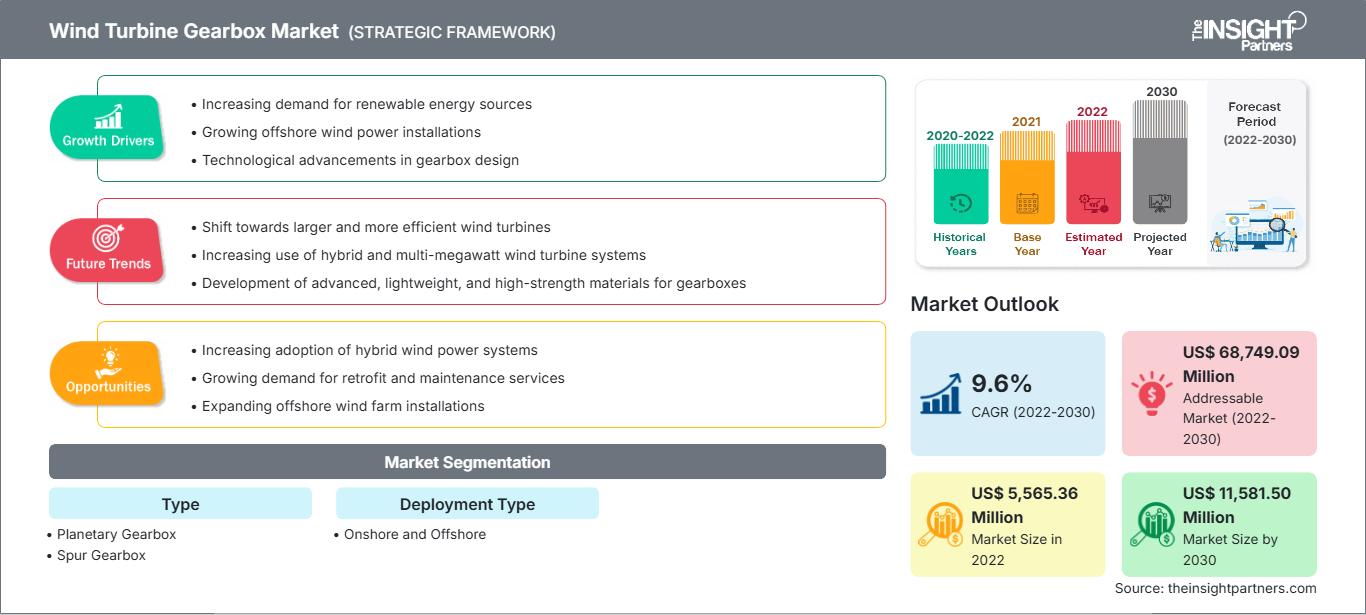

Wind Turbine Gearbox Market Overview and Growth by 2030

Wind Turbine Gearbox Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Planetary Gearbox, Spur Gearbox, Others); Deployment Type (Onshore and Offshore), and Geography

Historic Data: 2020-2022 | Base Year: 2022 | Forecast Period: 2022-2030- Report Date : Mar 2026

- Report Code : TIPRE00009857

- Category : Energy and Power

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

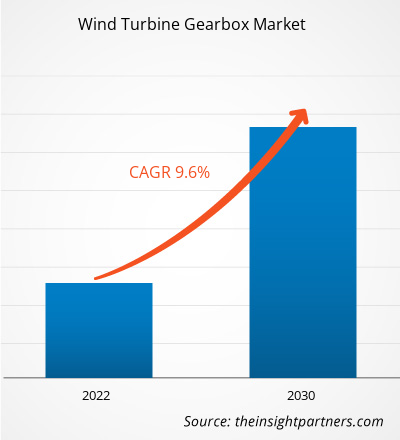

[Research Report] The wind turbine gearbox market was valued at US$ 5,565.36 million in 2022 and is projected to reach US$ 11,581.50 million by 2030; it is expected to grow at a CAGR of 9.6% during 2022–2030.

