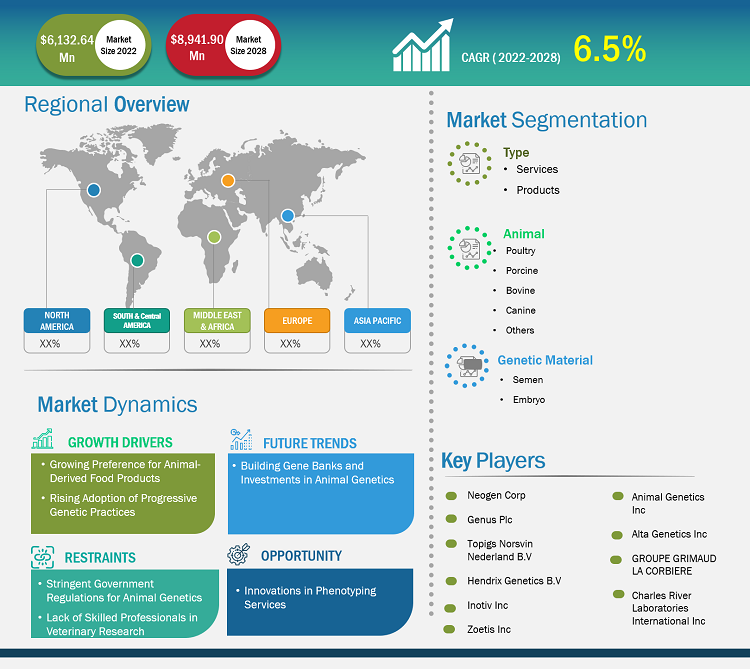

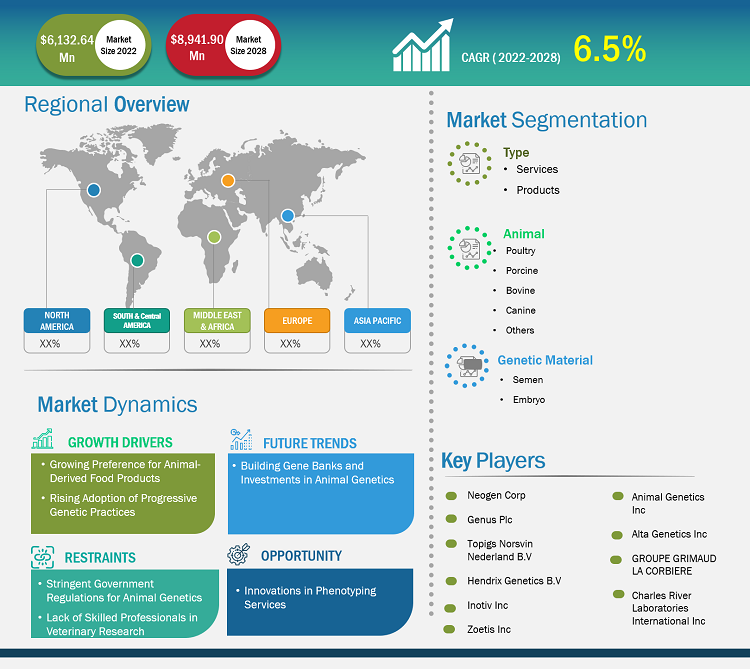

[Research Report] The animal genetics market is expected to grow from US$ 6,132.64 million in 2022 to US$ 8,941.90 million by 2028; it is estimated to grow at a CAGR 6.5% during 2022–2028.

Market Insights and Analyst View:

Technological advancements in the biotechnology industry are the primary factor supporting the growth of the animal genetics market. Intense research and development, and growing demand for poultry and bovine meat are the major trends in the animal genetics industry

In addition, the growing adoption of pet animals worldwide encourages animal genetics service providers to offer services for the development of different phenotypic features in pet animals. Animal genetics helps offer variations in the appearance of pets, in turn, attracting pet owners.Further, advancements in animal genetics help answer questions associated with the availability of genetically engineered animals on the market and the availability of food products derived from genetically engineered animals

Knowing about their availability has enabled researchers to offer good-quality meat products to the food industry and has helped enhance the health of livestock animals. Countries in which livestock production is one of the key businesses are receiving support from the respective governments through funding and infrastructure development efforts, which bolsters the animal genetics market size. This also encourages market players to focus on developments to propel the animal genetics market growth.Growth Drivers and Challenges:

