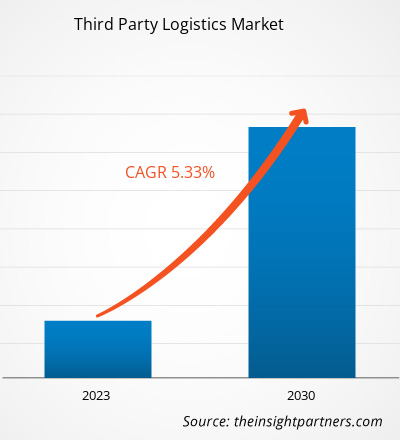

The third party logistics market was valued at US$ 1273.1 billion in 2022 and is projected to reach US$ 1929.18 billion by 2030; it is expected to register a CAGR of 5.33% during 2022–2030.

The growing proliferation of e-commerce is likely to remain a key trend in the market.

Third Party Logistics Market Analysis

The rise of e-commerce and the desire for same-day or next-day delivery propel demand for last-mile delivery services. For example, Amazon's Prime service has set new standards for fast delivery, prompting 3PLs to adapt their services to meet these expectations. Growing consciousness of environmental issues and sustainability has led to increased demand for eco-friendly logistics solutions. 3PL providers are adopting electric vehicles, optimizing routes to reduce emissions, and implementing sustainable packaging practices to align with consumer and regulatory expectations.

Third Party Logistics Market Overview

Transportation of manufactured goods from the factories to the warehouses is the first stage in the overall 3PL process. The 3PL business stores the product once it arrives at the warehouse or fulfillment center. The products are stored in accordance with their SKU, with each SKU having its own allocated storage place. Items entering the warehouse are normally entered into the provider's tracking system at this point. Software integration helps in efficient and effective processes.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Third Party Logistics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Third Party Logistics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Third Party Logistics Market Drivers and Opportunities

Benefits of Managing Seasonal Variations of Products to Favor Market

Third-party logistics firms have expanded resource networks that support prime companies enlarge efficiently in a cost-effective way. In addition, third-party logistics firms can deliver sufficient resources and elasticity in services for seasonal inventory or novel product releases. Many establishments experience seasonal variations in customer inclinations, and it becomes key to manage such swings to maintain effectiveness and meet the demand.

Application of Software Solutions and Adoption of Big Data Analytics

The adoption of RFID-enabled devices is also expected to store data for easy transport that will also simplify tracking and identification of products. Software related to transportation management systems will reduce inefficiency and costs. Furthermore, the usage of speech recognition software in warehouse management system communications will help with order turnaround and inventory records while lowering employee training needs. Along with this, the acceptance of cloud-based technology in third-party logistics organizations will respond to demands by recognizing the need for client access, allowing them to address seasonal trends better.

Third Party Logistics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the third party logistics market analysis are mode of transports, services and end users.

- Based on the mode of transports, the third party logistics market is divided into roadways, railways, waterways and airways. The roadways segment held a larger market share in 2023.

- Based on the services, the third party logistics market is divided into international transportation, warehousing, domestic transportation, inventory management, and others. The domestic transportation segment held a larger market share in 2023.

- Based on the end users, the third party logistics market is divided into automotive, healthcare, retail, consumer goods, and others. The others segment held a larger market share in 2023.

Third Party Logistics Market Share Analysis by Geography

The geographic scope of the third party logistics market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The scope of the third party logistics market report encompasses North America (the US, Canada, and Mexico), Europe (Russia, the UK, France, Germany, Italy, and the Rest of Europe), Asia Pacific (South Korea, India, Australia, Japan, China, and the Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa), and South & Central America (Argentina, Brazil, and the Rest of South & Central America). In terms of revenue, Asia Pacific dominated the third party logistics market share in 2023. Europe is the second-largest contributor to the global third party logistics market, followed by North America.

Third Party Logistics Market Regional Insights

The regional trends and factors influencing the Third Party Logistics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Third Party Logistics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Third Party Logistics Market

Third Party Logistics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1273.1 Billion |

| Market Size by 2030 | US$ 1929.18 Billion |

| Global CAGR (2022 - 2030) | 5.33% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Mode of transports

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Third Party Logistics Market Players Density: Understanding Its Impact on Business Dynamics

The Third Party Logistics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Third Party Logistics Market are:

- CEVA Logistics

- FedEx

- Expeditors

- SF Logistics

- Maersk Logistics

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Third Party Logistics Market top key players overview

Third Party Logistics Market News and Recent Developments

The Third Party Logistics Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the third party logistics market are listed below:

- DB Schenker, one of the world’s leading logistics service providers, and USA Truck, a leading capacity solutions provider, stated an agreement under which DB Schenker will acquire all outstanding shares of USA Truck common stock for $31.72 per share in cash. The transaction costs USA Truck approximately $435 million, including assumed cash and debt. (Source: DB Schenker, Press Release, July 2022)

- Deutsche Post DHL Group, the world's leading logistics company, declared today that it is changing the name of the company to "DHL Group" on July 1, 2023. The new name reflects the transformation the Group has gone through in the past years and pays tribute to the focus on its national and international logistics activities as a driver for future growth. (Source DHL Group, Press Release, July 2023)

Third Party Logistics Market Report Coverage and Deliverables

The “Third Party Logistics Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Third party logistics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Third party logistics market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Third party logistics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the third party logistics market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the third party logistics market in 2022?

Asia Pacific dominated the third party logistics market in 2022.

What are the future trends of the third party logistics market?

The investment in research & development by manufacturers is the future trend of the third party logistics market.

What would be the estimated value of the third party logistics market by 2030?

US$ 1929.18 billion estimated value of the third party logistics market by 2030.

What is the expected CAGR of the third party logistics market?

6.6% is the expected CAGR of the third party logistics market.

Which are the leading players operating in the third party logistics market?

DHL Group, Kuehne + Nagel International AG, DB Schenker, C.H. Robinson Worldwide Inc., DSV AS, Sinotrans Ltd., Giodis SA, United Parcel Service Inc., XPO Inc., Torello Transpoti Srl are some of the leading players in the market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Boat Sails Market

- Heavy Commercial Vehicle Air Brake Systems Market

- Heavy Commercial Vehicle Clutch Market

- Electric Vehicle Heat Pump Systems Market

- Event Logistics Market

- Industrial Vehicles Market

- Motorsport Transmission Market

- Automotive Telematics Market

- Low Speed Electric Vehicle Market

- Automotive Tow Bars Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Additional Companies - Third party logistics market

- CEVA Logistics

- FedEx

- Expeditors

- SF Logistics

- Maersk Logistics

- Kintetsu World Express

- Yusen Logistics

- Toll Group

- Hellmann Worldwide Logistics

- Penske Logistics

Get Free Sample For

Get Free Sample For