Satellite Transponders Leasing Market Size, Share, Trends & Opportunities 2034

Satellite Transponders Leasing Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Services, Application and Bandwidth

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPTE100000185

- Category : Aerospace and Defense

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

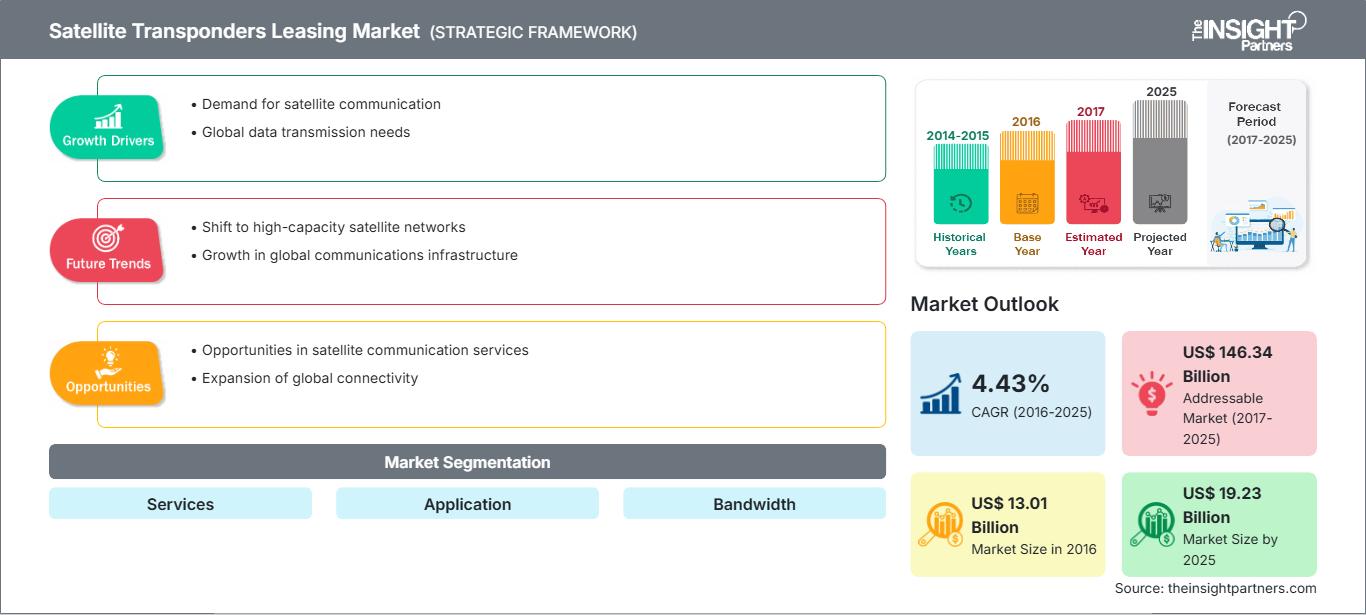

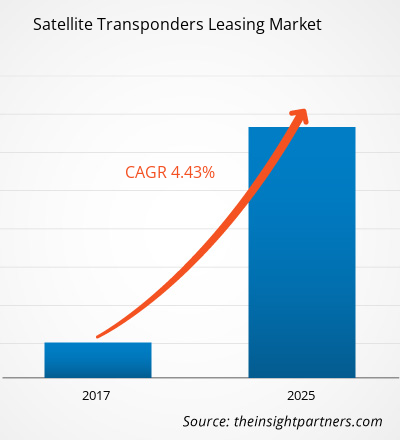

The satellite transponders leasing market size is expected to reach US$ 25.60 billion by 2034 from US$ 18.20 billion in 2025. The market is anticipated to register a CAGR of 4.36% from 2026–2034.

Satellite Transponders Leasing Market Analysis

The satellite transponders leasing market forecast indicates strong growth, driven by increasing demand for high-bandwidth connectivity, rising adoption of satellite-based communication in remote regions, and the expansion of telecom and broadcasting services globally. Strategic opportunities lie in government and defense contracts, the surge in OTT platforms, and the growing need for secure and reliable communication for navigation and remote sensing. Emerging technologies such as HTS (High Throughput Satellites), flexible payloads, and software-defined satellites are reshaping the competitive landscape, enabling providers to offer cost-effective and scalable leasing solutions. Market players are focusing on partnerships with telecom operators, integration of AI for bandwidth optimization, and expansion into underserved regions to capture untapped potential.