The increasing population and rapid urbanization worldwide have resulted in a growing preference for animal-derived food products such as dairy products and meat. Several studies have proved that genetically modified (GM) cows can produce more milk and are less susceptible to common cattle diseases such as bovine respiratory disease complex and clostridial infection. As proteins play an important role in nutrition, the consumption of meat and meat products has increased worldwide. Animal-derived proteins assist in the synthesis of body tissues for renovation and faster growth. The amino acid profile of animal-derived proteins plays a significant role in immunity, environmental adaptability, and other biological functions. Genetically modified poultry such as broilers are easily digestible despite the high protein content.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Animal Genetics Market: Strategic Insights

Market Size Value in US$ 6,132.64 million in 2022 Market Size Value by US$ 8,941.90 million by 2028 Growth rate CAGR 6.5% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Animal Genetics Market: Strategic Insights

| Market Size Value in | US$ 6,132.64 million in 2022 |

| Market Size Value by | US$ 8,941.90 million by 2028 |

| Growth rate | CAGR 6.5% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

According to the Food and Agriculture Organization of the United Nations (FAO) estimates, the global demand for meat products has increased by 58% from 1995 to 2020. The estimates also show that meat consumption has risen from 233 million metric ton in 2000 to 300 million metric ton in 2020. Similarly, milk consumption has increased from 568 million metric ton in 2000 to 700 million metric ton in 2020. The FAO also estimated that egg production has increased by 30% in 2020. China and Brazil are among the major developing countries propelling the demand for poultry, pig meat, and milk. In contrast, countries such as the US, Brazil, and Thailand are the largest producers of poultry, pig meat, and milk. Thus, animal genetics is serving to be a great tool to meet the growing demand for animal-derived food products.

On the other hand, growing concerns about animal-originated diseases and threats to livestock diversity have resulted in stringent government regulations for animal genetics in different countries. Constraints associated with the breeding, exporting, and conserving genetically modified animals are major restraining factors for the animal genetics market growth. The Convention on Biodiversity, Nagoya Protocol, and Commission on Genetic Resources for Food and Agriculture (CGRFA) are among the regulating agencies for genetically modified animals. Further, FAO’s Global Plan of Action for Animal Genetic Resources strictly monitors and evaluates animal genetic resources to conserve livestock biodiversity. FDA regulates these animals and is among the major agencies responsible for offering marketing approvals. The administration has put strict norms for the identification, characterization, manufacturing, and labeling of these animals. Additionally, each country has its regulation for the management of genetic animals. Therefore, stringent rules and regulations associated with animal breeding programs and genetic engineering experiments hinder the animal genetics market expansion.

Report Segmentation and Scope:

The “Global Animal Genetics Market” is segmented on the basis of type, genetic material, animal, and geography. Based on type, the market is bifurcated into products and services. Based on genetic material, the animal genetics market is bifurcated into semen and embryo. In terms of animal, the market is segmented into poultry, porcine, bovine, canine, and others. On the basis of geography, the animal genetics market is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on type, the animal genetics market is bifurcated into product and services. The services segment held a larger market share in 2022. The same segment is estimated to register the fastest CAGR in the animal genetics market during the forecast period. Further, the market for services is segmented into DNA typing, genetic trait tests, genetic disease tests, and others. The DNA typing segment held the largest share of the market for animal genetics services in 2022. The genetic disease tests segment is estimated to register the highest CAGR in the market during the forecast period. The growth of the market is driven by the increasing services for animal breeding to enhance the quality and production of animal-based food and non-food products. Many laboratories are offering cost-effective services that enable the growth of the market. In Houston, Texas, US, Laboratory Animal Genetic Services (LAGS)—supported by the Cancer Center Support Grant—offers cost-effective, customized genetic analysis for laboratory animal research and studies. Thus, the presence of such laboratories is contributing significantly to the growth of the market and is expected to show a similar trend in the coming years.

Based on genetic material, the animal genetics market is segmented into semen and embryo. The embryo segment held a larger share of the market in 2022. The semen segment is anticipated to register a higher CAGR in the market during the forecast period. The developments in animal breeding techniques are leading to increasing animal genetic testing

.

Based on animal, the animal genetics market is segmented into poultry, porcine, bovine, canine, and others. The porcine segment held the largest share of the market in 2022. On the other hand, the bovine segment is anticipated to register the highest CAGR in the market during the forecast period. The growth of the animal genetics market for the bovine segment is ascribed to the increasing number of companies offering cattle genetic testing servicesand the growingdemand for livestock DNA testing.

