Prefilled Syringes Market: Trends, Market Size & Forecast to 2034

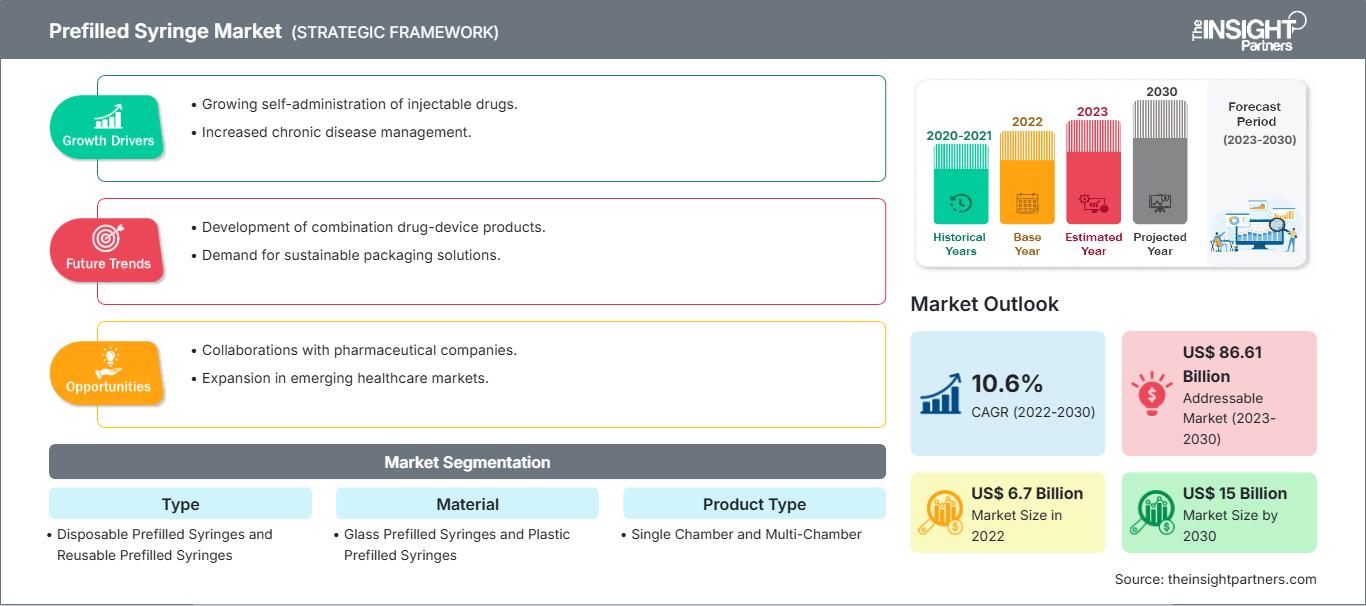

Prefilled Syringes Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Prefilled Syringes and Reusable Prefilled Syringes), Material (Glass Prefilled Syringes and Plastic Prefilled Syringes), Product Type (Single Chamber and Multi-Chamber), Application (Cancer, Diabetes, Cardiovascular Disease, Autoimmune Disease, Infectious Disease, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Channel)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Status : Published

- Report Code : TIPHE100001332

- Category : Life Sciences

- No. of Pages : 329

- Available Report Formats :

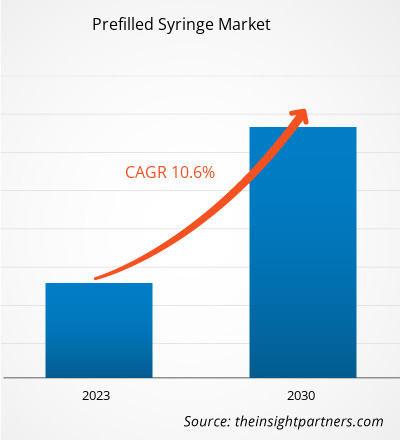

The Prefilled Syringes market size is projected to reach US$ 20.32 Billion by 2034 from US$ 8.83 Billion in 2025. The market is expected to register a CAGR of 9.9% during 2026–2034.

