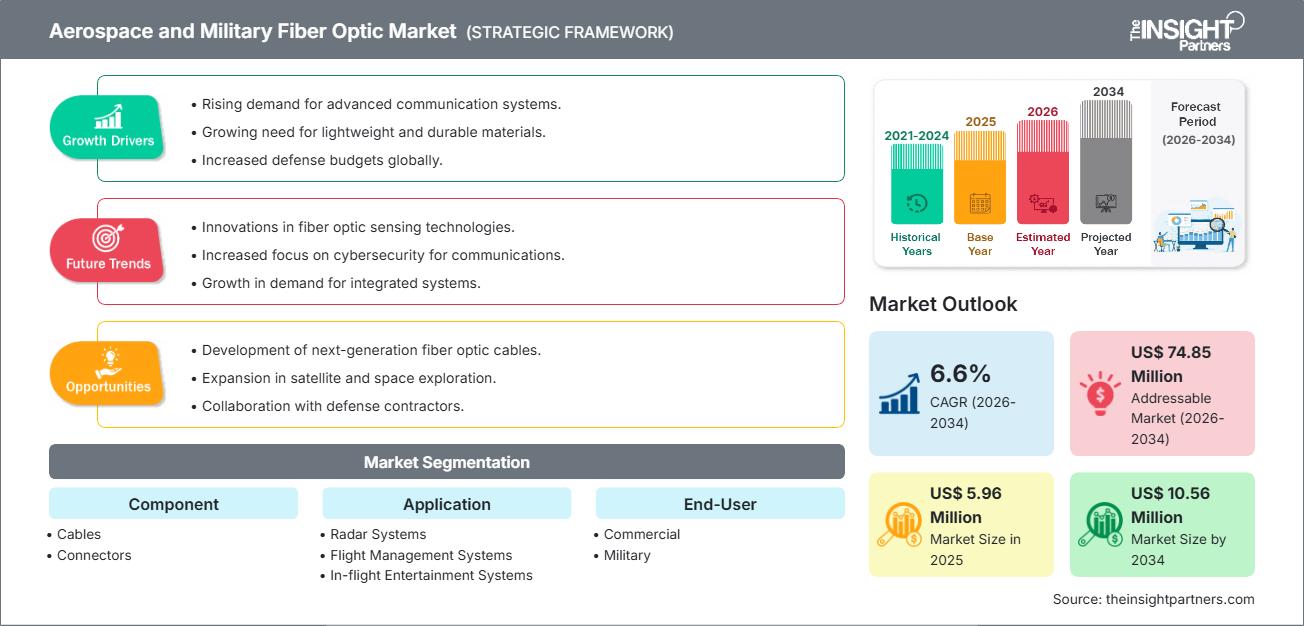

Aerospace and Military Fiber Optic Market Growth & Forecast 2034

Aerospace and Military Fiber Optic Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Cables and Connectors), Application (Radar Systems, Flight Management Systems, In-flight Entertainment Systems, Communication Systems, Electronic Warfare, Cabin Interiors, and Avionics), and End-User (Commercial and Military)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00024946

- Category : Electronics and Semiconductor

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

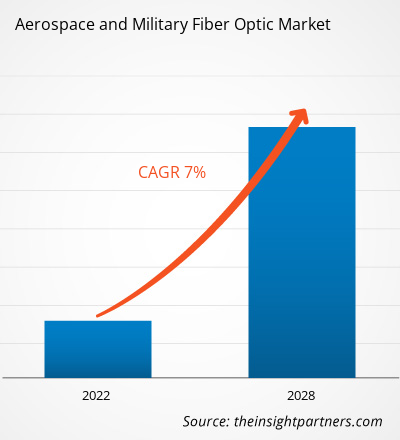

The Aerospace and Military Fiber Optic market size is expected to reach US$10.56 million by 2034 from US$5.96 million in 2025. The market is anticipated to register a CAGR of 6.6% during 2026–2034.

Aerospace and Military Fiber Optic Market Analysis

The market forecast indicates robust growth, primarily driven by the imperative for secure, high-speed, and low-latency data transmission across modern defense and aerospace platforms. Market expansion is accelerated by the critical need for weight reduction in aircraft and Unmanned Aerial Vehicles (UAVs), where lightweight fiber optic cables replace heavier copper alternatives to improve fuel efficiency and increase payload capacity. Additionally, large-scale defense modernization initiatives and the increasing complexity of avionics and electronic warfare systems are fueling the demand for advanced, ruggedized fiber optic components.

Aerospace and Military Fiber Optic Market Overview

Fiber optic technology is a critical enabler in injection molding systems, ensuring uniform heating across multiple zones to maintain optimal melt flow. For military and aerospace applications, fiber optics is indispensable for its superior data throughput, immunity to Electromagnetic Interference (EMI), and enhanced security compared to traditional copper wiring. These systems are essential components in mission-critical applications like C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance), radar, and flight management systems. By providing reliable data links that can withstand extreme environments, fiber optics is the backbone of high-precision operation and secure data transfer for both commercial and military platforms.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAerospace and Military Fiber Optic Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aerospace and Military Fiber Optic Market Drivers and Opportunities

Market Drivers:

- Increasing Demand for High-Speed Data and Bandwidth: Modern military and commercial platforms (e.g., 5th generation fighter jets, satellites) require ultra-high bandwidth to support data fusion from complex sensor arrays and real-time processing.

