The AI in auto insurance market size expected to reach US$ 5,460.88 Mn by 2027, registering at a CAGR of 20.5% during the forecast period of 2019 to 2027, according to a new research study conducted by The Insight Partners.

Artificial intelligence is transforming the face of every industry worldwide owing to its revolutionary capabilities that could substantially affect the performance of a business. In the past few years, banking, financial services, and insurance (BFSI) sector has been one of the largest adopter of artificial intelligence technology. In the current scenario, automotive is also opting for AI. On the other hand, higher disposable income among the individuals, the pattern of procurement of new vehicles is high in the country. Pertaining to the rise in the number of vehicles, several associated technologies and solutions are also increasing rapidly. These factors have positively impacted on the growth of the AI in auto insurance market in the region.

The global auto industry is going through a shift with technological advancements happening in the electric vehicle and autonomous vehicle sector. There are few technology trends where AI can help insurance companies and brokers make profits by integrating technology in their present product and service portfolio. Some of these major trends include behavioral policy pricing, personalization of customer experience & coverage, and customized claim settlement. With increasing number of IoT (internet of Things) enabled devices with various among customers, the opportunity to offer personalized services is growing at a fast pace. Customized coverage or on-demand insurance is another benefit through which customers get custom coverage for some specific events/items. With the help of virtual claim adjusters and online interfaces, artificial intelligence help customers in settling the claims faster and efficiently. Thus, upcoming applications of artificial intelligence in the auto insurance industry, the AI in auto insurance market is anticipated see tremendous growth during the forecast period of 2019 to 2027.

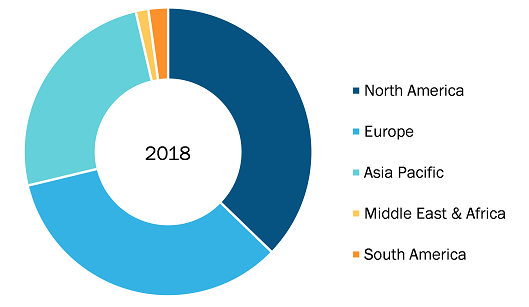

AI in Auto Insurance Market - Geographic Breakdown, 2018

AI in Auto Insurance Market to 2027 - Industry Analysis and Forecasts by Offerings (Usage-Based Insurance, On-Demand Insurance, Peer-to-peer Insurance); Application (Claims Assessment, Chatbots, Policy Pricing)

AI in Auto Insurance Market Trends and Top Players by 2027

Download Free Sample

The AI in auto insurance market has been derived from market trends and revenue generation factors from five different regions across the globe namely; North America, Europe, Asia Pacific, MEA, and SAM. In the current automotive insurance industry, AI in auto insurance is at a nascent stage, as very few countries have adopted the technology heavily. Geographically, the market is dominated by Europe. The region’s growth is rapidly driven by robust automotive industry and demand for wireless & connectivity technologies. The dominance of Europe in the global market is due to the fact that, the country houses a large number of automotive OEMs, telematics companies, and insurance companies. Additionally, the trend of adoption of newer technologies and solutions is also high in the country, which has pushed the residents to opt for AI in auto insurance. The Asia Pacific is estimated to be the fastest growing region in the global AI in auto insurance market during the forecast period from 2019 – 2027. This is majorly due to the significant adoption of the same in countries such as China, Singapore, India, Malaysia, and Japan among others. The number of vehicles in the countries are constantly increasing, and the adoption of auto insurance is also rising in the current scenario.

The major players operating in the market for AI in auto insurance market are ANT Financial Services Group, CCC Information Services Inc., Claim Genius, Clearcover, Inc., GEICO Corporation, ICICI Lombard, Microsoft Corporation, Nauto, Progressive Casualty Insurance Company, and Solaria Labs among others.

The report segments the global AI in auto insurance market as follows:

Global AI in Auto Insurance Market – By Offerings

- Usage-Based Insurance

- On-Demand Insurance

- Peer-to-peer Insurance

Global AI in Auto Insurance Market – By Application

- Claims Assessment

- Chatbots

- Policy Pricing

Global AI in Auto Insurance Market – By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- South Korea

- China

- India

- Australia

- Japan

- Rest of Asia Pacific

- Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America (SAM)

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com