Regional Analysis:

Based on geography, the animal genetics market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America is the most significant region in the global animal genetics market. The US, Canada, and Mexico are the major contributors to the market in this region. The market growth in North America is attributed to growing investments in animal genetics projects, rising livestock production and farming, and increasing initiatives to protect and preserve livestock animals. The US holds the largest share of the market in this region, followed by Canada. Further, Mexico holds vital opportunities for the market growth in the future. In Mexico, livestock activities are perceived as a socioeconomic aspect, which offers attractive business opportunities for companies operating in the livestock genetics business. 60% of the Mexican land is devoted to livestock activities, i.e., more than 3 million livestock production units. Over the last decades, beef, pork, and dairy production in the country has undergone valuable developments. Mexican businesses or organizations engaged in the expansion of livestock-intensive systems embrace modern technologies such as artificial insemination and embryo transfer for the genetic improvement of livestock. Nearly 53% of bovine breeders in Mexico use artificial insemination and 18% use embryo transfers.

Asia Pacific is expected to register the fastest CAGR in the global animal genetics market during the forecast period. The projected market growth is attributed to the rising preference for animal-derived protein supplements and food products, and the increasing adoption of progressive genetic practices such as artificial insemination and embryo transfer in the region. China is the leading country in the animal genetics market in Asia Pacific. In China, animal production has been growing dramatically over the past three decades. In 2021, the Ministry of Agriculture and Rural Affairs announced that the National Committee for Livestock and Poultry Genetics had approved three new varieties—Guangming 2, Shengze 901, and Wode 188—of white-feather broiler breeds on the Chinese market. According to the same source, chicken is the most consumed meat in Chinese households, and in 2020, chicken production in the country totaled 18.6 million tons, of which 52.4% were white-feather broilers. Further, consumers prefer high-quality chicken, which is achieved through breeding in animal farms. Thus, increasing animal breeding promotes the growth of animal genetics in China. Per the USDA Foreign Agricultural Service, poultry exports in China are expected to increase by 5% and reach 575 thousand metric tons by the end of 2023, compared to the previous year. Advancements in animal genetics are increasing animal breeding to enhance the quality of animal-based products.

Industry Developments and Future Opportunities:

Various initiatives by key players operating in the animal genetics market are listed below:

- In June 2023, Charles River expanded its Triple-Immunodeficient Mouse Model Portfolio. The new NCG mouse strains are best suited for studies in oncology, immunology, and infectious disease. NCG Plus portfolio expands the scope of preclinical research by including humanized mice. It can be used to recapitulate the human immune system using human peripheral blood mononuclear cells (PBMCs) and human hematopoietic stem cells (HSCs), which makes this model ideal for cancer immunotherapy research.

- In October 2022, Genus Plc and Tropic extended their trait development collaboration for the application of Tropic’s Gene Editing induced Gene Silencing (GEiGS) technology in porcine and bovine genetics. The extended collaboration will enable the two to explore additional traits based on the GEiGS platform to expand animal welfare traits in bovine and porcine species.

- In June 2022, Hendrix Genetics partnered with CSIRO, a national science agency in Australia, to test the viability of an innovative point-of-lay sex sorting technology for the egg-laying industry. The project focuses on studying a technology developed by CSIRO that uses a biomarker protein that is only found in male embryos and not in female embryos. This allows the research group to identify male embryos during the very early stages of development that occur before egg incubation. This exploratory research is an important first step that could lead to a solution for a major animal ethics and welfare challenge, alongside improving the carbon footprint and sustainability of the egg industry.

The developments made by the companies are helping the players to contribute actively to the growth of the animal genetic industry.

Animal Genetics Market Report Scope

COVID-19 Impact:

Research activities in genomic laboratories were widely affected in 2020 during the COVID-19 pandemic. Many animal laboratories conducting molecular testing in worldwide shifted their focus toward COVID-19 testing. With a rise in demand for PCR-based COVID-19 tests during the pandemic, animal laboratories had to shift their focus to this diagnostic area, which resulted in delayed animal genomic services. On the other hand, post-pandemic, the animal genetics market experienced good growth opportunities as SARS-CoV-2 is a zoonotic virus. A few animals, such as dogs, cats, ferrets, and minks, were tested positive for COVID-19. Thus, the lack of evidence of the origin of the transmission of COVID-19 from animals to humans, and insufficient insights into pathogenicity have provided vital growth opportunityi for research in animal genetics.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global animal genetics market include Neogen Corp, Genus Plc, Topigs Norsvin Nederland B.V, Zoetis Inc, Hendrix Genetics B.V, Inotiv Inc, Animal Genetics Inc, Alta Genetics Inc, GROUPE GRIMAUD LA CORBIERE, and Charles River Laboratories International Inc. These companies focus on new product launches and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Animal, Genetic Material, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America holds the major market share with US being the major contributor however, Asia Pacific is expected to develop significantly with the CAGR of 7.0% over the forecast period.

