Software Segment Held Larger Track and Trace Solutions Market Share in 2022

According to our new research study on "Track and Trace Solutions Market Forecast to 2030 – Global Analysis – by Component, Enterprise Size, Application, and Industry," was valued at US$ 6.85 billion in 2022 and is projected to reach US$ 22.7 billion by 2030; the market is expected to register a CAGR of 16.2% from 2022 to 2030.

The track and trace solutions market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth. Implementation of serialization to combat counterfeit drugs and increasing number of packaging-related product recalls propel the market growth. However, the high cost of products and implementation are hampering the growth of the market. Continuous technological advancement is expected to bring new track and trace solutions market trends in the coming years.

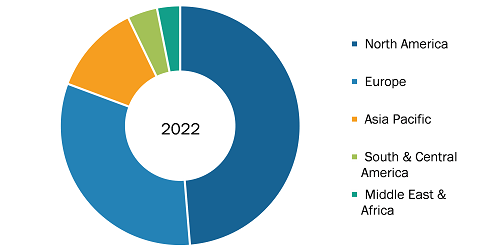

Track and Trace Solutions Market, by Region, 2022 (%)

Track and Trace Solutions Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software), Enterprise Size (SMEs and Large Enterprises), Application (Serialization and Aggregation), and Industry (Pharmaceutical, Medical Devices, Consumer Goods, Food & Beverages, and Others)

Track and Trace Solutions Market Research Report by 2030

Download Free Sample

Source: The Insight Partners Analysis

Increasing Number of Packaging-Related Product Recalls Propels Track and Trace Solutions Market Growth

Product recalls caused by issues with artwork and packaging are an ongoing problem for many consumer and pharmaceutical companies. The problems arise from several areas, such as non-standardized bills of material, translation mistakes, typos, and poor proofreading, expired digital assets, poor printing quality, third-party artwork suppliers, and printing shops. Product recalls not only cause financial damage to companies, but they also harm their status and can cause a drop in sales figures. Stricter regulations, especially in the pharmaceuticals and food segments, and rising consumer awareness about product quality have increased the need for innovative solutions to ensure product safety during the entire value chain. Pharmaceutical labeling errors have generated many global headlines. They are the leading cause of product recalls in the pharmaceutical industry. In November 2020, Aurobindo Pharma USA recalled 7,440 bottles of Ibuprofen oral suspension drug due to a labeling error. In the EU and across the world, pharmaceutical MAHs and other authorities are facing the same recall challenge. Although automated vision systems can prevent or limit a few recalls during manufacturing before the products go to market.

Further, the Packaging Machinery Manufacturers Institute estimates that more than 50% of pharma product recalls are related to labeling or packaging artwork errors. These errors are problematic, and the details can lead to significant pharmaceutical packaging and labeling inaccuracies. Common faults include gross errors, which occur when necessary information is missing from artwork, along with content mistakes, context and meaning flaws, and technical errors, such as dysfunctional barcodes. Once a problem occurs, the source must be identified to avoid reoccurrence. Preventing labeling errors is as crucial as containing inaccuracies in drug development. RFID labeling can be integrated into highly secure and effective track and trace systems to reduce the cases of labeling errors. Thus, the rising cases of product recalls are among the key factors contributing to the growing track and trace solutions market size.

The Track and Trace solutions market, by type, is bifurcated into hardware and software. In 2022, the software segment held a larger share of the market and is expected to record a higher CAGR during 2022–2030. The market, by application, is divided into serialization solutions and aggregation solutions. In 2022, the serialization solutions segment held a larger track and trace solutions market share. Moreover, the same segment is expected to record the highest CAGR during 2022–2030. Based on enterprise size, the global Track and Trace solutions market is divided into SMEs and large enterprises. In 2022, the large enterprise segment held a larger market share. The SMEs segment is expected to record a higher CAGR during 2022–2030. Large-sized enterprises may be a corporation, a quasi-corporation, a non-profit institution, or an unincorporated enterprise with more than 500 employees. Enterprises can be classified into different categories according to the size. Large enterprises need to manage a much larger number of employees and require more complex technology. Large businesses often need better connectivity among different locations across the globe. The primary reason for large enterprises to adopt managed network services is consistent and reliable services with a global reach and operational cost reductions. These enterprises work under tremendous pressure and time constraints to uphold their position in the market and maintain their customer base. Such factors drive the transfer of workloads to public clouds and the deployment of a Software-defined Wide Area Network (SD-WAN). Thus, the rising adoption of managed network services from large enterprises is expected to fuel the track and trace solutions market growth over the forecast period.

The track and trace solutions market, by industry, is segmented into pharmaceuticals, medical devices, consumer goods, food & beverages, and others. In 2022, the pharmaceuticals segment held a larger share of the market and is expected to record a higher CAGR during 2022–2030. The pharmaceutical industry determines, grows, produces, and markets pharmaceutical drugs for use as medications to be administered to patients for treatment, vaccination, or alleviating symptoms. Many EU and US regulators are helping in pharmaceutical manufacturing and distribution compliance.

The falsified medical products have increased in different countries across all regions in the last few years. A track and trace system is used to ensure the safety of the products by using 2D barcodes and RFID. The barcode system is based on a randomized serial number stamped on every pack of drugs. The legitimacy of each pack is verified by entering its unique identifier number into a repository system at the time of manufacture and checking the unique identifier against its entry in the repository system at one or more points in the supply chain. The system is only beneficial if the authenticity of the pack of drugs is checked before the medicine is dispensed to the patient.

The blood bank is a center where blood collected from blood donation is stored and preserved for later use in blood transfusion. As a transfusion management system designed by experienced blood bankers, the software was built with patient safety and multi-facility features that help protect patients and guard against mistakes. At the same time, robust interfaces enable seamless data exchange across the hospital network. The system is continuously updated to meet the needs of the customers, markets, and regulations, making it an ideal choice for numerous hospitals.

Research laboratories are workplaces for conducting scientific research. The research is focused on various applications that are widely used for the betterment of humans and animals. With the rapid growth of research specimen data and the need for data sharing across regional research teams, the availability of timely, traceable, and accurate laboratory information has become necessary for researchers. A reliable identification solution such as a barcoding solution provides more benefits than a manual data recording system. These benefits include reduced human errors and increased workplace efficiency. Therefore, owing to all the abovementioned factors, the pharmaceutical segment is likely to grow in the coming years.

The track and trace solutions market analysis has been carried out by considering the following segments: component, enterprise size, application, industry, and geography. By component, the market is bifurcated into hardware and software. Hardware component is further segmented into barcode scanner, radiofrequency identification reader, and others. Software component is further divided into plant manager, line controller and others. Based on enterprise size, the market is segmented into SMEs and large enterprise. Based on application, the market is divided into serialization and aggregation. Based on industry, the market is segmented into pharmaceutical, medical devices, consumer goods, food and beverages, and others.

The scope of track and trace solutions market report includes the assessment of the market performance in North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com