Radiation Oncology Market Developments and Forecast by 2031

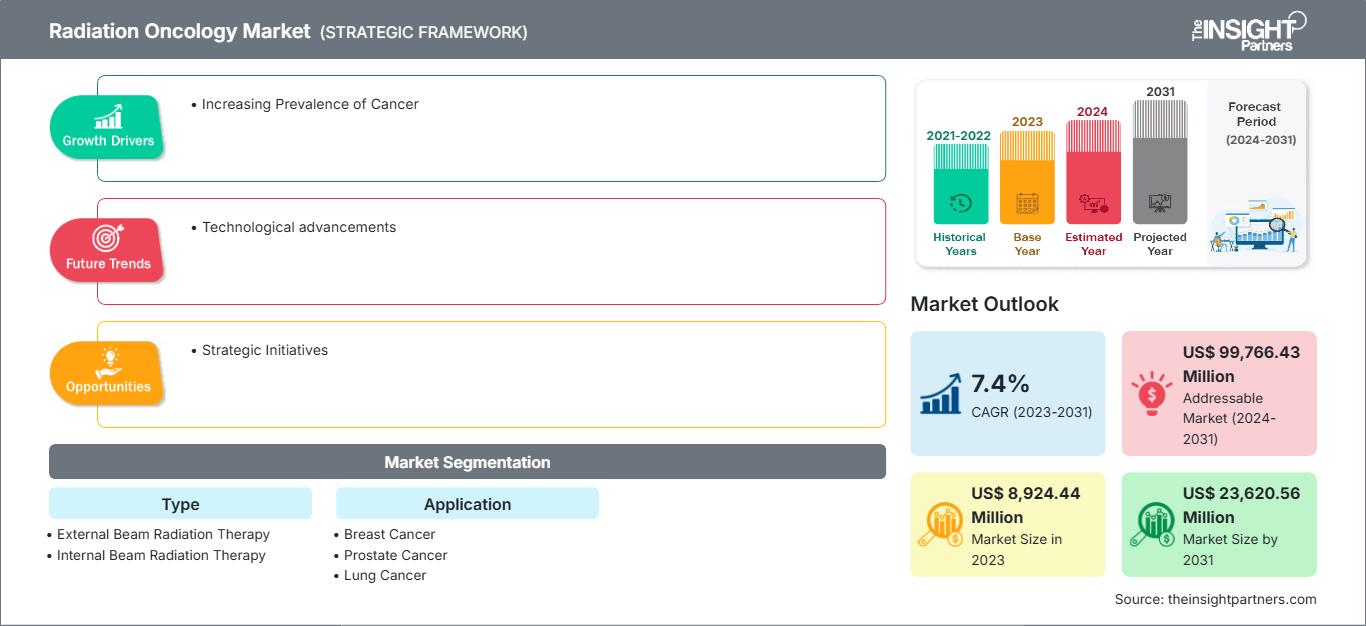

Radiation Oncology Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (External Beam Radiation Therapy and Internal Beam Radiation Therapy), Application (Breast Cancer, Prostate Cancer, Lung Cancer, Head & Neck Cancer, Cervical Cancer, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Status : Published

- Report Code : TIPRE00004195

- Category : Life Sciences

- No. of Pages : 170

- Available Report Formats :

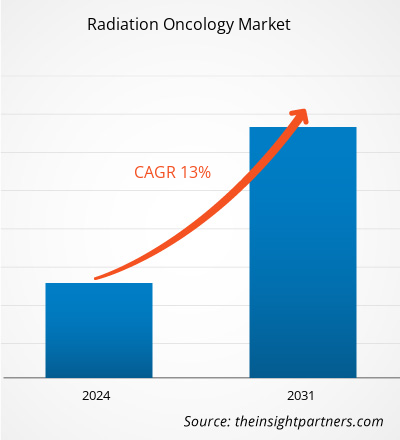

The radiation oncology market size is projected to reach US$ 23,620.56 million by 2031 from US$ 8,924.44 million in 2023. The market is expected to register a CAGR of 13.0% in 2023–2031. Technological advancements in radiation oncology are likely to bring key trends in the market in the coming years.