Analyst Perspective:

The Asia Pacific wind turbine gearbox market is segmented into Australia, China, India, Japan, South Korea, and the Rest of APAC. APAC is one of the leading regions in the wind turbine gearbox market owing to favorable government policies, a rise in investment in wind energy projects, and reduced cost of wind energy. Countries such as India, China, and Japan are the dominating countries, holding a large portion of the market share, which is further expected to increase during the forecast period. In APAC, China dominates the wind energy market and is the largest onshore market, with 21.2 GW of new capacity additions. In addition, the supportive government policies and incentives made China a favorable hotspot for investment. Also, according to the Global Wind Energy Council (GWEC) report, APAC is set to become a leader in offshore wind, with a growth in its share from ~25% in 2020 to ~42% by 2025.

The ongoing projects of capacity addition of wind farms are accelerating wind power generation. The capacity addition of wind energy would increase India’s existing 39.2 GW wind capacity by 50%, paving the way for incremental growth. Thus, the increasing investment in ongoing wind farms is augmenting the wind energy generation capacity, further strengthening market growth. For instance, APAC’s largest wind energy construction project, Dulacca Wind Farm, was initiated in Q3 of 2021. For the construction of this 180 MW wind farm, ~US$ 328 million investment was made, and the project was expected to finish in Q3 2023. In addition, Jiuquan Subei Mazongshan No.1 Area B Wind Farm involves the construction of a 200 MW wind farm with an investment of US$ 190 million and is expected to be completed in Q4 2023. The Karara Wind Farm involves the construction of a 103 MW wind farm with an investment of US$ 183 million and is expected to be completed in Q4 2024. The Golmud Dongtai Wind Farm involves the construction of a 100 MW wind farm with an investment of US$ 156 million. Thus, the growing addition of wind power capacity in APAC, coupled with significant investment to achieve the ambitious clean energy target, is anticipated to drive the demand for wind turbine gearbox during the forecast period.

Various global manufacturers have manufacturing facilities in the Asia Pacific, where they develop various components. In September 2022, Siemens Gamesa announced the expansion of their offshore nacelle facility in Taichung, Taiwan. This facility will be tripled in size to ~90,000 square meters, where the manufacturing of SG 14-222 DD offshore wind turbines will take place. Thus, such expansion by the global players in the Asia Pacific will further fuel the growth of the wind turbine gearbox market during the forecast period.

Market Overview:

A gearbox in wind turbine accelerates rotational speed from low-speed main shaft to high-speed shaft through an electrical generator. Across different parts of the world, different organic and inorganic strategies are occurring which will be proliferating wind turbine gearbox market. In June 2022, Eickhoff Wind Asia, Germany-headquartered company has established a new manufacturing unit near Chennai India). The new unit facility would focus on wind gearboxes that in turn will strengthen the geographical presence of Eickhoff in Asia. Storage, assembly, and testing of gearboxes up to a size of 8 MW would be the key functions of the unit. In April 2022, Flender, German drive specialist completed an acquisition of Moventas, a Finnish wind turbine gearbox manufacturer from investor N4 partners. Under the agreement, engineering and service capabilities of Moventas are subjected to be used for boosting Flender’s wind drives business.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONWind Turbine Gearbox Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increase in Number of Wind Farm is Driving the Wind Turbine Gearbox Market Growth

Growing focus on mitigating greenhouse gas emissions and rising concerns about increasing levels of environmental pollution are boosting the application of renewable energy sources in different end-use industries, which, in a way, is also fueling the demand for wind energy. Nearly 77.6 GW of new wind power capacity was installed, and the total installed capacity reached ~906 GW in 2022 globally. The increasing government initiatives toward funding wind projects and maintaining the old wind farms are boosting the demand for wind turbine towers globally. As per the US Energy Information Administration, Wind Prime (Iowa), Empire Wind 2 (New York), Beacon Wind (New York), Boswell Springs Wind (Wyoming), Seven Cowboy Wind Project (Oklahoma), Baird North Wind Facility (Texas), Badger Wind Project (North Dakota), Monte Alto I Wind and Monte Alto II Wind Projects (Texas), 25 Mile Creek Windfarm (Oklahoma), and Ranchland Wind Project II (Texas) were among the major wind farm projects in the US in 2022. Likewise, in Asia Pacific, the growing governmental focus on promoting renewable energy is fueling the number of wind projects. For instance, Pinnapuram Integrated Renewable Energy Project, Yudean Yangjiang Qingzhou I Offshore Wind Farm, MacIntyre Wind Farm, Yuedean Yangjiang Qingzhou II Offshore Wind Farm, and Abukuma Onshore Wind Farm were a few major wind projects in Asia Pacific in 2022. Gruissan Floating Offshore Wind Farm, Les Moulins de Lohan Wind Farm, Dobele Wind Farm, Maasvlakte 2 Wind Farm, and Askio III Wind Farm are among the major wind farms anticipated to be active during 2023–2025. The increase in wind project financing drives the wind turbine tower market. For instance, in 2023, Innergex Renewable Energy secured US$ 534 million in construction financing for developing Boswel Spring Wind Project in the US. In 2022, The Asian Development Bank sealed a US$ 107 million financing project with BIM Wind Power Joint Stock Company to help the operation of an 88 MW wind farm in Ninh Thuan province, Vietnam.

