Social Trading Platform Market Size, Share & Industry Growth by 2034

Social Trading Platform Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Platform (PC and Mobile), End User (Individual Traders and Professional Traders), and Asset Class (Equity, Commodity, Derivatives, Crypto, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Status : Data Released

- Report Code : TIPRE00027510

- Category : Technology, Media and Telecommunications

- No. of Pages : 150

- Available Report Formats :

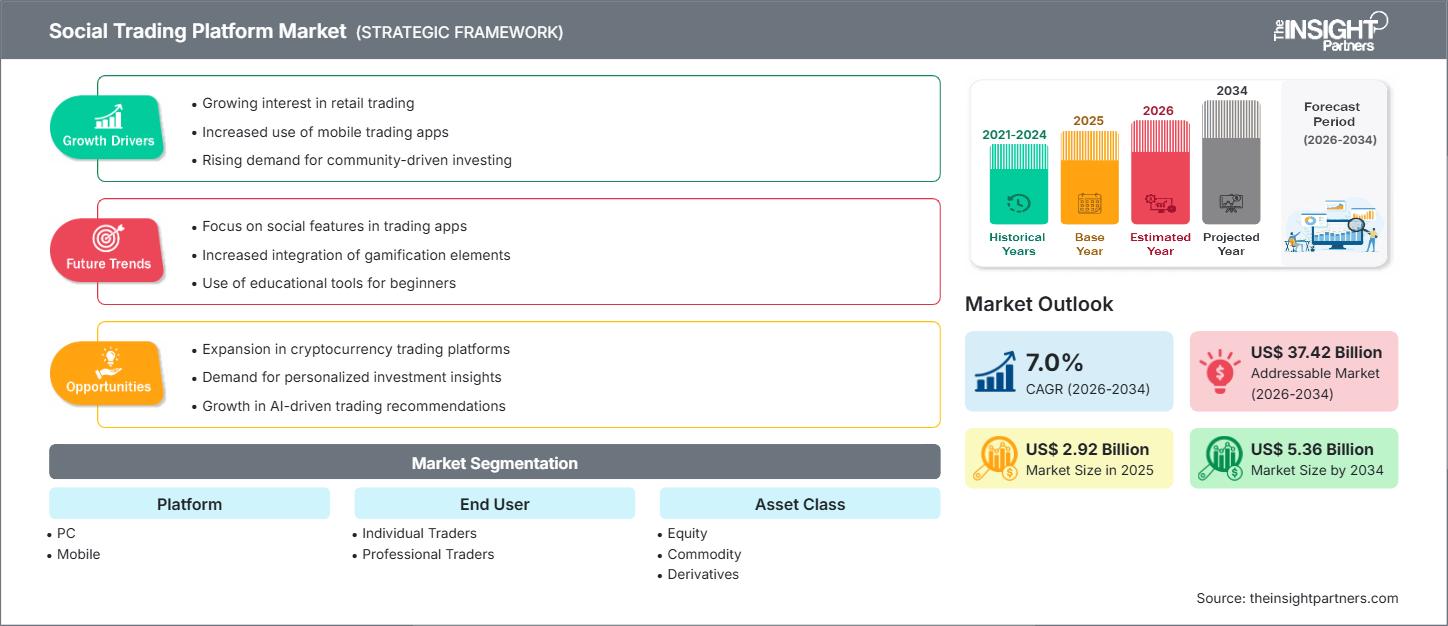

The global Social Trading Platform Market size is projected to reach US$ 4.93 Billion by 2034 from US$ 2.56 Billion in 2025. The market is anticipated to register a CAGR of 7.9% during the forecast period 2026–2034.

Social Trading Platform Market Analysis

The social trading platform market is expanding steadily as retail investors increasingly seek to follow, copy, or collaborate with more experienced traders via online platforms. The growth is being driven by:

- The rise of mobile-first trading solutions, especially among millennial and Gen Z users.

- Integration of social features (copy trading, community insights) into trading platforms, making trading more accessible and collaborative.

- Utilisation of advanced technologies such as AI-driven trading algorithms, machine learning, and big data analytics to provide improved user experience, predictive accuracy, and personalised trading strategies.

