Rising Focus on Clean Energy and Growing Number of Floating Wind Farms is Boosting the Wind Turbine Gearbox Market Growth

According to our latest market study on " Wind Turbine Gearbox Market Forecast to 2030 –Global Analysis – by Type and Deployment Type," the market is expected to grow from US$ 5,565.36 million in 2022 to US$ 11,581.50 million by 2030; it is anticipated to grow at a CAGR of 9.6% from 2022 to 2030.

The growing focus on mitigating carbon emissions and boosting the utilization of clean energy is one of the major reasons behind the growing proliferation of wind farms globally. The increasing number of onshore and offshore wind farms is having a positive impact on the demand for gearboxes and boosting the application of gearboxes worldwide. The increasing adoption of wind energy across various countries, such as Germany, China, Japan, the UK, Belgium, France, and Denmark. Further, the demand for floating wind technology is also increasing in the market owing to the increase in technological advancements, advantages associated with floating wind technology, and turnkey solutions provided by service providers. The growing awareness regarding clean energy in various countries is also propelling the demand for floating offshore wind power, thereby boosting the growth of the wind turbine gearbox market. Numerous financial investments are made in floating wind turbine projects by the governments of different countries. For instance, in May 2022, the UK government announced the opening of the US$ 192.09 million Floating Offshore Wind Manufacturing Investment Scheme (FLOWMIS) for expressions of interest from manufacturers and private investors. In addition, in June 2022, Equinor collaborated with Technip Energies to develop floating wind steel SEMI substructures that accelerate technology development for floating offshore wind. Also, in September 2022, the Department of Energy launched a floating offshore wind farm design project. Under this project, the National Renewable Energy Laboratory will develop various modeling tools to optimize designs for floating offshore wind farm arrays and several reference array designs for the US floating offshore wind farm sites. Thus, as the demand for floating offshore wind farms is increasing globally, the requirement for wind turbine components will also increase, fueling the wind turbine gearbox market growth. The rise in demand for renewable energy and its advantages in protecting the environment are expected to promote wind energy projects globally. Governments of various countries are supporting the construction of wind energy projects in terms of policies and investments. There is an increase in demand for a clean energy source as it eliminates greenhouse gases, reduces dependence on imported fuels, and diversifies the energy supply.

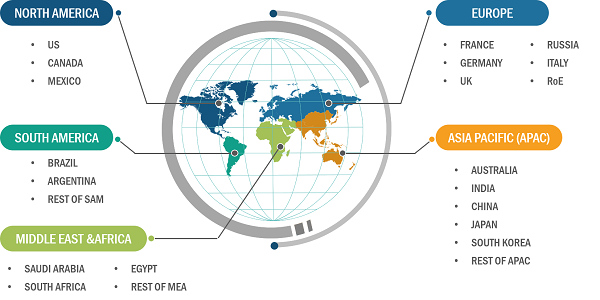

Wind Turbine Gearbox Market Share — by Region, 2022

Wind Turbine Gearbox Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Planetary Gearbox, Spur Gearbox, Others); Deployment Type (Onshore and Offshore), and Geography

Wind Turbine Gearbox Market Regional Overview by 2030

Download Free Sample

Source: The Insight Partners Analysis

China, India, Australia, Japan, and South Korea are some of the major countries across the Asia Pacific region. APAC is one of the major regions in the wind turbine gearbox market owing to supportive government policies, a rise in investment in wind energy projects, and reduced cost of wind energy. In APAC, China dominates the wind energy market and is the largest onshore market, with 21.2 GW of new capacity additions. In addition, the supportive government policies and incentives made China a favorable hotspot for investment. Also, according to the Global Wind Energy Council (GWEC) report, APAC is set to become a leader in offshore wind, with a growth in its share from ~25% in 2020 to ~42% by 2025. The ongoing projects of capacity addition of wind farms are accelerating wind power generation. The capacity addition of wind energy would increase India's existing 39.2 GW wind capacity by 50%, paving the way for incremental growth. Thus, the increasing investment in ongoing wind farms is augmenting the wind energy generation capacity, further strengthening market growth.

For instance, APAC's largest wind energy construction project, Dulacca Wind Farm, was initiated in Q3 of 2021. For the construction of this 180 MW wind farm, ~US$ 328 million investment was made, and the project was expected to finish in Q3 2023. In addition, Jiuquan Subei Mazongshan No.1 Area B Wind Farm involves the construction of a 200 MW wind farm with an investment of US$ 190 million and is expected to be completed in Q4 2023. The Karara Wind Farm involves the construction of a 103 MW wind farm with an investment of US$ 183 million and is expected to be completed in Q4 2024. The Golmud Dongtai Wind Farm involves the construction of a 100 MW wind farm with an investment of US$ 156 million. Thus, the growing addition of wind power capacity in APAC, coupled with significant investment to achieve the ambitious clean energy target, is anticipated to drive the demand for wind turbine components, for instance, gearbox, during the forecast period. Germany, France, Italy, Russia, and the UK are among the major countries in the European wind turbine gearbox market. The growing effects of global warming and climate change have made companies develop more sustainable products. The need for a newer and cleaner energy source is fueling the demand for wind energy, which drives the wind turbine gearbox market share.

In Europe, Germany continues to have the largest installed wind capacity, followed by Spain, the UK, France, and Sweden. Moreover, other European countries such as Italy, Poland, Denmark, the Netherlands, Portugal, and Belgium have more than 5 GW of installed wind capacity each. According to the WindEurope report, the region is expected to install 116 GW of new wind farms from 2022 to 2026, out of which three-quarters of these new capacity additions will be onshore wind. According to the National Wind Energy Association (ANEV), Europe will install 116 GW of new wind power capacity by 2026, an average of 23.1 GW a year. Thus, such massive wind energy potential in European countries is expected to drive the wind turbine gearbox market during the forecast period.

The North America wind turbine gearbox market is segmented into the US, Canada, and Mexico. Owing to stringent government regulations, an increase in investment in wind power projects, favorable policies, and reduced cost of wind energy, the wind industry across the region is expected to register remarkable growth. With the growing consumer awareness of climate change and the role of renewable energy, the demand for wind turbine gearboxes is projected to grow in North America.

The Middle East & Africa (MEA) wind turbine gearbox market is segmented into South Africa, Saudi Arabia, Egypt, and the Rest of MEA. South Africa, Morocco, and Kenya are a few major countries dominating the wind energy demand. These countries are significantly contributing to wind energy production. The key factors responsible for the market growth are the increased initiatives for using clean energy sources to meet the rising power demand, supportive government policies, and reducing dependency on fossil fuels.

Siemens Gamesa Renewable Energy SA, General Electric, Mitsubishi Heavy Industries, Vestas Wind Systems, Elecon Engineering Company Limited, ME Production AS, ZF Friedrichshafen AG, Flender GmbH, Dana Motion Systems, Stork Gears & Services BVare are among the key wind turbine gearbox market players profiled during this study. In addition, several other important wind turbine gearbox market players have been studied and analyzed during the study to get a holistic view of the wind turbine gearbox market and its ecosystem.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com