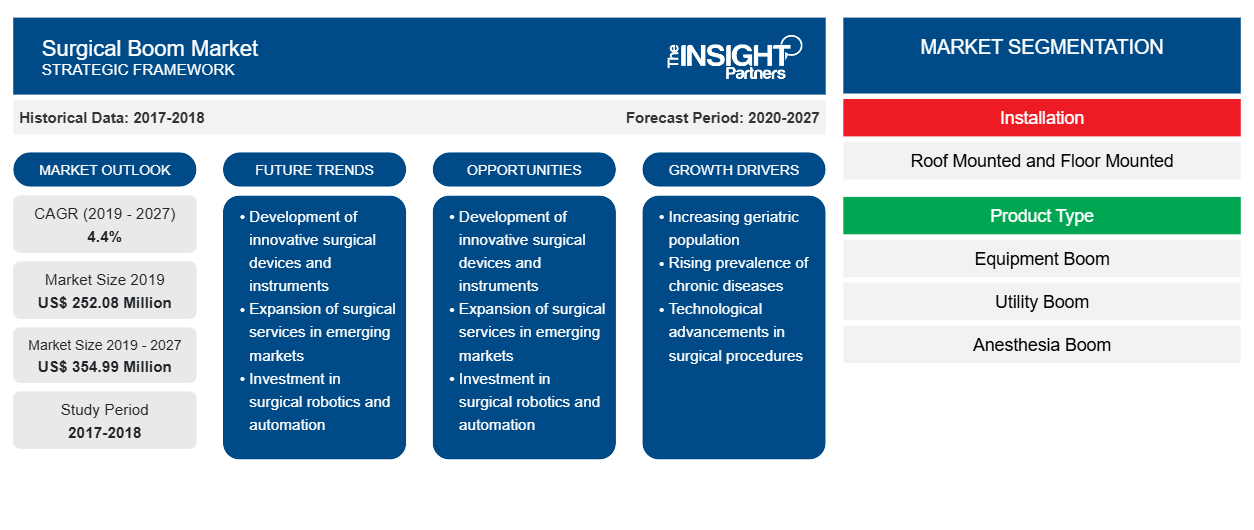

Surgical Boom Market Developments and Forecast by 2027

Surgical Boom Market Forecast to 2027 - Analysis by Installation ( Roof Mounted and Floor Mounted ); Product Type ( Equipment Boom, Utility Boom, Anesthesia Boom, and Custom Boom ); End-Use ( Hospitals, Ambulatory Surgical Centers, and Others ), and Geography

Historic Data: 2017-2018 | Base Year: 2019 | Forecast Period: 2020-2027- Status : Published

- Report Code : TIPRE00014171

- Category : Life Sciences

- No. of Pages : 198

- Available Report Formats :

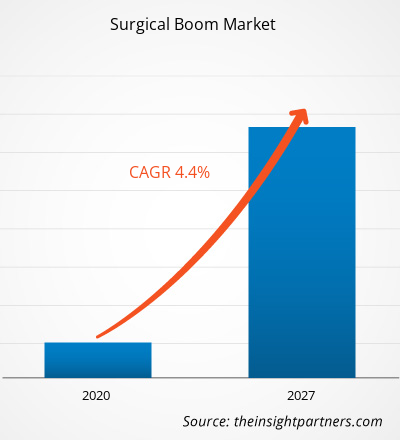

The surgical boom market was valued at US$ 252.08 million in 2019 and is projected to reach US$ 354.99 million by 2027; it is expected to grow at a CAGR of 4.4% from 2020 to 2027.

Surgical booms, also known as equipment columns or supply heads, are installed in healthcare facilities as they provide easy access to electrical power; audiovisual data services; and medical gasses such as oxygen, nitrogen, and carbon dioxide. Booms reduce the clutter caused by the cords and thus eliminate the risk of tripping hazards. They also have shelves that help in organizing and centralizing surgical equipment. The increasing number of surgeries, and the benefits of surgical booms such as flexibility, enhanced safety, and mobility are the major factor propelling the market growth. However, the troublesome functioning of surgical booms in hybrid operating rooms restricts the market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSurgical Boom Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Number of Surgical Procedures

Spike in the number of hospital admissions due to increase in geriatric population, mounting prevalence of chronic diseases, and surge in number of accidents, among others, has led to rise in number surgical procedures. As per the Lifespan Organization, cardiovascular disease is the leading cause of death in the US, and ~500,000 open surgeries are performed every year in the US. Surge in number of accidents and trauma cases is another factor boosting the number of surgeries being performed worldwide. Accident and emergency departments (A&E) in England reported ~70,231 patient visits every day in 2019, i.e., 4.8% higher than the count witnessed in 2018.

