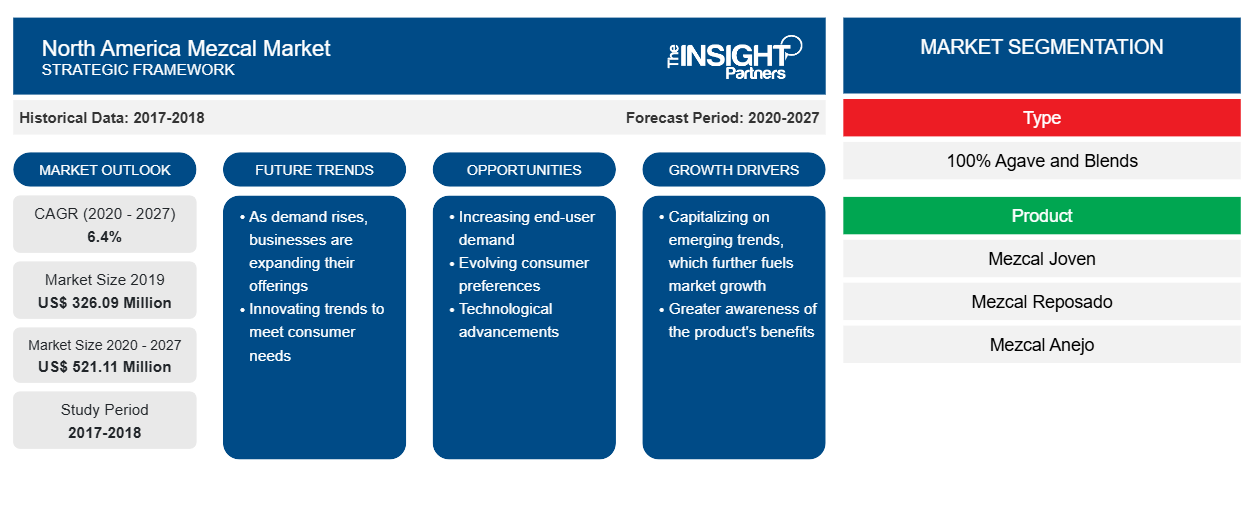

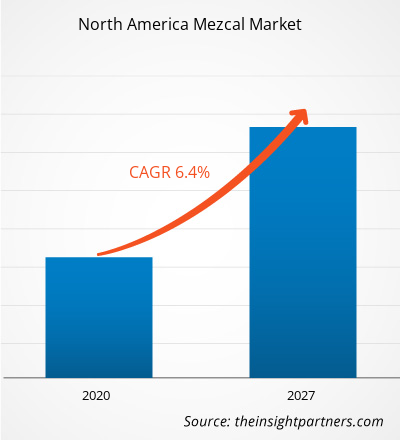

The North America mezcal market accounted to US$ 326.09 million in 2019 and is projected to account US$ 521.11 million by 2027; it is expected to grow at a CAGR of 6.4% during 2020–2027.

Mezcal, can be prepared from many different varieties of agave, the most popular being Agave Espadin, and must be produced in specific states as well. Mexico has nearly 330,000 hectares cultivating agave for Mezcal, owned by different producers. The title of a person responsible for preparing mezcal is “Maestro Mezcalero,” and more often than not, their trade has been passed on from generation to generation. Types Of mescal such as Mezcal Joven, Mezcal Reposado, Mezcal Anejo, and Others are quite popular among consumers in Mexico and in other countries. Growing preference for luxurious alcoholic beverages among consumers is propelling the market growth for mescal. With the emergence of advanced retail formats, a new format for operations in the form of specialty stores and food courts in large malls has emerged. These specialty stores offers consumers easy access to popular beverages while shopping and engaging in entertainment activities, and facilitating selecting between different products by providing an immediate opportunity to compare the store options. On the other hand, online retailers offer a wide variety of products to consumers through comprehensive catalogs, which also cover international brands. Moreover, online stores provide beverages at competitive prices along with other lucrative offers or coupons and equated monthly installment options. Recently, few countries have relaxed the government norms regarding online sales of alcohol, which is likely to offer relief for players to some extent. This is further supported by the increasing preference of consumers for e-commerce sites. They provide the same product at a competitive price, plenty of options to choose from, and ease of click-and-collect pickup and home delivery models. Moreover, the value of alcohol e-commerce across ten core markets is anticipated to reach US$24 billion this year, besides the US is predicted to overtake China by the end of 2021. These benefits are anticipated to act as positive factors driving the growth of the alcoholic and non-alcoholic beverages market, subsequently boosting the mezcal market over the forecast period.

