The North America current sampling resistance market is expected to grow from US$ 576.48 million in 2021 to US$ 809.83 million by 2028; it is estimated to grow at a CAGR of 5.0% from 2021 to 2028.

The US, Canada, and Mexico are economies in North America. Rising production of consumer electronics is expected to fuel the market growth. Consumer electronics and appliance makers aim to increase production rates in the coming years due to increasing demand from region. According to a report by Care Ratings, consumer electronics production is expected to rise by 5%–8% in fiscal 2022. The growth in work-from-home culture is anticipated to help the rise in demand for goods that improve personal convenience at home. Rural demand may surpass the demand from urban markets because of rising rural wages and government programs connected to rural electrification. As a result of the increased consumer electronics manufacturing, demand for electronics components such as resistors and capacitors are also projected to increase, as resistors are one of the most fundamental components in any electrical or electronic circuit. The electric resistors regulate the amount of current passing through the circuit. They control the voltage in the components to which they are connected. Without resistors, individual components cannot regulate the voltage, which can lead to overloading. Smart locks, doorbells, and cameras; smart smoke and carbon monoxide detectors; and smart switches, dimmers, and outlets are among the devices that are becoming increasingly popular in this sector. In addition, product diversification and the introduction of new technologies are also driving the demand for customized current sensing resistors. In addition to consumer electronics, wearables, smart speakers, home automation, connection technologies, and drones are contributing to the industry's growth across North America region.

In case of COVID-19, North America is highly affected specially the US. North America is known for the highest rate of adoption of advanced technologies due to favorable government policies to boost innovation and strengthen infrastructure capabilities. As a result, any factor affecting performance of industries in the region hinders its economic growth. Currently, the US is the world's worst-affected country due to the COVID-19 outbreak, which has led governments to impose several limitations on industrial, commercial, and public activities in the country, to control the spread of infection. Hence, the demand for passive components has steadily declined as a result of the suspension of operations in numerous industries, the closing of different production units, and people's unwillingness to enter the work force. Therefore, the COVID-19 epidemic and its repercussions have impacted the North America's current sampling resistance market in a negative manner.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America current sampling resistance market. The North America current sampling resistance market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Current Sampling Resistance Market Segmentation

North America Current Sampling Resistance Market – By Type

- Thick Film

- Thin Film

- Metal Plate

North America Current Sampling Resistance Market – By Application

- Consumer Devices

- Industrial

- Telecommunication

- Automotive

- Other Applications

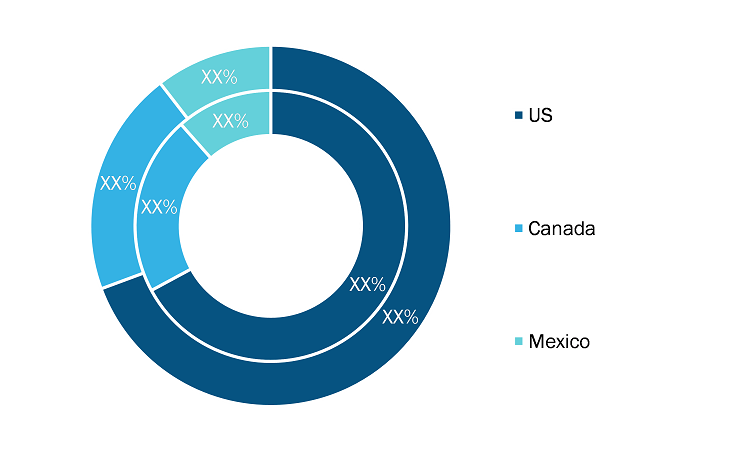

North America Current Sampling Resistance Market, by Country

- US

- Canada

- Mexico

North America Current Sampling Resistance Market -Companies Mentioned

- Cyntec Co., Ltd.

- KOA Speer Electronics, Inc.

- Panasonic Corporation

- ROHM CO., LTD.

- Samsung Electro-Mechanics Co, Ltd.

- Susumu Co., Ltd

- TT Electronics

- Viking Tech Corporation

- Vishay Intertechnology, Inc.

North America Current Sampling Resistance Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 576.48 Million |

| Market Size by 2028 | US$ 809.83 Million |

| CAGR (2021 - 2028) | 5.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For