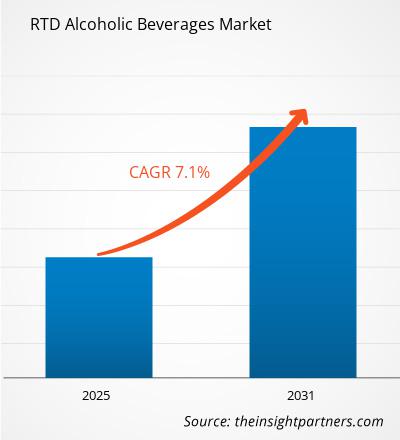

The RTD alcoholic beverages market size is projected to reach US$ 75.30 billion by 2031 from US$ 46.64 billion in 2024. The market is expected to register a CAGR of 7.1% during 2025–2031. The rising demand for low/reduced sugar alcoholic beverages is expected to create a new trend in the RTD alcoholic beverages market during the forecast period.

RTD Alcoholic Beverages Market Analysis

The RTD alcoholic beverages market is driven by the growing premiumization and innovation in RTD alcoholic beverages. Key market players focusing on launching new innovative flavors are contributing to the market growth. As urbanization rises and busy lifestyles become the norm, there is an increasing demand for convenient, ready-to-consume drink options that align with health-conscious choices. The popularity of low/reduced sugar alcoholic beverages, has surged due to their perceived lighter, healthier image compared to traditional alcoholic beverages. Additionally, innovations in flavors and product offerings are continually enticing new consumers, particularly among younger demographics.

RTD Alcoholic Beverages Market Overview

Ready-to-drink (RTD) alcoholic beverages are pre-mixed drinks that are ready for immediate consumption. They cover various options, including hard seltzers, canned cocktails, and wine spritzers, and are usually available in single-serve packs. The RTD alcoholic beverages market has witnessed significant growth, driven by changing consumer preferences and lifestyle trends. As urbanization accelerates and busy schedules become common, consumers are seeking convenient options that align with their health-conscious choices. In this context, hard seltzers have gained popularity due to their lighter and healthier image compared to traditional alcoholic drinks. The appeal of hard seltzers is enhanced by continuous innovations in flavors and product variations, attracting a diverse consumer base, particularly among younger demographics. As brands expand their offerings and tap into emerging markets, the RTD alcoholic beverages segment is poised for sustained growth, catering to a demand for refreshing and convenient drinks that fit modern lifestyles. Overall, this market is evolving rapidly, reflecting broader shifts in consumer behavior and preferences in the beverage industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