Animal genetics is analyzed on the basis of type, genetic material, and animal. Based on type, the market is segmented into product and services. The services segment is the dominating segment by type and is expected to retain its dominance during the forecast period. Based on genetic material, the growth of the market is segmented into embryos and semen. And based on animals, the market is categorized into poultry, porcine, bovine, canine, and others.

The lack of skilled professionals in veterinary research and stringent government regulations for animal genetics are likely to hamper the growth of the market to a certain extent.

The factors driving the growth of the market are a growing preference for animal-derived food products and rising adoption of progressive genetic practices expected to augment the growth of the market primarily.

Animal genetics majorly consists of the players such as Neogen Corp, Genus Plc, Topigs Norsvin Nederland B.V, Zoetis Inc, Hendrix Genetics B.V, Inotiv Inc, Animal Genetics Inc, Alta Genetics Inc, GROUPE GRIMAUD LA CORBIERE, and Charles River Laboratories International Inc.

Animal genetics is the study of animal genes. It provides information about the animal’s genetic makeup that is responsible for appearance and function. Animal genetics are used for genetic traits, DNA, and genetic disease testing. The animal genetics market is expected to increase in the forecast period.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Animal Genetics Market – By Type

1.3.2 Animal Genetics Market – By Genetic Material

1.3.3 Animal Genetics Market – By Animal

1.3.4 Global Animal Genetics Market – By Geography

2. Animal Genetics Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Animal Genetics Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America – PEST Analysis

4.2.2 Europe – PEST Analysis

4.2.3 Asia Pacific – PEST Analysis

4.2.4 Middle East & Africa – PEST Analysis

4.2.5 South & Central America– PEST Analysis

4.3 Expert Opinions

5. Animal Genetics Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Preference for Animal-Derived Food Products

5.1.2 Rising Adoption of Progressive Genetic Practices

5.2 Market Restraints

5.2.1 Lack of Skilled Professionals in Veterinary Research

5.2.2 Stringent Government Regulations for Animal Genetics

5.3 Market Opportunities

5.3.1 Innovations in Phenotyping Services

5.4 Future Trends

5.4.1 Building Gene Banks and Investments in Animal Genetics

5.5 Impact Analysis

6. Animal Genetics Market – Global Analysis

6.1 Global Animal Genetics Marker Revenue Forecast and Analysis

6.2 Global Animal Genetics Market, By Geography - Forecast And Analysis

6.3 Market Positioning of Key Players

7. Animal Genetics Market Analysis – by Type

7.1 Overview

7.2 Animal Genetics Market, By Type, 2022 & 2028 (%)

7.3 Product

7.3.1 Overview

7.3.2 Product: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

7.4 Service

7.4.1 Overview

7.4.2 Service: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

7.4.3 DNA Typing

7.4.3.1 Overview

7.4.3.2 DNA Typing: Animal genetics market Revenue and Forecast to 2028 (US$ Million)

7.4.4 Genetic Trait Tests

7.4.4.1 Overview

7.4.4.2 Genetic Trait Tests: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

7.4.5 Genetic Disease Tests

7.4.5.1 Overview

7.4.5.2 Genetic Disease Tests: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

7.4.6 Others

7.4.6.1 Overview

7.4.6.2 Others: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

8. Animal Genetics Market Analysis – by Animal

8.1 Overview

8.2 Animal Genetics Market, By Animal, 2022 & 2028 (%)

8.3 Poultry

8.3.1 Overview

8.3.2 Poultry: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

8.4 Porcine

8.4.1 Overview

8.4.2 Porcine: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

8.5 Bovine

8.5.1 Overview

8.5.2 Bovine: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

8.6 Canine

8.6.1 Overview

8.6.2 Canine: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

9. Animal Genetics Market Analysis – by Genetic Material

9.1 Overview

9.2 Animal Genetics Market, By Genetic Material, 2022 & 2028 (%)

9.3 Semen

9.3.1 Overview

9.3.2 Semen: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

9.4 Embryo

9.4.1 Overview

9.4.2 Embryo: Animal genetics market Revenue and Forecast to 2028 (US$ Million)

10. Animal Genetics Market – Revenue and Forecast to 2028 – Geographic Analysis

10.1 North America: Animal Genetics Market

10.1.1 Overview

10.1.2 North America: Animal Genetics Market, - Revenue and Forecast to 2028 (US$ Million)

10.1.3 North America: Animal Genetics Market, by Type– Revenue and Forecast to 2028 (US$ Million)

10.1.3.1 North America: Animal Genetics Market, by Service– Revenue and Forecast to 2028 (US$ Million)

10.1.4 North America: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.1.5 North America: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.1.6 North America: Animal Genetics Market, by Country, 2022 & 2028 (%)

