Rise in Sales of New Vehicles Boosts Eastern Canada Road Transportation Fuel Market Growth

According to our latest market study on "Eastern Canada Road Transportation Fuel Market Size and Forecast (2021–2031), Regional Share, Trend, and Growth Opportunity Analysis — by Type and Vehicle Type," the market was valued at US$ 40,909.03 million in 2024 and is anticipated to reach US$ 50,160.30 million by 2031; it is estimated to register a CAGR of 3.14% during 2025–2031. The report includes growth prospects in light of current Eastern Canada road transportation fuel market trends and driving factors influencing the market growth.

The rise in construction activities, infrastructure development, and trade activities, as well as the growth of the shipping and logistics industry, are fueling the demand for commercial vehicles across Canada. Passenger and commercial vehicles are essential for long-haul transport, people transport, and handling any loads, as well as for industries with significant hauling capacity. These vehicles include commercial buses, cars, passenger vehicles, delivery trucks, coaches, motors, large motor homes, tractor-trailers, and transit buses. Over the past few years, consumer behavior toward intercity and intracity transit has transformed to a newer level. With the increasing disposable income of individuals and the stable economic structure of countries, the production of vehicles has surged exponentially. The rising demand for commercial vehicles has propelled sales activities in Canada, which is creating a demand for various types of vehicles, including gasoline, diesel, and gas-based vehicles. The increasing sales of automobiles would continue to positively impact the demand for road transportation fuels, including gasoline and diesel. Furthermore, factors such as on-demand mobility, efficiency improvements, and technological advancements in the automobile sector are fueling the production and sales of automotive vehicles, thereby driving the demand for road transportation fuels in Canada.

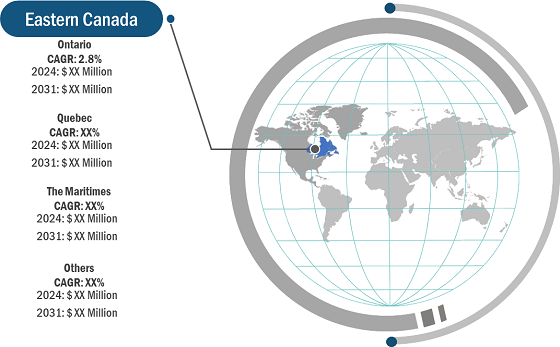

Eastern Canada Road Transportation Fuel Market Analysis – by Geography, 2024

Eastern Canada Road Transportation Fuel Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Gasoline, Diesel, Biofuel, Natural Gas, and Others), Vehicle Type (Light Vehicle and Heavy Vehicle), and Geography

Eastern Canada Road Transportation Fuel Market Share by 2031

Download Free Sample

Source: The Insight Partners Analysis

Canada relies on a mix of domestic production and imported natural gas and crude oil, with the US being the largest foreign supplier. Canada and the US are highly integrated, and supplies are delivered through a complex pipeline network connecting the two countries. Canada uses a variety of fuels to meet its primary and secondary energy needs. Alberta, Ontario, Quebec, and British Columbia are Canada's largest energy-consuming provinces, accounting for more than 85% of the country's primary and secondary energy demand. The demand for refined petroleum products (RPP) in Canada peaked in 2019 at approximately 1.6 MMB/d, a growth of more than 30% from 1995 levels. RPP demand has not yet recovered to pre-COVID-19 levels as motor gasoline and jet fuel demands continue to rebound. The demand reached approximately 1.4 MMB/d in 2023, which is still 10% below 2019 levels. Diesel and motor gasoline accounted for approximately 86% (2.2 MMB/d) of RPP demand in 2023. States or provinces such as Ontario and Quebec are the key major contributors to the Eastern Canada road transportation fuel market, owing to the rise in demand for passenger and freight road transportation across the country.

The scope of the Eastern Canada road transportation fuel market report focuses on Ontario, Quebec, the Maritimes, and others. In Eastern Canada, Ontario held the largest Eastern Canada road transportation fuel market share in 2024. As a result of potential growth in the country's transportation sector, the Eastern Canada road transportation fuel market in Ontario is anticipated to witness significant development in the coming years.

Ontario accounted for the largest market share in the Eastern Canada road transportation fuel market, owing to the rise in demand for road transportation fuels from passenger and freight transport vehicles in the region. In 2024, Ontario's road network covered a total of 213,900 km, with over 50% being two-lane paved roads. The road transportation fuel sale in Ontario was dominated by gasoline in 2023. As per the insights from the Government of Canada (Statistics Canada), gasoline fuel sales increased from 13.94 billion liters in 2022 to 15.87 billion liters in 2023. Also, net sales of diesel used by road motor vehicles in Ontario increased from 5.1 billion liters in 2021 to 5.4 billion liters in 2023. Moreover, new gasoline-type vehicle registrations in Ontario increased from 0.49 million units in 2022 to 0.54 million units in 2024, and new diesel vehicle registrations increased from 22,803 units in 2022 to 22,943 units in 2024. Hence, the rise in registration of new vehicles and fuel sales in Ontario is expected to drive the Eastern Canada road transportation fuel market during the forecast period.

Light vehicles include passenger cars, SUVs, light trucks, vans, minivans, pickup trucks, and bikes. As per the insights from the International Organization of Motor Vehicle Manufacturers (OICA), the total number of new passenger car registrations increased from 0.258 million units in 2022 to 0.262 million units in 2023. In addition, as per the insights from Statistics Canada, energy consumption by the road transportation sector increased by 1.7% in 2023. Gasoline is the main source of energy consumption by road transportation applications, followed by diesel. Ontario accounted for the largest market share in the light vehicle segment, followed by Quebec and the Maritimes. From 2021 to 2024, the Maritimes in Eastern Canada experienced the highest growth rate in new passenger car registrations, followed by Quebec and Ontario. This trend is expected to continue, with significant CAGR anticipated during the forecast period. The rise in new light vehicle registrations and road transportation fuel consumption in Eastern Canada is anticipated to drive market growth from 2025 to 2031. Other fuels used in the road transportation sector in Eastern Canada include propane, liquefied petroleum gas (LPG), and hydrogen. The rise in the requirement for sustainable fuels to fulfill the carbon emission reduction goals in Canada is anticipated to drive the demand for other types of fuels during the forecast period. In addition, the growing sales and demand for liquefied petroleum gas in the country are anticipated to further fuel market growth in the coming years. For instance, as per the insights from Statistics Canada, net sales of LPG increased from 503.84 million liters in 2020 to 554.92 million liters in 2023. In addition, hydrogen fuel is expected to be the key fuel in ensuring the targets for zero-emission vehicles (ZEVs) in the country.

Suncor Energy Inc., Parkland Corporation, Chevron Corporation, Equinor ASA, Exxon Mobil Corporation, CNOOC International Ltd, TotalEnergies, Shell Plc, Imperial Oil Limited, Irving Oil Ltd, and Cenovus Energy Inc. are among the key players profiled in the Eastern Canada road transportation fuel market report. Several other major players were also studied and analyzed in the report to get a holistic view of the market and its ecosystem. The Eastern Canada road transportation fuel market forecast can help stakeholders plan their growth strategies. The market analysis provides detailed market insights, which help the key players strategize their growth.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com