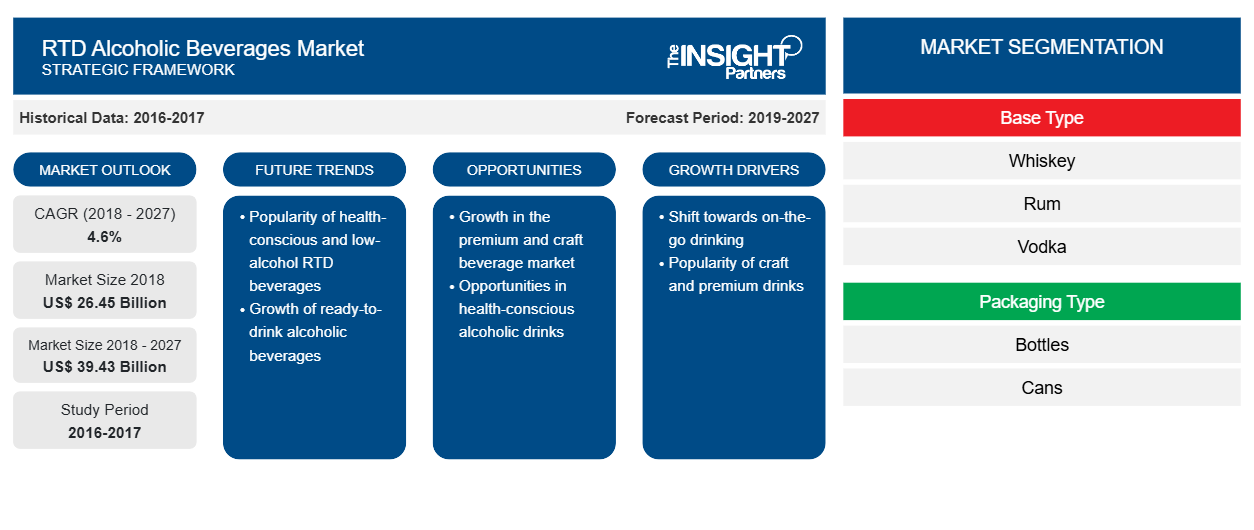

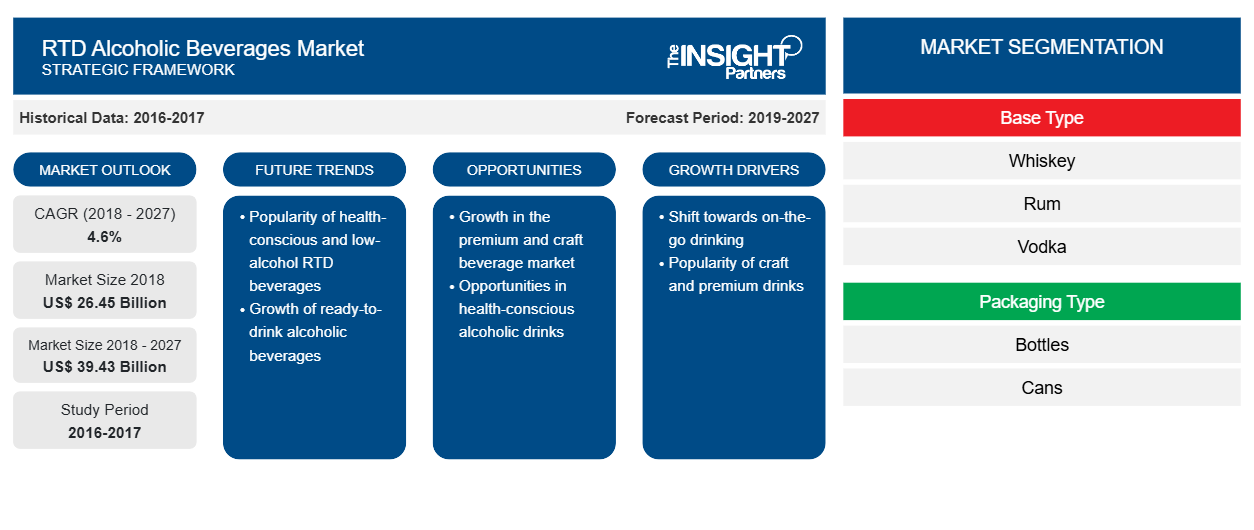

RTD Alcoholic Beverages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

RTD Alcoholic Beverages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

RTD Alcoholic Beverages Market Drivers and Opportunities

Marketing and Branding Strategies by Key Market Players

RTD alcoholic beverages and hard seltzers manufacturers are focusing on strategic development initiatives such as marketing, branding, and expansion of their businesses to attract consumers and enhance their market position. Market players leverage targeted marketing strategies that emphasize health-conscious messaging, influencer partnerships, innovative packaging, and digital-first advertising to capture evolving consumer preferences. The branding of these beverages as a healthy alternative to conventional beer and sugary cocktails propels their adoption. For instance, White Claw championed the "better for you" campaign, emphasizing low-calorie and low-sugar formulations that resonate with millennial and GenZ consumers who prioritize wellness without sacrificing drinking. Another strategy is intensive social media marketing, where brands capitalize on viral trends, memes, and influencer collaborations to drive engagement. Social media largely drove white Claw's rise in popularity through the "White Claw Summer" campaign, where consumers and influencers shared their experiences with the product.

