Prepaid Card Market Size, Share, and Growth Analysis by 2031

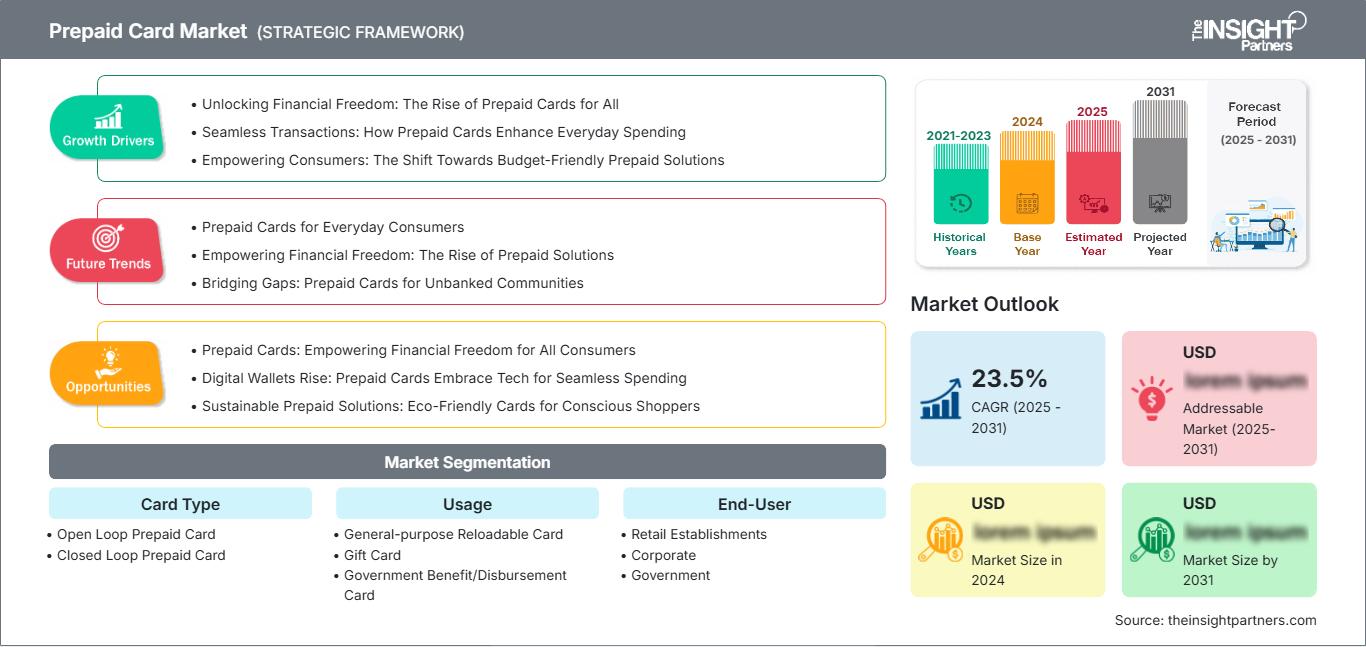

Prepaid Card Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Card Type (Open Loop Prepaid Card, Closed Loop Prepaid Card); Usage (General-purpose Reloadable Card, Gift Card, Government Benefit/Disbursement Card, Payroll Card, and Others); End-User (Retail Establishments, Corporate, and Government); and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2026

- Report Code : TIPRE00039062

- Category : Banking, Financial Services, and Insurance

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

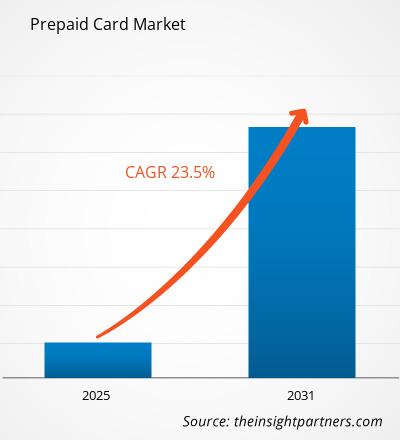

The Prepaid Card Market is expected to register a CAGR of 23.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX million by 2031.

The report is categorized by Card Type (Open Loop Prepaid Card, Closed Loop Prepaid Card) and further analyzes the market based on Usage (General-purpose Reloadable Card, Gift Card, Government Benefit/Disbursement Card, Payroll Card). It also examines the market by End-User (Retail Establishments, Corporate, Government) . A comprehensive breakdown is provided at global, regional, and country levels for each of these key segments.

The report includes market size and forecasts across all segments, presenting values in USD. It also delivers key statistics on the current market status of leading players, along with insights into prevailing market trends and emerging opportunities.

Purpose of the Report

The report Prepaid Card Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Prepaid Card Market Segmentation

Card Type

- Open Loop Prepaid Card

- Closed Loop Prepaid Card

Usage

- General-purpose Reloadable Card

- Gift Card

- Government Benefit/Disbursement Card

- Payroll Card

End-User

- Retail Establishments

- Corporate

- Government

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPrepaid Card Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Prepaid Card Market Growth Drivers

- Unlocking Financial Freedom: The Rise of Prepaid Cards for All

- Seamless Transactions: How Prepaid Cards Enhance Everyday Spending

- Empowering Consumers: The Shift Towards Budget-Friendly Prepaid Solutions

Prepaid Card Market Future Trends

- Prepaid Cards for Everyday Consumers

- Empowering Financial Freedom: The Rise of Prepaid Solutions

- Bridging Gaps: Prepaid Cards for Unbanked Communities

Prepaid Card Market Opportunities

- Prepaid Cards: Empowering Financial Freedom for All Consumers

- Digital Wallets Rise: Prepaid Cards Embrace Tech for Seamless Spending

- Sustainable Prepaid Solutions: Eco-Friendly Cards for Conscious Shoppers

Prepaid Card Market Regional Insights

The regional trends and factors influencing the Prepaid Card Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Prepaid Card Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Prepaid Card Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2025 - 2031) | 23.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Card Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Prepaid Card Market Players Density: Understanding Its Impact on Business Dynamics

The Prepaid Card Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Prepaid Card Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Prepaid Card Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Prepaid Card Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For