According to our latest market study on “Aerospace Titanium Fasteners Market Forecast to 2028 – COVID-19 Impact and Global Market Analysis – by Aircraft Type, Product Type, Application, and End User,” the aerospace titanium fasteners market is projected to reach US$ 1,119.23 million by 2028 from US$ 693.31 million in 2020; it is expected to grow at a CAGR of 6.9% during 2020–2028.

The aerospace titanium fasteners market is segmented on the basis of aircraft type, product type, application, and end user. Based on aircraft type, the market is segmented into narrow-body aircraft, wide-body aircraft, general aviation aircraft, cargo aircraft, helicopters, and military aircraft. Based on product type, the aerospace titanium fasteners market is segmented into bolts, nuts, screws, rivets, and others. Based on application, the market is segmented into flight control surfaces, airframes, engines, interiors, and landing gears. Based on end user, the market is segmented into aircraft manufacturers, MRO service providers, and military forces.

The aerospace titanium fasteners market ecosystem is diverse and evolving. Raw material providers, aerospace titanium fastener manufacturers, and end users are the major stakeholders in this ecosystem. Major players operate in various nodes of the aerospace titanium fasteners market ecosystem. Raw material suppliers provide materials to fastener manufacturers. The final products designed and produced by these manufacturers are supplied to aircraft manufacturers, component manufacturers, and MRO vendors through different channels, such as direct sales by company distributors or third-party sales through third-party distributors. Aircraft OEMs or component manufacturers then integrate fastener products to their respective assembly products.

XOT Metals; Leeart Industry Co. Ltd.; B&B Specialties Inc.; 3V Fasteners; LISI Aerospace; Cherry Aerospace; Ferralloy, Inc.; Superbti Co. Ltd.; TriMas Aerospace; and Torqbolt Inc. are among the leading manufacturers in the aerospace titanium fasteners market. These companies are engaged in designing, manufacturing, and sales of a wide range of titanium fasteners to end users, such as aircraft OEMs, MROs vendors, aircraft component manufacturers, military forces, and other customers.

The aerospace titanium fasteners market, by product type, is segmented into bolts, nuts, screws, rivets, and others. The bolts segment accounted for the largest market share in 2020 and is expected to retain its dominance over the forecast period as well. Further, the others segment is expected to register the highest CAGR in the market during the forecast period.

Moreover, the aerospace titanium fasteners market is also driven by the MRO service providers who are constantly working on jets, aircrafts, and helicopters for maintenance, owing to which the demand remains high. Additionally, increasing number of deliveries of business jets, helicopter, and others across different countries will drive the aerospace titanium fasteners market growth during the near future.

Impact of COVID-19 Pandemic on Aerospace Titanium Fasteners Market Growth

The US witnessed the most severe impact of COVID-19 in 2020. The region's aircraft manufacturers and service providers were affected due to nationwide lockdowns and travel restrictions, aircraft production facility shutdowns, and disrupted aerospace industry due to material shortages. All these adversities affected everything from supply chain and manufacturing to product sales. Boeing, the world’s largest aircraft OEM, delivered ~157 aircraft units in 2020 compared to 380 and 806 in 2019 and 2018, respectively. Boeing witnessed a massive decline in its production and deliveries during 2020. In December 2020, it delivered ~39 jets, including 28 737s (27 MAX/1 NG), 1 747-8, 6 767s, and 4 777s. For the second month in a row, no 787 Dreamliners were delivered by the company. The production of the 737 MAX was suspended from January 2020 until the end of May 2021, when Boeing announced that it had commenced a low-rate production of the aircraft. The company expects the 737 MAX production rate to gradually increase to 31 per month by early 2022, increasing further as per the market demand. Before the suspension of 737 MAX production, Boeing was manufacturing the jet at a reduced rate of 42 per month, and had produced and shipped 387 aircraft in 2019.

The pandemic presented unprecedented challenges to the airline industry in North America with increasing net losses and recovery delays. The region expects an aerospace titanium fasteners market recovery from the economic disruption by the end of 2027. Recovery in demands for commercial, military, and general aviation aircraft as well as helicopters for different applications is anticipated to boost the aerospace titanium fasteners market in North America during the forecast period.

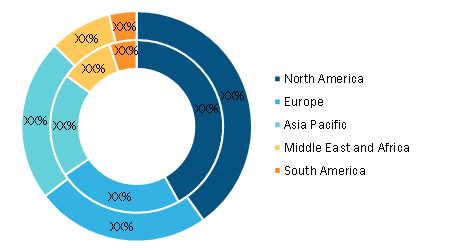

Aerospace Titanium Fasteners Market Size — by Region, 2020 and 2028 (%)

Aerospace Titanium Fasteners Market Dynamics by 2031

Download Free Sample

Aerospace Titanium Fasteners Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Aircraft Type (Narrow Body Aircraft, Wide Body Aircraft, General Aviation Aircraft, Cargo Aircraft, Helicopters, and Military Aircraft), Product Type (Bolts, Nuts, Screws, Rivets, and Others), Application (Flight Control Surface, Airframe, Engine, Interiors, and Landing Gear), End User (Aircraft Manufacturers, MRO Services Providers, and Military Forces), and Geography

Aerospace Titanium Fasteners Market Dynamics by 2031

Download Free SampleAerospace Titanium Fasteners Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Aircraft Type (Narrow Body Aircraft, Wide Body Aircraft, General Aviation Aircraft, Cargo Aircraft, Helicopters, and Military Aircraft), Product Type (Bolts, Nuts, Screws, Rivets, and Others), Application (Flight Control Surface, Airframe, Engine, Interiors, and Landing Gear), End User (Aircraft Manufacturers, MRO Services Providers, and Military Forces), and Geography

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com