Radiation Oncology Market Analysis

Governments and private entities are investing in healthcare infrastructure, including radiation therapy centers, to enhance service quality and availability. Thus, the radiation oncology market is driven by initiatives to support developments in radiation oncology for better and effective patient outcomes, along with the increasing prevalence of cancer. Moreover, companies in the radiation oncology market engage in product launches, product approvals, partnerships, mergers and acquisitions, which are expected to create ample opportunities in the market in the coming years.

Radiation Oncology Market Overview

Radiation oncology is one of the fastest-developing cancer treatment modalities. Technological advancements and increasing awareness among large populations are among the major factors contributing to the radiation oncology market growth. North America dominates the radiation oncology market, and Asia Pacific is expected to register the highest CAGR during the forecast period. Market growth in Asia Pacific is attributed to the presence of developing economies that hold ample growth opportunities. Cancer has quickly become a public health concern in India. Approximately 1.39 million cancer cases were reported in the country in 2020. The disease was also ranked among the world's leading causes of death in 2020, accounting for approximately 10 million deaths. To combat cancer more successfully, the Government of India has implemented several initiatives that focus on investing resources in building adequate infrastructure for cancer care as well as in implementing mass-scale programs for prevention, control, and screening of common cancer types.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONRadiation Oncology Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Radiation Oncology Market Drivers and Opportunities

Increasing Prevalence of Cancer Favor Radiation Oncology Market

Cancer is one of the common health conditions significantly impacting societies worldwide. According to the World Health Organization (WHO), it is the leading cause of death across the world; it was the cause of 20 million new cancer cases and 9.7 million deaths in 2022. The number of new cancer cases is expected to reach ~35 million new cancer cases by 2050. As per the WHO 2024 report, lung cancer is the most common cancer cause of mortality globally, followed by colorectal cancer, liver cancer, breast cancer, and stomach cancer, which are responsible for 18.7%, 9.3%, 7.8%, 6.9%, and 6.8% of the total cancer related deaths, respectively. The incidences of the top 10 cancer types are mentioned in the table below:

Statistics at Glance, Global, 2022

Cancer |

Total New Cases, 2022 |

|

Lung |

2 480 675 |

|

Breast |

2 296 840 |

|

Colorectum |

1 926 425 |

|

Prostate |

1 467 854 |

|

Stomach |

968 784 |

|

Liver |

866 136 |

|

Thyroid |

821 214 |

|

Cervix Uteri |

662 301 |

|

Bladder |

614 298 |

|

NHL |

553 389 |

Source: Global Cancer Observatory

The increasing incidence of cancer results in a huge demand for effective treatment options. Radiotherapy is one of the continuously evolving treatment options with effective outcomes for cancer patients. The method of intervention utilizes high doses of radiation such as X-rays and gamma rays to kill cancer cells. Radiation therapy is mainly prescribed in patients with the early stages of cancer, while it can be used at any point in the treatment. Various types of external beam radiotherapy are used for the treatment of different cancer types. For instance, brachytherapy is used for the treatment of breast cancer, cervix cancer, eye cancer, prostate cancer, and head & neck cancer. Further, systemic radiation therapy, also known as radioactive iodine therapy, is used for the treatment of thyroid cancer. Thus, the increasing prevalence of cancer and the evolution of radiotherapy in oncology bolsters the radiation oncology market growth.

Strategic Initiatives to Create Opportunities for Radiation Oncology Market Growth

Companies in the radiation oncology market are making continuous efforts in terms of product developments, innovations, launches, and approvals; mergers; acquisitions; and partnerships to contribute to the evolution of radiotherapy. A few of the recent strategic initiatives that took place in the market in recent years are mentioned below.

- In May 2024, Elekta launched its latest linear accelerator (linac) named Evo. This computed tomography (CT) linac with new high-definition, AI-enhanced imaging is capable of delivering offline and online adaptive radiation therapy along with image-guided radiation therapy treatments with improved standards.

- In May 2024, the Icon Group collaborated with Cyberknife Australia Pty Ltd to establish up to 6 new radiation oncology clinics (proposed joint ventures) with the goal of providing radiation oncology treatments using the “Cyberknife” system.

- In May 2024, GE HealthCare launched Revolution RT, a new CT radiation therapy solution with innovative hardware and software offerings, to help enhance imaging accuracy while simplifying simulation workflow for a more personalized and seamless cancer care process for clinicians and patients.

