billion |

| Global CAGR (2025 - 2031) | 16.84% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Inspection Drone Market Players Density: Understanding Its Impact on Business Dynamics

The Inspection Drone Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Inspection Drone Market Share Analysis by Geography

The inspection drone market in the Asia Pacific is witnessing the fastest growth due to rapid industrialization, infrastructure development, supportive government policies, rising investments, and increasing adoption across energy, agriculture, and construction sectors. Emerging markets in South & Central America, the Middle East & Africa have untapped opportunities for inspection drone providers to expand.

Each region's inspection drone market growth differs due to varying healthcare infrastructure, technology adoption, and investment levels. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Extensive adoption of state-of-the-art technology in infrastructure monitoring

- Early adoption of drone technology in infrastructure and industrial inspection in North America fuels market growth, supported by robust R&D, venture capital, and integration of advanced analytics for intelligent inspections.

- Growing demand for drones in the energy and utilities industry

- Supportive FAA regulations for commercial drone use.

- Trends: AI and machine learning integration in drone-based predictive maintenance applications.

2. Europe

- Market Share: Substantial share owing to early, stringent EU regulations

-

Key Drivers:

- Regulatory rigor on infrastructure safety

- With the expansion of wind and solar farms in Europe, the requirement for frequent, effective inspection through drones rises, fueling growth in automated and data-intensive drone solutions for clean energy upkeep.

- Increasing renewable energy projects require frequent inspections

- Dominant presence of drone startups and manufacturing.

- Trends: Increasing adoption of BVLOS (Beyond Visual Line of Sight) drone operations.

3. Asia Pacific

- Market Share: Fastest-growing region with dominant market share

-

Key Drivers:

- Accelerating urbanization and infrastructure growth

- Asia Pacific's rapid urbanization requires effective monitoring of bridges, roads, and towers, and drones are an indispensable means of real-time, scalable inspection of infrastructure in densely populated regions.

- Government encouragement of smart city measures

- Growing telecom and power grid networks.

- Trends: Drone-as-a-service (DaaS) models for urban inspections surge.

4. Middle East and Africa

- Market Share: Although small, it is growing quickly

-

Key Drivers:

- Increased investments in massive-scale infrastructure projects

- The Middle East's oil and gas sector utilizes drones to survey pipelines and facilities under harsh conditions, improving safety and operation efficiency, and lessening manual labor and downtime

- Requirement of surveillance and examination in extreme environments

- Increased applications of drones in oil-producing nations

- Trends: Autonomous drone use for desert infrastructure and utility inspections.

5. South & Central America

- Market Share: Growing Market with steady progress

-

Key Drivers:

- Remote monitoring requirements in the oil & gas and mining industries

- In far-flung regions with low accessibility, drones facilitate inexpensive surveillance of oil rigs and mining operations, minimizing the necessity for perilous physical examinations in the rugged landscapes of South America.

- Growth in industrial automation investment

- Lack of conventional infrastructure is impelling the use of drones.

- Trends: Increasing adoption of thermal drone imaging for environment and industrial inspections.

Inspection Drone Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of major global players such as Terra Drone Corp. (Japan), ScoutDI AS (Norway), Flyability SA (Switzerland), Flybotix SA (Switzerland), Voliro AG (Switzerland), Skydio, Inc. (USA), SZ DJI Technology Co Ltd (China), AeroVironment Inc (USA), Parrot SA (France), Delair SAS (France), Acecore Technologies (Netherlands), Ideaforge Technology Ltd (India), Inspired Flight Technologies, Inc. (USA), Autel Robotics Co Ltd (China), Teledyne FLIR LLC (USA), Chengdu JOUAV Automation Tech Co Ltd (China), Drone Volt SA (France), Airobotics Ltd. (Israel).

This high level of competition urges companies to stand out by offering:

- Innovative and reliable solutions

- Advanced Sensor Integration

- Autonomous and GPS-Free Navigation

- Durability and Specialized Design

- Industry-Specific Customization

Opportunities and Strategic Moves

- AI & Data Analytics Integration: AI-powered analytics, BVLOS operations, and drone-as-a-service models. Strategic moves include partnerships with infrastructure firms, regional expansions, and investing in regulatory compliance and autonomous inspection capabilities.

Other companies analyzed during the course of research:

- DJI

- Parrot

- Yuneec

- Skydio

- senseFly

- Delair

- Airobotics

- DroneDeploy

- PrecisionHawk

- Kespry

- Flyability

- Azur Drones

- Percepto

- Cyberhawk

- Terra Drone Corporation

Inspection Drone Market News and Recent Developments

-

MODEC, Inc. announced that it has renewed its joint research and development agreement with Terra Drone Corporation,

June 2025 -

MODEC, Inc. (MODEC) announced that it has renewed its joint research and development agreement with Terra Drone Corporation (Terra Drone) for the non-destructive internal inspection of crude oil storage tanks on Floating Production, Storage, and Offloading systems (FPSOs) using Terra UT drones. This renewed agreement builds upon the joint research and development contract signed by both companies in 2024, following significant achievements in improving measurement accuracy, enhancing safety, and reducing inspection time. - Flyability announced the launch of a new high-capacity battery for its Elios 3 drone, June 2025 - Flyability, a Swiss-based drone manufacturer specializing in indoor inspection technology, has announced the launch of a new high-capacity battery for its Elios 3 drone. This upgraded battery delivers up to 50% additional flight time per charge, enabling extended inspection missions with reduced downtime and increased operational efficiency.

Inspection Drone Market Report Coverage and Deliverables

The "Inspection Drone Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Inspection Drone Market for Healthcare size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Inspection Drone Market for Healthcare trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Inspection Drone Market for Healthcare analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the inspection drone market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For