- The increasing penetration of online communities, social networks, and more democratized access to financial markets.

Social Trading Platform Market Overview

Social trading platforms blend social network elements with trading/investment functionality, enabling users to interact, share strategies, copy trades, view others’ performance, and so on. They provide tools for novice and expert traders alike to engage in more collaborative and transparent trading activities.

As these platforms become more mature, they offer greater analytics, social features, asset variety (stocks, forex, crypto), and mobile accessibility, all of which enhance engagement, lower barriers to entry, and fuel growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSocial Trading Platform Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Social Trading Platform Market Drivers and Opportunities

Market Drivers:

- Rise in retail investor participation and demand for more user-friendly/trading‑social platforms.

- Growth of mobile trading, social sharing of investment insights, and community-based decision making.

- Advances in trading technology (AI/ML, algorithmic suggestions, data analytics) are improving trading outcomes and platform attractiveness.

- Demand for transparency, ease of use, and social features in trading platforms.

Market Opportunities:

- Expansion of offerings into newer asset classes (cryptocurrencies, derivatives) integrated with social trading features.

- Development of mobile apps with enhanced social engagement, copy‑trading, strategy sharing, and automated suggestions.

- Further integration of AI and analytics in social trading platforms to personalise strategies, provide insights, social sentiment analysis, and improve user retention.

- Growth opportunities in emerging markets where mobile penetration and interest in retail investing are rising.

Social Trading Platform Market Report Segmentation Analysis

The social trading platform market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Platform Type:

- Mobile applications

- PC

By User Type / Trader Type:

- Individual traders

- Professional traders

By Asset Class:

- Equities

- Crypto

- Commodity

- Derivatives

By Region (Geography):

- North America

- Europe

- Asia‑Pacific

- South & Central America

- Middle East & Africa

Social Trading Platform Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 2.56 Billion |

| Market Size by 2034 | US$ 4.93 Billion |

| Global CAGR (2026 - 2034) | 7.90% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Social Trading Platform Market Players Density: Understanding Its Impact on Business Dynamics

The Social Trading Platform Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Social Trading Platform Market Share Analysis by Geography

North America region accounted for a social trading platform market share. The U.S. dominates the social trading platform market, driven by its robust financial infrastructure and rapid adoption of advanced trading technologies. The Asia Pacific (APAC) region is rapidly emerging as a significant market for social trading platforms, driven by the rise of retail investors, increased smartphone usage, and growing internet penetration.

The social trading platform market shows a different growth trajectory in each region due to factors such as the rising need for customized trading platforms and the rising benefits of integration of chatbots with trading platforms. Below is a summary of market share and trends by region:

North America

- Market Share: Holds the largest share globally due to ‑a well-developed trading infrastructure, high mobile/trader adoption, and an advanced fintech ecosystem.

- Key Drivers: High penetration of trading apps, strong regulatory/fintech environment, advanced trading platforms, and investor sophistication.

- Trends: Growth of mobile/social trading features, copy trading popularity, community-based trading.

Europe

- Market Share: Significant, supported by mature financial markets and emerging retail trading interest.

- Key Drivers: Regulatory frameworks (MiFID, etc), adoption of social trading among retail traders, fintech growth.

- Trends: Multi-asset social trading platforms, cross-border platforms, European regulatory responses.

Asia‑Pacific

- Market Share: Among the fastest‑growing due to rising digital/ mobile adoption, increasing retail investor base, and growing interest in trading.

- Key Drivers: Rising smartphone/internet penetration, growing middle class and financial literacy, emerging social/fintech ecosystems.

- Trends: Localised social trading platforms, integration with mobile wallets, interest in cryptocurrencies and forex among retail.

South & Central America

- Market Share: Emerging region with opportunity, though starting from a smaller base.

- Key Drivers: Increasing retail investor interest, improving digital infrastructure, growth of fintech, and mobile access.

- Trends: Social trading adoption is more gradual but growing, partnerships/local platforms driving uptake.

Middle East & Africa

- Market Share: At an early stage but with strong growth potential thanks to rising digital finance, younger demographics, and interest in alternative trading.