10.1.7 US: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.1.7.1 Overview

10.1.7.2 US: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.1.7.3 US: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.1.7.3.1 US: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.1.7.4 US: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.1.7.5 US: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.1.8 Canada: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.1.8.1 Overview

10.1.8.2 Canada: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.1.8.3 Canada: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.1.8.3.1 Canada: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.1.8.4 Canada: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.1.8.5 Canada: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.1.9 Mexico: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.1.9.1 Overview

10.1.9.2 Mexico: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.1.9.3 Mexico: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.1.9.3.1 Mexico: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.1.9.4 Mexico: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.1.9.5 Mexico: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.2 Europe: Animal Genetics Market

10.2.1 Overview

10.2.2 Europe: Animal Genetics Market, - Revenue and Forecast to 2028 (US$ Million)

10.2.3 Europe: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.2.3.1 Europe: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.4 Europe: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.2.5 Europe: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.2.6 Europe: Animal Genetics Market, by Country, 2022 & 2028 (%)

10.2.7 Germany: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

10.2.7.1 Overview

10.2.7.2 Germany: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

10.2.7.3 Germany: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.2.7.3.1 Germany: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.7.4 Germany: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.2.7.5 Germany: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.2.8 UK: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.2.8.1 Overview

10.2.8.2 UK: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

10.2.8.3 UK: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.2.8.3.1 UK: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.8.4 UK: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.2.8.5 UK: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.2.9 France: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

10.2.9.1 Overview

10.2.9.2 France: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

10.2.9.3 France: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.2.9.3.1 France: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.9.4 France: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.2.9.5 France: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.2.10 Spain: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

10.2.10.1 Overview

10.2.10.2 Spain: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

10.2.10.3 Spain: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.2.10.3.1 Spain: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.10.4 Spain: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.2.10.5 Spain: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.2.11 Italy: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.2.11.1 Overview

10.2.11.2 Italy: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

10.2.11.3 Italy: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.2.11.3.1 Italy: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.11.4 Italy: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.2.11.5 Italy: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.2.12 Rest of Europe: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.2.12.1 Overview

10.2.12.2 Rest of Europe: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

10.2.12.3 Rest of Europe: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.2.12.3.1 Rest of Europe: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.2.12.4 Rest of Europe: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.2.12.5 Rest of Europe: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.3 Asia Pacific: Animal Genetics Market

10.3.1 Overview

10.3.2 Asia Pacific: Animal Genetics Market, - Revenue and Forecast to 2028 (US$ Million)

10.3.3 Asia Pacific Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.3.3.1 Asia Pacific Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.3.4 Asia Pacific Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.3.5 Asia Pacific Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.3.6 Asia Pacific: Animal Genetics Market, by Country, 2022 & 2028 (%)

10.3.7 China: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.7.1 Overview

10.3.7.2 China: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.7.3 China: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.3.7.3.1 China: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.3.7.4 China: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.3.7.5 China: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.3.8 Japan: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.8.1 Overview

10.3.8.2 Japan: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.8.3 Japan: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.3.8.3.1 Japan: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.3.8.4 Japan: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.3.8.5 Japan: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.3.9 India: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.9.1 Overview

10.3.9.2 India: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.9.3 India: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.3.9.3.1 India: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.3.9.4 India: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.3.9.5 India: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.3.10 South Korea: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.10.1 Overview

10.3.10.2 South Korea: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.10.3 South Korea: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.3.10.3.1 South Korea: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.3.10.4 South Korea: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.3.10.5 South Korea: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.3.11 Australia: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.11.1 Overview

10.3.11.2 Australia: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.11.3 Australia: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.3.11.3.1 Australia: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.3.11.4 Australia: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.3.11.5 Australia: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.3.12 Rest of Asia Pacific: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.12.1 Overview

10.3.12.2 Rest of Asia Pacific: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.3.12.3 Rest of Asia Pacific: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.3.12.3.1 Rest of Asia Pacific: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.3.12.4 Rest of Asia Pacific: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.3.12.5 Rest of Asia Pacific: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.4 Middle East & Africa: Animal Genetics Market

