Oil and Gas Fishing Market Size and Growth 2031

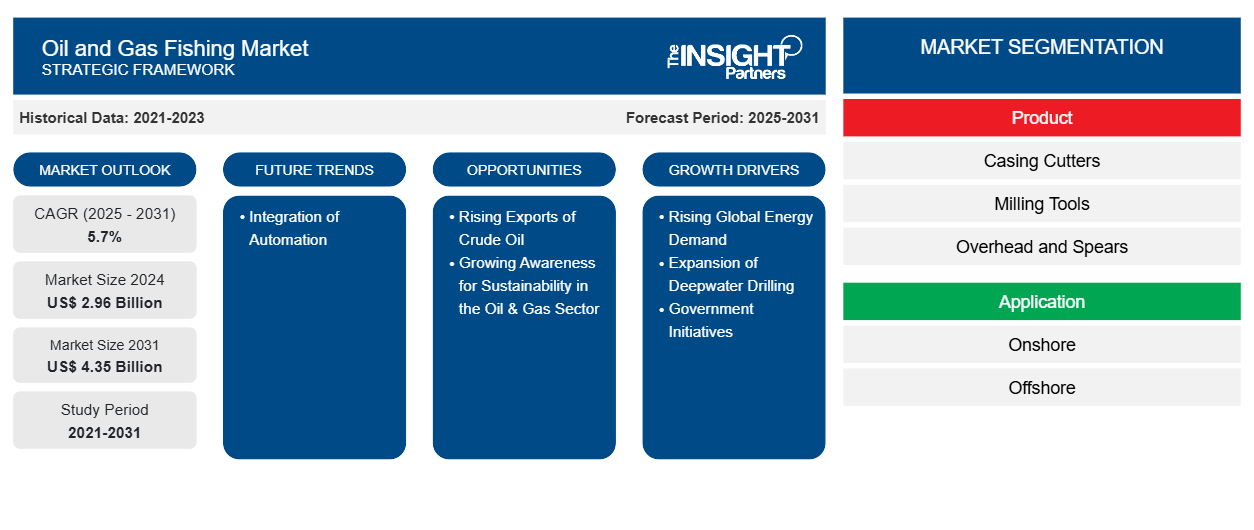

Oil and Gas Fishing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Casing Cutters, Milling Tools, Overhead and Spears, Fishing Jars, and Others), Application (Onshore and Offshore), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jul 2025

- Report Code : TIPRE00040949

- Category : Energy and Power

- Status : Published

- Available Report Formats :

- No. of Pages : 201

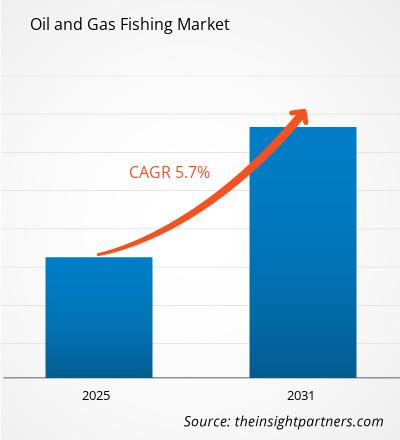

The oil and gas fishing market size is expected to reach US$ 4,355.06 million by 2031 from US$ 2,968.72 million in 2024. The market is estimated to register a CAGR of 5.7% during 2025–2031. The integration of automation is likely to bring new trends to the market in the coming years.

Oil and Gas Fishing Market Analysis

The demand for crude oil is increasing globally due to a growing economy, increasing industrial development, and rising energy needs. Factors such as supply uncertainties and energy security have encouraged oil-producing nations to boost their production levels. As a result, many countries are focusing more on exporting crude oil to meet global demand and support their economies.

Exporting crude oil is a major source of revenue and foreign exchange for these countries. It allows them to invest in infrastructure, technology, and other economic sectors. Countries aim to increase their export volumes to expand market share and attract foreign investment in oil and gas. This rise in crude oil exports offers significant opportunities for the oil and gas fishing market. Increased upstream activities such as drilling and well maintenance led to more situations where fishing services are required to recover stuck tools or equipment, minimizing downtime and production losses.

India is expanding its refining capacity from 250 million tonnes in 2020 to 450 million tonnes annually by 2030 to meet both domestic and export demands. Similarly, according to IEA in January 2024, Saudi Arabia, holding ~17% of the proven petroleum reserves, is one of the largest crude oil exporters. Saudi Aramco is heavily investing in upstream activities such as exploration and production to maintain its leading export position. These expansions in crude oil production and exports will drive demand for fishing services, creating growth opportunities for service providers worldwide.

Oil and Gas Fishing Market Overview

The oil industry is essential for meeting the world’s energy needs, especially through upstream activities such as exploration and drilling. During drilling operations, tools and equipment such as drill bits, casings, or pipes can sometimes get stuck or lost in the wellbore. Fishing operations are necessary to retrieve these items and continue the drilling process without major disruption.

