Consumables and Accessories Segment to Dominate Cardiac Output Monitoring Devices Market During 2022–2030

According to our new research study on "Cardiac Output Monitoring Devices Market Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis," the cardiac output monitoring devices market size is projected to grow from US$ 1,498.94 million in 2022 to US$ 2,215.84 million by 2030; the market is anticipated to record a CAGR of 5.0% from 2022 to 2030. Factors driving the market include technological advancement, an increase in the prevalence of cardiac diseases, patient awareness, and a rising number of unmet medical requirements in emerging and underdeveloped nations. However, the high cost of devices hinders the cardiac output monitoring devices market growth.

When the lungs degenerate and become inflamed, it is known as chronic obstructive pulmonary disease (COPD). Wheezing, coughing up mucous, and trouble breathing are a few of the symptoms. Prolonged exposure to dangerous substances, such as cigarette smoke, is intimately linked to it. Thus, the surging ratio of COPD disease is another important element anticipated to fuel the market expansion for cardiac output monitoring devices. For instance, COPD claims the lives of almost 3 million people annually, accounting for 6% of all fatalities worldwide.

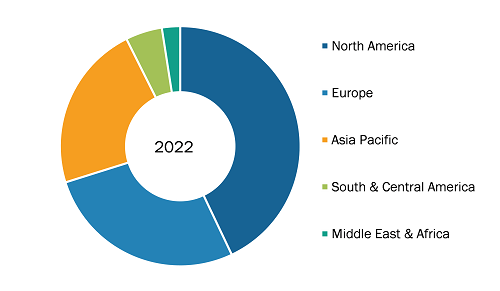

Cardiac Output Monitoring Devices Market, by Region, 2022 (%)

Cardiac Output Monitoring Devices Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product (Consumables and Accessories and Instruments), Type (Invasive and Non-invasive), End User (Hospitals, Ambulatory Surgical Centres, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa)

Cardiac Output Monitoring DevicesMarket Analysis by Size & Share 2030

Download Free Sample

Source: The Insight Partners Analysis

In addition, increased measures to reduce infections caused by cardiovascular implantable electronic device CIEDs are providing opportunities to the cardiac output monitoring devices market. CIEDs are linked to improved quality of life and survival rates when treating cardiac arrhythmias. However, a significant risk connected to using these devices is infection. Patients who have an implanted cardioverter defibrillator or a cardiac resynchronization therapy defibrillator device are most likely to get CIED infections. According to the European Heart Journal, the incidence of CIED infections for pacemakers was 1.19%; for implantable cardioverter-defibrillators, it was 1.91%; for cardiac resynchronization therapy pacemakers (CRT-Ps), it was 2.18%; and for CRT-defibrillators (CRTDs) it was 3.35%.

Medtronic provides the TYRX Absorbable Antibacterial Envelope, an absorbable, multifilament mesh envelope that elutes the antibiotics rifampin and minocycline while also improving CIED stability in the subcutaneous pocket. The purpose of these envelopes is to be used with CIEDs, such as pacemakers and implantable cardioverter defibrillators (ICDs). Compared to standard-of-care infection prevention alone, the envelope reduced the incidence of infection by 40%, according to the results of an international randomized controlled trial conducted in 2019.

Getinge AB, GE Healthcare, Baxter International Inc., Edward Lifesciences Corporation, Osypka Medical GmbH, LiDCO Group plc, Deltex Medical Group plc, ICU Medical, Inc., Uscom, and CNSystems Medizintechnik GmbH are among the key players operating in the cardiac output monitoring devices market. These companies have been implementing organic (launches, expansion, and product approvals) and inorganic (such as product launches, partnerships, and collaborations) strategies that contribute to their growth and lead to market transformation.

In October 2023, Masimo's LiDCO board-in-cable (BIC) module received a CE mark in accordance with the European Union Medical Device Regulation. For enhanced hemodynamic monitoring, the LiDCO BIC module can be connected to multi-patient monitoring platforms such as the Masimo Root Patient Monitoring and Connectivity Hub. With this technology, physicians may quickly integrate LiDCO hemodynamic monitoring into their Root patient monitoring hubs, utilizing its unique and adaptable PulseCO algorithm. The LiDCO module maximizes flexibility for doctors and hospitals by being pressure transducer agnostic, similar to the PulseCO algorithm. With the absence of a specialized hemodynamic monitoring box, a solution has been found for the first time to enable hemodynamic monitoring in addition to other supported metrics.

The report segments the cardiac output monitoring devices market as follows:

The cardiac output monitoring devices market is segmented on the basis of product, type, and end user. Based on product, the market is segmented into consumables and accessories and instruments. The cardiac output monitoring devices market, by type, is segmented into invasive and non-invasive. By end user, the cardiac output monitoring devices market is segmented into hospitals, ambulatory surgical centers, and others. Based on geography, the cardiac output monitoring devices market is divided into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com