- Need for System Weight Reduction: Fiber optic cables significantly reduce the weight of onboard wiring harnesses, directly improving aircraft fuel efficiency and payload capabilities.

- Immunity to Electromagnetic Interference (EMI): Fiber optics transmits light instead of electrical signals, offering inherent immunity to EMI, which is critical for systems near radar and electronic warfare equipment, and for resilience against EMP attacks.

- Defense Modernization and New Aircraft Procurement: Global defense budgets and increasing orders for new commercial aircraft (which utilize advanced avionics) drive the integration of fiber optic systems.

Market Opportunities:

- Proliferation of Autonomous Systems (UAVs/UGVs): Unmanned systems rely heavily on low-latency, high-speed fiber optic links for remote control, sensor feedback, and coordinated missions.

- Integration of Advanced Fiber Optic Sensors: The adoption of Fiber Optic Gyroscopes (FOGs) for precision navigation and Distributed Acoustic Sensing (DAS) for perimeter security presents significant growth potential.

- Development of Quantum-Secure Communications: The use of fiber optic lines for Quantum Key Distribution (QKD) offers virtually unbreakable encryption, creating a high-value opportunity in critical military communication networks.

- Miniaturization and Ruggedization: Continuous innovation in small, ruggedized, and high-density connectors and cables expands the application scope in confined and harsh military/space environments.

Aerospace and Military Fiber Optic Market Report Segmentation Analysis

The Aerospace and Military Fiber Optic market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Component:

- Cables

- Connectors:

The component segment forms the foundational base of the market, driven by the critical need for high-speed, secure data pathways. Cables, often single-mode or multi-mode, depending on the application designed to meet harsh environmental stresses, while expanded beam and hermetic types of connectors are used to provide reliable, low-loss interconnectivity for mission-critical systems in aerospace and defense.

By Application:

- Radar Systems

- Flight Management Systems

- In-flight Entertainment Systems

- Communication Systems

- Electronic Warfare

- Cabin Interiors

- Avionics.

The application segments are crucial in defining market demand. Communication Systems, followed closely by Avionics, drive the largest share due to the demand for reliable, high-bandwidth communication on air, land, and sea platforms, supporting real-time C4ISR and advanced navigation.

By End-User:

- Commercial Aerospace: Modern In-flight Entertainment and advanced Flight Management Systems are enabled by fiber optics in reducing the overall weight of the aircraft while supporting sophisticated passenger communication services.

- Military & Defense: The largest end-user, demanding high-reliability, ruggedized fiber for tactical communications, missile guidance, and Electronic Warfare (EW) systems that must be immune to electromagnetic threats.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The Aerospace and Military Fiber Optic market in Asia-Pacific is expected to witness the fastest growth during the forecast period, driven by rapid defense modernization and large-scale commercial aircraft fleet expansion in countries such as China and India.

Aerospace and Military Fiber Optic Market Regional Insights

The regional trends and factors influencing the Aerospace and Military Fiber Optic Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Aerospace and Military Fiber Optic Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Aerospace and Military Fiber Optic Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 5.96 Million |

| Market Size by 2034 | US$ 10.56 Million |

| Global CAGR (2026 - 2034) | 6.6% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aerospace and Military Fiber Optic Market Players Density: Understanding Its Impact on Business Dynamics

The Aerospace and Military Fiber Optic Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Aerospace and Military Fiber Optic Market top key players overview

Aerospace and Military Fiber Optic Market Share Analysis by Geography

Asia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for fiber optic systems providers to expand.

The Aerospace and Military Fiber Optic market shows a different growth trajectory in each region due to factors such as defense spending, aircraft modernization cycles, and stringent regulatory environments. Below is a summary of market share and trends by region:

-

North America

- Market Share: Holds the dominant market share due to advanced defense manufacturing and extensive R&D investment.

- Key Drivers:

- Widespread adoption of fiber in advanced platforms (e.g., F-35, UAVs)

- High budget allocation for military C4ISR and surveillance

- Presence of major aerospace OEMs

- Trends: Shift toward high-density, radiation-hardened fiber for space and satellite communication; Focus on Quantum Key Distribution (QKD) for ultra-secure military links.

-

Europe

- Market Share: Strong market presence, driven by key defense programs and regulatory mandates for system safety.

- Key Drivers:

- Strict adherence to material standards (e.g., REACH and RoHS)

- Major defense initiatives like the Future Combat Air System (FCAS)

- High demand for fiber optic gyroscopes (FOGs)

- Trends: Increasing focus on miniaturization and weight-saving in next-generation fighter aircraft and naval vessels; Greater adoption of fiber for shipboard radar and EW systems.

