Solid-State Lasers Segment to Register Highest CAGR During 2021–2028

According to our latest study, titled "Medical Lasers Systems Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Product Type, Application, and End User," the market size is expected to grow from US$ 2,398.60 million in 2021 to US$ 5,834.02 million by 2028. It is estimated to grow at a CAGR of 13.5% from 2021 to 2028. The report highlights the key factors driving the medical lasers systems market and prominent players' developments.

The medical lasers systems market's growth is attributed to the increasing prevalence of eye disorders and the significant rise in the elderly population. However, stringent safety regulations are hampering the market.

Based on product type, the medical lasers systems market is segmented into diode lasers, solid-state lasers [holmium yttrium aluminum garnet (Ho: YAG) lasers, erbium yttrium aluminum garnet (Er:YAG) lasers, neodynium yttrium aluminum garnet (Nd: YAG) lasers, potassium titanyl phosphate (KTP), alexandrite lasers, ruby lasers, and thulium yttrium aluminum garnet (Tm:YAG) lasers], gas laser [CO2 laser, argon laser, krypton laser, metal vapor (Au and Cu) laser, helium-neon laser, and excimer laser], dye lasers, and fiber laser (thulium fiber laser, erbium fiber laser, and ytterbium fiber laser).

The solid-state lasers segment is anticipated to account for the largest market share from 2021 to 2028. Solid-state lasers have gained attention in the global medical lasers systems market due to their significant improvement in the performance of such specialized lasers. This is evaluated as output power levels, wall-plug efficiency, reliability, and range of available wavelengths from the pump diodes and diode arrays. Also, modular and multiwavelength solid-state lasers provide therapeutic radiation proving effective for laser-lithotripsy, laser-angioplasty, neurosurgery, general surgery, and dentistry. Furthermore, solid-state lasers have had successful medical applications for many years due to their quick use and low absorption power in the water, which penetrates deeply into the skin and is mostly used in dermatology for hair removal and tissue rejuvenation.

By application, the medical lasers systems market is segmented into dermatology, ophthalmology, gynecology, dentistry, cardiology, urology, and others. The dermatology segment dominates the overall market and is projected to continue its dominance during the forecast period. Advances in medical lasers systems have enabled successful surgeries for multiple eye diseases, such as diabetic retinopathy, retinal tears, detachment, and macular degeneration. These medical lasers systems help prevent vision loss by improving sight. Additionally, the manufacturers are bringing innovative products to the medical lasers systems market. For example, Nidek, in May 2019, announced the launch of a new product by introducing the "YC-200 S plus ophthalmic YAG and SLT laser system/YC-200 ophthalmic YAG laser system", ensuring efficacious treatments for the patients.

By end user, the medical lasers systems market is segmented into hospitals, specialty clinics, ambulatory surgery centers, and others. The specialty clinics segment held a considerable market share in 2021 and is likely to continue its dominance during the forecast period. Specialty clinics are centers of excellence assuring to deliver high standards of clinical outcomes. Specialty clinics focus on any one organ, a body system, or a particular disease. Therefore, these clinics are staffed with para-medical and nursing personnel with specialized skills that have been perfected over time. The role of specialty clinics in detecting, diagnosing, and managing eye disease, cardiac diseases, and others have gained huge attention. These factors have raised the demand for medical lasers systems.

COVID-19 Impact Analysis: Medical Lasers Systems Market

As per the National Center for Biotechnology Information (NCBI) report, the COVID-19 pandemic significantly impacts the global health economies. The impact of the pandemic accounted for the sluggish growth of the overall medical lasers systems market. Medical lasers system procedures generally gain a large market in dermatology practices, and laser hair removal practices COVID-19 brought the majority of these procedures to a halt.

