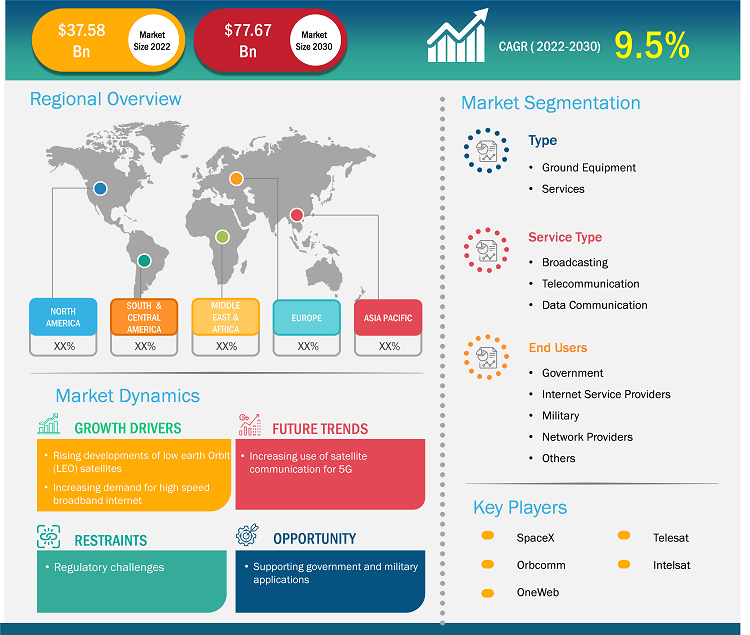

The satellite communication market size is expected to grow from US$ 37.58 billion in 2022 to US$ 77.67 billion by 2030; it is estimated to grow at a CAGR of 9.5% from 2022 to 2030.

Analyst Perspective:

A communication satellite in Earth's orbit is used to transmit information from one location to another in a system known as satellite communication. There are various applications across the globe requiring signal transmissions to different locations on Earth. This includes satellite news gathering, telecommunications, weather forecasting, television transmission, catastrophe warnings, and search and rescue missions. The market is evolving rapidly, and the current state of digitalization is playing a major role in the process. The need for low latency networks, stronger communication mediums, and a large number of connected devices are all driving the market growth. Some of the most crucial developments to keep an eye on in the satellite communication market include the rise in small satellites, the usage of low-Earth orbit (LEO), launches using reusable rocket launch vehicles, and new applications for 5G and the Internet of Things (IoT).

The market is witnessing an increasing number of space explorations and massive developments in the aviation industry, two of the major end users in the satellite communication market. Key market players are investing heavily in next-generation telecommunication technologies to enhance their satellite communication services such as critical communication, broadband, video broadcasting and others. For instance, in July 2023, Yashat Group of UAE announced the company’s plans to allocate over US$ 100 million for its T4-NGS satellite program. This comes over the already invested US$ 2 billion in satellite equipment and ground infrastructure. This will enhance the company’s multi-mission satellite services across 150 countries.

Market Overview:

Satellite communications entail electromagnetic spectrum-based communication between terrestrial receivers and transponders on man-made satellites. The market for satellite communications is still expanding and offers vital enabling services to numerous companies and research communities. Performance, security, and resilient connectivity from satellite to teleport to customers and resources will become increasingly important—and more difficult—as a result of recent investments in high-bandwidth satellite capacity for consumer applications and the widespread adoption of small satellites. Today's organizations are becoming more and more virtual, and satellite technology is essential to the development of new business apps and IoT-related business processes. Additionally, because of the increased need for bandwidth per site, connectivity requirements will keep growing.

Satellite communication technology has been advancing at a significant pace. A large number of satellites are being launched into space. Many of the current satellite launches and those of the future involve heavy use of IoT devices. Low-earth orbit launches are becoming quite important with the view of developing new satellite communications systems. For instance, Apple announced in September 2022 that it would employ the LEO constellation of Globalstar to offer an emergency SOS through satellite service for its most recent iPhone 14 models. Customers who wish to utilize the service must point their phones directly at the sky to catch an orbiting Globalstar satellite because Apple put an inbuilt antenna at the top of the iPhone 14's cover.

5G communications is expected to grow in the coming years. The increasing demand for 5G satellite communication for low latency and high-speed connectivity to reduce the communication gaps between remote areas of the world is further driving the developments in the satellite communication market.