Prefilled Syringes Market Analysis

As a result of an increasing number of patients suffering from chronic diseases, increasing immunization initiatives, and the increased need for accurate and convenient means to administer medications, the prefilled syringes market is expanding greatly. Innovations such as self-administered injectors and safety prefilled syringes, as well as combination products, improve patient adherence and reduce the risk of dosing error. Despite the complexities of manufacturing, regulatory compliance issues, and the lack of adequate cold-chain storage, there are numerous opportunities for biologics manufacturing, self-administering practices, as well as government support in immunization programs and injectable therapeutics.

Prefilled Syringes Market Overview

Demand for prefilled syringes is surging as more people seek safer ways to dose their medications, including vaccines, biologic medicine, and specialty medications. Prefilled syringes, often known generically as auto-injectors or safety-engineered devices, provide users with accurate dosing and help to reduce the potential for error in administering medications. They are desirable options for patients with chronic conditions, elderly patients, and those who are self-injected. Innovations developed in combination drug-device products, ready-to-use devices, and advances in materials will make it easier for hospitals to incorporate prefilled syringes into their workflows. The increasing understanding of the potential benefits of injecting medications, a rise in immunization programs being initiated, and more pending drug approvals for biologic agents are accelerating adoption rates. Leading manufacturers are placing greater focus on improving the safety profile and compatibility of prefilled syringes with currently utilized drug delivery infrastructure and enhancing ease of use. As healthcare access programs and immunization initiatives in developing countries expand, prefilled syringes will become an essential component of a pharmaceutical drug delivery system.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPrefilled Syringes Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Prefilled Syringes Market Drivers and Opportunities

Market Drivers:

- Rising Prevalence of Chronic Diseases: The rise in incidences of diabetes, cancer, and autoimmune disorders has created a need for injectable drug delivery systems.

- Advancements in Biologics and Biosimilars: With the introduction of more complex biologic drug formulations, there has been an increase in the use of prefilled syringe systems to provide accurate and safe administration of these products.

Market Opportunities:

- Chronic Disease Prevalence and Patient‑Centric Injection Needs: With the increase in the number of individuals living with chronic medical conditions, there is an increased demand for an at-home, self-administered, safe, and convenient method of administering injectable medications.

- Expanded Vaccination Programs and Public Health Initiatives: Through immunization efforts and government initiatives, prefilled syringe systems have been used worldwide.

Prefilled Syringes Market Report Segmentation Analysis

The prefilled syringes market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Disposable Prefilled Syringes: Single-use syringes reduce contamination risk, improve safety, and support widespread vaccination and hospital infection-control practices globally.

- Reusable Prefilled Syringes: Designed for multiple uses with proper sterilization, supporting cost efficiency in controlled clinical and institutional settings.

By Material:

- Glass Prefilled Syringes: Preferred for biologics due to high chemical resistance, stability, transparency, and long-term drug compatibility.

- Plastic Prefilled Syringes: Lightweight and break-resistant alternatives offer design flexibility, enhanced safety, and suitability for high-volume manufacturing.

By Product Type:

- Single Chamber

- Multi-Chamber

By Application:

- Cancer

- Diabetes

- Cardiovascular Disease

- Autoimmune Disease

- Infectious Disease

- Others

By Distribution Channel:

- Hospital Pharmacy

- Retail Pharmacy

- Online Channel

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Prefilled Syringes Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 8.83 Billion |

| Market Size by 2034 | US$ 20.32 Billion |

| Global CAGR (2025 - 2031) | 9.9% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Prefilled Syringes Market Players Density: Understanding Its Impact on Business Dynamics

The Prefilled Syringes Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Prefilled Syringes Market Share Analysis by Geography