The COVID-19 pandemic first began in Wuhan (China) in December 2019, and since then, it has spread at a fast pace across the globe. As of January 2021, USA, Mexico and Canada are among the worst-affected countries in terms confirmed cases and reported deaths. The pandemic has been affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. Shutdowns of food and beverages industry and disruptions in supply chains due to lockdown of countries has created a strain on the supplies of the various products offered by this industry. In North America, US is the worst-hit country by the COVID–19 outbreak. Owing to this pandemic, the North American food and beverages has witnessed an abrupt downturn in several major countries. The food and beverages industry in North America suffered its one of the biggest drops in activities after the restaurants and food centers were closed, and the supply of food products and workers were disrupted due to the pandemic. The drop in the demand for various food products in the region has directly affected the sales of the mezcal products in North America.

North America Mezcal Market

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Demand of Mezcal to Experience Consolidation

Consolidation is one of the most recent trends in the mezcal market. Various leading players are initiating mergers and acquisitions activities to increase their market share. In June 2018, Pernod Ricard signed an agreement to acquire most of Del Maguey Single Village Mezcal stakes. Del Maguey Co. employs the ancient production processes that have been passed down for hundreds of years. It also uses traditional organic methods combined with diverse microclimates and terroir of Mexico to produce quality products. Also, In February 2019, Bacardi announced to buy minority stakes in Illegal Mezcal. Besides, in May 2018, Diageo has acquired Pierde Almas S.A. De C.V to accelerate the development of mezcal in Mexico and growing the worldwide reach. Pierde Almas S.A. De C.V are also engaged in the manufacturing of the mezcal using Agave species. Also, it produces the mezcal products having an alcohol content ranging from 50% to 52%. Also, Pierde Almas is the first Brand in México to bring mezcal out of the villages. Moreover, in 2018, the company generated total revenue of USD 15.5 million.

Type Based Insights

The mezcal market based on type has been segmented into 100% agave and blends. In 2019, the 100% agave segment accounted for a larger share of the North America mezcal market, whereas the blends segment is expected to grow at a higher CAGR during the forecast period. Native mezcal is a carbohydrate obtained from wheat. Mezcal is defined as any agave-based liquor. This also includes tequila, which is prepared in specific regions of Mexico and must be made from only blue agave (agave tequilana). 100% Agave mezcal meant that all the fermented sugars which are distilled to become tequila come from the Blue Weber agave plant. It is a pure spirit where the addition of any other ingredient (color, flavor, etc.) Mezcal can be obtained from more than 30 varieties of agave. According to spirits writer Chris Tunstall, the most common varieties of agave utilized for mezcal are tobalá, tobaziche, tepeztate, arroqueño, and espadín, which is the most common agave and accounts for up to 90% of mezcal. The two types of mezcal are made of 100% agave and are mixed with other ingredients, with about 80% agave. Both types consist of four categories. White mezcal is clear also hardly aged. Dorado (golden) is not aged; however, a coloring agent is added. This is primarily done with a mixed mezcal. Reposado or añejado (aged) is poured in wood barrels mostly from two to nine months. This can be made with 100% agave or mixed mezcals.