10.4.1 Overview

10.4.2 Middle East & Africa: Animal Genetics Market - Revenue and Forecast to 2027 (US$ Million)

10.4.3 Middle East & Africa Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.4.3.1 Middle East & Africa Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.4.4 Middle East & Africa Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.4.5 Middle East & Africa Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.4.6 Middle East & Africa Animal Genetics Market, by Country, 2022 & 2028 (%)

10.4.7 Saudi Arabia: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.4.7.1 Overview

10.4.7.2 Saudi Arabia: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.4.7.3 Saudi Arabia: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.4.7.3.1 Saudi Arabia: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.4.7.4 Saudi Arabia: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.4.7.5 Saudi Arabia: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.4.8 UAE: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.4.8.1 Overview

10.4.8.2 UAE: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.4.8.3 UAE: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.4.8.3.1 UAE: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.4.8.4 UAE: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.4.8.5 UAE: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.4.9 South Africa: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.4.9.1 Overview

10.4.9.2 South Africa: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.4.9.3 South Africa: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.4.9.3.1 South Africa: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.4.9.4 South Africa: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.4.9.5 South Africa: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.4.10 Rest of Middle East & Africa: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.4.10.1 Overview

10.4.10.2 Rest of Middle East & Africa: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.4.10.3 Rest of Middle East & Africa: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.4.10.3.1 Rest of Middle East & Africa: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.4.10.4 Rest of Middle East & Africa: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.4.10.5 Rest of Middle East & Africa: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.5 South & Central America: Animal Genetics Market

10.5.1 Overview

10.5.2 South & Central America: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.5.3 South & Central America: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.5.3.1 South & Central America: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.5.4 South & Central America: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.5.5 South & Central America: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.5.6 South & Central America: Animal Genetics Market, by Country, 2022 & 2028 (%)

10.5.7 Brazil: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.5.7.1 Overview

10.5.7.2 Brazil: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.5.7.3 Brazil: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.5.7.3.1 Brazil: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.5.7.4 Brazil: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.5.7.5 Brazil: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.5.8 Argentina: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.5.8.1 Overview

10.5.8.2 Argentina: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.5.8.3 Argentina: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.5.8.3.1 Argentina: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.5.8.4 Argentina: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.5.8.5 Argentina: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

10.5.9 Rest of South & Central America: Animal Genetics Market – Revenue and Forecast to 2027 (USD Million)

10.5.9.1 Overview

10.5.9.2 Rest of South & Central America: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

10.5.9.3 Rest of South & Central America: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

10.5.9.3.1 Rest of South & Central America: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

10.5.9.4 Rest of South & Central America: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

10.5.9.5 Rest of South & Central America: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

11. Impact Of COVID-19 Pandemic on Animal Genetics Market

11.1 North America: Impact Assessment of COVID-19 Pandemic

11.2 Europe: Impact Assessment of COVID-19 Pandemic

11.3 Asia-Pacific: Impact Assessment of COVID-19 Pandemic

11.4 South & Central America: Impact Assessment of COVID-19 Pandemic

11.5 Middle East & Africa: Impact Assessment of COVID-19 Pandemic

12. Animal Genetics Market–Industry Landscape

12.1 Overview

12.2 Growth Strategies Done by the Companies in the Market, (%)

12.3 Organic Developments

12.3.1 Overview

12.4 Inorganic Developments

12.4.1 Overview

13. Company Profiles

13.1 Neogen Corp

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Genus Plc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Topigs Norsvin Nederland BV

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Zoetis Inc

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Hendrix Genetics BV

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Inotiv Inc

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Animal Genetics Inc

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Alta Genetics Inc

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 GROUPE GRIMAUD LA CORBIERE

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Charles River Laboratories InternationalInc

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. North America: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 2. North America: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 3. North America: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 4. North America: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 5. US: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. US: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 7. US: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 8. US: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 9. Canada: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 10. Canada: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 11. Canada: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 12. Canada: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 13. Mexico: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 14. Mexico: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 15. Mexico: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 16. Mexico: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 17. Europe: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 18. Europe: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 19. Europe: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 20. Europe: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 21. Germany: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 22. Germany: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 23. Germany: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 24. Germany: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 25. UK: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 26. UK: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 27. UK: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 28. UK: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 29. France: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 30. France: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 31. France: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 32. France: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 33. Spain: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 34. Spain: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 35. Spain: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 36. Spain: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 37. Italy: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 38. Italy: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 39. Italy: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 40. Italy: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 41. Rest of Europe: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 42. Rest of Europe: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 43. Rest of Europe: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 44. Rest of Europe: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 45. Asia Pacific Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 46. Asia Pacific Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 47. Asia Pacific Animal Genetics Market, by Animal - Revenue and Forecast to 2028 (US$ Million)