North America is leading the way in the prefilled syringe business due to the amount of drug manufacturing taking place in the region, the number of biologic products available for purchase, the vaccination efforts currently occurring throughout the country, and the strong infrastructure within the healthcare systems. Europe ranks next in importance due to the stringent regulations and due to the increased use of injectable medications as a result of the presence of large pharmaceutical companies. APAC is growing at the highest rate due to a significant increase in the number of drug manufacturers establishing facilities, increased incidence of chronic illness, and the ongoing development of extensive vaccination campaigns within developing countries, such as China and India. Within the MEA, the adoption of pre-filled syringes is occurring, although gradually, in part due to a growing ability to gain access to quality health services in this region. There continue to be concerns over the affordability of healthcare and the continuing development of proper system infrastructures. South and Central America see a steady increase in this market segment, due to the establishment of new public health programs, the growth of vaccination campaigns, and an increasing level of public education regarding the importance of having safe and effective systems for administering medications.

Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers:

- High prevalence of chronic diseases requiring injectable therapies

- Strong pharmaceutical manufacturing base and favorable reimbursement policies

- Trends: Increased adoption of self-administration devices and home-based injectable therapies

2. Europe

- Market Share: Substantial market share

- Key Drivers:

- An aging population and growing demand for biologics and vaccines

- Stringent regulatory standards ensure drug safety and quality

- Trends: Expansion of safety-engineered prefilled syringes and combination drug-device products

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

- Key Drivers:

- Rapid growth in pharmaceutical manufacturing and healthcare infrastructure

- Increasing vaccination programs and chronic disease awareness

- Trends: Fastest Regional Growth in Premium and Connected Devices.

4. South and Central America

- Market Share: Growing market with steady progress

- Key Drivers:

- Expanding public healthcare systems and immunization initiatives

- Increasing access to injectable therapies

- Trends: Preference for affordable, standardized prefilled syringe formats.

5. Middle East and Africa

- Market Share: Although small, but growing quickly

- Key Drivers:

- Government healthcare investments and expanding immunization coverage

- Rising demand for safe injectable drug delivery

Trends: Gradual adoption of prefilled syringes in public hospitals and vaccination programs

Opportunities and Strategic Moves

- In October 2025, West Pharmaceutical Services, Inc announced the launch of its West Synchrony Prefillable Syringe (PFS) System at CPHI Worldwide in Frankfurt, Germany. This innovative system marks a significant shift in drug delivery solutions by offering a fully verified platform from a single supplier that will be commercially available in January 2026.

- In October 2025, to accelerate self-administration and homecare, SCHOTT Pharma launched a large-volume prefillable glass syringe.

- In January 2026, BD invested US$ 110M to expand production of prefillable syringes.

Other companies analyzed during the course of research:

- Vetter Pharma International GmbH

- Catalant Inc.

- Elcam Medical

- Oval Medical Technologies

- SHL Medical AG

- Haselmeier AG

- Owen Mumford

- Unilife Corporation

- Abbott Laboratories

- Bayer AG

- Medtronic PLC

- AptarGroup Inc.

- Helvoet Rubber & Plastic Technologies Inc.

- F. Haffmann-La Roche Ltd.

- Thermo Fischer Scientific Inc.

- Bruker

- Immunoexpress Inc.

- Oval Technologies Ltd

- Boditech med Inc.

- SHL Medical AG

Prefilled Syringes Market News and Recent Developments

- In October 2025, Becton, Dickinson and Company announced a strategic partnership with Ypsomed, a leading provider of injection systems, to enhance self-injection solutions for high-viscosity biologic drugs. Through a joint initiative, BD and Ypsomed have pre-assessed and optimized the integration of the BD Neopak XtraFlow Glass Prefillable Syringe with Ypsomed’s YpsoMate 2.25 autoinjector platform. This collaboration addresses existing challenges by enabling the delivery of biologic drugs with viscosities exceeding 15cP in an autoinjector format.

Prefilled Syringes Market Report Coverage and Deliverables

The "Prefilled Syringes Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Prefilled Syringes market size and forecast at global, regional, and country levels for all the segments covered under the scope

- Prefilled Syringes market trends, as well as dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Prefilled Syringes market analysis covering key trends, global and regional framework, major players, regulations, and recent developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the prefilled syringes market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For