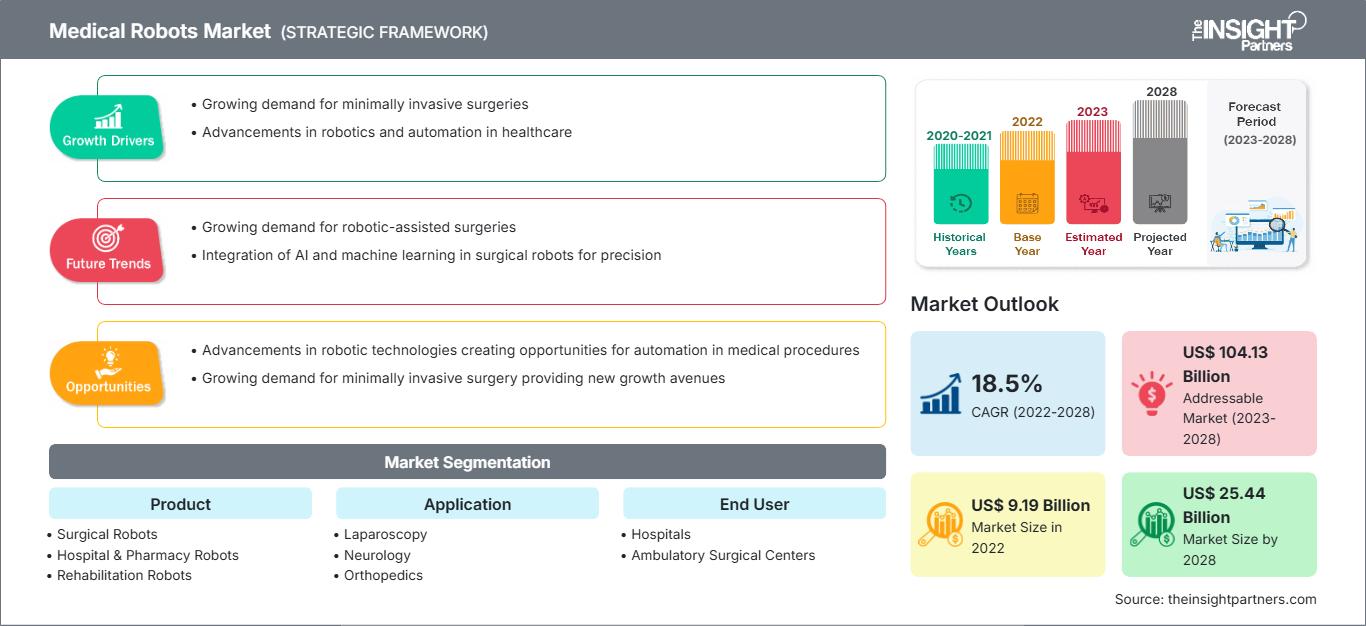

Medical Robots Market Growth and Forecast by 2028

Medical Robots Market Forecast to 2028 - Analysis By Product (Surgical Robots, Hospital & Pharmacy Robots, Rehabilitation Robots, Non-Invasive Radiosurgery Robots, and Others), Application (Laparoscopy, Neurology, Orthopedics, Gynecology, Urology, Cardiology, and Others), and End User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Status : Published

- Report Code : TIPHE100000816

- Category : Life Sciences

- No. of Pages : 241

- Available Report Formats :

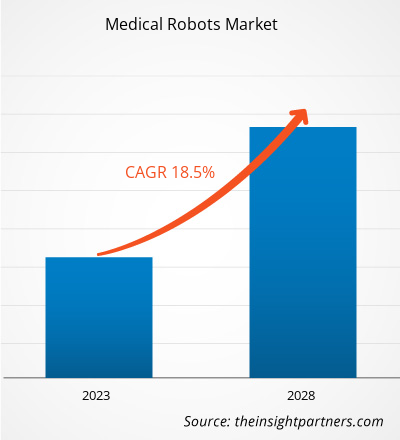

The medical robots market is projected to reach US$ 25,443.36 million by 2028 from an ectimated value of US$ 9,189.70 million in 2022; it is expected to grow at a CAGR of 18.5% from 2022 to 2028.