Growth in the On-Trade and E-Commerce Channel

The rapid expansion of on-trade (i.e., bars, restaurants, and hotels) and e-commerce channels is expected to present significant growth opportunities for the market during the forecast period. The shift in consumer preference toward convenience, premium experiences, and digital shopping has fueled the demand for RTD alcoholic beverages across these channels. As the global hospitality industry advances, bars, restaurants, and entertainment venues incorporate RTD alcoholic beverages into their menus, recognizing the appeal among consumers seeking high-quality alternatives to traditional cocktails. One of the major factors fueling the on-trade channel is the increasing adoption of RTD cocktails in bars and restaurants, where consumers seek premium beverages associated with mixology-based cocktails. As per the National Restaurant Association report published in 2023, 84% of adults aged more than 21 years who drink wine, beer, or cocktails say restaurants are a great place to explore new alcoholic beverages. Beer (70%), wine (69%), and cocktail consumers (67%) are more likely to choose a restaurant based on its alcohol selection. 34% of adults age 21+ say they will drink a cocktail with a meal at a restaurant, and 21% say they will drink a cocktail with a meal at home. Millennials (44%) are the most likely to order a cocktail or mixed drink in a restaurant, followed by Gen X (35%).

RTD Alcoholic Beverages Market Report Segmentation Analysis

Key segments that contributed to the derivation of the RTD alcoholic beverages market analysis are product type, base type, packaging type, category, and distribution channel.

- Based on the product type, the market is segmented into hard seltzers, RTD cocktails, wine-based spritzers, and others. The RTD cocktails segment is expected to record the highest CAGR over the forecast period.

- In terms of base type, the market is categorized into malt-based, wine-based, and spirit-based. The spirit-based segment is anticipated to register the highest CAGR during the forecast period.

- By packaging type, the market is segmented into bottles, cans, and others. The cans segment accounted for the largest market share in 2024.

- As per category, the market is bifurcated into low/no sugar and regular. The low/no sugar segment is expected to dominate the market over the forecast period.

- On the basis of distribution channel, the market is bifurcated into on-trade and off-trade. The on-trade segment is expected to record the highest CAGR during the forecast period.

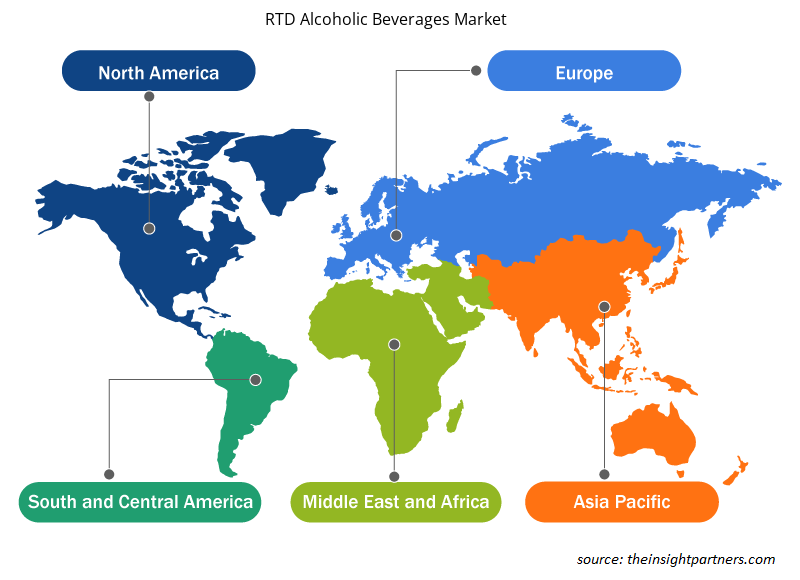

RTD Alcoholic Beverages Market Share Analysis by Geography

The geographic scope of the RTD alcoholic beverages market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The RTD alcoholic beverages market in Asia Pacific is expected to grow significantly during the forecast period.