Table 48. Asia Pacific Animal Genetics Market, by Genetic Material - Revenue and Forecast to 2028 (US$ Million)

Table 49. China: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 50. China: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 51. China: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 52. China: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 53. Japan: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 54. Japan: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 55. Japan: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 56. Japan: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 57. India: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 58. India: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 59. India: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 60. India: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 61. South Korea: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 62. South Korea: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 63. South Korea: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 64. South Korea: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 65. Australia: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 66. Australia: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 67. Australia: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 68. Australia: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 69. Rest of Asia Pacific: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 70. Rest of Asia Pacific: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 71. Rest of Asia Pacific: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 72. Rest of Asia Pacific: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 73. Middle East & Africa Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 74. Middle East & Africa Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 75. Middle East & Africa Animal Genetics Market, by Animal - Revenue and Forecast to 2028 (US$ Million)

Table 76. Middle East & Africa Animal Genetics Market, by Genetic Material - Revenue and Forecast to 2028 (US$ Million)

Table 77. Saudi Arabia: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 78. Saudi Arabia: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 79. Saudi Arabia: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 80. Saudi Arabia: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 81. UAE: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 82. UAE: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 83. UAE: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 84. UAE: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 85. South Africa: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 86. South Africa: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 87. South Africa: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 88. South Africa: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 89. Rest of Middle East & Africa: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 90. Rest of Middle East & Africa: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 91. Rest of Middle East & Africa: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 92. Rest of Middle East & Africa: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 93. South & Central America: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 94. South & Central America: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 95. South & Central America: Animal Genetics Market, by Genetic Material - Revenue and Forecast to 2028 (USD Million)

Table 96. South & Central America: Animal Genetics Market, by Animal - Revenue and Forecast to 2028 (US$ Million)

Table 97. Brazil: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 98. Brazil: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 99. Brazil: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 100. Brazil: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 101. Argentina: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 102. Argentina: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 103. Argentina: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 104. Argentina: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 105. Rest of South & Central America: Animal Genetics Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 106. Rest of South & Central America: Animal Genetics Market, by Service – Revenue and Forecast to 2028 (US$ Million)

Table 107. Rest of South & Central America: Animal Genetics Market, by Genetic Material – Revenue and Forecast to 2028 (US$ Million)

Table 108. Rest of South & Central America: Animal Genetics Market, by Animal – Revenue and Forecast to 2028 (US$ Million)

Table 109. Organic Developments Done By Companies

Table 110. Inorganic Developments Done By Companies

Table 111. Glossary of Terms, Animal Genetics Market

LIST OF FIGURES

Figure 1. Animal Genetics Market Segmentation

Figure 2. Animal Genetics Market – By Geography

Figure 3. Animal Genetics Market Overview

Figure 4. Porcine Product Segment Held Largest Share of Animal Genetics Market

Figure 5. Asia Pacific to Show Significant Growth During Forecast Period

Figure 6. Animal Genetics Market, by Geography (US$ Million)

Figure 7. Global Animal Genetics Market – Leading Country Markets (US$ Million)

Figure 8. Global Animal Genetics Market, Industry Landscape

Figure 9. North America PEST Analysis

Figure 10. Europe PEST Analysis

Figure 11. Asia Pacific PEST Analysis

Figure 12. Middle East &Africa PEST Analysis

Figure 13. South & Central America PEST Analysis

Figure 14. Animal Genetics Market Impact Analysis of Driver and Restraints

Figure 15. Global Animal Genetics Market – Revenue Forecast And Analysis – 2020- 2028

Figure 16. Global Animal Genetics Market – By Geography Forecast and Analysis – 2020- 2028

Figure 17. Market Positioning Of Key Players In Global Animal Genetics Market

Figure 18. Animal Genetics Market, by Type, 2022 & 2028 (%)

Figure 19. Product: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. Service: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. DNA Typing: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 22. Genetic Trait Tests: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 23. Genetic Disease Tests: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 24. Others: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 25. Animal Genetics Market, by Animal, 2022 & 2028 (%)

Figure 26. Poultry: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 27. Porcine: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 28. Bovine: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 29. Canine: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 30. Others: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 31. Animal Genetics Market, by Genetic Material, 2022 & 2028 (%)

Figure 32. Semen: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 33. Embryo: Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 34. North America: Animal Genetics Market, by Key Country – Revenue (2020) (US$ Million)

Figure 35. North America: Animal Genetics Market, Revenue and Forecast to 2028 (US$ Million)