Increasing number of surgical procedures and rising number of product launches and approvals are expected to drive the medical robots market. However, the high cost of surgical procedures and installation hinders the market growth.

Medical robots are designed for specialized medical applications. These robots can perform a variety of medical tasks such as surgery, medical testing, and patient monitoring. They can perform surgery solely based on the surgeon's pre-surgical planning. Medical robots enable high precision in open and minimally invasive surgeries. They also significantly reduce the time required for surgery. Further, medical robots can be used to transport patients from one location in a hospital to another. Robots for remote caregiving, disinfectant robots to reduce hospital-acquired infections, and robotic exoskeletons for rehabilitation training that provide external support and muscle training are all examples of medical robot applications. Robotic technique in healthcare was first used in 1985, although it was only in 2000 that the da Vinci robot received US FDA approval for carrying out surgical procedures. The da Vinci robot is widely known for its applications in cardiac surgery, head and neck surgery, and urologic surgery.

North America is likely to dominate the medical robots market during the forecast period. The US held the largest share of the North American market in 2022 and is expected to continue this trend during the forecast period. According to a study published by the American Society for Metabolic and Bariatric Surgery in 2022, the US witnessed around 62.0% of growth in bariatric surgeries during the past decade. In addition, according to the study published by the Agency for Healthcare Research and Quality in 2017, around 0.7 million total knee replacement surgeries were performed in the US per year. Such a significant number of surgical procedures is estimated to offer a favorable environment for adopting advanced healthcare facilities that will drive the US medical robots market during the forecast period.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMedical Robots Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The medical robots market is segmented based on product, application, end user, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The medical robots report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, market dynamics, and the competitive analysis of the globally leading market players.

Market Insights

High Number of Surgical Procedures

There is a rise in the number of surgeries performed worldwide. There has been an increase in the incidence of cardiovascular diseases in European countries in the last 25 years. In the region, the rise in diabetic cases and lifestyle changes are increasing the number of cardiovascular surgeries and general surgeries.

Cancer and diabetes are among the leading causes of mortality globally. As per a study by the American Cancer Society (ACS), in 2021, ~1.9 million new cancer cases were diagnosed in the US. In 2021, according to Dutch Cancer Registry, around 123,672 new cancer cases were registered in the Netherlands. Moreover, according to the International Diabetes Federation (IDF), in 2021, an estimated 537 million people across the world had diabetes. The number is expected to reach 783 million by 2045.

According to the study published by the American Society for Metabolic and Bariatric Surgery, in 2019, around 252,000 weight loss surgeries were performed in the US. The increasing number of surgical procedures creates a need for robotic surgery instruments. Therefore, the staggering prevalence of chronic conditions and the rising number of surgical procedures generate the demand for robotic surgery instruments.

Product Insights

Based on product, the global medical robots market is segmented into surgical robots, rehabilitation robots, non-invasive radio surgery robots, hospitals & pharmacy robots, and others. The surgical robots are subsegmented into neurological surgery robotic systems, cardiology surgery robotic systems, laparoscopic surgical robotic systems, and orthopedic surgical robotic systems. In 2022, the surgical robots segment held the largest share of the market. Robotic surgeries are surgical procedures performed using robotic surgical systems. Surgical robots are self-automated and computer-controlled medical devices that are programmed to assist in the positioning and manipulating the surgical instruments, these surgical robots helps surgeons to perform complex surgical procedures. These robots has the ability to enhance the capabilities of surgeons performing open surgery. Therefore, the surgical robots are allowed to perform the complex and advanced surgical procedures with increases precision through minimally invasive ways. However, the rehabilitation robots segment is anticipated to register the highest CAGR during the forecast period.

