According to our latest market study on “Hydraulic Filter Market Forecast to 2027 – COVID-19 Impact and Global Analysis – by Product (Suction Filter, Pressure Filter, Return Line Filter, Off-Line Filter, Breather Filter, and Others) and End User (Manufacturing, Marine, Automotive, Chemical and Petrochemical, Power Generation, Agriculture, Construction, Metal and Mining, and Others),” the market was valued at US$ 1,194.88 million in 2019 and is projected to reach US$ 2,089.54 million by 2027; it is expected to grow at a CAGR of 7.3% from 2020 to 2027.

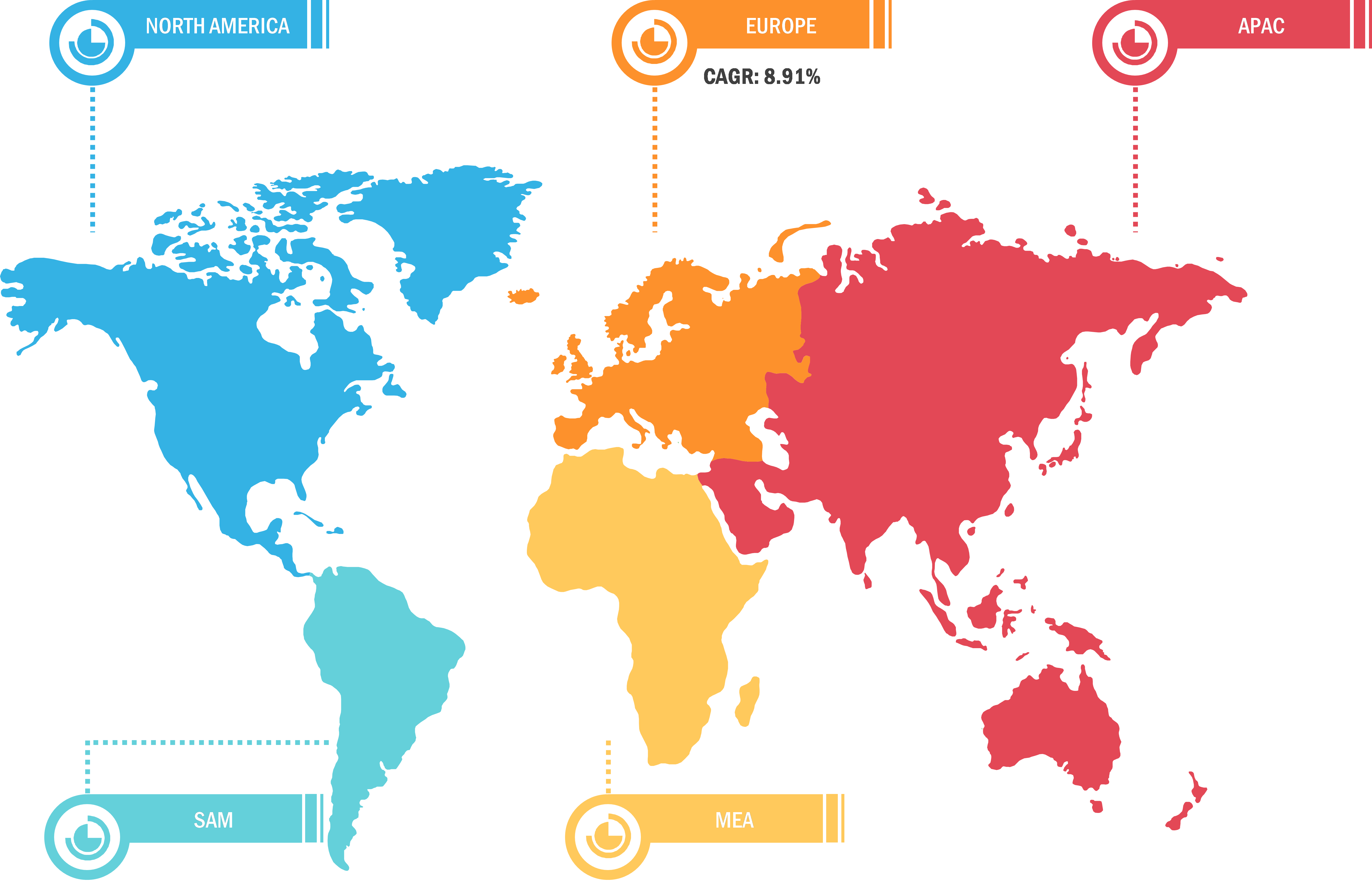

In 2019, North America led the global hydraulic filter market with 36.81% revenue share, followed by Europe and North America. North America comprises developed economies, including the US and Canada, and developing economies, such as Mexico. This region's significant share is mainly due to high customer awareness and greater acceptance of innovative technologies. Hydraulic filter is increasingly used in high-risk environments, including mining operations, oil & gas recovery, and construction sites. Increased consolidation of farms, increased government support through subsidies, a positive economic outlook, and a large production base are driving sales of high capacity hydraulic filter equipment. Hydraulic filter manufacturers are at the forefront of the agricultural sector's change and evolution, which gives rise to the modern-day integrated farm management approach. Farmers are increasingly adopting advanced technologies—such as GPS-controlled agricultural machinery—and precision farming systems form the backbone of these technologies in most North American markets. Growing adoption of precision farming is one of the critical factors influencing the market's growth over the forecast period. Companies are continuously developing their overall business processes to meet consumers' demands for high-quality goods. Moreover, the US aerospace, automotive, and defense sectors have been the major driving factors for metal-forming hydraulic filters. The requirement for manufactured metal products is high in these industries. As Industry 4.0 has gained momentum throughout the manufacturing sector, it is also affecting the hydraulic filters' market to become part of the smart systems. Industry 4.0 can improve the use of hydraulic filter in fabrication operations by cutting down on idle time. The trade deal between the US and China, which could significantly increase Chinese imports of US agricultural products, may boost agricultural equipment investment. The market players are focusing on both organic and inorganic growth strategies to sustain the competitive environment. For instance, in January 2019, Eaton Corporation plc—a multinational power management company—announced that the Aftermarket division of its Vehicle Group had entered an agreement with Bezares SA for improving its presence in the North American region. The agreement would also enable the company to offer a comprehensive mobile power hydraulic portfolio, including hydraulic filters, to cater to the North American customers' dynamic needs.

In 2019, Europe stood second in the hydraulic filter market with a decent market share and it is anticipated to witness a steady CAGR from 2020 to 2027. The European continent involves Germany, France, the UK, and Italy, among others. 2019 showed promising results for tech investments in Europe, as European tech continues to break records despite the UK and EU economic slowdowns. Over the past five years, capital invested in European technology has grown by 124%, with a 39% increase between 2018 and 2019 alone, reaching US$ 34.3 billion in capital investment for 2019. This compares with reductions in investment in both the US and Asian capital between 2018 and 2019. Western Europe is renowned for its improved living conditions, with higher income levels among residents.

