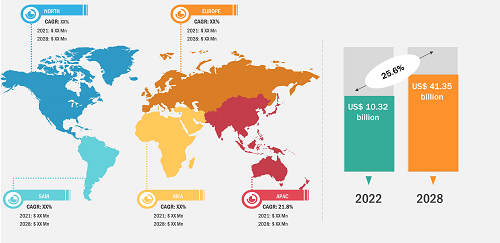

The Drone Service Market size is expected to reach USD 41.35 billion by 2028; registering at a CAGR of 25.6% from 2022 to 2028, according to a new research study conducted by The Insight Partners

Increasing Number of End-Use Cases of Drones Expected to Create Lucrative Growth Opportunities for Drone Service Market

The aerial drone industry has experienced tremendous growth, especially in military forces across the world. In the recent few years, these unmanned devices have been introduced into the commercial industry, witnessing immense positive influence in law enforcement, agriculture, real estate, and infrastructure activities. Rising applications of drones is projected to boost drone service market.

The commercial drone service providers have faced severe stringent rules and regulations set by the governing authorities such as Federal Aviation Administration (FAA in the US) and European Aviation Safety Agency (EASA in Europe). Some of the stringent rules implemented in the recent past on operating commercial drones include maximum weight of the drone to be restricted to 55 kg, the drone should be within the line of sight of the operator, and the drone cannot be operated over certain height. However, with the increasing emphasis on the simplification of rules and legislation, manufacturers of commercial drones are witnessing significant demand from individuals and several third-party service providers. This factor will have a positive impact in drone service market growth.

In terms of development in drone services, countries such as Canada are experiencing developments with regard to surveying application. In December 2022, DeepRock Minerals Inc. declared that EarthEx Geophysical Solutions Inc. has completed an in-depth drone-supported airborne magnetometer survey (Mag Survey) of their Golden Gate Project. The objective of the geophysical and geological surveying was to develop and concentrate on exploration targets for the drill testing activities in 2023. Such projects will boost the demand for drones, and therefore fueling the drone service market.

Based on geography, North America held the largest drone service market share on 2022. Drones are extensively used in commercial real estate market for planning, as well as examine high raised home multi-unit projects and help groups during selling or surveying, mapping, and inspection activities. Similarly, drones are adopted in the agriculture industry for monitoring crop growth. Rising end use cases of drones is forecasted to fuel the drone service market growth.

Drones are integrated with advanced sensors along with digital imaging capabilities that permit farmers to get a richer picture of their crop fields. The introduction of newer technologies for improving crop production results in the growth of new measures for the protection of crops. These factors have further boosted the overall drone services growth in the region. Zipline International Inc. (US), SkySpecs, and Aerodyne Technologies (US) are driving the current phase of drone manufacturing and service provider as they look to diversify from core of drone services and compete more effectively with the other drone service market players.

Besides, the US and Canada are prominent countries witnessing positive inclination toward drones. For instance, in December 2022, Drone Delivery Canada Corp. (DDC) declared about an update on flight testing of their largest drone—Condor drone. The Condor drone exhibits features of two-stroke gasoline-powered helicopter drone with a range of 200 km, maximum payload capacity of 180 kg, and maximum take-off weight of 476 kg. DDC announced that the new updated in Condor makes it compatible for more commercial applications due to its better distance capabilities and higher payload capacities. The drone service market players are taking necessary steps to promote the adoption of drones for commercial and law enforcement purposes.

Due to the COVID-19 outbreak, the manufacturing units across North America were temporarily shut to combat the rapid spread of the virus. However, the defense sector being the critical industries of any economy experienced continuous supply of their products. The defense equipment manufacturing being one of the essential services was impacted partially because of disrupted raw material supply. The US defense also placed orders for anti-drone systems and carried out experimentation to implement the same in their operations. For instance, in July 2021, the US Navy finished the presentation of its new DroneSentry-X counter-drone system. Developments in respect to development of new drones for varied purposes will help in accelerating the overall drone service market size.

Drone Service Market – by Region, 2022

Drone Service Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Drone Type (Fixed Wing, Rotary Wing, and Hybrid), Services (Surveying, Mapping, and Inspection; Delivery; and Aerial Photography), and End Use industry (Real Estate/Infrastructure, Media & Entertainment, Agriculture, Industrial, and Law Enforcement, Others) and Geography

Drone Service Market Drivers and Trends 2031

Download Free Sample

Based on industries, the drone service market size is categorized into real estate/infrastructure, media & entertainment, agriculture, industrial, and law enforcement. The real estate/infrastructure industries held the largest conveyor system market share in 2022 globally. The demand for drone services worldwide is the maximum among the real estate/infrastructure industry. This is majorly attributed to the rising demand for residential and commercial infrastructures and rising cost for manned surveying and mapping.

Real estate is evolving with constant technological developments and rising popularity of drone videography and photography. In the luxury housing market, various realtors, along with qualified professionals, are working together to capture residential properties through drones. As drones are becoming affordable and smaller, their adoption for creating aerial photography is influencing the real estate sales positively. As per the MLS statistics, residential homes with aerial images were sold 68% quicker than homes with standard images. Augmenting real estate industry is projected to contribute massively towards the drone service market.

The drone service market players include Terra Drone Corporation, CyberHawk Innovations Limited, Drone Volt, Zipline, Aerodyne Group, Airinov, Sky-Futures, SkySpecs, Measure, and Flirtey.

- In December 2022, TSAW Drones collaborated with Tata 1mg to transfer diagnostic samples across Dehradun (Uttarakhand). The drones would be utilized to collect medical samples from different parts of Dehradun and transport them to Tata 1mg lab for processing. The drones are also projected to be used for transporting medicines to remote areas.

- In October 2022, Zipline began with dropping over-the-counter medications and prescriptions to residential in the Salt Lake City (Utah). Zipline partnered with Intermountain Healthcare to install initial fleet of five electric and autonomous drones in Salt Lake Valley distribution center. Zipline is working on on-demand deliveries to their patients’ homes directly in ~15 minutes.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com