Thus, the increasing governmental initiative and funding, along with the growing inclination toward wind energy as one of the prominent renewable energy sources, is boosting the demand for wind turbine gearboxes globally. The growing number of wind farms is acting as a major driver for the wind turbine gearbox market.

Segmental Analysis:

Based on gearbox type, the wind turbine gearbox market is bifurcated into planetary gearboxes, spur gearboxes, and others. In 2022, the planetary gearboxes segment acquired a larger share of the global wind turbine gearbox market owing to their compact and small design with high-efficiency features. Many gearboxes at a 1.5 MW rated power range of wind turbines utilize a one- or two-stage planetary gearing system, which is also known as an epicyclic gearing system. Since planetary gearboxes are highly efficient, they persist with strong resistance to shock and a high torque to weight ratio. The planetary gearboxes have better stability as compared to other wind turbine gearboxes. This feature is contributing to the adoption of planetary gearboxes. However, planetary gearboxes use steel gear, which makes them prone to wear and noisy. Spur gears are mounted on parallel shafts and possess straight teeth. These gears are available in different gear ratios and sizes to fulfill requirements specific to torque and speed. These types of gears are majorly made up of brass or steel and sometimes are built using nylon and polycarbonate. The spur gear offers efficient speed control and has high torque output, which makes it ideal for wind turbines.

Regional Analysis:

Asia Pacific dominates the wind turbine gearbox market owing to its growing emphasis on integrating renewable energy resources in the overall power mix and target of mitigating the environmental pollution caused by fossil fuels. China dominates the market in terms of onshore and offshore wind installations. The growing focus of turbine gearbox manufacturers on the supply chain ecosystem is also majorly impacting the overall wind turbine gearbox market positively. The rising positive approach towards encouraging the utilization of green energy resources instead of conventional sources for power generation by funding renewable projects, subsidies, and policies is boosting the demand for wind turbine gearboxes in India and Australia. The growing number of new wind capacity installations across Japan and South Korea is also boosting the demand for wind turbine gearboxes in the Asia Pacific.

Wind Turbine Gearbox Market Regional InsightsThe regional trends and factors influencing the Wind Turbine Gearbox Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Wind Turbine Gearbox Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Wind Turbine Gearbox Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5,565.36 Million |

| Market Size by 2030 | US$ 11,581.50 Million |

| Global CAGR (2022 - 2030) | 9.6% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Wind Turbine Gearbox Market Players Density: Understanding Its Impact on Business Dynamics

The Wind Turbine Gearbox Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Wind Turbine Gearbox Market top key players overview

Key Player Analysis:

Siemens Gamesa Renewable Energy SA, General Electric, Mitsubishi Heavy Industries, Vestas Wind Systems, Elecon Engineering Company Limited, ME Production AS, ZF Friedrichshafen AG, Flender GmbH, Dana Motion Systems, Stork Gears & Services BVare are among the key wind turbine gearbox market players profiled during this study. In addition, several other important wind turbine gearbox market players have been studied and analyzed during the study to get a holistic view of the wind turbine gearbox market and its ecosystem.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the wind turbine gearbox market. A few recent developments by the key wind turbine gearbox market players are listed below:

Date |

News |

Region |

|

June-2022 |

In June 2022, Eickhoff Wind Asia, Germany-headquartered company has established a new manufacturing unit near Chennai India). The new unit facility would focus on wind gearboxes that in turn will strengthen the geographical presence of Eickhoff in Asia. Storage, assembly, and testing of gearboxes up to a size of 8 MW would be the key functions of the unit |

Europe |

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For