Red Blood Cells Segment to Bolster Donor Blood Components Market Growth

According to our new research study on "Donor Blood Components Market Forecast to 2031 – Global Analysis – by Blood Component, Indication, Application, Age Group, and End User," the market was valued at US$ 10.08 billion in 2024 and is projected to reach US$ 14.64 billion by 2031. The market is anticipated to register a CAGR of 5.7% during 2025–2031. The report emphasizes the donor blood components market trends, along with drivers and deterrents affecting the market growth. The rising prevalence of cancer and immunosuppressive diseases and increasing donor awareness are contributing to the growing donor blood components market size. However, the inconsistent voluntary donations hamper market growth. Further, the rising demand for plasma-derived therapies is expected to emerge as a new market trend in the coming years.

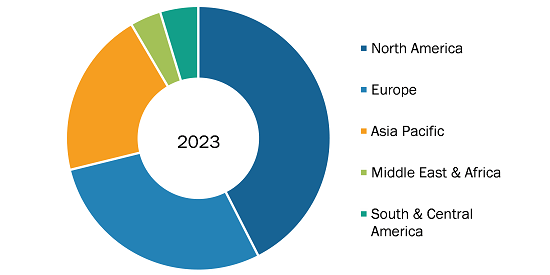

Donor Blood Components Market Share, by Region, 2024 (%)

Donor Blood Components Market Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Blood Component (Red Blood Cells, White Blood Cells, Platelets, Plasma, and Others), Indication (Immunosuppression and Oncology), Application (Anemia Management, Thrombocytopenia Treatment, Coagulopathy Correction, Supportive Care During Chemotherapy, Surgery, and Others), Age Group (Adult and Child), End User (Hospitals, Oncology Centers, Transplant Centers, Ambulatory Surgical Centers, and Others), and Geography

Donor Blood Components Market Size, Share, Developments by 2031

Download Free Sample

Source: The Insight Partners Analysis

Increasing Donor Awareness Fuels Donor Blood Components Market Growth

Public health initiatives, celebrity sponsorships, and community efforts have been instrumental in rallying voluntary blood donation. In 2024, the World Health Organization celebrated the 20th anniversary of World Blood Donor Day with a focus on expressing appreciation to donors and pushing for more involvement globally.

In the US, NFL legend Tom Brady partnered with Abbott and the Big Ten universities to try and alleviate a critical blood shortage in the Midwest. 13 out of 19 community blood centers in the region had less than a two-day blood supply. Under the campaign, a school that donated the most blood during the 2024 football season was rewarded with a US$ 1 million donation by Abbott for advance student or community health causes. Brady emphasized the value of blood donations in saving lives, pointing out that each donation can save three lives.

Ahmedabad stands out in blood donation with 138 centurion donors, including India’s only female centurion, a couple, and a differently-abled donor. Mukesh Patel leads with 151 donations. In 2023, the Indian Red Cross Society collected over 250,000 units, highlighting the city's strong donor awareness and contribution to a stable blood supply.

Scope of Donor Blood Components Market Report:

The analysis of the donor blood components market has been carried out by considering the following segments: blood component, indication, application, age group, and end user, and geography.

Based on blood component, the donor blood components market is segmented into red blood cells, white blood cells, platelets, plasma, and others. The red blood cells segment held the largest share of the market in 2024. Packed red blood cells (RBCs) are vital for treating anemia, trauma, and chronic conditions. According to an article published in July 2023, The Lancet: New study reveals global anemia cases remain high among women and children, ~1.92 billion people worldwide had anemia in 2021, representing an increase of 420 million cases over three decades. Additionally, according to the American National Red Cross facts, ~29,000 units of RBCs are needed every day in the US and is driven by RBCs need in trauma, surgeries, chronic medical conditions, and cancer care. RBCs are highly utilized in treating anemia and blood loss from surgeries and widespread medical procedures, ranging from trauma care and elective surgeries (cardiac bypass) to chronic disease treatments, such as cancer chemotherapy, and hematological disorders.

By indication, the donor blood components market is bifurcated into immunosuppression and oncology. The immunosuppression segment dominated the market in 2024. The demand for blood-derived products is increasing to treat autoimmune diseases, prevent transplant rejection, and manage immunodeficiency disorders. Immunosuppressive therapies often rely on immunoglobulins, plasma derivatives, and specialized blood components to modulate the immune system. Key indications include organ transplantation, autoimmune diseases, and primary immunodeficiency disorders.

In organ transplantation, immunosuppressive therapies are critical to prevent graft rejection. For instance, intravenous immunoglobulin (IVIG) is used alongside immunosuppressants to reduce rejection risks in kidney, liver, and heart transplants. As per the Global Observatory on Donation and Transplantation (GODT), over 150,000 organ transplants are performed globally each year, with kidney transplants being the most common. The rising prevalence of end-stage renal disease and liver cirrhosis fuels demand for these therapies.