Technological advancements are enabling various hospitals and medical institutes to perform a large number of surgeries in a year. For instance, Taiwan’s Chang Gung Memorial Hospital performs ~167,000 surgeries in a year, and it claims to have performed the highest number of surgeries in the world. Further, in 2018, the All India Institute of Medical Sciences (AIIMS) performed the maximum number of surgeries, i.e., ~194,000 surgeries.

Introduction Government Initiatives to Promote Healthcare Modernisation

Government authorities in developed and developing countries are focusing on strengthening their healthcare sector through significant investments. For instance, the Government of India under its Pradhan Mantri Swasthya Suraksha Yojana—sanctioned USD 84,221,420 (INR 620 crore) for the construction of AIIMS-like institutions and USD 27,168,200 (INR 200 crore) for procuring medical equipment for establishing modular operation theaters. According to the Invest India, the hospital industry in India accounts for 80% of its total healthcare market, and it effectively attracting both global as well as domestic investors. The hospital industry in the country is expected to reach US$ 132 billion by 2023 from US$ 61.8 billion in 2017 at a CAGR of 16–17%. Similarly many healthcare investments are being made in Poland. The city of Kraków in Poland invested in three hospitals to expand their services. With these funds the Kraków center for rehabilitation and orthopedics aims to set up three new operating rooms, a recovery room, a blood bank, and a few new rooms for patients. Increase in such government activities is creating vital growth opportunities for the surgical boom market players to secure growth in the coming years.

Installation-Based Insights

Based on installation, the surgical boom market is segmented into roof mounted and floor mounted. The roof mounted segment held a larger share of the market in 2019, and the floor mounted segment is anticipated to register a higher CAGR of 4.8% during the forecast period. The roof mounted booms are ideal for the supply of electricity and medical gasses. The roof mounted booms allow easy provision and removal of medical gasses as per the hospital needs.

Product Type-Based Insights

Based on product type, the surgical boom market is segmented into equipment boom, utility boom, anesthesia boom, and custom boom. The utility boom segment held the largest share of the market in 2019, and the anesthesia booms segment is anticipated to register the highest CAGR of 5.9% during the forecast period. The utility booms feature a flexible arm with the connections to provide utility services such as video/data, gasses, and electricity in sterilized fields. It reduces the tripping hazard caused due to cables and cords. STERIS plc. offers HarmonyAIR Utility Hub with a flexible arm that provides power, data/video signal, and gas connections; the equipment is installed as a single mount or in tandem with surgical lights.

Product launch and expansion strategies are commonly adopted by the companies to expand their footprint worldwide, meet the growing demand by expanding their product portfolio. The key players operating in the surgical boom market have been adopting the strategy of product innovations to cater to changing customer demand worldwide, which also permits the players to maintain their brand name globally.

Surgical Boom Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 252.08 Million |

| Market Size by 2027 | US$ 354.99 Million |

| Global CAGR (2019 - 2027) | 4.4% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Installation

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Surgical Boom Market Players Density: Understanding Its Impact on Business Dynamics

The Surgical Boom Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

By Installation

- Roof Mounted

- Floor Mounted

By Product Type

- Equipment Boom

- Utility Boom

- Anesthesia Boom

- Custom Boom

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Spain

- Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- South and Central America (SCAM)

- Brazil

- Argentina

Company Profiles

- Steris Corporation

- Stryker Corporation

- Amico

- Getinge Group

- Dragerwerk AG & Co. KGaA

- Skytron

- C V Medical

- Medicana

- Hillrom

- Shenzhen Mindray Bio Medical Electronics Co., Ltd

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For