Companies adopt inorganic market strategies to expand their footprints across the world and meet the growing demand. The hydraulic filter market players mainly focus on the acquisition strategy to expand their business and maintain their brand name globally. For instance, in 2020, Pall Corporation formed a joint venture named Pall Arabia with Tanajib, a leading petroleum services company in GCC. Under the JV, Pall Arabia would market and distribute Pall corporation’s products in GCC

Impact of COVID-19 on Hydraulic Filter market

Coronavirus or COVID-19 outbreak first began in Wuhan, China, during December 2019, and since then, it has spread at a fast pace across the globe. The coronavirus outbreak has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global electronics & semiconductor industry is one of the primary sectors suffering severe disruptions, such as supply chain breaks, technology event cancellations, and office shutdowns. China is the global hub of manufacturing and the largest raw material supplier for various industries, and it is also one of the worst-affected countries. The lockdown of different plants and factories in China affects the global supply chains and negatively impacts the manufacturing of various electronic goods. The international travel bans imposed by countries in Europe, Asia, and North America affect business collaborations and partnerships opportunities. All these factors are anticipated to affect the electronic & semiconductor industry negatively and thus act as a restraining factor for the growth of various markets related to this industry in the coming months, such as the hydraulic filters market. Due to COVID-19 pandemic, the manufacturing plants, construction industry, automotive industry, and several other businesses are functioning slowly, negatively impacting the hydraulic filters market. Adding to this, the prices of hydraulic filter raw-materials fluctuate at a high pace due to lockdown and travel restrictions. This is also anticipated to negatively impact the growth of the hydraulic filters market during the forecast period.

Hydraulic Filter Market – Geographic Breakdown, 2019

Hydraulic Filters Market Growth Report and Size by 2031

Download Free Sample

Hydraulic Filters Market Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Suction Filter, Pressure Filter, Return Line Filter, Off-Line Filter, Breather Filter, and Others); End User (Manufacturing, Marine, Automotive, Chemical and Petrochemical, Power Generation, Agriculture, Construction, Metal and Mining, and Others) and Geography

Hydraulic Filters Market Growth Report and Size by 2031

Download Free SampleHydraulic Filters Market Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Suction Filter, Pressure Filter, Return Line Filter, Off-Line Filter, Breather Filter, and Others); End User (Manufacturing, Marine, Automotive, Chemical and Petrochemical, Power Generation, Agriculture, Construction, Metal and Mining, and Others) and Geography

The report segments the global hydraulic filter market as follows:

By Product- Suction Filter

- Pressure Filter

- Return Line Filter

- Off-Line Filter

- Breather Filter

- Others

- Manufacturing

- Marine

- Automotive

- Chemical and Petrochemical

- Power Generation

- Agriculture

- Construction

- Metal and Mining

- Others

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

- Middle East & Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- South America (SAM)

- Brazil

- Argentina

- Rest of SAM