-

Asia Pacific

- Market Share: Fastest-growing region owing to rapid defense modernization and surging commercial fleet expansion.

- Key Drivers:

- Government-supported indigenous defense production programs

- Massive commercial aircraft orders from China and India

- Growing investment in naval and maritime surveillance

- Trends: High adoption of multi-mode and single-mode cables for cost-effective, high-output communication systems; Development of local manufacturing capacity to meet regional demand.

-

South and Central America

- Market Share: Emerging market with growing investments in national defense upgrades.

- Key Drivers:

- Expansion of local aerospace manufacturing capabilities (e.g., Brazil)

- Need for efficient avionics solutions in aging fleets.

- Public-private partnerships for defense technology transfer

- Trends: Increasing adoption of ruggedized tactical fiber for ground communication networks; Focus on cost-effective, durable fiber solutions for defense applications.

-

Middle East and Africa

- Market Share: Developing market with strong growth potential due to rising defense and aerospace infrastructure spending.

- Key Drivers:

- National defense diversification projects (e.g., Saudi Arabia, UAE)

- Strategic geographical location driving military and air traffic investments

- Need for border and critical infrastructure security.

- Trends: Implementation of fiber-based Distributed Acoustic Sensing (DAS) for perimeter security; Investment in integrated surveillance and C4ISR systems that require secure, high-bandwidth backbones.

Aerospace and Military Fiber Optic Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intensifying due to the presence of major global vendors such as Carlisle Interconnect Technologies, Amphenol Corporation, and TE Connectivity. Regional specialists and niche fiber technology firms also contribute to the market landscape.

This competitive environment pushes vendors to differentiate through:

- Technological Leadership: Focusing on R&D for miniaturized, radiation-hardened (for space), and ultra-lightweight solutions to meet strict industry standards (e.g., F-35 program).

- Product Ruggedization: Developing highly durable cable assemblies and connectors (e.g., expanded beam connectors) that can perform reliably under extreme mechanical shock, vibration, and temperature variations.

- Strategic Partnerships: Collaborating with large defense contractors and military agencies to integrate next-generation optical solutions into long-term defense programs (e.g., Future Combat Air System).

- System Integration: Providing seamless, pre-terminated fiber harnesses and connectivity solutions that reduce installation complexity and enhance time-to-market for aircraft and defense platform manufacturers.

Major Companies operating in the Aerospace and Military Fiber Optic Market are:

- Carlisle Interconnect Technologies

- Amphenol Corporation

- Raytheon Technologies Corporation

- Prysmian Group

- ITT Inc.

- TE Connectivity

- AFL Corporation

- Timbercon, Inc

- NEXANS Group

Disclaimer: The companies listed above are not ranked in any particular order.

Aerospace and Military Fiber Optic Market News and Recent Developments

- Carlisle Interconnect Technologies Acquisition by Amphenol : Carlisle Interconnect Technologies (CIT), a leading supplier of harsh-environment interconnect solutions for aerospace and defense, announced its acquisition agreement with Amphenol Corporation for approximately $2.025 billion. The deal, expected to close in Q2 2024, will strengthen Amphenol’s fiber-optic capabilities across commercial and military platforms.

- Amphenol Launches Rugged Fiber-Optic Transceivers : Amphenol Active Optics launched a series of high-speed rugged transceivers, including SCFF 1-TRX 10G/25G and FiberQuad, for extreme aerospace and defense applications. These solutions exhibit data rates of up to 28 Gbps per channel to support advanced radar and avionics systems.

- Raytheon Technologies Secures DARPA Contract for Quantum Sensors : Raytheon's BBN Technologies was awarded a DARPA Award to develop photonic chip-scale quantum sensors using squeezed light, expected to lead to 10x sensitivity improvements in fiber-based sensing and navigation systems for military applications.

Aerospace and Military Fiber Optic Market Report Coverage and Deliverables

The “Aerospace and Military Fiber Optic Market Size and Forecast (2021–2034)” report provides a detailed analysis of the market covering the following areas:

- Aerospace and Military Fiber Optic Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope, including Component, Application, End-User, and Platform type.

- Aerospace and Military Fiber Optic Market trends, as well as market dynamics such as drivers, restraints, and key opportunities influencing the industry growth. Major factors include the rising demand for high-speed, secure data transmission, lightweight system design, and modernization of military and aerospace fleets.

- Detailed PEST and SWOT analysis providing insights into the political, economic, social, and technological forces shaping the market landscape.

- Aerospace and Military Fiber Optic Market analysis covering key market trends, global and regional frameworks, major players, defense procurement standards, and recent technological developments across aerospace and military communication networks.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and strategic developments in the Aerospace and Military Fiber Optic Market.

- Detailed company profiles, including business overview, product portfolio, recent contracts, partnerships, and financial highlights (where available) for leading companies such as Amphenol Corporation, TE Connectivity, Carlisle Interconnect Technologies, Raytheon Technologies Corporation, and Corning Incorporated.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For