Figure 36. North America: Animal Genetics Market, by Country, 2022 & 2028 (%)

Figure 37. US: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 38. Canada: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 39. Mexico: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 40. Europe: Animal Genetics Market, by Key Country – Revenue (2022) (US$ Million)

Figure 41. Europe: Animal Genetics Market, Revenue and Forecast to 2028 (US$ Million)

Figure 42. Europe: Animal Genetics Market, by Country, 2022 & 2028 (%)

Figure 43. Germany: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 44. UK: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

Figure 45. France: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

Figure 46. Spain: Animal Genetics Market– Revenue and Forecast to 2028 (US$ Million)

Figure 47. Italy: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 48. Rest of Europe: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 49. Asia Pacific: Animal Genetics Market, by Key Country – Revenue (2022) (US$ Million)

Figure 50. Asia Pacific: Animal Genetics Market, Revenue and Forecast to 2028 (US$ Million)

Figure 51. Asia Pacific: Animal Genetics Market, by Country, 2022 & 2028 (%)

Figure 52. China: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 53. Japan: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 54. India: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 55. South Korea: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 56. Australia: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 57. Rest of Asia Pacific: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 58. Middle East & Africa: Animal Genetics Market, by Key Country – Revenue (2022) (US$ Million)

Figure 59. Middle East & Africa Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 60. Middle East & Africa: Animal Genetics Market, by Country, 2022 & 2028 (%)

Figure 61. Saudi Arabia: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 62. UAE: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 63. South Africa: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 64. Rest of Middle East & Africa: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 65. South & Central America: Animal Genetics Market, by Key Country – Revenue (2022) (US$ Million)

Figure 66. South & Central America Animal Genetics Market Revenue and Forecast to 2028 (US$ Million)

Figure 67. South & Central America: Animal Genetics Market, by Country, 2022 & 2028 (%)

Figure 68. Brazil: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 69. Argentina: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 70. Rest of South & Central America: Animal Genetics Market – Revenue and Forecast to 2028 (US$ Million)

Figure 71. Impact of COVID-19 Pandemic In North American Country Markets

Figure 72. Impact of COVID-19 Pandemic in European Country Markets

Figure 73. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

Figure 74. Impact of COVID-19 Pandemic on South & Central American Countries Markets

Figure 75. Impact of COVID-19 Pandemic on Middle East & African Countries Markets

Figure 76. Growth Strategies Done by the Companies in the Market, (%)

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Aug 2023

MRI-guided Focused Ultrasound Therapy Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Breast Cancer, Prostate Cancer, Liver Cancer, Pancreatic Cancer, Breast Lifting and Aesthetic Application, Nipple and Areola Preservation, Post Surgical Applications, and Others), End User (Healthcare Facilities, Diagnostic Imaging Centers, and Research Centers), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Aug 2023

Gene Therapy CDMO Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Drug Development and Manufacturing, Testing and Regulatory Services, and Other Service Types), End User (Pharmaceutical Companies, Biopharmaceutical Companies, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Aug 2023

RT-PCR Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Reagents & Consumables, Instruments, and Software & Services), Application (Research Application, Clinical Application, and Forensic Application), End user (Hospitals and Diagnostic Centers, Pharmaceutical and Biotechnology Companies, Research Laboratories and Academic Institutes, Forensic Laboratories, and Clinical Research Organizations)

Aug 2023

dPCR Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Reagents & Consumables, Instruments, and Software & Services), Application (Research Application, Clinical Application, and Forensic Application), End user (Hospitals and Diagnostic Centers, Pharmaceutical and Biotechnology Companies, Research Laboratories and Academic Institutes, Forensic Laboratories, and Clinical Research Organizations)

Aug 2023

Oscillometry Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Device and Accessories), Technology (Impulse Oscillometry, Forced Oscillation Technique, and Hybrid Oscillometry Devices), Application (Asthma, COPD, and Others), End User (Hospitals, Diagnostic Laboratories, and Others)

Aug 2023

Prenatal Testing Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Diagnostic Type (Noninvasive and Invasive), Disease (Aneuploidy, Microdeletions, Structural Chromosomal Abnormalities, and Others), End User (Hospitals, Diagnostic Laboratories, Specialty Clinics, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Aug 2023

Joint Resurfacing Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Knee, Hip, Shoulder, Ankle, and Others), Material (Metal, Ceramic, and Others), End User (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South and Central America)

Aug 2023

Embolization Plugs Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Neurology, Peripheral Vascular Disease, Oncology, Urology, and Others), End User (Hospital, Ambulatory Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Get Free Sample For

Get Free Sample For