Application Insights

Based on application, the global medical robots market is segmented into laparoscopy, neurology, orthopedics, gynecology, urology, cardiology, and others. In 2022, the laparoscopy segment held the largest share of the market. However, the neurology segment is expected to register the highest CAGR during the forecast period. Laparoscopy is a surgical diagnostic procedure used to examine the organs inside the abdomen. Robotic surgery is a minimally invasive procedure that requires only small incisions and has low risk. In 2000, the da Vinci surgery system became the first robotic surgery system approved by the FDA for general laparoscopic surgery. And the latest high-end model is the da Vinci Xi. The deployment of medical robots has led to improved efficiency in laparoscopic surgical procedures. In January 2022, a robot performed laparoscopic surgery on the soft tissue of a pig without the guiding hand of a human. As the medical field moves toward more laparoscopic approaches for surgeries, it will be important to have an automated robotic system designed for such procedures to assist. One of the major reasons behind the growing preference for laparoscopic procedures in recent years is the gradual shift of the healthcare sector away from open surgeries. The laparoscopy market is likely to grow in the coming years due to all the factors mentioned above.

End User Insights

Based on end user, the global medical robots market is segmented into hospitals, ambulatory surgical centers, and others. In 2022, the hospitals segment held the largest share of the market. Moreover, the same segment is expected to register the highest CAGR in the market during the forecast period, owing to the medical advantages and usage of medical robots in the surgical procedures at an increased rate and enhaced performance of the robots during surgical procedures.

Product launches and collaborations are highly adopted strategies by the global medical robots market players to expand their global footprints and product portfolios. The players also focus on the partnership strategy to enlarge their clientele, which, in turn, permits them to maintain their brand name globally. They aim to flourish their market shares with the development of innovative products. A few of the recent key market developments are listed below:

- In February 2022, Capsa Healthcare a leading innovator in healthcare delivery solutions for hospitals, long-term care, and retail pharmacy providers acquired Humanscale Healthcare, a designer and manufacturer of flexible technology solutions and computing workstations based in New York, NY.

- In January 2022, Omnicell, Inc. launched Reimaging IV Station, a fully automated IV compounding robot that tackles industry issues head-on while delivering patient safety, accuracy, cost savings, supply chain control, and compliance benefits.

- In October 2021, Accuray launched Precision Treatment Planning System, enabling users to plan with ease, optimize with quality, and deliver treatments efficiently. VOLO Ultra is the latest evolution of the planning solution, the Accuray Precision Treatment Planning System. It helps accelerate Radixact and TomoTherapy treatments so clinicians can treat more patients each day. It includes a state-of-the-art optimizer with a modern and fast gradient-based algorithm that provides optimal plan quality for every treatment.

- In June 2021, ARxium launched a robot "RIVA" at the Lille University Hospital to prepare injectable chemotherapies.

Medical Robots Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 9.19 Billion |

| Market Size by 2028 | US$ 25.44 Billion |

| Global CAGR (2022 - 2028) | 18.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Robots Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Robots Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Medical Robots – Market Segmentation

The global medical robots market is segmented based on product, application, and end user. In terms of product, the global medical robots market is segmented into surgical robots, rehabilitation robots, non-invasive radiosurgery robots, hospital & pharmacy robots, and others. Based on application, the global medical robots market is segmented into laparoscopy, neurology, orthopedics, gynecology, urology, cardiology, and others. In terms of end user, the medical robots market is segmented into hospitals, ambulatory surgical centers, and others.

Company Profiles

- Intuitive Surgical, Inc.

- Stryker Corporation

- Hocoma AG

- Medtronic

- Auris Health, Inc.

- Accuray Incorporated

- Omnicell Inc.

- Arxium

- Ekso Bionics Holdings, Inc.

- Kirby Lester LLC.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For