Satellite Transponders Leasing Market Overview

Satellite transponders leasing involves renting transponder capacity on communication satellites to transmit signals for applications such as broadcasting, telecom, navigation, and remote sensing. This service is critical for organizations that require global coverage without investing in satellite infrastructure. Leasing models offer flexibility, cost efficiency, and scalability, making them attractive for government agencies, telecom operators, and commercial enterprises. The market is witnessing significant traction due to the rise in data-intensive applications, growing demand for real-time connectivity, and the proliferation of satellite-based services in emerging economies. Advancements in Ka-band and Ku-band technologies, combined with the deployment of LEO and MEO constellations, are further accelerating market adoption.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSatellite Transponders Leasing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Satellite Transponders Leasing Market Drivers and Opportunities

Market Drivers:

- Growing Demand for High-Bandwidth Connectivity Across Industries: The exponential rise in data consumption, driven by streaming services, cloud computing, and remote work, has created a surge in demand for high-speed connectivity. Terrestrial networks often fail to cover remote or underserved regions, making satellite transponder leasing a critical solution for telecom operators, broadcasters, and enterprises. This demand is further amplified by the need for real-time data transfer in sectors like aviation, maritime, and oil & gas, where connectivity is mission-critical.

- Expansion of Government and Defense Applications: Governments and defense agencies increasingly rely on satellite communication for secure data transmission, surveillance, disaster response, and navigation. Leasing transponders provides flexibility for short-term missions and cost efficiency compared to owning dedicated satellites. The growing geopolitical tensions and emphasis on national security have accelerated investments in satellite-based communication systems, creating a steady demand for leasing services.

- Proliferation of Remote Sensing and Navigation Services: Industries such as agriculture, mining, and environmental monitoring require Earth observation and remote sensing capabilities. Leasing transponders enables these organizations to access advanced satellite infrastructure without incurring high capital costs. Additionally, the rise of autonomous vehicles and precision navigation systems has increased the need for reliable satellite connectivity, further driving market growth.

Market Opportunities:

- Integration of High Throughput Satellites (HTS) and Software-Defined Payloads: HTS technology offers significantly higher data capacity compared to traditional satellites, while software-defined payloads allow dynamic bandwidth allocation and service customization. Providers that incorporate these technologies into their leasing models can deliver cost-effective, scalable solutions, attracting customers seeking flexibility and performance optimization.

- Emerging Market Adoption and Financial Inclusion Initiatives: Regions such as Asia Pacific, Africa, and Latin America present untapped potential due to limited terrestrial infrastructure and growing demand for connectivity. Governments in these regions are launching digital inclusion programs, creating opportunities for satellite operators to offer localized leasing solutions tailored to regional payment methods, languages, and regulatory frameworks.

- Strategic Partnerships with Telecom Operators and OTT Platforms: The surge in OTT content consumption and broadband demand has opened doors for collaborations between satellite operators and telecom companies. Bundled offerings that combine transponder leasing with managed services, analytics, and cybersecurity can differentiate providers in a competitive market. These partnerships also enable operators to penetrate new verticals such as aviation, maritime, and enterprise connectivity.

Satellite Transponders Leasing Market Report Segmentation Analysis

By Services:

- Protected: These transponders guarantee uninterrupted service even during congestion or interference. They are preferred for mission-critical applications such as defense, government communications, and emergency response, where reliability is paramount.

- Unprotected: Unprotected services offer cost-effective leasing without guaranteed priority during congestion. They are widely used for commercial broadcasting and telecom services where occasional interruptions are acceptable.

- Preemptable: Preemptable transponders provide the lowest-cost option but can be reclaimed by the operator for higher-priority customers. Ideal for short-term projects, research, and non-critical applications where flexibility outweighs guaranteed availability.

By Application:

- Government & Military: Used for secure communication, surveillance, and navigation. Leasing allows agencies to scale capacity for specific missions without investing in dedicated satellites.

- Telecom: Supports broadband connectivity, backhaul for mobile networks, and OTT content delivery in remote regions. Leasing helps telecom operators expand coverage quickly.

- Commercial: Includes broadcasting, enterprise connectivity, and maritime/aviation services. Businesses lease transponders to ensure global reach for data and media transmission.

- Research & Development: Enables universities and research institutions to access satellite capacity for Earth observation, climate studies, and experimental projects without high capital costs.

- Navigation: Supports GPS augmentation and precision navigation for aviation, shipping, and autonomous vehicles. Leasing ensures flexibility for evolving navigation needs.

- Remote Sensing: Critical for environmental monitoring, disaster management, and resource mapping. Leasing provides cost-effective access to high-resolution data transmission.

By Bandwidth:

- Ku-Band: Popular for broadcasting and VSAT services due to its balance of coverage and cost. Ideal for DTH television and enterprise connectivity.

- Ka-Band: Offers higher throughput and speed, making it suitable for broadband internet and data-intensive applications. Increasingly used in aviation and maritime connectivity.

