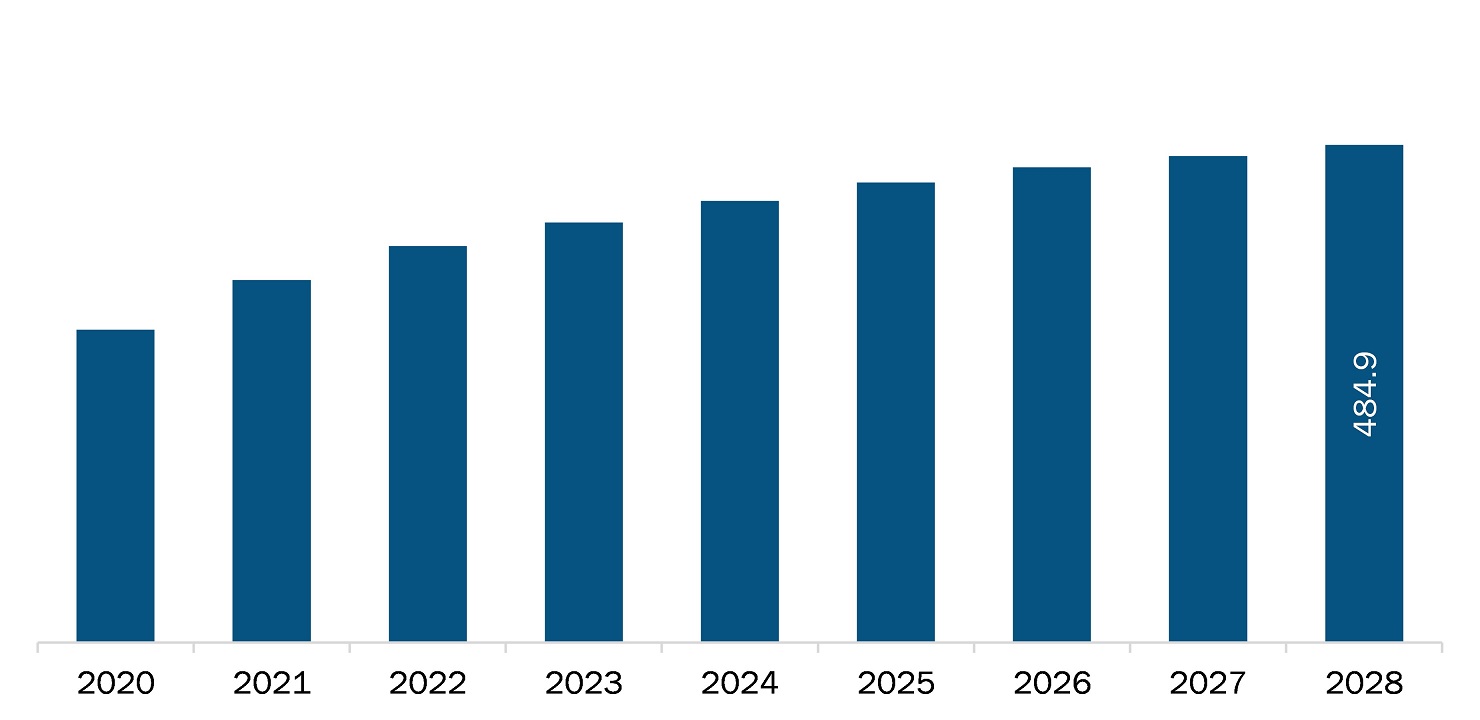

The South and Central America dual clutch transmission market is expected to reach US$ 484.87 million by 2028 from an estimated value of US$ 304.71 million in 2021; it is likely to grow at a CAGR of 4.6% from 2021 to 2028.

Growing sales of SUVs worldwide and increasing concerns about fuel economy and CO2 emission are driving the market. However, the increasing adoption of electric vehicles and their high costs may hamper the growth of the South and Central America dual clutch transmission market during the forecast period.

The demand for dual clutch transmission is increasing at a prime rate for SUVs. The rising demand for SUVs globally is boosting the growth of the dual clutch transmission market. The popularity of SUVs continues to grow in almost every market in the world. As the global marketplace declines following trade tensions and a slowdown in the Chinese market, car manufacturers look for new ways to expand their market. The shifting interest of customers from sedans or hatchbacks to SUVs started around seven years ago and is still growing strong. The increasing preference of consumers for SUVs is forcing vehicle manufacturers to focus on integrating advanced dual clutch transmission in vehicles. This corresponds with a drop in consumer spending capabilities. General Motors (GM) kept the lead but squandered market share to Toyota, Nissan, Ford, and Honda. FCA, the second-largest SUV manufacturer, overtook shares, owing to the new Jeep Wrangler and Compass. VW Group, Hyundai-Kia, Mazda, Subaru, and BMW Group were among the other major SUV market shareholders. Furthermore, advanced techniques such as dual clutch transmission systems are used by automotive OEMs to minimize fuel consumption and CO2 emissions while preserving performance. Hence, the increasing concern about fuel economy and CO2 emission will propel market growth.

Brazil recorded the highest number of COVID-19 cases in South and Central America, followed by Ecuador, Chile, Peru, and Argentina. The governments in South America (SAM) have taken an array of actions to protect their citizens and contain COVID-19’s spread. It is anticipated that South America will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to China, Europe, and the US, which are important trade partners. Containment measures in several countries of South America have impacted the manufacturing industry, including automotive manufacturing. Major automotive manufacturers have also temporarily closed their production process in the region, owing to cost control measures because of the pandemic.

Further, due to the non-availability of raw materials and supply chain disruption, the dual clutch transmission market had been negatively affected in 2020. In 2021, with the relaxation of lockdown measures and the beginning of the vaccination process, the shipment of raw materials needed for dual clutch transmission manufacturing and the manufacturing of passenger vehicles & commercial vehicles has started again. This will create a positive impact on the growth of the dual clutch transmission market in the region.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SOUTH AND CENTRAL AMERICA DUAL CLUTCH TRANSMISSION MARKET SEGMENTATION

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Propulsion Type

- Internal Combustion Engine (ICE)

- Hybrid

By Vehicle Segment

- A/B

- C

- D

- E and Above

- SUV

By Forward Gears

- 6 and Below

- 7

- 8 and Above

By Country

- Brazil

- Argentina

- Rest of South and Central America

Company Profiles

- Magna International Inc.

- Schaeffler Technologies AG & Co. KG

- BorgWarner Inc.

- Daimler AG

- Volkswagen AG

- ZF Friedrichshafen AG

- OC Oerlikon Management AG

- Ricardo

- Renault Group

- Hyundai Transys

South and Central America Dual Clutch Transmission Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 304.71 Million |

| Market Size by 2028 | US$ 484.87 Million |

| CAGR (2021 - 2028) | 4.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For