Strategic Insights

Market Driver:

Rising Developments of Low Earth Orbit (LEO) Satellites to Drive Growth of Satellite Communication Market

LEO is a compelling option for providers of satellite broadband, positioning, navigation, and timing (PNT-GPS augmentation or replacement) and remote sensing services (also referred to as "Non-Terrestrial Networks" or "NTN"). This is due to shorter latency, better and more reliable communications, and comparatively affordable launch costs made possible by the close proximity to Earth. Due to the rising developments in the LEO satellites and remote sensing applications, the global satellite communication market is expanding significantly. The industry is being driven by major players like SpaceX, Planet Labs, and Boeing, thanks to their technological breakthroughs and business alliances. These satellites find applications in communication, weather monitoring, and earth observation, among others. For instance, according to a 2021 report by Aerospace America, by the end of 2021, it was conservatively estimated that SpaceX Starlink and OneWeb had launched 1,016 and 316 LEO satellites, respectively, bringing their mega constellation totals to 1,969 and 420 satellites, with a total gross aggregate capacity of more than 36 terabits per second. The continuous developments in advanced communication systems in Earth’s low orbit are driving the growth of the satellite communication market.

Segmental Analysis:

Based on service type, the satellite communication market is segmented into telecommunication, broadcasting, and data communication. A thriving satellite communication market has emerged as a result of proliferating advancements in satellite technology, offering a range of services to broadcasters, ISPs, governments, the military, and other industries. Telephone calls and services offered to wireless, mobile, and cellular network providers, as well as telephone businesses, are examples of telecommunication services.

Through the use of portable wireless technology, mobile communications offer users two-way voice or data communications services. In most cases, satellite mobile communications service providers use Geostationary Orbit (GEO), Medium Earth Orbit (MEO), or Low Earth Orbit (LEO) satellites to relay signals up from a handset or terminal and back down to a ground station where the signal interfaces with the public telephone network or the internet. Users of satellite telephones may be able to send and receive text messages as well as phone calls almost anywhere. Users can connect using satellite data modems without relying on terrestrial mobile networks. Machine-to-machine (M2M) data may also be made available by satellite service providers for a variety of purposes, such as tracking or monitoring. For instance, according to a June 2022 report, the first and only space-based cellular network being built by Vodafone Group partner AST SpaceMobile, which is accessible directly from conventional mobile phones, confirmed the plans to launch its BlueWalker 3 test satellite. In August 2022, plans for direct satellite-to-cellphone connections were launched by T-Mobile and SpaceX in collaboration. T-Mobile's service initially planned to solely transmit texts and calls.

However, the absence of uniform and open regulatory frameworks is one of the major obstacles to the satellite communication market in emerging economies and regions. For satellite communication market operators and service providers, separate laws and regulations apply to licensing, spectrum allotment, taxation, and market access. For SATCOM stakeholders, this regulation uncertainty and complexity may be exacerbated by some of these regulations being outdated, inconsistent, or prohibitive.

Regional Analysis:

The North American satellite communication market was valued at US$ XX billion in 2022 and is projected to reach US$ XX billion by 2030; it is expected to grow at a CAGR of XX% during the forecast period. North America holds one of the largest global satellite communication market shares. High technology adoption trends in the space and telecommunication industry in the North American region have fueled the growth of the satellite communication market. The region has been witnessing high investments in defense and government sectors for establishing low-latency communication networks. For instance, in August 2023, as part of a 10-year IDIQ U.S. Space Force contract, Intelsat was selected to supply commercial satellite communications bandwidth, hardware, and services to the U.S. Defense Department.

Moreover, in September 2023, The U.S. Space Force awarded Artel LLC, a provider of secure network communication services to U.S. government agencies, a Commercial Satellite Communications Proliferated Low Earth Orbit (p-LEO) contract. Artel LLC is collaborating with Rivada Space Networks to provide the next-generation network necessary to support U.S. Government communications.

Key Player Analysis:

The Satellite Communication market analysis consists of players such as Thales Group, Inmarsat Global Limited, Iridium Communication Inc., Gilat Satellite Networks Ltd, Orbcomm Inc., Viasat, Space X (Starlink), Eutelsat, OneWeb; Kuiper Systems are among the key Satellite Communication market players profiled in the report.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Satellite Communication market. A few recent key market developments are listed below:

- In July 2023, To get authorizations for establishing earth stations, Starlink submitted an application to the Indian National Space Promotion & Authorization Centre (IN-SPACe). This came after the company applied for a global mobile personal communication by satellite services (GMPCS) license to the Department of Telecommunication (DOT) for the introduction of internet from space services under its Starlink brand in India.

- In September 2023, a cooperation between Eutelsat Communications and Can Marine Systems, a well-known supplier of maritime systems in Asia, was announced. The partnership offers marine firms operating at sea in Asia access to next-generation satellite communication services, enhancing connectivity and capabilities.

- In July 2023, a Tier 1 global telecommunications operator selected Gilat for the satellite connectivity of a significant utility company in Western Europe, according to an announcement made today by Gilat Satellite Networks Ltd., a global pioneer in satellite networking technology, solutions, and services.