Autoimmune diseases, affecting 5–10% of the global population, also drive market growth. According to the American Autoimmune Related Diseases Association (AARDA), conditions such as rheumatoid arthritis, affecting ~1% of the global population, and systemic lupus erythematosus, with a prevalence of 20–150 per 100,000 people, often require IVIG or plasma exchange to manage severe flares. Chronic inflammatory demyelinating polyneuropathy is another key indication, with IVIG being a first-line therapy. Although rare, PID affects 1 in 1,200 to 2,000 live births, per the Immune Deficiency Foundation data, and necessitates lifelong immunoglobulin replacement therapy. Rising transplant procedures, autoimmune disease incidence, and advancements in blood-based therapies favor the growth of the segment.

Based on application, the donor blood components market is segmented into anemia management, thrombocytopenia treatment, coagulopathy correction, supportive care during chemotherapy, surgery, and others. The anemia management segment held the largest share of the market in 2024. Anemia is a significant public health concern, mainly impacting young children, pregnant and postpartum women, and menstruating adolescent girls and women. According to the World Health Organization (WHO) data, ~30.7% of women aged 15–49 suffered from anemia in 2023. Low- and lower-middle-income countries bear the most significant burden of anemia, mainly affecting populations living in rural settings, in poorer families, with no formal education.

Anemia affects ~25% of the global population and is managed primarily through red blood cell (RBC) transfusions to boost hemoglobin and oxygen delivery. Platelets and plasma are also used in specific cases. Donor blood components play a vital role in treating chronic anemia and severe blood loss. Donor blood components, specifically RBCs, are crucial in managing anemia by replenishing oxygen-carrying capacity. Transfusions help in saving life in extreme anemia, mainly when the body cannot produce enough RBCs or notable blood loss. RBCs are transfused to increase hemoglobin levels and enhance tissue oxygen delivery.

By age group, the donor blood components market is bifurcated into adult and child. The adult segment dominated the market in 2024. The adult population, typically categorized into young adults (18–35 years), middle-aged adults (36–55 years), and older adults (56 years and above). Blood components such as RBCs, platelets, and plasma are vital for treating adults across age groups. The demand for blood components increases with age due to the rising prevalence of chronic diseases and age-related conditions. Young adults support donor pools and trauma care, while middle-aged and older adults need more transfusions due to chronic diseases such as anemia and cancer. According to the American Society of Hematology, anemia is a common blood disorder. It affects over 3 million Americans as well, with ~10% of the adults over 65 being currently anemic. Additionally, platelet donations from young adults are critical for patients undergoing chemotherapy, as platelet counts often drop during cancer treatments. Middle-aged adults increasingly require blood components due to the onset of chronic diseases such as cardiovascular disorders and cancer. Older adults require transfusions due to the increased prevalence of age-associated conditions such as anemia and cancer. Furthermore, hematologic malignancies common in older adults necessitate regular transfusions to manage symptoms and treatment side effects.

As per end user, the donor blood components market is categorized into hospitals, oncology centers, transplant centers, ambulatory surgical centers, and others. The hospitals segment dominated the market in 2024. Donor blood components are essential for treating different medical conditions in hospitals. These components are separated from whole blood and transfused individually based on a patient's needs, allowing one donation to benefit multiple individuals. Hospitals have blood banks or transfusion services that manage blood components' collection, storage, and distribution. They guarantee that blood is appropriately tested for infectious diseases and ABO/Rh compatibility before transfusion. Hospitals also have transfusion committees that implement policies and guidelines for the safe and appropriate use of blood and blood products.

Hospitals rely on donated blood components to treat various medical conditions. Blood donation is separated into multiple components, including platelets, RBCs, and plasma, each performing a specific objective in patient care. These parts are essential for patients undergoing surgery, cancer treatment, and managing various diseases.

Collaboration ensures a smooth flow of blood components from collection centers to hospitals, minimizing waste and ensuring timely availability for patients. For instance, in March 2025, the University of Pittsburgh School of Medicine and UPMC scientist-surgeons reported that providing plasma that has been isolated from other parts of donated blood enhances results in traumatic brain injury (TBI) or shock patients; however, giving unseparated or whole blood may be most suitable for patients with traumatic bleeding.

Donor Blood Components Market Analysis: Based on Geography

The geographic scope of the donor blood components market includes the assessment of the market performance in North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), South & Central America (Brazil, Argentina, and the Rest of South & Central America), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa).

The World Health Organization (WHO), the American Society of Plastic Surgeons, Health Resources and Services Administration, American Cancer Society, The Leukemia & Lymphoma Society, Health Canada, International Agency for Research on Cancer (IARC), Federal Statistical Office (Destatis), Macmillan Cancer Support data, National Health Commission (NHC), Indian Council of Medical Research-National Centre for Disease Informatics and Research (ICMR-NCDIR), Australian Institute of Health and Welfare, Australian Red Cross Lifeblood, GLOBOCAN are among the primary and secondary sources referred to while preparing the donor blood components market report.