Fishing in the oilfield refers to the recovery of undesirable materials or equipment left in the wellbore. These situations can be caused by mechanical failures, hole instability, formation damage, lost circulation, well deviation, or human errors such as mishandling or dropping tools. To retrieve the stuck or lost equipment, specialized tools such as fishing jars, overshots, spears, or coiled tubing are used. These tools are designed to grip or latch onto the equipment and safely bring it back to the surface.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOil and Gas Fishing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Oil and Gas Fishing Market Drivers and Opportunities

Expanding Deepwater Drilling

The oil and gas industry is expanding into deepwater and ultra-deepwater drilling as companies need the latest reserves to meet rising global energy demand. These offshore projects are often located in more complex and high-risk environments, requiring advanced technologies and highly skilled operations.

Shell has stated that more of its oil and gas output comes from its deepwater business, which delivers higher-profit and lower-carbon barrels. The company is actively developing major projects in the Gulf of Mexico, including Vito (which began production in 2023), Whale (its 14th deepwater development in the region), and Sparta (which is under construction and expected to start operations by 2028). These projects reflect Shell’s commitment to deepwater expansion and highlight a wider industry move toward offshore exploration.

Deepwater operations grow with several technical challenges. Drilling at such depths involves high pressure, high temperatures, and complicated well structures. This increases the risk of stuck pipes, lost tools, or blockages—issues that can stop drilling and lead to costly downtime. Oil and gas companies rely on fishing services to solve these problems. Fishing involves using special tools to retrieve lost or stuck equipment from the well. These tools must be highly advanced and operated by experienced crews to work safely and effectively in deepwater environments. Thus, the expansion of deepwater drilling drives the oil and fishing market.

Growing Awareness for Sustainability in the Oil & Gas Sector

The focus on sustainability and environmental responsibility is rising in the oil and gas industry. Companies are adopting cleaner technologies, reducing emissions, and improving operational efficiency to meet stricter environmental regulations and respond to growing demand for sustainable practices. Sustainable practices require the use of advanced, reliable, and efficient fishing tools and services that minimize environmental risks and reduce operational downtime. Fishing operations play a key role in maintaining oil and gas well integrity and preventing leaks or spills that harm the environment.

Companies are investing in the latest technologies that are safer and more environmentally friendly. This includes fishing tools designed to reduce waste, lower energy use, and handle complex well conditions without causing damage. As sustainability is prioritized, oil and gas operators are willing to spend more on services that help them achieve their environmental goals. The development of environmentally friendly tools and services can create ample opportunities for the oil and gas fishing market players.

Oil and Gas Fishing Market Report Segmentation Analysis

Key segments in the oil and gas fishing market analysis are product and application.

- By product, the market is categorized into casing cutters, milling tools, overhead and spears, fishing jars, and others. The overhead and spears segment dominated the market in 2024.

- Based on application, the market is bifurcated into onshore and offshore. The onshore segment dominated the market in 2024.

Oil and Gas Fishing Market Share Analysis by Geography

The oil and gas fishing market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South and Central America (SAM). North America dominated the market in 2024, followed by the Middle East and Africa and Asia Pacific.

The market in North America is segmented into the US, Canada, and Mexico. North America stands as a formidable leader in the global oil and gas fishing market, driven by significant crude oil production. As per the International Energy Agency (IEA), in 2022, North America holds 22% of global crude oil production. Crude oil is pumped from wells onshore and offshore, then transported via pipelines or tanker ships to refineries, where it is processed into fuels such as gasoline and diesel, as well as industrial chemicals. However, during drilling or well operations, equipment failures or accidents can lead to the need for fishing services, a term for retrieving lost, stuck, or damaged tools and equipment from the wellbore.

In North America, particularly in the US and Canada, the continued demand for oil and natural gas has led to increased drilling activity. As of 2024, the US remains the world's largest oil producer, with an average daily crude oil production of ~13.2 million barrels per day, according to the US Energy Information Administration (EIA). This high level of activity leads to increased instances of operational challenges, thus fueling demand for fishing services.

Oil and Gas Fishing

Oil and Gas Fishing Market Regional Insights

The regional trends and factors influencing the Oil and Gas Fishing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Oil and Gas Fishing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Oil and Gas Fishing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.96 Billion |

| Market Size by 2031 | US$ 4.35 Billion |

| Global CAGR (2025 - 2031) | 5.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Oil and Gas Fishing Market Players Density: Understanding Its Impact on Business Dynamics

The Oil and Gas Fishing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Oil and Gas Fishing Market News and Recent Developments

The oil and gas fishing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the oil and gas fishing market are listed below:

- Shell has awarded Halliburton several key projects in Brazil, Suriname, and São Tomé and Príncipe. In Brazil, Halliburton signed contracts with Shell that marked a significant milestone in the development of the Gato do Mato deepwater field in the pre-salt Santos Basin. Halliburton was selected for its integrated approach to well construction, completions, and interventions. (Source: Shell, Press Release, May 2025)

- Halliburton Co secured a contract from Petrobras to provide integrated well interventions and offshore well-plugging services in Brazil, including fluids, completion equipment, wireline, slackline, flow back services, and coiled tubing. (Source: Halliburton, Press Release, August 2024)

Oil and Gas Fishing Market Report Coverage and Deliverables

The "Oil and Gas Fishing Market Size and Forecast (2025–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Oil and Gas Fishing Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Oil and Gas Fishing Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Oil and Gas Fishing Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Oil and Gas Fishing Market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For