- In January 2023, In order to connect its satellites to smartphones, Iridium signed a service provider agreement with a business that is generally assumed to be Samsung. The news follows Iridium's statement in July that it had secured a development agreement with a business to integrate its satellite technology into cell phones.

- In March 2023, owned by Bharti Enterprises, Together with SpaceX, owned by Elon Musk, OneWeb launched 40 new satellites into orbit from Florida's Cape Canaveral Space Force Station. With this launch, OneWeb's entire satellite fleet in orbit has increased to 582.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Satellite Communication Market Report Analysis

-

CAGR (2023 - 2031)9.50% -

Market Size 2023

US$ 41.15 Billion -

Market Size 2031

US$ 85.05 Billion

Report Coverage

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Industry landscape and competition analysis & recent developments

- Detailed company profiles

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

Key Players

- Thales Group

- Inmarsat Global Limited

- Iridium Communication Inc.,

- Gilat Satellite Networks Ltd

- Orbcomm Inc.,

- Viasat

- Space X (Starlink)

- Eutelsat

- OneWeb

- Kuiper Systems

Regional Overview

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Market Segmentation

By Type

By Type

- Ground Equipment and Services

By Service Type

By Service Type

- Broadcasting

- Telecommunication

- Data Communication

By End Users

By End Users

- Government

- Internet Service Providers

- Military

- Network Providers

- Others

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Satellite Communication Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 41.15 Billion |

| Market Size by 2031 | US$ 85.05 Billion |

| Global CAGR (2023 - 2031) | 9.50% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

- Thales Group

- Inmarsat Global Limited

- Iridium Communication Inc.,

- Gilat Satellite Networks Ltd

- Orbcomm Inc.,

- Viasat

- Space X (Starlink)

- Eutelsat

- OneWeb

- Kuiper Systems

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Satellite Communication Market

Apr 2024

Engineering Professional Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Consulting, Non-Consulting), Service Type (Designing and Construction, ESG, Program Management, Others), Sector (Private, Public), Vertical (Advanced Manufacturing, Infrastructure, Energy and Utilities, Environmental, Transportation, Others), Advanced Manufacturing (Data Center, Life Sciences, Electronics, and Semiconductor, EV and EV Battery, Others), Infrastructure (Buildings and Cities, Health Infrastructure, Telecommunication Infrastructure, Others), Energy And Utilities (Renewables, Energy Storage, Transmission and Distribution), Transportation (Aviation, Highways and Bridges, Ports and Maritime, Rail and Transit), Water (Water, Wastewater), and Geography (Americas, Europe, Asia Pacific and Middle East and Africa)

Apr 2024

Virtual Reality Puzzle Games Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Age (18 to 34 Years, Above 35 Years, 13 to 17 Years, and Upto 12 Years), Player Type (Single Player and Multi Player), and End Users (Individuals and Professionals)

Apr 2024

AI Data Management Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Offering (Solution and Service), Deployment (On-premise and Cloud), Technology [Machine Learning, Natural Language Processing (NLP), Computer Vision, and Context Awareness Computing], and Industry Vertical (BFSI, Retail & E-commerce, IT & Telecom, Healthcare, Government & Utilities, and Others), and Geography

Apr 2024

Mobile Threat Defense Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Operating System (Android and iOS), Enterprise Size (Large Enterprises and SMEs), and End-User (IT and Telecomm, BFSI, Manufacturing, Retail and E-commerce, Government, and Others)

Apr 2024

Spend Analytics for Electronics and Semiconductor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Component (Software and Service), Type (Descriptive Analytics, Predictive Analytics, and Prescriptive Analytics), Deployment (On-premise and Cloud), and Application (Financial Management, Risk Management, Governance and Compliance Management, Supplier Sourcing and Performance Management, Demand and Supply Forecasting, and Others)

Apr 2024

Photonic Design Automation Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Service), Deployment (On-Premise and Cloud), Organization Size (SMEs and Large Enterprises), and Application (Academic Research and Industrial Research & Manufacturing)

Apr 2024

Voice-based Payments Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware and Software), By Enterprise Size (Large Enterprises and Small and Medium-Sized Enterprises), By Industry (BFSI, Automotive, Healthcare, Retail, Government, and Others), and by Geography

Apr 2024

3D Reconstruction Technology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Active 3D reconstruction and Passive 3D reconstruction), Component (Software and Services), Deployment (On-Premises and Cloud), Enterprise Size (Large Enterprises and SMEs), and End-Use Industry (Automotive, Education, Aerospace & Defense, Healthcare, Media & Entertainment, Construction & Architecture, Government & Public Safety, and Others), and Geography