In Asia Pacific, the demand for RTD alcoholic beverages and hard seltzers is increasing owing to shifting consumer preferences, particularly among the young and urban population. These consumers seek convenience, portability, and variety, making RTDs an attractive choice as they offer a hassle-free, premixed option for social gatherings and casual consumption. The rising health consciousness, along with increasing disposable incomes, is driving the popularity of low-alcohol and low-sugar alternatives. The growing social media and influencer culture has also helped popularize these products, aligning with a trend toward casual and inclusive drinking experiences.

RTD Alcoholic Beverages Market Regional Insights

The regional trends and factors influencing the RTD Alcoholic Beverages Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses RTD Alcoholic Beverages Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for RTD Alcoholic Beverages Market

RTD Alcoholic Beverages Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 46.64 Billion |

| Market Size by 2031 | US$ 75.30 Billion |

| Global CAGR (2025 - 2031) | 7.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

RTD Alcoholic Beverages Market Players Density: Understanding Its Impact on Business Dynamics

The RTD Alcoholic Beverages Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the RTD Alcoholic Beverages Market are:

- Bacardi Ltd

- Pernod Ricard SA

- Diageo Plc

- Beam Suntory Inc

- Heineken NV

- Firebrand Brewing Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the RTD Alcoholic Beverages Market top key players overview

RTD Alcoholic Beverages Market News and Recent Developments

The RTD alcoholic beverages market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the RTD alcoholic beverages market are as follows:

- ATRÓN Tequila announced the launch of the “Additive-Free Tequila” campaign, emphasizing its additive-free heritage and handcrafted production process. (Source: ATRÓN Tequila, Company Website, February 2025)

- The Coca-Cola Company and Bacardi Limited announced an agreement to debut BACARDÍ rum and Coca-Cola as a ready-to-drink (RTD) pre-mixed cocktail. BACARDÍ Mixed with Coca-Cola RTD is available in several markets worldwide, with the initial launch planned for select European markets and Mexico in 2025. (Source: The Coca-Cola Company, Company Website, September 2024)

RTD Alcoholic Beverages Market Report Coverage and Deliverables

The "RTD Alcoholic Beverages Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- RTD alcoholic beverages market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- RTD alcoholic beverages market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces analysis and SWOT analysis

- RTD alcoholic beverages market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the RTD alcoholic beverages market

- Detailed company profiles

Frequently Asked Questions

What is the estimated value of the RTD alcoholic beverages market by 2031?

The market size is projected to reach US$ 75.30 billion by 2031.

Which region dominated the RTD alcoholic beverages market in 2024?

North America dominated the market with the largest share in 2024.

Which are the leading players operating in the RTD alcoholic beverages market?

Bacardi Ltd, Pernod Ricard SA, Diageo Plc, Beam Suntory Inc, Heineken NV, Firebrand Brewing Limited, Anheuser-Busch InBev NV, Mark Anthony Brands International, RTM Beverages, Constellation Brands Inc, Spritz Bev Inc, Signal Hill Products Pty Ltd, RAMONA, The Boston Beer Co, and Molson Coors Beverage Co are among the key players operating in the market.

What will be the future trends in the RTD alcoholic beverages market?

The rising demand for low/reduced sugar RTD alcoholic beverages is likely to bring new trends in the market in the future.

What are the driving factors impacting the RTD alcoholic beverages market?

Premiumization and innovations in RTD alcoholic beverages and marketing and branding strategies by key market players are major factors contributing to market growth.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - RTD Alcoholic Beverages Market

- Bacardi Ltd

- Pernod Ricard SA

- Diageo Plc

- Beam Suntory Inc

- Heineken NV

- Firebrand Brewing Limited

- Anheuser-Busch InBev NV

- Mark Anthony Brands International

- RTM Beverages

- Constellation Brands Inc

- Spritz Bev Inc

- Signal Hill Products Pty Ltd

- RAMONA

- The Boston Beer Co

- Molson Coors Beverage Co

Get Free Sample For

Get Free Sample For