According to research conducted by the Commonwealth Fund report, the hardest-hit medical specialties, including dental, Ophthalmology, ENT, and dermatology, experienced a strong decline beyond 50% during the first week of both April and May. With COVID-19 lockdowns, all dermatology practices and med-spas stopped such medical lasers system treatments, which led to them experiencing a strong decline in terms of procedures performed in hospitals. For instance, in March 2020, the UK introduced a country-wide lockdown that came into effect on March 23. Since then, clinics offering laser and intense pulsed light services have remained closed for the business.

With a strategy to relax COVID-19 lockdown being implemented worldwide and the vaccination drive proving helpful, many medical lasers practitioners have resumed their medical lasers systems services. But the NCBI report states that the decision on when to start doing non-emergency laser and other energy-based procedures should be taken in mind by the medical practitioners depending on the availability of PPE for frontline healthcare providers dealing with COVID-19. Also, until there is an inadequate supply of PPE or a reported number of cases, medical lasers systems procedures should be avoided.

Lumenis Be Ltd.; Ellex; Koninklijke Philips N.V.; BIOLASE, Inc.; Boston Scientific Corporation; Bausch Health Companies Inc.; Alcon Inc.; Iridex Corporation; Candela Medical; and Artivion, Inc. are the leading companies operating in the global medical lasers systems market.

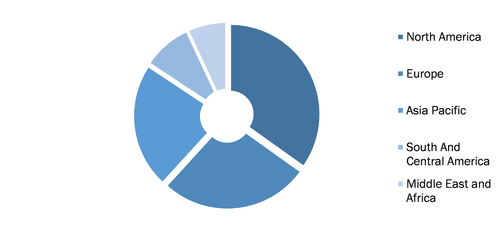

Medical Lasers System Market, by Region, 2021 (%)

Medical Laser Systems Market by Size, Share & Trend Analysis 2028

Download Free Sample

Medical Laser Systems Market Forecast to 2028 - Analysis By Product Type {Diode Lasers, Solid-State Lasers [Holmium Yttrium Aluminum Garnet (Ho: YAG) Lasers, Erbium Yttrium Aluminum Garnet (Er: YAG) Lasers, Neodynium Yttrium Aluminum Garnet (Nd: YAG) Lasers, Potassium Titanyl Phosphate (KTP), Alexandrite Lasers, Ruby Lasers, and Thulium Yttrium Aluminum Garnet (Tm:YAG) Lasers], Gas Laser [CO2 Lasers, Argon Lasers, Krypton Lasers, Metal Vapor (Au and Cu) Lasers, Helium-Neon Lasers, and Excimer Lasers], Dye Lasers, and Fiber Laser (Thulium Fiber Lasers, Erbium Fiber Lasers, and Ytterbium Fiber Lasers)}, Application (Dermatology, Ophthalmology, Gynecology, Dentistry, Cardiology, Urology, and Other), and End User (Hospitals, Specialty Clinics, Ambulatory Surgery Centers, and Others)

Medical Laser Systems Market by Size, Share & Trend Analysis 2028

Download Free SampleMedical Laser Systems Market Forecast to 2028 - Analysis By Product Type {Diode Lasers, Solid-State Lasers [Holmium Yttrium Aluminum Garnet (Ho: YAG) Lasers, Erbium Yttrium Aluminum Garnet (Er: YAG) Lasers, Neodynium Yttrium Aluminum Garnet (Nd: YAG) Lasers, Potassium Titanyl Phosphate (KTP), Alexandrite Lasers, Ruby Lasers, and Thulium Yttrium Aluminum Garnet (Tm:YAG) Lasers], Gas Laser [CO2 Lasers, Argon Lasers, Krypton Lasers, Metal Vapor (Au and Cu) Lasers, Helium-Neon Lasers, and Excimer Lasers], Dye Lasers, and Fiber Laser (Thulium Fiber Lasers, Erbium Fiber Lasers, and Ytterbium Fiber Lasers)}, Application (Dermatology, Ophthalmology, Gynecology, Dentistry, Cardiology, Urology, and Other), and End User (Hospitals, Specialty Clinics, Ambulatory Surgery Centers, and Others)

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com