- Key Drivers: National fintech/financial inclusion strategies, increasing mobile adoption, desire for new investment vehicles.

- Trends: Mobile trading apps with social features, copy‑trading for new investor segments, ‑and region-specific regulatory evolution.

Social Trading Platform Market Players Density: Understanding Its Impact on Business Dynamics

The social trading platform market is witnessing intensified competition due to the presence of major global technology providers alongside emerging niche players and specialized startups. Companies are actively innovating to strengthen their market position and meet the growing demand for intelligent decision-making platforms across industries.

The competitive landscape is driving vendors to differentiate through:

- Major trading/brokerage platforms expanding into social trading.

- New entrants focusing purely on social/copy‑trading, community features, and mobile-first experiences.

- Differentiation via platform usability, asset class variety (crypto, stocks, forex), social features (copying, sharing, live feed), educational content, regulatory compliance, and analytics/AI.

- Regulatory and trust issues: As more retail investors engage, platforms must ensure transparency, risk‑management, AML/KYC compliance, and ethical operations.

- Increased competition is driving innovation: social features, mobile experiences, multi-asset integration, AI-driven insights, and user community engagement.

Opportunities and Strategic Moves

- Platforms expanding socially‑enabled trading communities, where users follow/copy top traders and share strategies.

- Integration of AI-powered recommendation engines, sentiment analysis, and real-time analytics into social trading platforms.

- Mobile-first design, gamification, collaborative features, and educational tools aimed at retail investors.

- Geographic expansion into emerging markets (Asia‑Pacific, Latin America, MEA) with localisation, mobile access, and asset diversification.

- Partnerships and acquisitions: Established brokers or fintechs acquiring or partnering with social‑trading tech firms to capture growth.

- Broadening asset classes: Incorporating cryptocurrencies, forex, commodities, and derivatives in social trading environments to attract a diverse trader base.

Major Companies Operating in the Social Trading Platform Market Are:

- eToro

- A-Trade

- ZuluTrade

- Tornado

- MetaQuotes

- PrimeXBT

- Pepperstone Markets Limited

- Tickmill

- Octa Markets Incorporated

- Assetgro Fintech Pvt. Ltd (Stockgro)

Disclaimer: The companies listed above are not ranked in any particular order.

Social Trading Platform Market News and Recent Developments

- For instance, on October 29, 2025, eToro, the trading and investing platform, announced that it is bringing its patented CopyTrader™ technology to US users. US users can instantly copy the investment strategies of real US traders across stocks, ETFs, or cryptoassets.

- On September 08, 2025, Public has acquired the retail brokerage accounts of Tornado, an AI platform for financial institutions. Tornado will continue scaling its unparalleled agentic AI research capabilities for institutional investors. More than 85,000 Tornado brokerage customers will migrate to the Public active trading platform, where they will be able to invest across a broad range of asset classes.

- For instance, on August 07, 2025, eToro Group Ltd., the trading and investing platform, announced how the company is harnessing artificial intelligence to redefine social investing. eToro is launching a suite of AI tools that will transform social investing by creating a community-built marketplace for investing built on top of eToro’s new public API. This marks a significant leap forward in the democratization of investing, arming retail traders and investors with sophisticated, AI-powered capabilities previously only accessible to quantitative hedge funds.

- On July 07, 2025, PrimeXBT, a leading multi-asset broker, introduced a series of updates across its platforms and trading conditions, aimed at delivering greater control, stronger risk management, and enhanced flexibility for traders. MetaTrader 5, PXTrader, and Crypto Futures: these enhancements reflect PrimeXBT's commitment to empowering traders with the tools needed to navigate today's fast-moving and volatile markets.

- In July 2023, Tickmill announced the launch of Tickmill Social Trading, an innovative integrated platform for Social Trading. This platform seamlessly connects Strategy Providers and Followers from any server at Tickmill, either on MT4 or MT5.

Social Trading Platform Market Report Coverage and Deliverables

The "Social Trading Platform Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Social Trading Platform Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Social Trading Platform Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Social Trading Platform Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Social Trading Platform Market. Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For