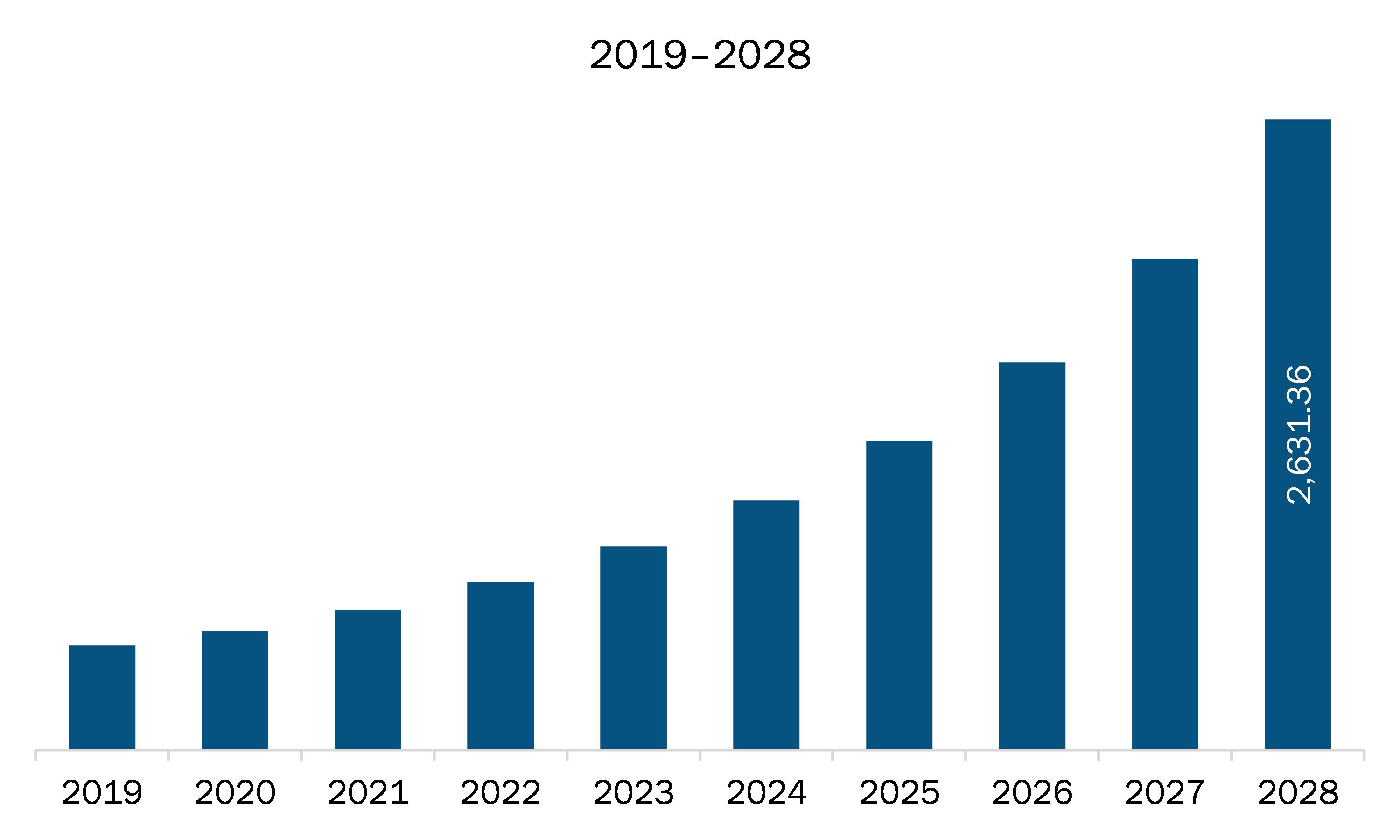

The fiber bragg grating market in North America is expected to grow from US$ 548.48 million in 2021 to US$ 2,631.36 million by 2028; it is estimated to grow at a CAGR of 24.0% from 2021 to 2028.

The US, Canada, and Mexico are major economies in North America. Growing application of fiber bragg grating is the major factor driving the growth of the North America fiber bragg grating market. FBG is majorly a sensor of strain and temperature, and hence, it is utilized as a sensor for obtaining measurements of load, temperature, strain, tilt, vibration, pressure, and displacement. It also helps in measuring the presence of several biomedical, chemical, and industrial substances in both dynamic and static modes of operation. Fiber bragg grating are designed to withstand any intense mechanical, electrical, and electromagnetic stresses. They have a stable structure, which makes them ideal to be used in telecom applications including add/drop, filters, dense wavelength division multiplexing, mux/demux, and lasers. Fiber bragg grating sensors are being implemented in aircraft to locate variations in vibration, temperature, and sound in aircraft and its components. With continuous technological developments and a decrease in the cost of telecommunications devices and equipment, FGBs are now getting utilized as sensors. Fiber bragg grating are used for different purposes, including structural health or strain monitoring of engineering structures such as footbridges, bridges, skyscrapers, dams, and aircraft wings; monitoring the behavior of ultrahigh quality precision tools, optical telescope, robotic surgical instruments, and more; and measuring nanometer level deformations in structures that lead to the beginning of cracks. Civil and geotechnical engineering; energy production, conversion, storage; security and perimeter monitoring; commercial transportation; performance vessels, vehicles, equipment; and medical & biotech are some additional applications where fiber bragg grating are being used. With the rising applications of fiber bragg grating, their adoption rate is also booming, which, in turn, is driving the market.The US is the most affected country in North America due to the COVID-19 outbreak. The continuous growth of infected individuals has led the government to impose lockdown across the nation's borders during Q2 in 2020. Most manufacturing facilities were either temporarily shut or operating with minimum staff, and the supply chain of components and parts was disrupted.The outbreak has severely affected production and revenue generation since the US has many FBG manufacturers, component manufacturers, and end-user industries. The lower number of manufacturing staff has resulted in lesser production quantity.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America fiber bragg grating market. The North America fiber bragg grating market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Fiber Bragg Grating Market Segmentation

North America Fiber Bragg Grating Market – By Type

- FBG Sensor

- FBG Filter and others

North America Fiber Bragg Grating Market – By Application

- Sensing

- Measuring

- Monitoring and others

North America Fiber Bragg Grating Market – By Industry

- Telecommunication

- Aerospace

- Energy and Utilities

- Transportation

- Others

North America Fiber Bragg Grating Market, by Country

- US

- Canada

- Mexico

North America Fiber Bragg Grating Market - Companies Mentioned

- Alnair Labs Corporation

- AOS GmbH

- FBGS Technologies GmbH

- HBM Fibersensing S.A

- ITF Technologies Inc.

- Ixblue Photonics

- Micron Optics (Luna Innovations)

- Proximion AB

- Technica

- TeraXion

North America Fiber Bragg Grating Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 548.48 Million |

| Market Size by 2028 | US$ 2,631.36 Million |

| CAGR (2021 - 2028) | 24.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For