North America Mezcal Market, by Type – 2019 and 2027

Product Based Insights

Based on product, the mezcal market is segmented into mezcal joven, mezcal reposado, mezcal anejo, and others. In 2019, the mezcal joven segment dominated the North America mezcal market whereas, the mezcal reposado segment is expected to grow at the fastest rate during 2020–2027. Unaged mezcal is basically referred to as Joven, or as young. Joven is the more preferred drink, followed by Reposado due to its same flavor as tequila. It is cheaper as compared to other types as it comes aged for less than two months or un-aged. The product is available in different flavors, including citrus, green apple, and white pepper. Mezcal Joven is mostly preferred in cocktails to add the sacred flavor of sweet agave in the drinks. The heart of Joven is mainly produced at a traditional Palenque in Matatlán, but it is grown & distilled in the Oaxaca region of Mexico. The delicate and sparkling nose of wood smoke and savory herbs introduces citrus, bright, tart fruit, and peppery palate in the drink. Mezcal Joven finds high demand among consumers worldwide due to their more distinct as well as crisper taste compared with mezcal varieties. Mezcal Joven is further available in various flavors that further increases its demand rate in the forecast period.

Sales Channel Based Insights

Based on sales channel, the mezcal market is segmented into HORECA, specialty stores, online and hypermarkets & supermarkets. In 2019, the HORECA segment dominated the North America mezcal market whereas, the online segment is expected to grow at the fastest rate during 2020–2027. In recent years, the hospitality industry, also known as the HoReCa industry is one of the fastest-growing markets across the world. B2B wholesale giants such as Walmart is increasingly becoming part of the FMCG along with the beverages supply chain due to their reach in the HoReCa (Hotels, Restaurants, and Catering) space that services the hotel industry. Since the first steps on the market, products required attentive care, and retail marketing offers an exclusive network of sales supporters in the HoReCa field who will use their expertise and skills to highlight the brand according to the channel it belongs to. Alcoholic beverages are eying at this lucrative segment today since it outnumbers the bars, cafes, clubs, and pubs in North America. There is increasing footfall of consumers into the hotels, restaurants, cafes, bars, and other such places, which is positively contributing to the mescal market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Mezcal Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Product development, merger and acquisition, and business planning are the commonly adopted strategies by companies to expand their product portfolio. El Silencio, Mezcal Vago, Pernod Ricard, Ilegal Mezcal, Rey Campero, Mezcal Amores, Craft Distillers, Los Danzantes, Mezcalgulroo and Wahaka are amongst the market players implementing this strategy to enlarge the customer base and gain significant market share in North America, which in turn permits them maintain their brand name in the North America market.

Report Spotlights

- Progressive industry trends in the North America mezcal market that help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the North America mezcal market from 2017 to 2027

- Estimation of North America mezcal demand across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the market competition in North America

- Market trends and outlook, coupled with factors driving and restraining the growth of the North America mezcal market

- Decision-making process by understanding strategies that underpin commercial interest with regard to the North America mezcal market growth

- North America mezcal market size at various nodes of market

- Detailed overview and segmentation of the North America mezcal market, as well as its dynamics in the industry

- North America mezcal market size in various regions with promising growth opportunities

North America Mezcal Market, by Type

- 100% Agave

- Blends

North America Mezcal Market, by Product

- Mezcal Joven

- Mezcal Reposado

- Mezcal Anejo

- Others

North America Mezcal Market, by Sales Channel

- HoReCa

- Specialty Stores

- Supermarkets

- Hypermarkets

- Online

Company Profiles

- El Silencio

- Mezcal Vago

- Pernod Ricard

- Ilegal Mezcal

- Rey Campero

- Mezcal Amores

- Craft Distillers

- Los Danzantes

- Mezcalgulroo

- Wahaka

North America Mezcal Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 326.09 Million |

| Market Size by 2027 | US$ 521.11 Million |

| CAGR (2020 - 2027) | 6.4% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Mezcal Market Players Density: Understanding Its Impact on Business Dynamics

The North America Mezcal Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America Mezcal Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For