- In April 2024, Accuray Incorporated showcased advancements in hardware and software designed to improve the cancer treatment experience at ESTRO 2024. The latest-generation CyberKnife and Radixact platforms provide medical care teams with the technology necessary for expanding the curative power of radiation therapy.

- In October 2023, CIVCO Radiotherapy and Qfix collaboratively launched a new brand CQ Medical. The company focuses on the improvement of cancer care and patient outcomes, with deep engagement in the field with clinicians and technology partners.

- In September 2023, MVision AI launched the first comprehensive Guideline-Based Segmentation (GBS) solution, harnessing the abilities of its Guide, Verify, and Contour+ offerings for effective radiation therapy contouring. The Guide facilitates clinical teams to accurately evaluate AI-generated structures, thus enabling them to refine their contouring skills. The Verify system allows the visual and volumetric comparison of contours, facilitating clinics to observe similarities and differences. The combined implementation of Guide, Verify, and Contour+ encompasses all clinical needs in radiotherapy contouring.

Therefore, strategic initiatives by market players operating in the radiation oncology market are expected to create ample opportunities for the radiation oncology market in the coming years

Radiation Oncology Market Report Segmentation Analysis

Key segments that contributed to the derivation of the radiation oncology analysis are type and application.

- Based on type, the radiation oncology market is bifurcated into external beam radiation therapy and internal beam radiation therapy. The external beam radiation therapy segment held a larger share of the market in 2023; however, internal beam radiation therapy is anticipated to register a higher CAGR during the forecast period.

- By application, the market is segmented into breast cancer, prostate cancer, lung cancer, head & neck cancer, cervical cancer, and others. The breast cancer segment held the largest share of the market in 2023; it is further anticipated to register the highest CAGR during 2023–2031.

Radiation Oncology Market Share Analysis by Geography

The geographic scope of the radiation oncology report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. North America dominates the radiation oncology market, which can be attributed to the increasing prevalence of cancer along with technological advancement in the region. The US is expected to account for the dominating share of the market in this region. The number of professionals having radiation treatment expertise is also on the rise in the country, which can be attributed to the accessibility of a developed healthcare infrastructure. As per the American Society of Clinical Oncology, approximately two-thirds of cancer patients globally are estimated to receive radiation therapy as a part of their treatment. In 2022, over 1 million cancer patients in the US received radiation therapy. The government and healthcare authorities are taking several initiatives to encourage the adoption of radiotherapy. In June 2020, the American Society for Radiation Oncology (ASTRO) introduced new clinical guidelines regarding radiotherapy for nonmetastatic cervical cancer. The new guidelines focus on precisely implementing steps and processes to conduct radiation therapy. Asia Pacific is anticipated to record the highest CAGR during 2023–2031.

Radiation Oncology Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8,924.44 Million |

| Market Size by 2031 | US$ 23,620.56 Million |

| Global CAGR (2023 - 2031) | 7.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Radiation Oncology Market Players Density: Understanding Its Impact on Business Dynamics

The Radiation Oncology Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Radiation Oncology Market News and Recent Developments

The radiation oncology market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Curium has submitted a new drug application (NDA) for its lutetium-177 (Lu-177) DOTATATE radiopharmaceutical for the treatment of somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors (GEP-NETS). The radiopharmaceutical is designed to be injected into patients to deliver Lu-177 radiation directly to tumors. (Curium, Company Website, July 2024)

- IBA has signed a contract with the Connecticut Proton Therapy Center, a collaboration between Yale New Haven Health, Hartford HealthCare, and Proton International, for the installation of a Proteus ONE compact proton therapy system. (IBA, Company Website, May 2024)

- Varian has received 510(k) clearance from the US Food and Drug Administration (FDA) and the CE mark in the European Union for Halcyon and Ethos radiotherapy systems featuring Varian's HyperSight imaging solution. HyperSight enables clinicians to capture high-quality images of patients during their daily radiation treatments. (Varian, Company Website, February 2024)

Radiation Oncology Market Report Coverage and Deliverables

The "Radiation Oncology Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Radiation oncology market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Radiation oncology market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Radiation oncology market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the radiation oncology market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For