- C-Band: Known for reliability and resistance to rain fade, making it essential for telecom backhaul and critical communication in tropical regions.

- Others (S, L, X & K): Specialized bands are used for military, scientific, and niche applications such as radar, deep-space communication, and secure government networks.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Satellite Transponders Leasing Market Regional Insights

The regional trends and factors influencing the Satellite Transponders Leasing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Satellite Transponders Leasing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Satellite Transponders Leasing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 18.20 Billion |

| Market Size by 2034 | US$ 25.60 Billion |

| Global CAGR (2026 - 2034) | 4.36% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered | By ServicesBy ApplicationBy Bandwidth |

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Satellite Transponders Leasing Market Players Density: Understanding Its Impact on Business Dynamics

The Satellite Transponders Leasing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Satellite Transponders Leasing Market top key players overview

Satellite Transponders Leasing Market Share Analysis by Geography

North America:

- Market Share: Largest share due to advanced satellite infrastructure and strong demand from telecom and defense sectors.

- Key Drivers:

- High adoption of OTT and broadband services

- Government investments in secure satellite communication

- Expansion of aerospace and defense programs

- Trends: Integration of AI for bandwidth optimization and deployment of HTS for high-speed connectivity.

Europe:

- Market Share: Significant share driven by broadcasting and navigation services.

- Key Drivers:

- Growth in satellite-based broadband for rural areas

- Increasing demand for Earth observation and remote sensing

- Regulatory support for space-based communication initiatives

- Trends: Adoption of software-defined satellites and Ka-band technology.

Asia Pacific:

- Market Share: Fastest-growing region due to rising telecom penetration and government-led space programs.

- Key Drivers:

- Expansion of DTH and OTT platforms

- Government initiatives for digital connectivity in rural areas

- Increasing investments in LEO and MEO constellations

- Trends: Partnerships between satellite operators and telecom providers for broadband services.

Central & South America:

- Market Share: Emerging region with growing demand for connectivity in remote areas.

- Key Drivers:

- Rising adoption of satellite broadband for underserved regions

- Growth in commercial broadcasting services

- Government programs for disaster management and navigation

- Trends: Leasing models tailored for cost-sensitive markets and integration of Ku-band for broadcasting.

Middle East & Africa:

- Market Share: Developing market with high growth potential due to limited terrestrial infrastructure.

- Key Drivers:

- Increasing demand for secure communication in the defense and government sectors

- Expansion of telecom services in remote regions

- Investments in space programs and satellite launches

- Trends: Adoption of Ka-band for high-speed internet and partnerships for regional connectivity.

Satellite Transponders Leasing Market Players Density: Understanding Its Impact on Business Dynamics

The market is moderately competitive, with global and regional players focusing on innovation, cost optimization, and strategic partnerships. Differentiation strategies include:

- Deployment of HTS and software-defined satellites

- Flexible leasing models and dynamic bandwidth allocation

- Integration of managed services and analytics

Opportunities and Strategic Moves:

- Collaborations with telecom operators and OTT platforms

- Expansion into emerging markets with localized solutions

- Investment in AI-driven bandwidth optimization and cybersecurity

Major Companies Operating in the Satellite Transponders Leasing Market Are:

- SES S.A.

- Intelsat S.A.

- Eutelsat

- Telesat

- Arabsat

- AsiaSat

- SingTel Optus

- MEASAT satellite systems

- ISRO

Disclaimer: The companies listed above are not ranked in any particular order

Satellite Transponders Leasing Market News and Recent Developments

- In April 2025, Telesat, one of the world's largest and most innovative satellite operators, announced that Viasat Inc. had signed a substantial multi-year contract for Satellite Transponders Leasing under Telesat Lightspeed Low Earth Orbit (LEO) services. As part of its multi-orbit strategy, Viasat planned to integrate Telesat Lightspeed into its services portfolio for aviation, maritime, enterprise, and defense markets.

- SES announced that its latest pair of O3b mPOWER satellites had been successfully launched into space by a SpaceX Falcon 9 rocket from Kennedy Space Center in Florida, United States, at 5:26 pm local time. Both satellites joined the first six O3b mPOWER spacecraft already in operation at medium Earth orbit (MEO), adding incremental capacity for Satellite Transponders Leasing to the initial O3b mPOWER constellation.

Satellite Transponders Leasing Market Report Coverage and Deliverables

The "Satellite Transponders Leasing Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

1. Growing demand for high-bandwidth connectivity

2. Expansion of government and defense applications

3. Proliferation of remote sensing and navigation services

2. Software-defined payloads

3. AI-driven bandwidth optimization

2. Asia Pacific is the fastest-growing region, driven by telecom expansion and government-led space programs.

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For