Surging Industrial Modernization and Advanced Manufacturing Investments Fuel Europe Power Quality Equipment Market Growth

According to our latest study, “Europe Power Quality Equipment Market Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis – by Equipment, Phase, End Users, and Country," the market was valued at US$ 8.05 billion in 2024 and is expected to reach US$ 11.45 billion by 2031; it is estimated to record a CAGR of 5.5% from 2025 to 2031. The report includes growth prospects owing to the current Europe power quality equipment market trends and their foreseeable impact during the forecast period.

Europe is emphasizing rapid industrial modernization and increasing investments in advanced manufacturing. Aerospace, automotive, and electronic sectors are embracing cutting-edge technologies and expanding production capacities to meet global demand. Companies in the region are expanding their manufacturing capabilities, driving the Europe power quality equipment market growth. On March 26, 2025, GE Aerospace announced a strategic investment exceeding €78 million (US$ 84.3 million) to enhance its manufacturing capabilities across Europe throughout 2025. This initiative is focused on expanding capacity, upgrading key facilities, and ensuring top-tier quality standards for commercial and defense aerospace customers. A portion of the investment will be directed toward scaling the production of next-generation aircraft engine components, leveraging advanced materials and cutting-edge manufacturing technologies to boost engine range, power, durability, and efficiency. As GE Aerospace modernizes its facilities and ramps up production, the need for reliable and stable power becomes critical. High-performance power quality equipment—such as harmonic filters, voltage regulators, and uninterruptible power supplies (UPS)—plays a vital role in preventing downtime, minimizing energy losses, and protecting sensitive machinery from electrical disturbances. These features are important in aerospace manufacturing, where precision, continuity, and operational integrity are non-negotiable. The investment reflects an emerging trend across European industrial sectors, where manufacturers are adopting power quality solutions to support Industry 4.0 initiatives and meet stringent EU regulations.

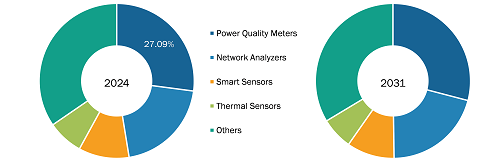

Europe Power Quality Equipment Market Share (%) – by Equipment, 2024 and 2031

Europe Power Quality Equipment Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Equipment (Power Quality Meters, Network Analyzers, Smart Sensors, Thermal Sensors, and Others), Phase (Three Phase and Single Phase), End Users (Industrial, Commercial, Distribution System Operators (DSO), and Others), and Country

Europe Power Quality Equipment Market Research Report 2031

Download Free Sample

Source: The Insight Partners Analysis

The report includes the Europe power quality equipment market forecast by equipment, phase, and end users. Based on equipment, the market is segmented into smart sensors, thermal sensors, power quality meters, network analyzers, and others. In terms of revenue, the others segment held a larger power quality equipment market share, and it is further expected to record a higher CAGR during the forecast period.

The scope of the Europe power quality equipment market report focuses on France, Germany, Russia, Italy, the UK, and the Rest of Europe. In terms of revenue, Germany held the largest Europe power quality equipment market share. The nation is the largest market for automobiles worldwide and is a hub of vehicle manufacturing companies such as Volkswagen and BMW AG. The country comprises vehicle manufacturers such as passenger cars, light commercial vehicles, and heavy commercial vehicles. According to the German Association of the Automotive Industry (VDA), Germany produced 4,109,371 passenger cars in 2023, marking an 18% increase compared to 2022. This resurgence in automotive manufacturing highlights the sector’s recovery and renewed momentum, driven by domestic demand and export growth, particularly in electric and hybrid vehicles. The scaling up of production lines—which involves advanced automation, robotics, and high-precision electronic systems—has heightened the need for consistent, high-quality power supply across manufacturing facilities. This scale-up is driving the demand for power-quality equipment as manufacturers seek to minimize downtime, protect sensitive machinery, and ensure energy efficiency within their operations. As the automotive industry continues its electrification and digital transformation, investment in power conditioning, voltage regulation, and uninterrupted power supply systems is surging.

Camlin Group; HIOKI E.E. CORPORATION; Schneider Electric SE; ABB Ltd; Siemens AG; Emerson Electric Co; DEHN SE; Gridspertis; NEO Messtechnik Gmbh; and COMTECH Ltd are key players profiled during the Europe power quality equipment market report. Other essential market players were also studied and analyzed to get a holistic view of the Europe power quality equipment market and its ecosystem.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com