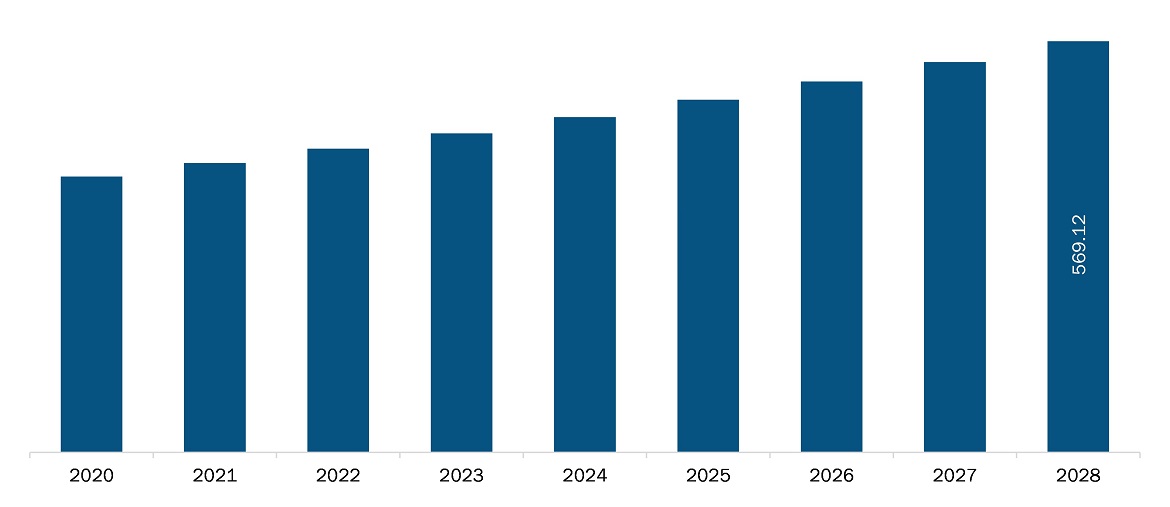

The North America cosmetic bioactive ingredients market is expected to reach US$ 569.1 million by 2028 from US$ 400.6 million in 2021. The market is estimated to grow at a CAGR of 5.1% from 2021–2028.

Increasing consumer demand for natural products is fueling the research related to bioactive substances that can be used in cosmetics. North America is home to a few of the biggest bioactive ingredient manufacturers and personal care brands such as BASF, and DSM. The launch of bioactive ingredients for the personal care industry is driving the growth of the market. In June 2019, BASF Care Creations launched three new active ingredients for the beauty market, which use rambutan trees that provide skin hydration and rejuvenation. Similarly, in April 2019, Lonza launched the H2OBioEV bioactive ingredient, which is a unique combination of naturally sourced ingredients—Aphanothece Sacrum polysaccharides and Galactoarabinan—with water and glycerin. The ingredient confers moisturization abilities by replenishing essential humectants, which facilitates optimal environment for the formation and maintenance of a strong epidermal protein barrier.

Beauty habits change when the consumer is at home - a maximum number of women reported wearing little or no makeup when working from home. They are generally more relaxed and more focused on self-care than their beauty routines and makeup glamor. Working from home could be the “next to normal” for many, which will mean that some of the challenges/pressures will continue to affect the sector. Regardless of the channels and categories served, every brand has felt a profound impact from COVID-19 - those who can adapt quickly in these troubled times are ready to recover and be stronger on the other side of the pandemic. Based on the scenarios anticipated by global executives and current trends, we estimate that global beauty industry revenues could drop 20-30 percent in 2020, up to 35 percent. The short-term effects of the COVID-19 pandemic include changes in demand, revisions to the regulatory process, changes in the research and development process, and the shift towards e-commerce. The largest fashion and lifestyle e-commerce marketplace reported a boom in pampering and self-care beauty categories, including cosmetics, aromatherapy, and detox products; Sales of skin, nail, and hair care products increased compared to the previous year. The demand for beauty and personal care products is increasing. And demand is likely to remain buoyant even after the current crisis. These factors are expected to drive demand for North American cosmetic bioactive ingredients in the region over the forecast period.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the cosmetic bioactive ingredients market. The North America cosmetic bioactive ingredients market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Cardiovascular Needle Market Segmentation

By Ingredient Type

- Probiotics and Prebiotics

- Omega-3 Fatty Acids

- Vitamins

- Carotenoids and Antioxidants

- Plant Extracts

- Minerals

- Amino Acids

- Proteins and Peptides

- Others

By Sources

- Plant

- Animal

- Microbial

By Country

- North America

US

Canada

Mexico

Companies Mentioned

- BASF SE

- DuPont de Nemours, Inc.

- FMC CORPORATION

- Cargill, Incorporated

- Sensient Technologies Corporation

- DSM

- Ajinomoto Co. Inc.

- Roquette Frères

- ADM

- Vytrus Biotech

North America Cosmetic Bioactive Ingredients Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 400.6 Million |

| Market Size by 2028 | US$ 569.1 Million |

| CAGR (2021 - 2028) | 5.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Ingredient Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For