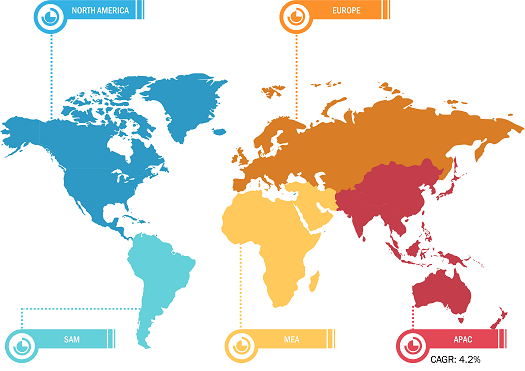

Asia Pacific Dominates Mining Explosives Market

According to our latest market study on “Mining Explosives Market Forecast to 2030 – COVID-19 Impact and Global Analysis – by Type [Trinitrotoluene (TNT), ANFO, RDX, Pentaerythritol Tetranitrate (PETN), and Others] and Application (Quarrying and Non-Metal Mining, Metal Mining, and Coal Mining),” the Global mining explosives market size was valued at US$ 18,353.55 million in 2022 and is projected to reach US$ 25,092.62 million by 2030; it is expected to record a CAGR of 4.2% from 2023 to 2030. The report highlights key factors driving the market and prominent players along with their developments in the market.

Global Mining Explosives Market Breakdown – by Region

Mining Explosives Market Forecast to 2030 - Industry Analysis By Type [Trinitrotoluene (TNT), ANFO, RDX, Pentaerythritol Tetranitrate (PETN), and Others], Application (Quarrying and Non-Metal Mining, Metal Mining, and Coal Mining)

Mining Explosives Consumable Market Size, Trends, Shares and Forecast - 2030

Download Free Sample

In 2022, Asia Pacific dominated the mining explosives market. Asia Pacific marks the presence of major surface mining projects: Green Mine (China), Sangatta Mine (Indonesia), Heidaigou Mine (China), Oyu Tolgoi Copper-Gold Mine (Mongolia), Gevra OC Mine (India), Letpadaung Copper Mine (Myanmar), Li Mine (Thailand), FTB Project (Thailand), and Pasir Mine (Indonesia). Asia is also home to leading mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, and BHP. China is the major consumer of mining explosives in the region. According to a report released by the US Geological Survey in 2022, China held the leading position in mine production of critical minerals such as antimony, barite, germanium, graphite, magnesium, rare-earth elements, titanium, and tellurium. As per the British Geological Survey released in 2023, China accounted for the highest aluminum production, accounting for over 50% of global aluminum mining in 2021. The coal mining production in the country reached 4,368.13 million metric tons in 2021, an increase from 4,130.54 million metric tons in 2020. Mining operations primarily involve blasting mines using explosives to break mineral-containing rocks. Hence, the rise in mining production in the country is projected to boost the mining explosives market growth in coming time. India also holds a prominent position regarding the use of mining explosives in Asia Pacific. The expansion of the mining industry is the leading factor for the mining explosives market growth in the country. According to the National Investment Promotion & Facilitation Agency, the mining industry in India significantly contributes to the country’s economy. India is the second-largest coal producer and ranks fifth amongst all countries in terms of coal deposits. The mineral production in the country accounted for US$ 1.21 billion from 2022 to 2023. Further, the government of India announced its plans to increase coal production by 1.3 billion tons by 2025 and 1.5 billion tons by 2030. The country also marks the presence of 1,533 operational mines and produces ninety-five minerals, which include four fuels and ten metallic, twenty-three non-metallic, three atomic, and fifty-five minor minerals. In 2023, the production of copper concentrate, chromite, phosphorite, manganese ore, coal, limestone, and lead concentrate recorded growth of 41.9%, 34%, 32.8%, 13.6%, 12.5%, 7.6%, and 6.3%, respectively, compared to 2022. The key trends related to the mining industry in the country are projected to drive the demand for mining explosives during 2022 to 2030.

Orica Limited, Al Fajar Al Alamia Co SAOG, Dyno Nobel, China Poly Group Corporation, NOF Corporation, Hanwha Group, Anhui Jiangnan Chemical Co Ltd, Koryo Nobel Explosives, Solar Group, and Omnia Group Company are among the major players operating in the global mining explosives market. Market players are highly focused on developing high-quality and innovative product offerings to fulfill the customer’s requirements.

Impact of COVID-19 Pandemic on Global Mining Explosives Market

In 2020, various industries had to slow down their operations due to disruptions in value chains caused by the shutdown of national and international boundaries. The COVID-19 pandemic caused supply chain disruptions in the chemicals & materials industry and hampered the growth of the mining explosives market. The adverse effect of the pandemic on the mining industry negatively impacted the demand for mining explosives from this industry.

However, various economies started reviving their operations in 2021. With this, the demand for mining explosives started increasing. The increasing use of mining explosives in rare earth metals is expected to offer more growth opportunities for the global mining explosives market in the near future.

The report includes the segmentation of the global mining explosives market as follows:

Based on type, the global mining explosives market is segmented into trinitrotoluene (TNT), ANFO, RDX, pentaerythritol tetranitrate (PETN), and others. Based on application, the market is segmented into quarrying and non-metal mining, metal mining, and coal mining. By geography, the global mining explosives market is broadly segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. The mining explosives market in North America is further segmented into the US, Canada, and Mexico. The mining explosives market in Europe is subsegmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. The mining explosives market in Asia Pacific is further segmented into Australia, China, India, Indonesia, Vietnam, and the Rest of Asia Pacific. The market in the MEA is further segmented into South Africa, Zimbabwe, Nigeria, Saudi Arabia, the UAE, and the Rest of MEA. The mining explosives market in South & Central America is segmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com